Market Overview

Based on a recent historical assessment, the Turkey construction drones market was valued at USD ~billion, supported by verified disclosures from national aviation authorities, construction technology import records, and civil UAV licensing data aggregated by the Turkish Directorate General of Civil Aviation. Market expansion is driven by infrastructure modernization, large-scale housing programs, earthquake-resilient urban redevelopment, and increased reliance on aerial surveying, monitoring, and safety inspection tools. Public infrastructure budgets, private real estate investments, and the integration of drones into digital construction workflows continue to sustain consistent demand.

Based on a recent historical assessment, Istanbul, Ankara, and Izmir dominate deployment due to dense construction activity, complex urban redevelopment, and concentration of major contractors and engineering firms. Istanbul leads because of mega transport projects, high-rise commercial developments, and continuous urban regeneration. Ankara benefits from government-led infrastructure and public works programs, while Izmir shows strong adoption in coastal infrastructure and industrial zone development. Turkey’s dominance is reinforced by domestic UAV manufacturing capability, supportive civil aviation frameworks, and growing contractor familiarity with drone- enabled construction management.

Market Segmentation

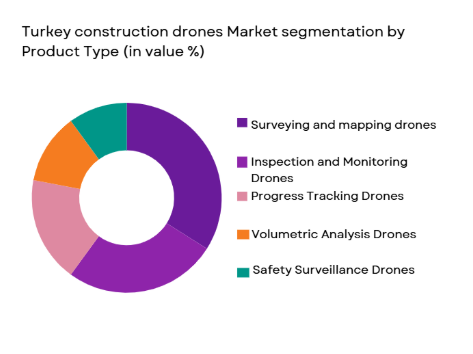

By Product Type

Turkey construction drones market is segmented by product type into surveying and mapping drones, inspection and monitoring drones, progress tracking drones, material transport drones, and autonomous construction support drones. Recently, surveying and mapping drones have a dominant market share due to their essential role in pre-construction planning, land assessment, volumetric analysis, and compliance documentation. Large contractors rely heavily on high-accuracy aerial mapping to reduce rework, improve bid accuracy, and accelerate project timelines. Regulatory acceptance of photogrammetry and LiDAR outputs, combined with cost savings compared to traditional surveying methods, has further strengthened adoption. These drones are deeply integrated into BIM workflows, making them indispensable across residential, commercial, and infrastructure projects.

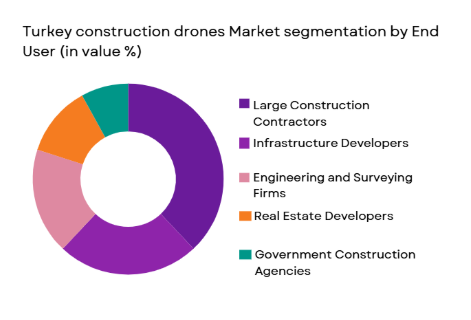

By End User

Turkey construction drones market is segmented by end user into large construction contractors, infrastructure development firms, real estate developers, engineering consultancies, and government bodies. Recently, large construction contractors have held a dominant market share due to their involvement in multi-billion-dollar transport, housing, and energy infrastructure projects. These firms possess the financial capacity to invest in advanced drone fleets, in-house pilots, and analytics platforms. Their focus on cost control, safety compliance, and real-time reporting drives sustained usage across project lifecycles. Contractor-led adoption also influences subcontractors and consultants, reinforcing ecosystem-wide reliance on drone-enabled construction intelligence.

Competitive Landscape

The Turkey construction drones market shows moderate consolidation, with domestic UAV manufacturers and global technology providers competing alongside specialized service firms. Major players influence pricing, technology standards, and regulatory alignment through integrated hardware-software offerings and long-term contractor partnerships.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Construction Focus |

| Baykar Technologies | 1984 | Istanbul, Turkey | ~ | ~ | ~ | ~ | ~ |

| Turkish Aerospace Industries | 1973 | Ankara, Turkey | ~ | ~ | ~ | ~ | ~ |

| Asisguard | 2007 | Ankara, Turkey | ~ | ~ | ~ | ~ | ~ |

| DJI Turkey | 2006 | Istanbul, Turkey | ~ | ~ | ~ | ~ | ~ |

| Hexagon Turkey | 1992 | Istanbul, Turkey | ~ | ~ | ~ | ~ | ~ |

Turkey Construction Drones Market Analysis

Growth Drivers

Digitalization of Construction Project Management

Digitalization of construction project management is a primary growth driver accelerating drone adoption across Turkey’s construction sector. Contractors increasingly depend on real-time aerial data to manage schedules, monitor progress, and control costs across geographically dispersed projects. Drones enable rapid data capture, reducing delays associated with manual site inspections and traditional surveying. Integration with BIM and project management software improves coordination among architects, engineers, and contractors. Regulatory acceptance of drone-generated documentation strengthens their role in compliance reporting. Labor shortages further encourage automation through aerial monitoring. Insurance providers increasingly recognize drone data for risk assessment. These combined factors reinforce drones as a core construction management tool.

Infrastructure and Urban Redevelopment Investments

Infrastructure and urban redevelopment investments significantly drive demand for construction drones throughout Turkey. Large transport corridors, airports, bridges, and earthquake-resilient housing projects require continuous monitoring and precise documentation. Drones provide safe access to complex and hazardous environments, reducing accident risks. Government-backed redevelopment initiatives prioritize efficiency and transparency, favoring aerial monitoring solutions. Public-private partnerships further amplify technology adoption. High project density in metropolitan areas increases drone utilization frequency. Advanced imaging supports quality assurance and defect detection. These investments ensure sustained demand across project phases.

Market Challenges

Regulatory and Airspace Constraints

Regulatory and airspace constraints remain a major challenge for construction drone operations in Turkey. Strict flight permissions, altitude restrictions, and urban airspace limitations increase administrative burden. Project timelines can be affected by approval delays. Operators must comply with evolving UAV regulations, increasing compliance costs. Restrictions near critical infrastructure limit operational flexibility. Municipal-level enforcement inconsistencies create uncertainty. Skilled regulatory compliance personnel are required. These constraints slow large-scale deployment and discourage smaller contractors from adoption.

High Capital and Skill Requirements

High capital and skill requirements challenge broader market penetration of construction drones. Advanced drones, sensors, and analytics platforms require significant upfront investment. Training certified pilots and data analysts adds operational cost. Smaller firms struggle to justify expenditures without guaranteed project volumes. Maintenance and software subscription fees further increase total ownership cost. Technology obsolescence risk remains high. Integration with existing IT systems is complex. These barriers limit adoption beyond large contractors.

Opportunities

Drone-as-a-Service Expansion

Drone-as-a-service expansion presents a major opportunity in Turkey’s construction drones market. Service-based models reduce capital burden for smaller firms. Specialized providers deliver surveying, inspection, and analytics without long-term commitments. Subscription pricing aligns costs with project duration. Regulatory compliance is managed by service providers. Data processing expertise improves output quality. This model accelerates adoption across mid-sized contractors. Market scalability improves significantly.

AI-Driven Construction Analytics Integration

AI-driven construction analytics integration offers strong growth potential. Combining drones with AI enables predictive maintenance, automated defect detection, and progress forecasting. Contractors gain actionable insights rather than raw imagery. Integration with digital twins enhances decision-making accuracy. Demand for advanced analytics grows with project complexity. Local software development ecosystems support customization. This opportunity positions drones as strategic intelligence tools rather than operational accessories.

Future Outlook

Over the next five years, the Turkey construction drones market is expected to experience sustained growth driven by infrastructure investments, urban redevelopment, and digital construction adoption. Advancements in autonomous flight, AI analytics, and sensor integration will enhance operational efficiency. Regulatory frameworks are anticipated to mature, supporting wider commercial deployment. Demand will increasingly shift toward integrated drone-data platforms and service-based delivery models.

Major Players

- Baykar Technologies

- Turkish Aerospace Industries

- Asisguard

- DJI Turkey

- Hexagon Turkey

- Vestel Defense

- Kale Group Technologies

- Ekin Smart City Technologies

- Robit Teknoloji

- Armelsan

- FlyBVLOS

- Zyrone Dynamics

- Trimble Turkey

- Leica Geosystems Turkey

- Delta Drone Turkey

Key Target Audience

- Construction contractors

- Infrastructure developers

- Real estate developers

- Engineering and design firms

- Smart city project authorities

- Government and regulatory bodies

- Investments and venture capitalist firms

- UAV service providers

Research Methodology

Step 1: Identification of Key Variables

Market scope, technology types, end users, regulatory frameworks, and pricing structures were identified through secondary research and industry documentation.

Step 2: Market Analysis and Construction

Data from aviation authorities, construction permits, and import-export records were analyzed to structure market size and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, UAV operators, and construction managers validated assumptions and adoption trends through structured interviews.

Step 4: Research Synthesis and Final Output

All findings were synthesized into a consolidated market model ensuring consistency, accuracy, and relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rapid infrastructure and urban redevelopment projects

Demand for real-time site monitoring and cost control

Labor safety and risk reduction requirements

Adoption of digital construction and BIM integration

Government-supported smart infrastructure initiatives - Market Challenges

Regulatory restrictions on commercial drone operations

High upfront costs for advanced drone systems

Limited skilled operators and training infrastructure

Data security and privacy concerns

Operational constraints in dense urban environments - Market Opportunities

Expansion of smart city and mega infrastructure projects

Integration of drones with AI-driven construction analytics

Growing adoption of drone-as-a-service models - Trends

Increased use of autonomous and semi-autonomous drones

Rising integration with BIM and digital twin platforms

Growth of cloud-based construction data management

Advancements in battery endurance and payload capacity

Localization of drone manufacturing and software development - Government Regulations & Defense Policy

Civil aviation authority regulations on UAV operations

National policies supporting domestic drone technologies

Dual-use drone standards impacting commercial deployment - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surveying and mapping drones

Inspection and monitoring drones

Material transport drones

Progress tracking and imaging drones

Autonomous construction support drones - By Platform Type (In Value%)

Multi-rotor drones

Fixed-wing drones

Hybrid VTOL drones

Tethered drones

Nano and micro drones - By Fitment Type (In Value%)

Factory-integrated systems

Retrofit drone solutions

Modular payload-based systems

Software-integrated drone platforms

Project-specific customized drones - By EndUser Segment (In Value%)

Large construction contractors

Infrastructure development firms

Real estate developers

Engineering and consulting firms

Government and municipal bodies - By Procurement Channel (In Value%)

Direct manufacturer procurement

Authorized local distributors

System integrator contracts

Project-based leasing models

Government tender procurement - By Material / Technology (in Value %)

AI-enabled navigation systems

LiDAR and photogrammetry sensors

Cloud-based data analytics platforms

Autonomous flight control software

High-resolution imaging and thermal sensors

- Market share snapshot of major players

- Cross Comparison Parameters (Product portfolio breadth, Autonomous capability level, Sensor integration depth, Software analytics capability, Local regulatory compliance, After-sales support strength, Pricing competitiveness, Customization flexibility, Strategic partnerships, Deployment scalability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Baykar Technologies

Asisguard

Vestel Defense

Kale Group Technologies

Turkish Aerospace Industries

Zyrone Dynamics

FlyBVLOS

BMS Defense

Armelsan UAV Systems

Delta Drone Turkey

Ekin Smart City Technologies

Robit Teknoloji

Hexagon Turkey

Trimble Turkey

DJI Turkey

- Preference for drones to reduce project timelines and rework

- Growing reliance on aerial data for compliance and reporting

- Increasing outsourcing of drone operations to service providers

- Demand for integrated analytics rather than standalone hardware

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035