Market Overview

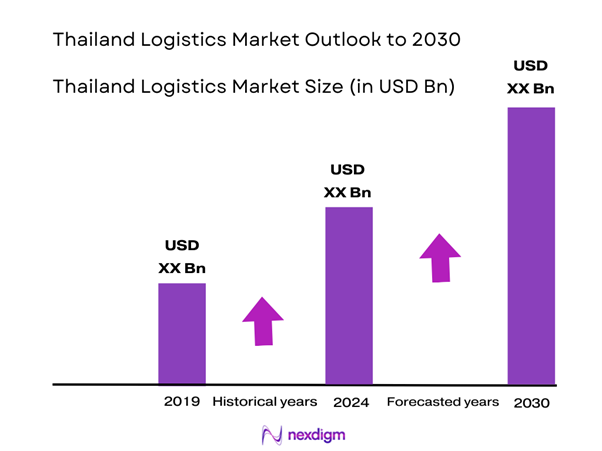

The Thailand Logistics Market is valued at USD 53.38 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 6.22% from 2025-2030, reflecting significant growth driven by the country’s strategic geographical position as a logistics hub in Southeast Asia. The rise in ecommerce and increasing foreign direct investment (FDI) play a pivotal role in this expansion. Furthermore, the impressive infrastructure improvements, including transportation networks, have enhanced the efficiency of logistics operations, making Thailand an attractive destination for businesses looking to optimize their supply chains.

Bangkok dominates the Thailand Logistics Market due to its status as an economic center, boasting the largest amount of commercial activity. As the capital city, it is equipped with advanced infrastructure such as two major international airports and several seaports, which facilitate efficient logistics operations. Additionally, cities like Laem Chabang are crucial due to their significant port activities, while regions surrounding industrial estates continue to attract manufacturing and logistics businesses, contributing to overall market growth.

Investments in infrastructure are pivotal for Thailand’s logistics market, as the government has set ambitious targets to enhance its road, rail, and port facilities. In 2022, the Thai government outlined a 20 trillion baht (approximately USD 600 billion) infrastructure plan that includes development projects such as new rail lines, road expansions, and port upgrades.

Market Segmentation

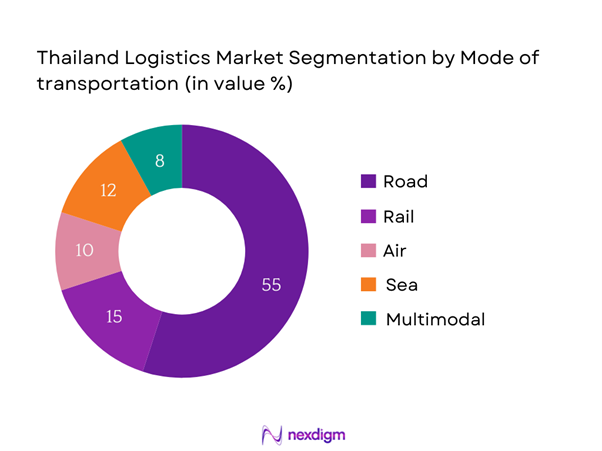

By Mode of Transportation

The Thailand Logistics Market is segmented by mode of transportation into road, rail, air, sea, and multimodal. Road transport currently holds the largest market share, attributed to its flexibility in reaching urban and rural areas alike efficiently. With a well-developed network of highways and increasing truck capacity, road transport remains essential for domestic freight delivery. Moreover, the rising demand for just-in-time deliveries and the growth of the ecommerce sector further reinforces road transport’s position as the market leader in logistics.

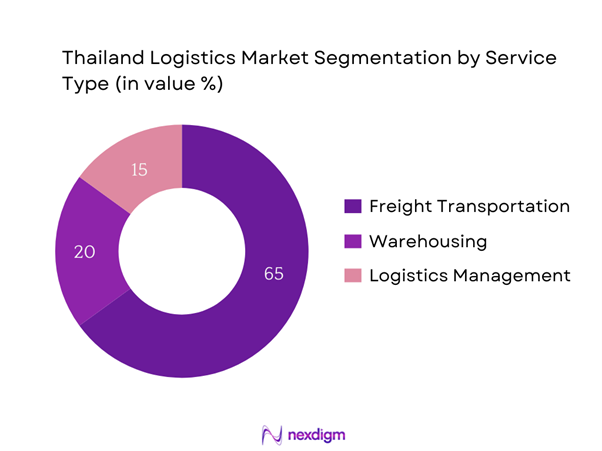

By Service Type

The Thailand Logistics Market is also segmented by service type, including freight transportation, warehousing, and logistics management. The prevailing segment within this category is freight forwarding, which dominates due to the continuous rise in global trade and the increased need for rapid product delivery. As consumer preferences shift toward immediate gratification, businesses invest heavily in freight solutions that can adapt, leading to rising revenues in this segment. Furthermore, the logistics sector’s adaptability allows it to cater to both local and international markets, reinforcing its significance.

Competitive Landscape

The Thailand Logistics Market is characterized by a competitive landscape where established local players co-exist with global giants. Major players include SCG Logistics, Kerry Logistics, and BTS Group Holdings, which dominate through their comprehensive services and extensive networks. These players’ ability to innovate and adapt to market needs, coupled with strategic partnerships, enhances their competitive advantage, making them problem solvers in logistics solutions for various industries.

| Company Name | Establishment Year | Headquarters | Mode of Transportation Expertise | Service Type Focus | Geographic Coverage | Revenue (USD Millions) |

| SCG Logistics | 1993 | Bangkok | – | – | – | – |

| Kerry Logistics | 1981 | Hong Kong | – | – | – | – |

| BTS Group Holdings | 1992 | Bangkok | – | – | – | – |

| JWD Group | 1994 | Bangkok | – | – | – | – |

| Thai Post | 1885 | Bangkok | – | – | – | – |

Thailand Logistics Market Analysis

Growth Drivers

Increasing E-commerce Activity

The logistics sector in Thailand has seen significant momentum due to the rising e-commerce activity, which is projected to reach USD 36 billion by end of 2025 as reported by the Digital Economy and Society Development Agency (DESDA). The proliferation of online shopping platforms and consumer preference for home deliveries have prompted businesses to prioritize logistics solutions capable of meeting these demands. The government’s push for digital economy development has fostered an environment where logistics firms can innovate and expand their capabilities, directly supporting logistics demand. E-commerce fulfillment centers and warehouse development projects have also accelerated, reinforcing the infrastructure necessary for these services.

Rising Demand for Supply Chain Optimization

Amid global disruptions, the demand for supply chain optimization solutions has surged. As of late 2023, the World Bank indicated that global supply chain disruptions cost economies approximately USD 1 trillion each year, urging companies to focus on robust logistics strategies. In Thailand, industries are adopting advanced technology, such as data analytics for inventory management and transportation routing. The current focus on resilience in supply chains is catalyzing investments in logistics technologies and practices that enhance efficiency and performance, preparing firms to withstand future shocks while better serving their customer bases.

Market Challenges

Infrastructure Limitations

Despite ongoing enhancements, Thailand still faces challenges related to its logistics infrastructure. A 2022 report from the Asian Development Bank highlighted that while significant investments are being made, logistical performance remains hampered by inadequate road conditions and congestion in urban centers. Over 28% of roads in rural areas are in poor condition, affecting delivery times and overall service quality. With urban areas experiencing increasing logistics traffic, optimizing infrastructure remains a key hurdle that hinders the effectiveness of logistics providers and limits overall market growth.

Regulatory Framework Issues

The logistics sector in Thailand is complicated by regulatory challenges that often create barriers to efficient operations. A thorough review by the Ministry of Transport revealed over 150 regulations related to transportation and logistics service provision, which can cause delays and increase operational costs. The time required to comply with various licensing procedures can extend operational timelines, potentially discouraging investment in logistics capabilities. Additionally, inconsistencies in enforcement can create an unpredictable operating environment for logistics providers, necessitating reforms for smoother operations.

Opportunities

Expansion of Cross-Border Trade

Current infrastructures at various border trade points are set to facilitate a significant increase in cross-border trade, particularly with neighboring ASEAN countries. Thailand’s exports to ASEAN are expected to surpass USD 31 billion in 2024, highlighting the potential for logistics service providers to optimize supply chains that encompass regional trade. This developing scenario provides logistics companies with opportunities to enhance services tailored specifically for cross-border needs, such as customs clearance solutions and duty management. These enhancements aim to streamline operations and drive overall trade efficiency in the logistics sector.

Growth in Smart Logistics Solutions

The trend towards smart logistics solutions is rapidly gaining traction in Thailand. The logistics sector is expected to invest approximately 15% of its operational budget into technology innovations in 2023, aiming for efficiencies. Key technologies such as IoT-enabled solutions and warehouse automation are becoming increasingly critical due to the growing need for efficiency and real-time data analytics. Industry reports indicate that organizations that adopt smart logistics practices experience up to a 20% reduction in operational costs.

Future Outlook

Over the next five years, the Thailand Logistics Market is anticipated to experience substantial growth propelled by the ongoing advancement of infrastructure, the increasing demand for sustainable logistics solutions, and the expanding ecommerce landscape. As businesses adapt to meet the expectations of efficiency and speed, innovations in automation and technology will further enhance operational effectiveness. Strategic governmental support through improved regulations and public-private partnerships is also expected to play a crucial role in shaping the market’s future trajectory.

Major Players

- SCG Logistics

- Kerry Logistics

- BTS Group Holdings

- JWD Group

- Thai Post

- Yusen Logistics

- Transimex

- P. Moller-Maersk

- Nippon Express

- Toll Group

- CJ Logistics

- Sinopacific Shipping

- DKSH

- Charoen Pokphand Group

- SRT Freight Rail

Key Target Audience

- Corporate Supply Chain Managers

- Logistics and Warehouse Operators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Transport, Department of Land Transport)

- Freight Forwarding Companies

- Retail and E-commerce Businesses

- Manufacturing Companies

- Shipping and Freight Companies

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, an ecosystem map is constructed that encompasses all major stakeholders within the Thailand Logistics Market. This step is underpinned by extensive desk research, employing a blend of secondary and proprietary databases to gather comprehensive industry-level information. The aim is to identify and clearly define the critical variables that impact market dynamics, allowing for an informed analysis of trends and drivers.

Step 2: Market Analysis and Construction

The next phase involves compiling and analyzing historical data relevant to the Thailand Logistics Market. Key statistics such as market penetration rates, the ratio of logistics providers to service demand, and resultant revenue generation are meticulously assessed. This phase also includes evaluating service quality metrics to ensure the reliability of the revenue estimates provided in the market analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through direct interviews with industry experts representing a wide array of companies in the logistics sector. These consultations yield invaluable operational and financial insights from practitioners, enhancing the credibility and accuracy of the data gathered. Feedback from experts helps refine market data and validate assumptions derived from earlier analyses.

Step 4: Research Synthesis and Final Output

In the final phase, we engage directly with multiple logistics providers to obtain granular details about service segments, sales performance, consumer preferences, and other pertinent factors influencing the market. This direct engagement is geared towards validating and supplementing the statistics derived from the bottom-up approach, ensuring that the final output presents a comprehensive and accurate analysis of the Thailand Logistics Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Market Genesis

- Major Milestones in the Logistics Sector

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing E-commerce Activity

Government Initiatives for Infrastructure Development

Rising Demand for Supply Chain Optimization - Market Challenges

Infrastructure Limitations

Regulatory Framework Issues

Competitive Pricing Pressures - Opportunities

Expansion of Cross-Border Trade

Growth in Smart Logistics Solutions

Demand for Sustainable Logistics Practices - Trends

Adoption of Green Logistics

Technological Innovations in Logistics

Digital Transformation in Supply Chain - Government Regulation

Logistic Licensing and Compliance

Tariffs and Trade Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mode of Transportation (In Value %)

Road

– Last-Mile Delivery

– Intra-Island Freight

– Express & Same-Day Services

– Commercial Trucking

Rail

– Cargo Rail

– Intermodal Hubs

Air

– Domestic Air Cargo

– International Freight

– Express Courier Services

Sea

– RoRo Logistics

– Inter-island Shipping

– Bulk Freight

– Containerized Freight

Multimodal

– Port-to-Door Logistics

– Cross-Docking Hubs

– Integrated E-commerce Fulfillment

– Cold Chain Linkages - By Service Type (In Value %)

Freight Transportation

– Full Truckload (FTL)

– Less-than-Truckload (LTL)

– Parcel & Courier Logistics

– Container Drayage

Warehousing

– Bonded Warehouses

– Cold Storage

– Ambient Storage

– Cross-Docking and Transshipment Hubs

Logistics Management

– Inventory & Order Management

– Fleet Management Solutions

– Reverse Logistics

– Customs Clearance and Documentation - By End-User Industry (In Value %)

E-commerce

– B2C Fulfillment Centers

– Last-Mile Delivery Networks

– Returns Handling

Automotive

– Parts Distribution

– Assembly Plant Logistics

– Vehicle Transport Services

Retail

– Multi-location Inventory Sync

– Store-to-Store Transfers

– Omni-Channel Fulfillment

Food & Beverage

– Cold Chain Logistics

– Perishable Goods Transport

– Restaurant Supply Distribution

Healthcare

– Medical Supplies & Pharma Delivery

– Vaccine Logistics (cold chain)

– Hospital Fulfillment & Consignment Stocks - By Region (In Value %)

Central Region

Northern Region

Southern Region

Northeastern Region

Western Region (Recommended addition) - By Technology Usage (In Value %)

IoT-Enabled Solutions

– Real-time Fleet Tracking

– Temperature and Humidity Sensors

– Asset Tracking & Condition Monitoring

Warehouse Automation

– Pick-to-Light / Put-to-Light Systems

– Automated Storage & Retrieval Systems (ASRS)

– Conveyor Belt & Robotics

Blockchain Technology

– Transparent Freight Billing

– Smart Contracts for Freight Transactions

– Tamper-Proof Documentation

AI and Data Analytics

– Predictive Demand Planning

– Route Optimization

– Freight Consolidation & Forecasting

- Market Share of Major Players by Value/Volume, 2024

Market Share Breakdown by Service Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenue Metrics, Distribution Channels, Partnerships, Technology Adoption, Market Positioning, Delivery Speed & SLA Compliance, Fleet Size and Modal Capacity, Geographical Coverage, Sustainability Initiatives)

- SWOT Analysis of Major Players

- Pricing Structure Analysis with SKU Details

- Detailed Profiles of Major Competitors

SCG Logistics

Kerry Logistics

BTS Group Holdings

JWD Group

Thai Post

Yusen Logistics

DKSH

Nippon Express

Transimex

Toll Group

CJ Logistics

Charoen Pokphand Group

SRT Freight Rail

Sinopacific Shipping

A.P. Moller-Maersk

- Market Demand and Utilization

- Budget Allocations by End User

- Regulatory Compliance Insights

- Needs and Pain Point Assessment

- Decision-Making Dynamics

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030