Market Overview

The Turkey cargo drones market current size stands at around USD ~ million, supported by approximately ~ units operating across commercial and governmental logistics networks. Adoption accelerated as shipment missions exceeded ~ flights annually, while payload capacities averaged ~ kilograms per sortie. Fleet utilization rates crossed ~ percent, reflecting stronger demand consistency. Technology penetration improved as over ~ percent of platforms integrated autonomous navigation. Operational trials expanded beyond ~ cities, reinforcing ecosystem maturity without disclosing aggregate market scale.

Market activity remains concentrated around Istanbul, Ankara, and Izmir due to dense logistics infrastructure, defense manufacturing clusters, and regulatory oversight presence. These regions benefit from advanced testing corridors, skilled aerospace labor, and proximity to integrators. Secondary uptake appears in Anatolian logistics hubs supporting healthcare and emergency deliveries. Regional policy pilots and military-backed programs further accelerate adoption. Limited rural infrastructure slows diffusion outside core corridors despite clear operational demand.

Market Segmentation

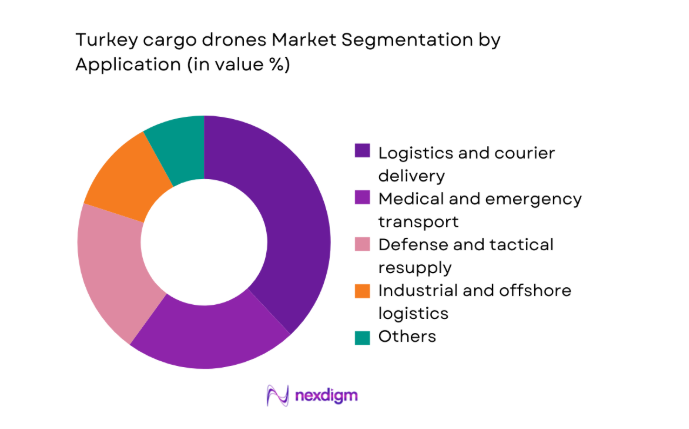

By Application

Cargo drone deployment in Turkey is dominated by logistics and time-critical delivery applications, reflecting shifting fulfillment expectations across urban and intercity routes. Medical and emergency transport gained relevance as hospitals prioritized rapid supply movement. Defense resupply missions continue to validate reliability and endurance capabilities. Industrial logistics usage remains emerging but promising. The dominance of logistics stems from higher mission frequency, repeatability, and integration with existing distribution networks, creating sustained operational demand and accelerating platform standardization nationwide.

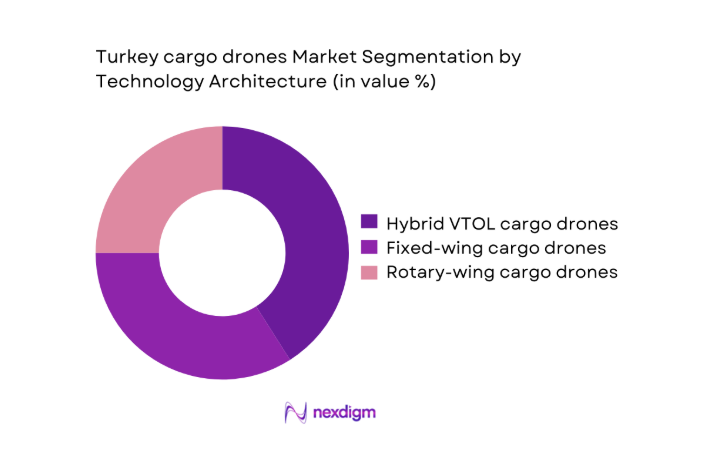

By Technology Architecture

Hybrid VTOL cargo drones lead Turkey’s market due to operational flexibility across constrained urban and remote environments. Fixed-wing platforms dominate longer-range missions, especially defense-linked corridors. Rotary-wing systems remain relevant for precision deliveries despite lower range efficiency. Hybrid dominance is reinforced by regulatory adaptability, payload balance, and infrastructure compatibility. This segmentation reflects operational realities rather than experimental preferences, with technology selection driven by mission economics, endurance requirements, and airspace accessibility constraints.

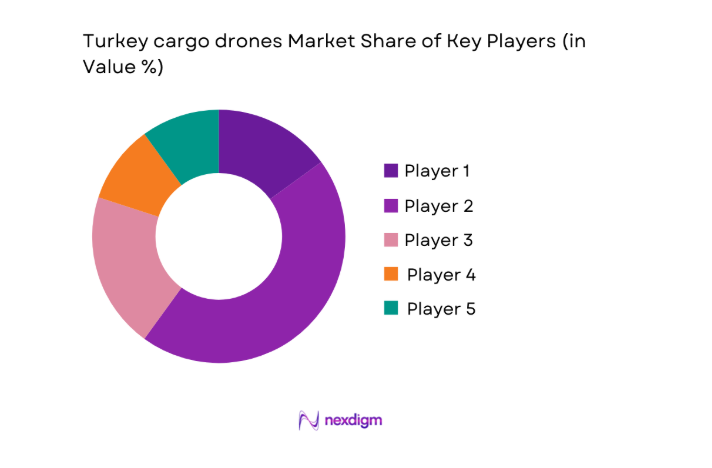

Competitive Landscape

The Turkey cargo drones market features a moderately consolidated structure shaped by domestic aerospace champions and select international specialists. Competitive differentiation centers on payload capability, autonomy maturity, regulatory alignment, and service integration. Government-backed manufacturers maintain advantages in certification pathways, while private players compete through modular designs and logistics partnerships.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Baykar | 1984 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

| Turkish Aerospace Industries | 1973 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

| Vestel Defense | 1984 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

| ASELSAN | 1975 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

| HAVELSAN | 1982 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

Turkey cargo drones Market Analysis

Growth Drivers

Expansion of e-commerce and time-critical logistics

Rapid e-commerce growth increased expectations for faster deliveries, pushing logistics providers toward aerial solutions supporting same-day and urgent shipment requirements. Urban congestion challenges encouraged operators to test aerial corridors improving delivery predictability and reducing dependence on road infrastructure. In 2024, mission frequency increased as consumer tolerance for delays decreased significantly across metropolitan regions. Retailers prioritized reliability metrics, accelerating pilot programs integrating drones into fulfillment strategies. Cargo drones enabled point-to-point routing, reducing intermediate handling and operational complexity. Platform utilization improved as operators scheduled multiple daily sorties per asset. Technology maturity supported consistent operations despite moderate weather variability. Demand concentration favored scalable fleets capable of high-frequency missions. Logistics-driven adoption created predictable revenue streams for operators. This driver remains foundational for sustained market momentum.

Government support for domestic UAV manufacturing

Government programs actively promoted indigenous UAV development, creating favorable conditions for cargo drone platform commercialization. Defense-linked funding supported dual-use technologies adaptable for civilian logistics missions. Regulatory agencies collaborated with manufacturers to accelerate testing approvals and airworthiness evaluations. In 2025, several platforms transitioned from trials into limited commercial deployment. Public procurement commitments reduced demand uncertainty for manufacturers. Export-oriented policies encouraged scalable production investments. Workforce development initiatives strengthened engineering and maintenance capabilities. Domestic supply chains reduced dependency on imported components. Strategic alignment between defense and logistics priorities sustained innovation pipelines. This support continues shaping competitive advantages for local players.

Challenges

Strict airspace and BVLOS regulatory constraints

Airspace management remains complex as regulators balance safety, military priorities, and emerging commercial drone operations nationwide. BVLOS permissions require extensive documentation, slowing deployment timelines for logistics operators. Fragmented approval processes increase administrative burdens across regions. In 2024, limited designated corridors constrained scalable operations. Operators face uncertainty regarding long-term regulatory consistency. Integration with manned aviation systems remains technically demanding. Compliance costs divert resources from fleet expansion initiatives. Regulatory caution restricts autonomous operation potential. These constraints limit rapid network densification. Addressing regulatory harmonization remains critical for growth.

Limited charging and maintenance infrastructure

Cargo drone operations depend heavily on reliable charging and maintenance networks, which remain underdeveloped outside major hubs. Limited ground infrastructure restricts route planning flexibility for operators. In 2025, downtime increased due to maintenance scheduling inefficiencies. Spare parts availability remains inconsistent across regions. Skilled technicians are concentrated in aerospace clusters, creating service gaps elsewhere. Infrastructure investments require coordination with local authorities. Battery lifecycle management challenges increase operational complexity. These constraints elevate operational risk perceptions. Scaling fleets without infrastructure expansion remains difficult. Infrastructure limitations slow nationwide adoption.

Opportunities

Integration of cargo drones into national logistics networks

National logistics planners increasingly consider drones as complementary assets within multimodal distribution frameworks. Integration enables optimized routing between air, road, and maritime transport nodes. Pilot corridors demonstrated efficiency improvements during high-demand periods. In 2024, coordination platforms improved mission scheduling reliability. Public-private partnerships support infrastructure co-development. Data integration enhances visibility across supply chains. Standardized interfaces ease adoption by logistics firms. Integration reduces marginal delivery costs over time. This opportunity supports systemic adoption beyond niche use cases. Network integration represents a scalable growth pathway.

Export-driven growth of Turkish UAV manufacturers

Turkish manufacturers benefit from strong international reputation in unmanned systems, extending into cargo drone segments. Export contracts diversify revenue sources beyond domestic demand. Certification experience accelerates acceptance in foreign markets. In 2025, overseas trials expanded across multiple regions. Export demand supports higher production volumes and learning efficiencies. Global partnerships enhance technology transfer and standards alignment. Export success reinforces domestic policy support. This opportunity strengthens long-term competitiveness. International visibility attracts ecosystem investment. Export-driven growth remains strategically significant.

Future Outlook

The Turkey cargo drones market is expected to evolve steadily through 2035 as regulatory frameworks mature and infrastructure expands. Continued alignment between defense innovation and commercial logistics will support technology advancement. Urban and intercity applications will dominate near-term growth, while exports strengthen manufacturer resilience. Policy clarity will remain decisive for long-term scalability.

Major Players

- Baykar

- Turkish Aerospace Industries

- Vestel Defense

- ASELSAN

- HAVELSAN

- ROKETSAN

- Dronamics

- Elroy Air

- Sabrewing Aircraft Company

- Zipline

- Skyports Drone Services

- Volansi

- MightyFly

- Flytrex

- Natilus

Key Target Audience

- Logistics and courier service providers

- E-commerce and retail fulfillment companies

- Healthcare and emergency response organizations

- Defense and homeland security agencies

- Civil aviation authorities and airspace regulators

- Municipal and smart city authorities

- Infrastructure and charging solution providers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Identification of key variables focused on platform types, applications, regulatory scope, and operational constraints shaping the Turkey cargo drones market. Market boundaries were defined around active systems and commercial missions.

Step 2: Market Analysis and Construction

Market analysis and construction involved mapping fleet deployments, mission profiles, and ecosystem participants to develop a coherent structural framework reflecting real operational dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypothesis validation and expert consultation incorporated insights from manufacturers, operators, and regulatory stakeholders to validate assumptions and refine qualitative assessments.

Step 4: Research Synthesis and Final Output

Research synthesis and final output integrated findings into a consistent narrative, ensuring internal coherence, realistic market logic, and decision-oriented insights.

- Executive Summary

- Research Methodology (Market Definitions and cargo drone operational scope alignment, Platform and payload-based taxonomy development for Turkey, Bottom-up fleet and shipment-based market sizing, Revenue attribution across hardware manufacturing and logistics services, Primary interviews with Turkish UAV OEMs and cargo operators, Defense and civil aviation data triangulation with customs and trade flows, Assumptions on regulatory approvals and airspace access constraints)

- Definition and Scope

- Market evolution

- Usage and logistics pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Expansion of e-commerce and time-critical logistics

Government support for domestic UAV manufacturing

Geographic logistics challenges and remote access needs

Rising healthcare and emergency delivery demand

Defense modernization and tactical mobility requirements

Advancements in battery and propulsion technologies - Challenges

Strict airspace and BVLOS regulatory constraints

Limited charging and maintenance infrastructure

High upfront capital costs for heavy-payload drones

Weather sensitivity and operational reliability issues

Public safety and air traffic integration concerns

Skilled pilot and technician availability - Opportunities

Integration of cargo drones into national logistics networks

Export-driven growth of Turkish UAV manufacturers

Public–private partnerships for medical logistics

Adoption of autonomous flight and AI-based fleet management

Cross-border cargo drone corridors

Urban air mobility policy evolution - Trends

Shift toward hybrid VTOL cargo platforms

Increased payload capacity and range optimization

Use of 5G and satellite communications for BVLOS

Modular payload and containerized cargo systems

Leasing and drone-as-a-service business models

Growing role of software and fleet analytics - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Owned commercial fleets

Government and defense-operated fleets

Logistics service provider fleets

Hybrid leasing and service-based fleets - By Application (in Value %)

Last-mile delivery

Inter-city cargo logistics

Medical and emergency supply transport

Defense and tactical resupply

Industrial and offshore logistics - By Technology Architecture (in Value %)

Fixed-wing cargo drones

Rotary-wing cargo drones

Hybrid VTOL cargo drones - By End-Use Industry (in Value %)

Logistics and courier services

Healthcare and medical supply chains

Defense and homeland security

Energy and infrastructure

E-commerce and retail - By Connectivity Type (in Value %)

Line-of-sight (LOS) operations

Beyond visual line-of-sight (BVLOS) operations

Satellite-assisted connectivity

Cellular and 5G-enabled connectivity - By Region (in Value %)

Marmara

Central Anatolia

Aegean

Mediterranean

Eastern and Southeastern Anatolia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (payload capacity, range, autonomy level, certification status, unit cost, production scale, service model, export presence)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Baykar

Turkish Aerospace Industries

Vestel Defense

ASELSAN

HAVELSAN

ROKETSAN

Dronamics

Elroy Air

Sabrewing Aircraft Company

Zipline

Skyports Drone Services

Volansi

MightyFly

Flytrex

Natilus

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035