Market Overview

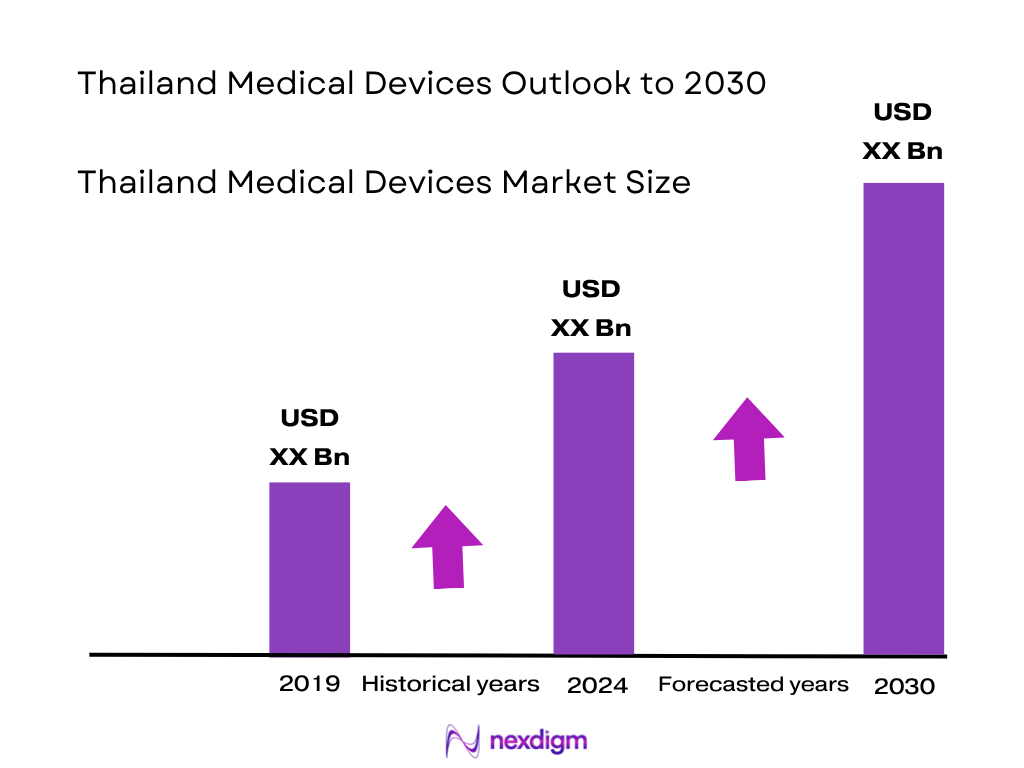

The Thailand medical devices market is valued at USD 2.23 billion in 2024, based on recent projections. This market size has been shaped by a significant rebound in import activity, with device imports growing by 11.0 % in USD terms in 2023. The strong import momentum, especially in consumables and orthopaedic products, alongside Thailand’s strategic push in medical tourism and health infrastructure investments, have been the principal drivers behind the market’s current scale and growth.

Thailand’s medical devices sector is dominated by Bangkok and other major urban centers such as Chiang Mai and Phuket, where world-class hospitals and specialist clinics cater to both domestic patients and medical tourists. Their prominence stems from advanced healthcare infrastructure, high-capacity hospitals like Bumrungrad International and Bangkok Hospital, and strong integration with the tourism industry.

Market Segmentation

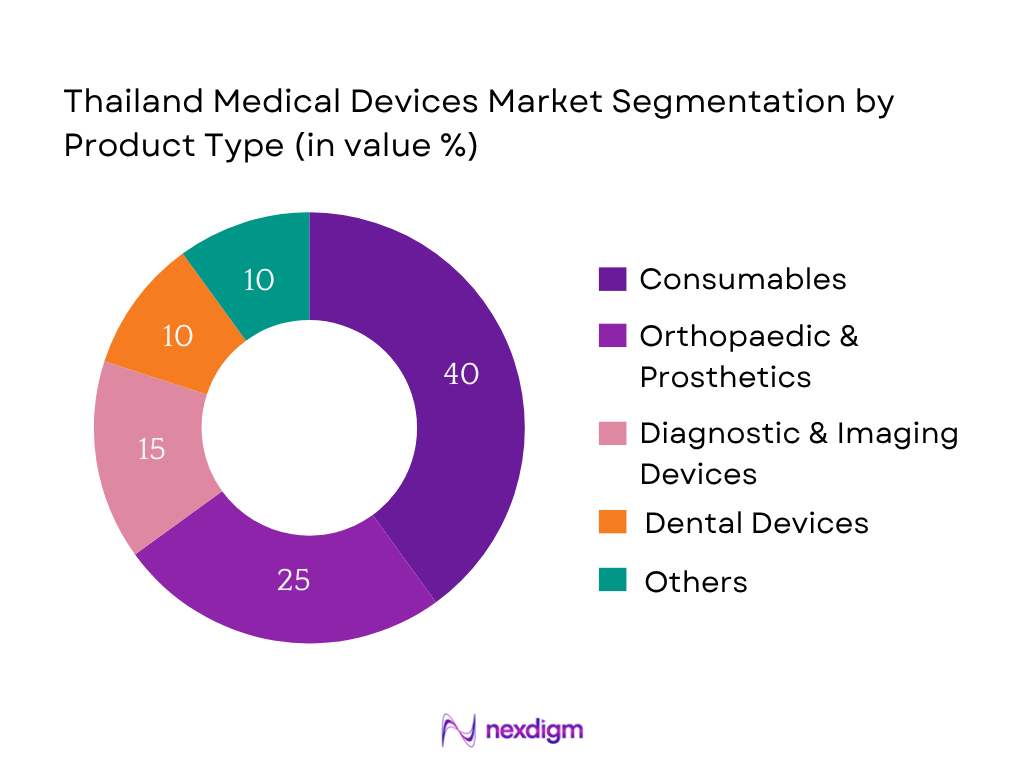

By Product Type

The Thailand medical devices market is segmented into consumables, orthopaedic & prosthetics, diagnostic & imaging devices, dental devices, and others. Consumables hold the dominant share at 40 %, driven by high turnover requirements in hospitals and clinics as well as robust import volumes in 2023. Their lower unit cost and constant replacement needs ensure consistent demand. Additionally, consumables include essential products such as surgical gloves, syringes, and bandages—areas where Thailand relies heavily on imports due to limited domestic production capability. This combination of import dependency, steady usage, and affordability underlines the consumables segment’s leading position in the market.

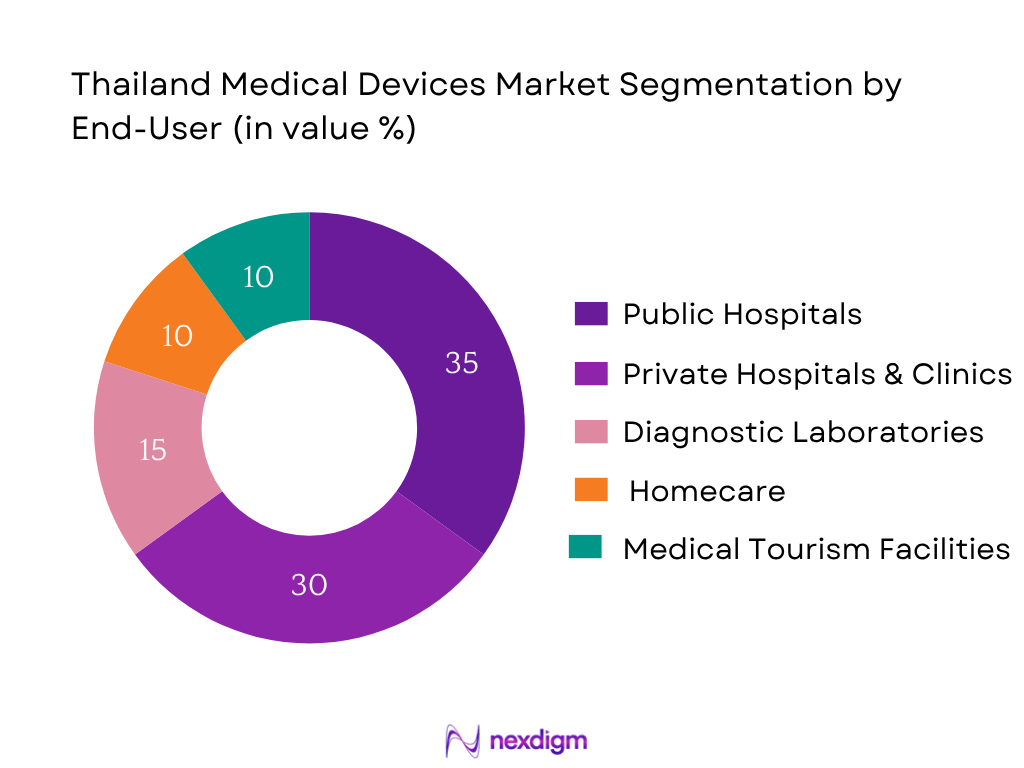

By End‑User

The Thailand medical devices market is categorized into public hospitals, private hospitals & clinics, diagnostic laboratories, homecare & long‑term care services, and medical tourism facilities. Public hospitals command the largest share at 35 %, largely due to government-backed healthcare frameworks such as Universal Health Coverage and substantial public healthcare spending. These institutions predominantly procure high volumes of standard medical devices and consumables, ensuring consistent demand across a broad product range. Their purchasing power, central budgeting, and high-volume procurement cycles surpass those of private entities, diagnostic centers, and niche providers. This makes public hospitals the most influential and stable buyers in Thailand’s medical devices ecosystem.

Competitive Landscape

The competitive landscape in Thailand’s medical devices market features both global multinationals and local players, reflecting a mix of import dependence and domestic supply constraints. Major players include leading global manufacturers with strong distribution networks, such as Medtronic, Johnson & Johnson, Stryker, GE Healthcare, and Philips Healthcare, whose products dominate advanced therapeutic, imaging, and diagnostic device segments.

| Company Name | Establishment Year | Headquarters | Distribution Network | TFDA Approval Track Record | Local Partnerships | After‑Sales Service Coverage | Device Portfolio Breadth |

| Medtronic | 1949 | Dublin, Ireland | – | – | – | – | – |

| Johnson & Johnson | 1886 | New Brunswick, USA | – | – | – | – | – |

| Stryker | 1941 | Kalamazoo, USA | – | – | – | – | – |

| GE Healthcare | 1892 | Chicago, USA | – | – | – | – | – |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | – | – | – | – | – |

Thailand Medical Devices Market Analysis

Growth Drivers

Expansion of Universal Health Coverage (UHC)

Thailand’s Universal Coverage Scheme (UCS), also known as the “Gold Card” system, provides healthcare access to 99.5 percent of the population, as reported by the World Bank. This near-universal coverage ensures consistent, large-scale procurement of medical devices across public healthcare facilities, including 927 government hospitals and 9,768 Primary Care Health Units as of recent estimates. Public healthcare spending per capita stood at USD 370 in 2022, reflecting steady growth from USD 364 in 2021 and USD 304 in 2020. The combination of extensive infrastructure (10,695 government hospitals and clinics overall) and comprehensive coverage creates a robust foundation for demand in medical devices such as disposables, diagnostic tools, and curative equipment.

Rise in Non‑Communicable Diseases (NCDs) and Aging Population

While specific NCD prevalence data for Thailand is limited in open sources, the aging trend is well-documented: Thailand’s demographic transition includes an expanding proportion of older adults, increasing the demand for chronic disease management devices (e.g., glucose monitors, cardiac monitors). Meanwhile, overall health spending per capita rose to USD 370 in 2022, up from USD 364 in 2021, signaling higher utilization and consistent investment in health services that cater to aging-related conditions. This uptick underscores rising consumption of durable medical devices in both public and private settings, driven by long-term care needs and treatment of NCDs across Thailand’s healthcare infrastructure.

Market Challenges

Heavy Reliance on Imported Devices

Thailand’s domestic medical device manufacturing remains limited, causing strong dependence on imports. Although precise import volumes are not publicly disclosed, the consistently rising per capita health spending (USD 370 in 2022 vs USD 364 in 2021) suggests that most specialized equipment and consumables must be imported to meet demand—especially within expanded infrastructure and medical tourism hubs (Bangkok, Phuket, Chiang Mai). This reliance on international supply chains exposes the market to foreign exchange fluctuations and supply-side disruptions, creating vulnerabilities for healthcare providers and affecting device availability and procurement.

Delayed TFDA Approval Timelines

Thailand’s Food and Drug Administration (TFDA) oversees medical device approvals—a process that often entails extensive documentation and clinical evidence. Though specific timeline data is not publicly available, stakeholders frequently report delays that disrupt hospital procurement cycles, especially for complex or innovative products. Meanwhile, public infrastructure and per capita health spending (USD 370 in 2022) continue to grow, amplifying frustration over regulatory latency. This bottleneck constrains access to cutting-edge technology and impedes healthcare delivery efficiencies across both urban and rural settings.

Market Opportunities

Growth in Home Healthcare and Remote Monitoring

Thailand’s escalating per capita health expenditure—USD 370 in 2022—reflects overall system investment and rising chronic-care demands, which are increasingly addressed through home healthcare and remote monitoring solutions. With 99.5 percent coverage under universal healthcare and expanding digital health initiatives, there is a strong policy impetus for remote health services, especially in rural areas served by 9,768 primary care units and outreach clinics. Demand for remote patient monitoring (e.g., blood pressure monitors, wearable sensors) is rising, supported by telehealth platforms being piloted across provinces—presenting opportunities for medical device firms to expand into home-based consumables and connected devices aligned with government healthcare access goals.

Contract Manufacturing under BOI Investment Schemes

Thailand’s Board of Investment (BOI) active promotion of the medical devices sector as a targeted industry enables contract manufacturing opportunities. Although specific investment numbers aren’t publicly disclosed, inclusion in BOI’s incentive framework and ongoing infrastructure development—as evidenced by rising per capita healthcare spend (USD 370 in 2022) and extensive hospital networks—create conditions favorable for multinational device firms to establish local production. This can help firms overcome import challenges, leverage Thailand’s healthcare infrastructure, and meet domestic demand, aligning with national industrial strategy under Thailand 4.0 and reducing supply chain vulnerabilities.

Future Outlook

Over the next six years, the Thailand medical devices market is anticipated to exhibit steady growth supported by increased healthcare spending, continuous recovery and growth in medical tourism, and ongoing enhancements in public healthcare infrastructure. Government-backed policies such as Thailand 4.0 and BOI incentives are expected to further propel import volumes, digital health adoption, and local production capabilities.

Major Players

- Medtronic

- Johnson & Johnson

- Stryker

- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

- Boston Scientific

- Mindray

- Braun

- Canon Medical Systems

- Boston Scientific

- Smith & Nephew

- Roche Diagnostics

- Samsung Medison

- BD (Becton Dickinson)

Key Target Audience

- Hospital procurement directors (public sector)

- Hospital procurement directors (private sector)

- Equipment distributors and importers

- Medical tourism clinic investors

- Healthcare infrastructure investors and venture capitalist firms

- Ministry of Public Health (MoPH), Thailand

- Board of Investment (BOI), Thailand

- Health Insurance Providers & Reimbursement Agencies (e.g., NHSO – National Health Security Office)

Research Methodology

Step 1: Secondary Desk Research

We collected and reviewed historical data from official sources such as the Thailand Office of Industrial Economics (MEDIU), BMI (Fitch Solutions), and industry databases to construct an accurate 2024 market size and document import trends and regulatory insights.

Step 2: Data Triangulation & Segmentation Analysis

Historical production, import, and export figures were used in conjunction with stakeholder interviews and hospital procurement data, enabling precise segmentation by product type and end‑user, and validation of market share estimates.

Step 3: Expert Consultation & Validation

Key insights were validated through structured interviews with hospital procurement heads, importers, and representatives from MoPH and BOI. These consultations ensured accuracy in demand drivers, regulatory procedures, and segmentation trends.

Step 4: Forecasting & Cross‑Validation

We applied a bottom‑up forecasting model using market fundamentals and validated the CAGR (4.9 %) against published third‑party forecasts from BMI. The final projections were corroborated through stakeholder feedback to ensure alignment with real‑time market dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Primary and Secondary Research Approach, Validation Techniques, Limitations and Future Outlook)

- Definition and Scope

- Industry Genesis and Development Roadmap

- Device Classification (MoPH and TFDA Criteria)

- Regulatory Landscape (Medical Device Act, TFDA, ASEAN MDD)

- Value Chain and Procurement Ecosystem

- Timeline of Regulatory and Investment Milestones

- Import & Export Dependency Overview

- Major Public and Private Healthcare Consumers

- Growth Drivers

Expansion of Universal Health Coverage

Rise in Non-Communicable Diseases and Aging Population

Growth in Medical Tourism (Bangkok, Phuket, Chiang Mai)

Infrastructure Expansion in Public and Private Hospitals

Government Incentives for Local Manufacturing - Market Challenges

Heavy Reliance on Imported Devices

Delayed TFDA Approval Timelines

Lack of Trained Biomedical Technicians

Price Cap Regulations in Public Procurement

Regulatory Misalignment with Global Standards - Market Opportunities

Growth in Home Healthcare and Remote Monitoring

Contract Manufacturing under BOI Investment Schemes

Smart Hospitals and Digital Transformation Initiatives

Expansion of ASEAN Medical Device Single Market

Rise in Geriatric-Focused Medical Solutions - Market Trends

Surge in AI-enabled Diagnostic Equipment

Growing Demand for Single-use Consumables

Shift Toward Minimally Invasive Devices

Digitization of Medical Imaging Archives

3D Printing Adoption in Surgical Planning - Government Regulation

Import-Export Compliance and TISI Standards

Tax Incentives under BOI for Local Device Manufacturing

Environmental and Disposal Regulations for Devices - SWOT Analysis

- Porter’s Five Forces

- Stakeholder Ecosystem Mapping

- By Value, 2019-2024

- By Volume, 2019-2024

- By Import vs Domestic Procurement, 2019-2024

- By Government vs Private Sector Usage, 2019-2024

- By Product Type (In Value %)

Diagnostic Imaging Devices

Consumables & Disposables

Therapeutic Devices

Monitoring Devices

Surgical Equipment - By End-User (In Value %)

Public Hospitals

Private Hospitals

Specialty Clinics

Diagnostic Labs

Homecare Settings - By Distribution Channel (In Value %)

Direct Sales (Manufacturer to Hospital)

Authorized Distributors

Medical Device Retail Chains

E-Commerce Portals - By Application (In Value %)

Cardiology

Orthopedics

Radiology

Oncology

General Surgery - By Region (In Value %)

Bangkok Metropolitan Area

Eastern Economic Corridor

Northern Thailand

Southern Thailand

Northeastern Region (Isan)

- Market Share Analysis (By Value and Volume)

Market Share by Product Category

Market Share by Region and Procurement Channel - Cross Comparison Parameters (Company Overview, Device Portfolio Breadth, Distribution Strength in Thailand, TFDA Compliance Record, After-Sales Service Network, Investment in Local Manufacturing, Revenue Contribution from Thailand, Product Pricing Structure, Warehousing Capacity in Thailand, Key Partnerships in Thai Healthcare Sector)

- SWOT Analysis of Major Players

- Pricing Matrix of Major SKUs by Players

- Detailed Profiles of Key Companies

GE Healthcare

Siemens Healthineers

Philips Healthcare

Canon Medical Systems

Mindray

Boston Scientific

B. Braun

Medtronic

Johnson & Johnson

Stryker

Smith & Nephew

Hitachi Medical Systems

Roche Diagnostics

Samsung Medison

Thai Medical Device Technology Industry Association (THAIMED) Members

- Procurement Behavior of Public vs Private Hospitals

- Budget Allocation & Procurement Cycle Timelines

- Decision-Making Hierarchy (MoPH, Hospitals, Clinics)

- Demand Trends from Specialized Clinics (Fertility, Dental, Ortho)

- Pain Points & Unmet Needs among Regional Hospitals

- By Value, 2025-2030

- By Volume, 2025-2030

- By Import vs Domestic Procurement, 2025-2030

- By Government vs Private Sector Usage, 2025-2030