Market Overview

Thailand’s medical tourism market is valued at USD 2.57 billion. This valuation reflects a substantial increase over 2023, driven by greater accessibility, advanced treatment offerings, and hospital accreditations. Rising demand for cost-effective specialist procedures—such as cosmetic surgery, dental reconstruction, fertility services, and oncology—coupled with enhancements in care infrastructure and government-backed patient protection, are primary drivers steering this growth.

Thailand’s appeal centers around key destination hubs like Bangkok, Phuket, and Chiang Mai, which dominate the market thanks to world-class hospitals, deep portfolio of specialized treatments, and robust international transportation links. Bangkok leads owing to its medical expertise and multi-specialty institutions; Phuket attracts patients seeking integrated medical and recovery tourism; while Chiang Mai draws visitors through a mix of modern medical care and traditional wellness offerings.

Market Segmentation

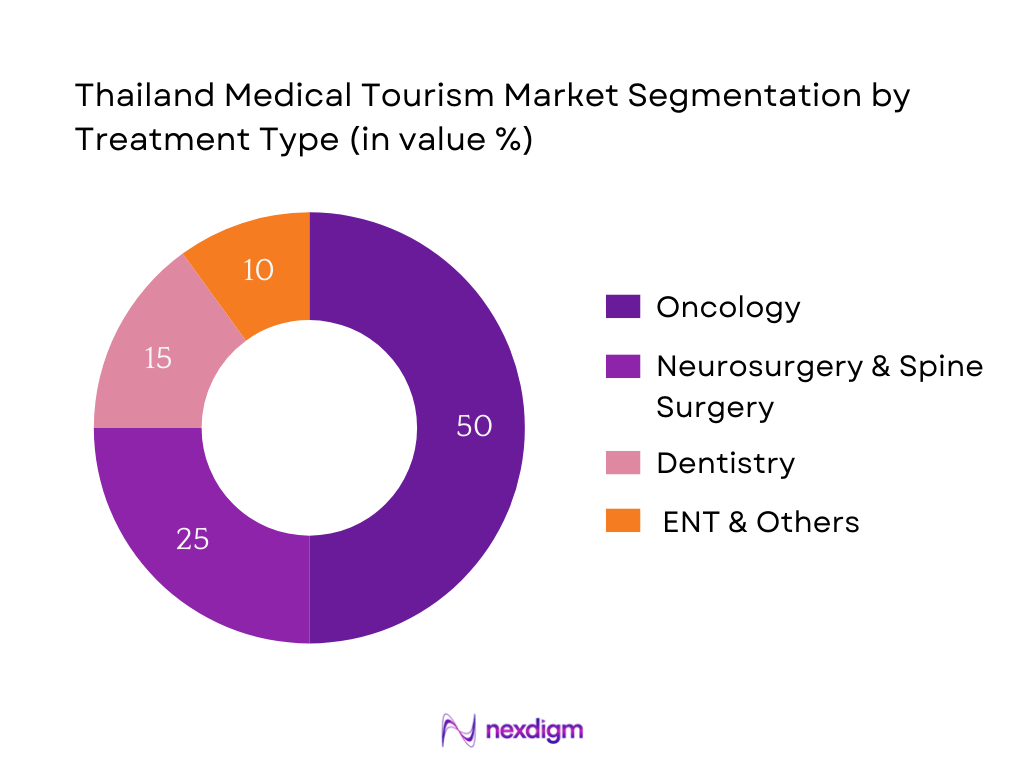

By Treatment Type

The Thailand medical tourism market is segmented by treatment type into several key categories: Oncology, Neurosurgery and Spine Surgery, Dental, ENT, Gynecology, Urology, Ophthalmology, Plastic & Reconstructive Surgeries, and others. Within this segmentation, Oncology holds the largest share, driven by Thailand’s advanced cancer care infrastructure, specialized oncologists, and comparatively affordable treatment costs.

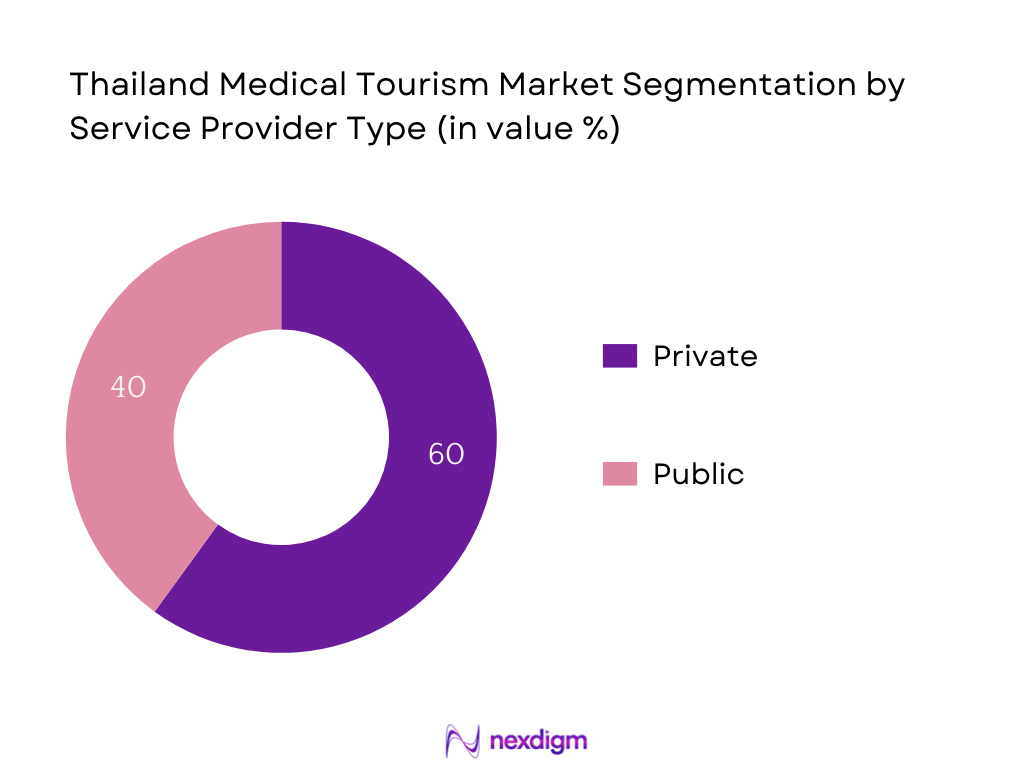

By Service Provider Type

Thailand’s market is also segregated by providers into Private and Public. The Private segment dominates, benefitting from superior accreditation (e.g., JCI), concierge‐style offerings, and international branding that attract higher‑value foreign patients.

Competitive Landscape

Thailand’s medical tourism sector is highly concentrated, with top hospitals and healthcare groups leading the market. These key players include Bumrungrad International, Bangkok Hospital Group, Samitivej Hospitals, Phyathai Hospitals, BNH, Yanhee, and others. This consolidation underscores significant influence and trust among international patients.

Below is a snapshot of major players, detailing establishment year, headquarters, and six market‑specific parameters:

| Company | Established | Headquarters | Accreditations | International Patient Volume | Specialties / Services | Concierge & Language Support | International Presence / Offices |

| Bumrungrad International Hospital | 1980 | Bangkok | – | – | – | – | – |

| Bangkok Hospital Group (BDMS) | 1969 | Bangkok | – | – | – | – | – |

| Samitivej Hospital Group | – | Bangkok | – | – | – | – | – |

| Yanhee International Hospital | 1984 | Bangkok | – | – | – | – | – |

| Phyathai Hospitals Group | 1976 | Bangkok | – | – | – | – | – |

Thailand Medical Tourism Market Analysis

Growth Drivers

Healthcare Quality Accreditation

Thailand leads Asia in health security, ranking sixth globally in the 2019 Global Health Security Index, with 62 hospitals accredited by Joint Commission International (JCI) across the country. This robust accreditation environment signals high care standards and patient safety, enhancing appeal to international patients. Economically, Thailand’s Gross National Income (GNI) reached USD 511.7 billion in 2024, up from USD 503.0 billion in 2023, reflecting rising national incomes and ability to invest in quality healthcare infrastructure. The convergence of accreditation prominence and robust macroeconomic income underpins Thailand’s strong healthcare infrastructure, driving trust and demand in medical tourism.

Cost Advantage

Thailand’s nominal GDP per capita stood at approximately USD 7,345 in 2023, a level that places it solidly within the upper-middle-income bracket. Additionally, the cost to start a business in Thailand is just 3 percent of income per capita, well below the 11 percent average among upper-middle-income economies, supporting efficient healthcare investment and cost containment. Furthermore, public aid programs such as the THB 10,000 cash transfer implemented in 2024 helped stabilize household purchasing power, enabling increased healthcare spending. Together, these economic factors create a favorable environment for cost-competitive, high-quality medical tourism services.

Market Challenges

Language Barriers

Thailand’s population of approximately 66 million in 2024, with over 20 percent aged over 60, underscores demographic diversity—but rural areas often suffer from insufficient multilingual healthcare services. While urban hospitals offer language support, the uneven physician density—one physician per 565 persons in Bangkok versus one per 2,870 in some Isan provinces—exacerbates gaps, especially in rural care where language and cultural nuances impede communication and patient follow-up. This imbalance challenges continuity of care for medical tourists who may require out-of-center support post-treatment.

Post‑Treatment Follow‑Ups

Thailand’s healthcare infrastructure shows strong primary care reach: 927 government hospitals, 363 private hospitals, and 9,768 primary-care units, serving nearly 99.5 percent population coverage via universal schemes. However, with an aging population—over 20 percent aged above 60 in 2024 —the existing system strains under chronic and complex post-treatment care demands. Particularly for international patients, navigating follow-up appointments and rehabilitation across regional facilities with resource constraints may hinder seamless recovery and recidivism management.

Emerging Market Opportunities

Integrative Wellness Packages

Thailand’s healthcare network includes 25,615 private clinics and extensive primary-care infrastructure, enabling blending of modern treatment with holistic wellness offerings. Life expectancy improvements in Thailand—average GDP per capita USD 7,345 may support lifestyles that favor preventive and wellness travel. High physician access in urban centers and rural primary clinics facilitates delivery of integrative packages combining medical procedures and post-care wellness. These structural strengths align with rising demand for medical-wellness hybrids, positioning Thailand as a unique holistic destination.

Regenerative Medicine Tourism

Thailand’s advanced healthcare infrastructure, backed by its GNI of USD 511.7 billion in 2024, and strong institutional foundations (e.g., JCI‑accredited hospitals), provide a promising platform for emerging therapies such as regenerative medicine. Though not yet mainstream, the extensive private-sector hospital network (over 363 private hospitals) and Thailand’s demonstrated ability to integrate innovative treatments—while maintaining universal coverage—suggest capacity to support curative tourism. This provides fertile ground for future growth in niche high‑value medical services tempered by existing macroeconomic strength.

Future Outlook

Over the projected period, Thailand’s medical tourism market is expected to grow steadily, propelled by continuous expansion of healthcare infrastructure, accreditation growth, and integrated medical‑wellness packages. Technological adoption, policy initiatives such as extended medical‑visas, and strong global patient trust will drive demand forward.

Major Players

- Bumrungrad International Hospital

- Bangkok Hospital Group (BDMS)

- Samitivej Hospital Group

- Phyathai Hospital Group

- BNH Hospital

- Yanhee International Hospital

- MedPark Hospital

- Kasemrad International Rattanathibet Hospital

- Mission Hospital

- Paolo Hospital Group

- Praram 9 Hospital

- Vejthani Hospital

- Bangkok Smile Dental Group

- hai Medical Vacation

- Bookimed Limited

Key Target Audience

- Hospital and Healthcare Facility CEOs and Directors

- Private Equity Investors & Venture Capitalist Firms

- Medical Tourism Facilitator Organizations

- International Health Insurance Providers / TPAs

- Aviation and Hospitality Investment Partners

- Thailand Tourism Authority (TAT)

- Ministry of Public Health of Thailand

- Board of Investment (BOI), Thailand

Research Methodology

Step 1: Identification of Key Variables

Map all stakeholders in Thailand’s medical tourism ecosystem—spanning hospitals, regulators, facilitators, insurers, and tourists—using both secondary sources and proprietary industry databases to frame critical variables affecting market dynamics.

Step 2: Market Analysis and Construction

Assemble historical data including treatment volumes, revenue, tourist origins, and procedure mix. Validate through hospital reports and public health data, ensuring reliability in revenue and market structure modeling.

Step 3: Hypothesis Validation and Expert Consultation

Develop hypotheses around cost‑competitiveness, accreditation impact, and geographic hub dominance. Validate these via structured interviews (e.g. CATI) with hospital executives, tourism officials, and facilitation agencies to obtain operational insights.

Step 4: Research Synthesis and Final Output

Engage directly with key hospitals and tourism agencies to refine data from bottom‑up models. This ensures comprehensive, validated, and grounded analysis of Thailand’s medical tourism market for 2024–2030.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Evolution and Genesis of the Market

- Timeline of Key Government Policies and Private Investments

- Role of Public-Private Partnerships in Healthcare Infrastructure

- Medical Tourism Ecosystem in Thailand

- Inbound Medical Tourist Journey Mapping

- Value Chain and Stakeholder Analysis

- Overview of Supporting Sectors (Wellness, Hospitality, Transport)

- Growth Drivers (Healthcare Quality Accreditation, Cost Advantage, Visa Ease)

- Market Challenges (Language Barriers, Post-Treatment Follow-ups, Regulatory Compliance)

- Emerging Market Opportunities (Integrative Wellness Packages, Regenerative Medicine Tourism)

- Key Trends (AI in Diagnosis, Telehealth Consults for Pre/Post Travel)

- Government Regulations and Support Schemes (Thailand Board of Investment, Health Accreditation Agencies)

- SWOT Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- By Revenue Generated from Medical Tourists, 2019-2024

- By Number of Inbound Medical Tourists, 2019-2024

- By Average Spend per Medical Tourist, 2019-2024

- By Length of Stay of Medical Tourists, 2019-2024

- By Type of Medical Procedure (In Value %)

Cosmetic and Aesthetic Surgery

Orthopedic Treatments

Dental Services

Fertility Treatments (IVF, ICSI, etc.)

Cardiac and Cardiovascular Procedures - By Source Country (In Value %)

United Arab Emirates

China

Myanmar

Australia

United States

European Union Nations - By Type of Healthcare Facility (In Value %)

Multi-Specialty Hospitals

Specialty Clinics

Wellness and Rehabilitative Centers

Dental Hospitals

IVF and Fertility Centers - By Distribution Channel (In Value %)

Medical Tourism Facilitators

Direct Hospital Booking

Government Portals

Insurance and International TPA Tie-ups

Online Platforms (Web/App) - By Region ((In Value %)

Bangkok

Phuket

Chiang Mai

Pattaya

Hua Hin

- Market Share by Revenue/Volume for Key Players

Market Share by Procedure Type for Key Players - Cross Comparison Parameters (Company Overview, Business Strategy, Number of International Accreditations (JCI, GHA, etc.), Annual International Patient Footfall, Core Medical Specialties and Revenue Split, Hospital Infrastructure (Beds, Operating Theatres, Recovery Rooms), Language and Concierge Services, Tie-ups with Insurance/TPAs, Direct Air Connectivity and Location Access, Telemedicine Integration and Virtual Consult Capabilities, Medical Visa & Immigration Support, Clinical Outcome Benchmarking, Digital Patient Experience Capabilities, Medical Tourism Package Inclusions, Wellness and Spa Integration)

- SWOT Analysis of Leading Players

- Price Benchmarking for Top Procedures

- Profiles of Key Players

Bumrungrad International Hospital

Bangkok Hospital Group (BDMS)

Samitivej Hospitals

Phyathai Hospital Group

BNH Hospital

Yanhee International Hospital

Sikarin Hospital

Paolo Hospital

Vejthani Hospital

JCI-accredited Aikchol Hospital

Saint Louis Hospital

MedPark Hospital

Mission Hospital Bangkok

World Medical Hospital

Piyavate Hospital

- Tourist Intent Mapping and Treatment Journey

- Budget Preferences and Willingness-to-Pay Behavior

- Regulatory and Insurance Coverage Needs

- Language, Culture, and Religious Accommodation Preferences

- Destination Decision-Making Process

- By Revenue Generated from Medical Tourists, 2025-2030

- By Number of Inbound Medical Tourists, 2025-2030

- By Average Spend per Medical Tourist, 2025-2030

- By Length of Stay of Medical Tourists, 2025-2030