Market Overview

The Thailand healthcare market is valued at USD 31.5 billion in 2024, driven by its thriving medical and wellness tourism sector, where affordable procedures and high-quality facilities attract international patients. Growth in domestic demand is also supported by expanding healthcare infrastructure and increased patient willingness to pay for preventive and wellness services.

The market is dominated by cities such as Bangkok, Phuket, and Chiang Mai, recognized as international hubs due to their high concentration of JCI‑accredited hospitals, premium wellness resorts, and proximity to international airports. These locations offer bundled travel‑plus‑care packages in areas like oncology, orthopedics, cosmetic surgery, and holistic wellness, drawing global clientele based on reputation and accessibility.

Based on the medical and wellness tourism sub‑sector, the total healthcare market in Thailand is valued at USD 31.5 billion in 2024, with a projected CAGR of 13 % from 2024 to 2030 driving growth to USD 110 billion by 2034.

Market Segmentation

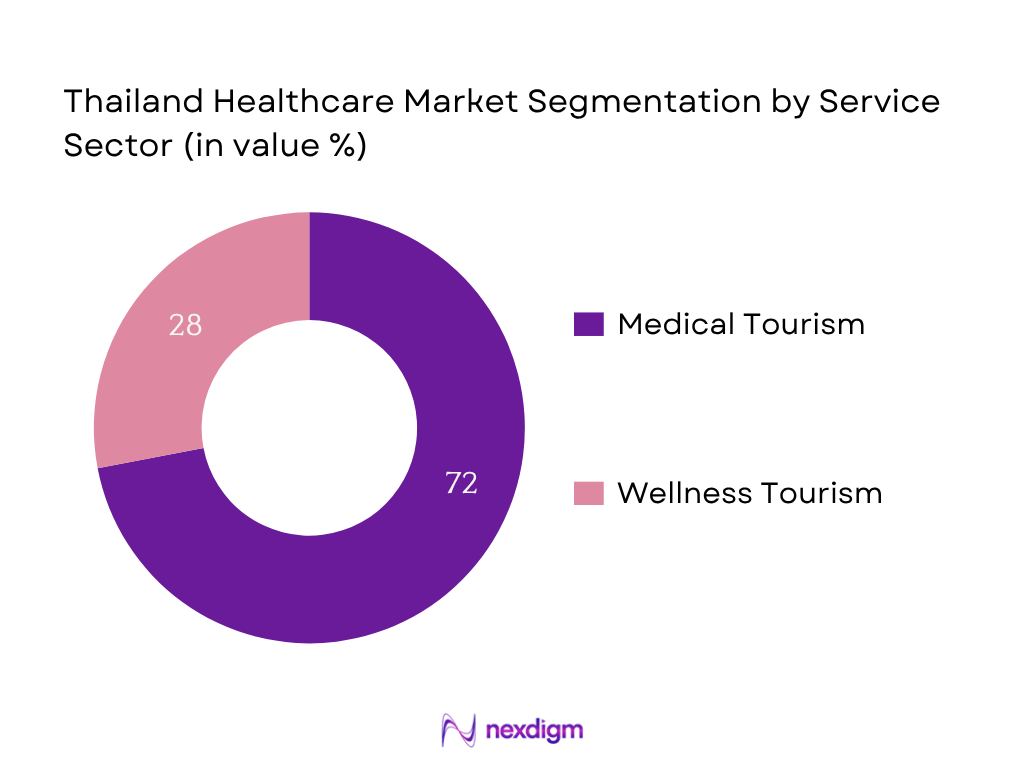

By Service Sector

The Thailand healthcare market divides into medical tourism and wellness tourism. Medical tourism accounts for the larger share (~72 %), owing to high demand for major surgeries such as orthopedic and oncology procedures at competitive prices compared to Western nations. Hospitals such as Bumrungrad and Bangkok Hospital attract international patients seeking specialist treatments. Wellness tourism, while smaller, is growing rapidly thanks to Thailand’s cultural heritage in spa resorts and holistic healing practices, combining traditional Thai therapies with modern wellness offerings like detox, mindfulness retreats, and integrated wellness plans of longer duration.

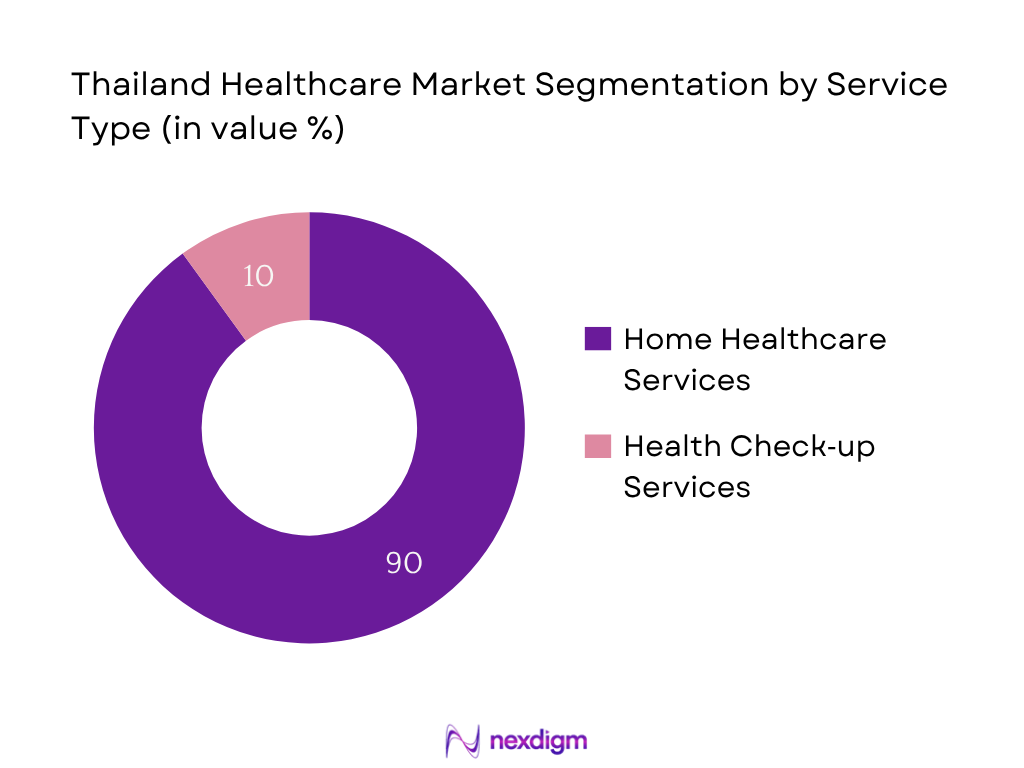

By Service Type

Home healthcare services in Thailand contributed approximately 9 % of the broader healthcare revenue in 2024, reflecting the growing trend of in‑home chronic care and elderly care, valued at USD 2,683.5 million. This segment is expanding due to an aging population and patient preference for low‑cost, at‑home medical support. Health check‑up services, including preventive diagnostic screenings, represent about 1 % (USD 294.3 million), led by general wellness packages offered through hospital networks and standalone labs. Their growth is attributed to rising health awareness and corporate wellness programmes.

Competitive Landscape

The Thailand healthcare market is led by a handful of large hospital chains and medical tourism operators. This consolidation reflects the dominance of firms that offer integrated, accredited facilities and international partnerships, shaping patient preference and price structure.

| Company Name | Establishment Year | Headquarters | JCI‑Accredited Hospitals | International Patient Volume | Centers of Excellence | Average Procedure Package Cost (USD) | Wellness Resorts Tie‑ups | Insurance Network Partnerships |

| Bangkok Dusit Medical Services (BDMS) | 1969 | Bangkok | – | – | – | – | – | – |

| Bumrungrad International Hospital | 1980 | Bangkok | – | – | – | – | – | – |

| Bangkok Hospital (Thailand) | 1972 | Bangkok | – | – | – | – | – | – |

| Samitivej Public Co. Ltd. | 1979 | Bangkok | – | – | – | – | – | – |

| Thonburi Healthcare Group | 2007 | Non‑metro Bangkok | – | – | – | – | – | – |

Thailand Healthcare Market Analysis

Growth Drivers

Medical Tourism Revenue

International medical travelers generated approximately USD 850 million in medical tourism revenue in 2023 in Thailand, with around 3 million medical tourists receiving treatment, as stated by Travel experts and medical tourism statistics sources. Thailand hosted about 28 million foreign visitors in 2023, contributing THB 1.2 trillion (~USD 33.7 billion) tourism earnings, of which a significant share is attributable to healthcare travelers visiting accredited hospitals and wellness service providers. Those inflows are supported by a public healthcare infrastructure that provides universal insurance coverage to 99.5 percent of the population, enabling a smooth coordination environment for private sector tourism-oriented healthcare services. Together, robust inbound tourism, accreditation infrastructure, and universal coverage strengthen medical tourism as a core growth driver.

Aging Population

By 2023, approximately 13 million Thais aged 60 and above, representing roughly 20.08 percent of the population, placed increased demand on healthcare services, especially chronic disease management and elderly care. Life expectancy rose to 79.7 years in 2022, compared to global average of 72, underscoring a higher elderly care burden within Thailand’s system. This population group also accounts for around 400,000 NCD-related deaths annually, equivalent to nearly 75 percent of all deaths, driving expansion in outpatient, home care, and preventive service demand. Aging demographics and elevated chronic disease prevalence thus significantly propel healthcare utilization and service diversification.

Market Challenges

Specialist Shortage

Thailand’s rural areas remain underserved with lower doctor-to-population ratios compared to Bangkok. Public data show that rural health centers struggle to attract skilled professionals, even though urban-centre hospitals draw most specialists and foreign patients. Further, government regulations require newly graduated doctors to serve rural provinces before transitioning to metropolitan private hospitals—a policy highlighting the skewed distribution. While no exact national specialist per 10,000 figure is widely published, the rural–urban disparity remains well-documented by the Ministry of Public Health as ongoing challenge.

Regulatory Bottlenecks

Thailand’s Thai FDA approval and import licensing processes are reportedly slower compared to peer ASEAN markets. While no precise delay in days is public, the requirement to comply with both FDA Thailand certification and BOI investment registration slows the adoption of new technologies and med-tech imports—particularly affecting private hospitals expanding elite service lines. Government agencies report that compliance overhead and review cycles persist as impediments for private sector providers seeking international accreditation alignments and patient care expansion.

Opportunities

Telehealth

Thailand reports over 80 percent household internet penetration, and with 13 million people aged 60+, telemedicine platforms can serve chronic care remotely—a segment historically underserved in rural zones. Government support for telemedicine pilot schemes and digital clinics, coupled with high mobile connectivity, lays a strong infrastructure base for scalable virtual care. These conditions position telehealth services to evolve rapidly without relying on future projections, enhancing reach to elderly and immobile patients.

Obesity Management Clinics

With NCDs accounting for 400,000 deaths annually, and high rates of diabetes, hypertension, and metabolic disorders, clinics focusing on weight management, lifestyle medicine, and preventive metabolic care are expanding. Existing data on NCD burden highlight increasing demand for specialized, outpatient-led treatment protocols. Hospitals and wellness centers are already establishing multidisciplinary obesity clinics combining medical care with wellness tourism packages, meeting both domestic and international demand for lifestyle disease management.

Future Outlook

Over the next five years, the Thailand healthcare market is expected to sustain robust growth driven by continued expansion of medical and wellness tourism, supportive government policies, and increasing demand from aging domestic segments and regional visitors. Technological adoption, including telehealth, home healthcare, and preventive services, will further accelerate sector evolution, positioning Thailand as a holistic healthcare destination.

Major Players

- Bangkok Dusit Medical Services (BDMS)

- Bumrungrad International Hospital

- Bangkok Hospital (Thailand)

- Samitivej Public Co. Ltd.

- Thonburi Healthcare Group

- Mega Lifesciences Public Co. Ltd.

- Ramkhamhaeng Hospital Public Co. Ltd.

- Vibhavadi Medical Center Public Co. Ltd.

- Praram 9 Hospital Public Co. Ltd.

- Chularat Hospital Public Co. Ltd.

- Sikarin Public Co. Ltd.

- Thai Nakarin Hospital Public Co. Ltd.

- Inter Pharma Public Co. Ltd.

- Aikchol Hospital Public Co. Ltd.

- Phyathai Hospitals Group

Key Target Audience

- Hospital Group Strategy Heads

- Medical and Wellness Tourism Investors

- Insurance Company Strategy Leads

- Private Equity and Venture Capital Firms (investments and venture capitalist firms)

- Ministry of Public Health (Thailand)

- Thai FDA / Ministry of Commerce (regulatory bodies)

- Health-Tech Startup Executives

- Network and Accreditation Authorities (e.g. JCI coordination teams)

Research Methodology

Step 1: Identification of Key Variables

Develop an ecosystem map of Thailand’s healthcare stakeholders including hospitals, tourist flows, insurers, and wellness operators. Gather secondary data from regulatory agencies, hospital financials, government tourism boards, and global healthcare databases.

Step 2: Market Analysis and Construction

Compile historical data on revenue from segments such as medical tourism, wellness tourism, home care, and diagnostics. Analyze utilization statistics, average procedure pricing, device import values, and tourism arrivals to construct bottom‑up revenue models.

Step 3: Hypothesis Validation and Expert Consultation

Draft hypotheses about growth drivers and segment dominance. Validate these with structured interviews (CATI) conducted with hospital administrators, wellness resort operators, insurance firms, and tourism boards to refine assumptions and fill data gaps.

Step 4: Research Synthesis and Final Output

Engage directly with hospital chains, wellness center networks, and telehealth providers to obtain insights on patient mix, pricing, service portfolio, and future expansion plans. Use this primary data to validate the models and produce a comprehensive, accurate market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach [THB revenue, patient volumes, procedure counts], Consolidated Research Approach, Understanding Market Potential through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Regulatory & Policy Milestones

- Healthcare Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Medical tourism revenue,

Aging Population %

Insurance Penetration %

Digital Adoption - Market Challenges

Specialist shortage per 10k population

Regulatory Bottlenecks

Import Dependency - Opportunities

Telehealth growth

Obesity Management Clinics

Wellness Tourism Expansion - Trends

Centres of Excellence

Bundled Packages for Tourists

EHR integration - Government Regulation

Thai FDA

BOI incentives

JCI standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value (THB, USD), 2019-2024

- By Volume (Patient‑days, OPD visits, surgical procedures), 2019-2024

- By Average Price (Bed‑day, consultation, procedure, drug pricing), 2019-2024

- By Service Type (In Value %)

In‑patient Care

Out‑patient Care

Telehealth

Wellness & Medical Tourism

Preventive Screenings - By Ownership (In Value %)

Public/Government

Private Domestic

International Hospital Chains - By End‑User (In Value %)

Domestic Patients

International Medical Tourists

Corporate/Occupational Health

Self‑pay Individuals - By Delivery Mode (In Value %)

Hospitals (Brick‑and‑Mortar)

Clinic Chains

Virtual Care Platforms - By Insurance Coverage (In Value %)

UCS (Public Health Insurance)

Social Security Scheme

Private Health Insurance

Direct‑pay/Self‑pay

- Market Share of Major Players (By Value/Volume)

Market Share by Service Type (In‑patient, Out‑patient, Telehealth, Wellness) - Cross Comparison Parameters (Company Overview, Service Portfolio Mix, International Patient Volume, Number of Centres of Excellence, JCI Accreditation Count, Average Revenue per Bed‑day, Revenue Split by Segment, Insurance Network Tie‑ups)

- SWOT Analysis of Major Players

- Pricing Analysis (Procedure packages, room tariffs, consultation fees)

- Detailed Profiles of Major Companies:

Bangkok Dusit Medical Services Public Co. Ltd.

Bumrungrad International Hospital Public Co. Ltd.

Samitivej Public Co. Ltd.

Bangkok Chain Hospital Public Co. Ltd.

Mega Lifesciences Public Co. Ltd.

Ramkhamhaeng Hospital Public Co. Ltd.

Vibhavadi Medical Center Public Co. Ltd.

Praram 9 Hospital Public Co. Ltd.

Chularat Hospital Public Co. Ltd.

Sikarin Public Co. Ltd.

Thonburi Healthcare Group Public Co. Ltd.

Thai Nakarin Hospital Public Co. Ltd.

Inter Pharma Public Co. Ltd.

Aikchol Hospital Public Co. Ltd.

Phyathai Hospitals Group

- Market Demand and Utilization Patterns (Domestic vs international patient mix)

- Purchasing Power and Budget Allocations (Procedure cost benchmarks)

- Regulatory and Compliance Requirements (Licensing, insurance claims)

- Needs, Desires, and Pain‑Point Analysis (Wait times, language barriers, access issues)

- Decision‑Making Process (Hospital selection, treatment choice, tourism tie‑ups)

- By Value (THB, USD), 2025-2030

- By Volume (Patient‑days, procedures, telehealth sessions), 2025-2030

- By Average Price (Bed‑day, procedure, consultation), 2025-2030