Market Overview

The Turkey Delivery Drones Market is estimated to reach approximately USD ~ billion, driven by technological advancements and increasing demand for faster, more efficient delivery systems. The rise of e-commerce, paired with regulatory support, has accelerated the integration of drones in delivery services. Advancements in autonomous drone technology and improvements in battery life are also contributing to the market’s growth, with logistics and retail sectors showing significant adoption.

The dominant players in the Turkey Delivery Drones Market are largely based in urban centers such as Istanbul and Ankara, which offer ideal infrastructure and regulatory frameworks for drone operations. Turkey’s strategic geographic location, coupled with a supportive government stance on drone regulations, has made it a hub for testing and deploying delivery drone systems. Cities with well-developed tech ecosystems and strong commercial demand are particularly influential in driving market expansion.

Market Segmentation

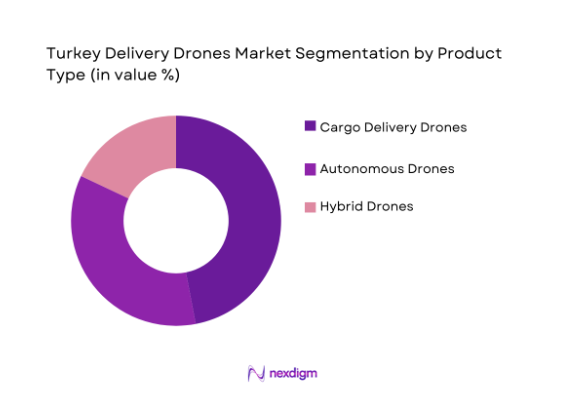

By Product Type

The Turkey Delivery Drones Market is segmented by product type into cargo delivery drones, autonomous drones, and hybrid drones. The dominant sub-segment in the market is cargo delivery drones, primarily driven by their ability to transport goods efficiently over long distances. These drones are preferred due to their robustness, larger payload capacities, and higher operational range compared to other types. They cater to industries like retail, healthcare, and logistics, where timely delivery is crucial. As Turkey’s e-commerce and logistics industries continue to grow, cargo delivery drones are expected to retain their leadership in the market.

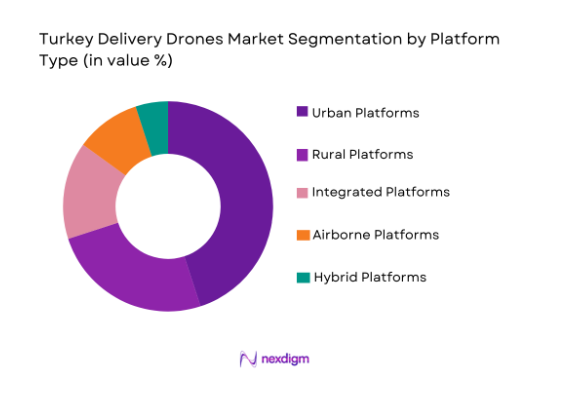

By Platform Type

The Turkey Delivery Drones Market is segmented by platform type into urban platforms, rural platforms, integrated platforms, airborne platforms, and hybrid platforms. Urban platforms dominate the market share due to the concentrated demand for quick and efficient delivery services within metropolitan areas. These platforms are better suited for navigating through congested city environments, making them ideal for last-mile delivery solutions. With Turkey’s rapidly growing urbanization and increased investment in smart city infrastructure, urban platforms are expected to remain the primary focus of delivery drone operations.

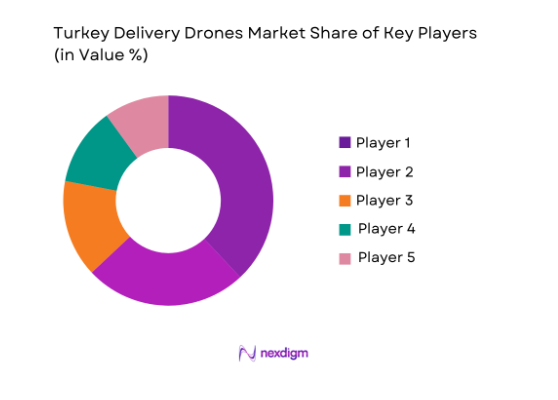

Competitive Landscape

The competitive landscape of the Turkey Delivery Drones Market is characterized by innovation and the increasing involvement of major players in expanding delivery capabilities. Companies are increasingly focusing on autonomous technologies, longer flight times, and improved cargo capacity. This market is expected to witness consolidation as larger firms merge with smaller, tech-focused companies to enhance capabilities and improve market reach.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Regulatory Compliance |

| Turkish Aerospace | 1984 | Ankara | ~ | ~ | ~ | ~ | ~ |

| Aselsan | 1975 | Ankara | ~ | ~ | ~ | ~ | ~ |

| Flytrex | 2013 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

| Zipline | 2014 | Rwanda | ~ | ~ | ~ | ~ | ~ |

| Amazon Prime Air | 2013 | Seattle | ~ | ~ | ~ | ~ | ~ |

Turkey Delivery Drones Market Analysis

Growth Drivers

Government Support

Government policies aimed at facilitating the growth of the drone industry have been pivotal in driving the Turkey Delivery Drones Market. The Turkish government has recognized the potential of drones for various applications, including delivery, and has provided support through regulations that encourage their integration into commercial use. This includes the creation of a regulatory framework that allows for safe operations and testing of drones in controlled airspaces. Furthermore, the government has been actively involved in promoting drone research and development through financial incentives and collaborations with private companies. Such initiatives have made it easier for companies to enter the drone delivery market and scale their operations. The government’s focus on integrating drones into Turkey’s digital transformation strategy, particularly in logistics and transportation, plays a key role in creating an ideal environment for this market’s expansion.

E-commerce Growth

The rapid growth of e-commerce has also been a major driving force behind the expansion of the Turkey Delivery Drones Market. With increasing consumer demand for faster and more reliable delivery methods, businesses are turning to drones as a solution to meet these expectations. Drones provide an efficient means of handling last-mile delivery, a segment that has traditionally been plagued by delays and high costs. Turkey’s growing e-commerce sector, coupled with the adoption of digital payment systems, has accelerated the need for more streamlined logistics. Companies in the retail sector, including those focused on grocery deliveries, are investing in drones to meet customer demands for quicker service, especially in urban areas where traffic congestion often hampers traditional delivery methods. As e-commerce continues to evolve, drone delivery services are increasingly seen as an integral part of the logistics landscape, further driving market growth.

Market Challenges

Regulatory Barriers

Regulatory challenges continue to be one of the most significant obstacles facing the Turkey Delivery Drones Market. While the government has made progress in creating a regulatory framework for drone operations, it remains complex and slow-moving in certain areas. Strict airspace regulations, safety standards, and operational restrictions hinder the widespread adoption of drones for delivery services. The approval process for drone operations can be cumbersome, requiring multiple levels of certification and testing, which delays market entry for new players. Furthermore, regulations regarding privacy and data protection add another layer of complexity, especially for drones used in urban areas where they may capture sensitive information. The evolving nature of regulations, coupled with the fact that many drone operations remain unregulated in certain regions, creates a sense of uncertainty for companies looking to invest heavily in drone technology for delivery applications.

High Operational Costs

Another challenge impacting the growth of the Turkey Delivery Drones Market is the high operational costs associated with drone deployment. Drones, particularly those used for delivery, require significant upfront investment in both hardware and software. The cost of developing and maintaining drones equipped with advanced sensors, high-capacity batteries, and autonomous flight capabilities can be prohibitively high, especially for smaller businesses. In addition to the initial investment, ongoing maintenance and operational costs, including the need for skilled personnel to manage and monitor drone fleets, add to the financial burden. Moreover, the cost of insurance and compliance with safety regulations can further drive up expenses for drone operators. As a result, high operational costs may deter smaller companies from entering the market, leaving it dominated by larger players with the necessary financial resources to overcome these barriers.

Opportunities

Integration with Smart Cities

One of the most promising opportunities for the Turkey Delivery Drones Market lies in the integration of drones within the infrastructure of smart cities. As Turkey continues to invest in digital infrastructure and smart city technologies, drones are expected to play an increasingly significant role in urban logistics. The use of drones in smart cities can offer a solution to the challenges posed by congestion and traffic in densely populated areas, enabling faster and more efficient delivery services. This is particularly relevant for last-mile deliveries, which are typically slower and more expensive due to urban congestion. With the development of autonomous traffic management systems, drones will be able to navigate urban environments more effectively, further enhancing their efficiency. Turkey’s focus on innovation and smart city projects presents an ideal environment for the widespread adoption of drones, creating significant growth opportunities for businesses operating in the drone delivery space.

Use in Healthcare Deliveries

Another key opportunity in the Turkey Delivery Drones Market is the potential use of drones for healthcare deliveries, particularly for urgent medical supplies and equipment. Drones offer an efficient solution for delivering critical medical products such as blood samples, vaccines, and emergency medications to hospitals and clinics, especially in remote or hard-to-reach areas. This is particularly valuable in Turkey’s rural regions, where traditional delivery methods may be slower or less reliable. As healthcare systems worldwide look for more efficient ways to manage supply chains and ensure timely delivery of medical goods, drones provide a viable alternative. The Turkish government’s growing interest in enhancing its healthcare system and improving emergency response capabilities makes the healthcare sector an attractive space for drone deployment. As demand for faster, more reliable medical deliveries continues to rise, drones are poised to become an integral part of Turkey’s healthcare logistics infrastructure.

Future Outlook

The Turkey Delivery Drones Market is expected to grow rapidly in the next five years, with significant advancements in drone technology, including longer flight times, greater payload capacity, and more efficient autonomous systems. The demand for faster delivery solutions is expected to increase as e-commerce continues to grow, especially in urban areas. Government regulations are expected to evolve to support the integration of drones into the national airspace, creating new opportunities for the market. In the coming years, Turkey is poised to become a leader in drone-based delivery services, especially with the continued development of smart cities and infrastructure for drone operations.

Major Players

- Turkish Aerospace Industries

- Aselsan

- Flytrex

- Zipline

- Amazon Prime Air

- Matternet

- Urban Aeronautics

- Boeing

- Airobotics

- Volocopter

- Skyports

- Harris Corporation

- L3 Technologies

- Northrop Grumman

- Leonardo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- E-commerce companies

- Logistics service providers

- Healthcare organizations

- Aerospace manufacturers

- Drone technology developers

- Delivery service providers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the primary factors influencing the market, including technological trends, regulatory requirements, and consumer demand.

Step 2: Market Analysis and Construction

Market data is analyzed through both qualitative and quantitative methods to assess the market size, segmentation, and trends.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and stakeholders are consulted to validate market findings and refine hypotheses, ensuring that the analysis is accurate.

Step 4: Research Synthesis and Final Output

All data and insights are synthesized into a comprehensive report, providing actionable conclusions and market forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for E-commerce Deliveries

Technological Advancements in Drone Technology

Government Support for Autonomous Transport - Market Challenges

Regulatory Barriers to Drone Operations

Safety Concerns and Public Perception

High Development and Operational Costs - Market Opportunities

Expansion of Drone Delivery in Rural Areas

Partnerships with E-commerce Giants

Advancements in Drone Battery Technology - Trends

Increase in Autonomous Drone Operations

Integration of AI in Delivery Drones

Use of Drones for Healthcare Deliveries - Government Regulations

Airspace Regulation and Safety Standards

Data Protection and Privacy Regulations

Government Funding and Grants for Drone Technology

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Autonomous Drones

Cargo Delivery Drones

Fixed-Wing Drones

Rotary-Wing Drones

Hybrid Drones - By Platform Type (In Value%)

Urban Platforms

Rural Platforms

Hybrid Platforms

Airborne Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premises Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

E-commerce & Retail

Logistics Providers

Food Delivery Services

Postal Services

Healthcare Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Fitment Type, System Complexity Tier, Pricing Strategy, Technology Adoption, Innovation Rate)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Turkish Aerospace Industries

Aselsan

Airobotics

Flytrex

Urban Aeronautics

Aptiv

Skyports

Boeing

Zipline

Matternet

DJI

Amazon Prime Air

Wing Aviation

Flirtey

Volocopter

- E-commerce companies increasing drone adoption for faster delivery

- Healthcare providers utilizing drones for urgent medical deliveries

- Logistics companies seeking cost-effective delivery methods

- Government agencies investing in regulatory frameworks for drones

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035