Market Overview

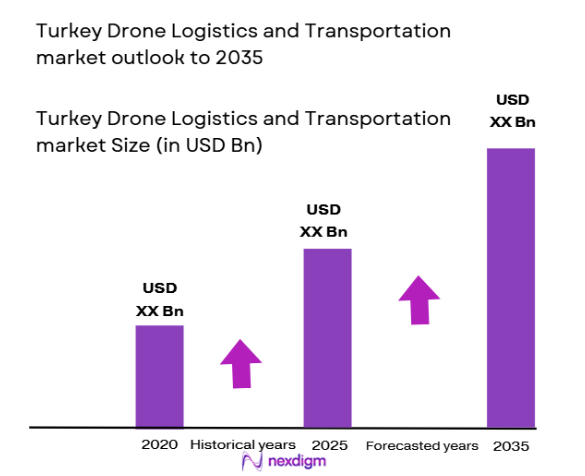

The Turkey Drone Logistics and Transportation market is valued at approximately USD ~ billion based on a recent historical assessment. The market is primarily driven by the rising demand for efficient, cost-effective transportation solutions and advancements in drone technology, including autonomous flight capabilities and enhanced payload capacities. Increased investments in drone infrastructure and regulatory frameworks have significantly contributed to the market’s growth, particularly in logistics and delivery services. Additionally, the surge in e-commerce has led to a higher demand for fast and reliable delivery systems, further boosting the drone logistics market.

Turkey has become a prominent player in the drone logistics and transportation market due to its strategic geographic location, which bridges Europe, Asia, and the Middle East. The country’s increasing investments in technology and infrastructure, coupled with strong governmental support for UAV development, have propelled its dominance. Urban centers like Istanbul and Ankara are particularly significant due to their high demand for logistics and transportation services. Moreover, the country’s continuous expansion of drone technology and the integration of drones into national defense projects add to its growing presence in this market.

Market Segmentation

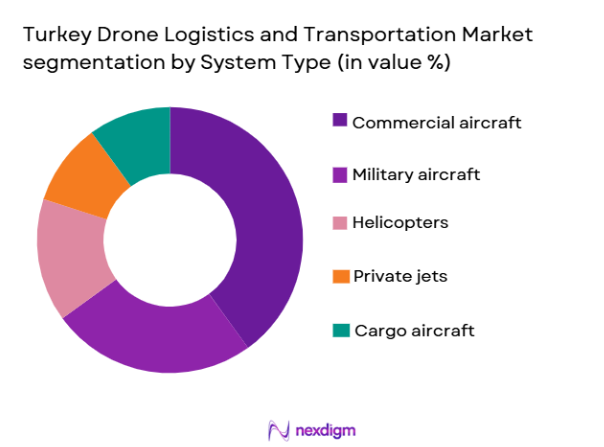

By System Type:

The Turkey Drone Logistics and Transportation market is segmented by system type into several categories, with autonomous delivery drones emerging as the dominant sub-segment. This dominance can be attributed to their ability to navigate complex environments independently, reducing human intervention and ensuring efficient delivery processes. Autonomous drones are increasingly preferred for their reliability, lower operational costs, and ability to work in various weather conditions. Furthermore, the increased focus on automation within logistics companies has led to a surge in demand for these systems, making them the most sought-after option in the market.

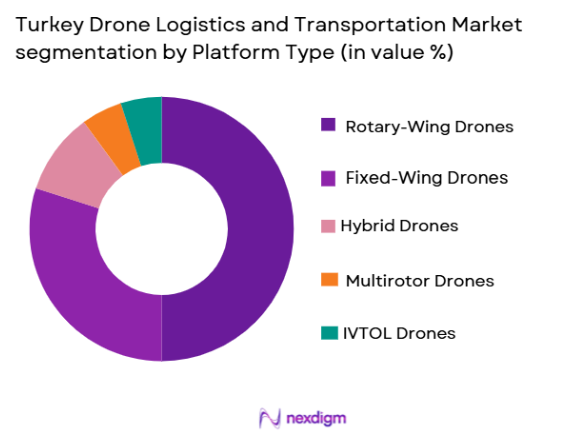

By Platform Type:

The market is also segmented by platform type, with rotary-wing drones dominating the platform category. These drones are favored for their flexibility, vertical take-off and landing capabilities, and ability to operate in more confined urban environments. Their versatile nature allows for easy maneuverability in both rural and urban settings, which has been a key factor in their widespread adoption. These platforms are ideal for short-range deliveries and have been extensively used in e-commerce and last-mile delivery services, contributing significantly to their market share.

Competitive Landscape

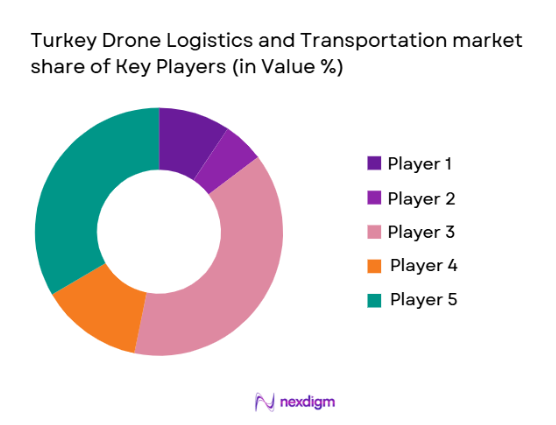

The competitive landscape of the Turkey Drone Logistics and Transportation market is dynamic, with both established players and new entrants striving for dominance. Leading companies in this space have been consolidating through mergers and acquisitions to strengthen their market position. Major players continue to invest heavily in technological advancements such as AI-powered drones, payload optimization, and longer battery life. Furthermore, partnerships with logistics and e-commerce firms are essential for driving growth in the drone delivery sector. The competition remains fierce, with companies vying to develop cost-effective, high-performance solutions to meet the evolving needs of the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Turkish Aerospace | 1984 | Ankara | ~ | ~ | ~ | ~ | ~ |

| STM Turkey | 1991 | Istanbul | ~ | ~ | ~ | ~ | ~ |

| Amazon Prime Air | 2013 | USA | ~ | ~ | ~ | ~ | ~ |

| DJI Innovations | 2006 | China | ~ | ~ | ~ | ~ | ~ |

| FedEx Express | 1971 | USA | ~ | ~ | ~ | ~ | ~ |

Turkey Drone Logistics and Transportation Market Analysis

Growth Drivers

Technological Advancements in Drone Technology:

The rapid evolution of drone technology has been a significant driver for the Turkey Drone Logistics and Transportation market. Advances in autonomy, AI, and machine learning have made drones more efficient, reliable, and capable of handling complex delivery tasks. These technological improvements have allowed drones to fly longer distances, carry heavier payloads, and navigate autonomously, reducing human intervention and lowering operational costs. Moreover, the integration of sensors and advanced cameras has enabled drones to safely and efficiently deliver goods even in challenging environments, making them highly suitable for both urban and rural areas. These advancements have made drones more attractive to logistics companies looking to optimize their supply chains and reduce delivery times. The growing demand for faster, cost-effective, and eco-friendly delivery solutions has led many businesses to embrace drone technology, accelerating market growth. Furthermore, continuous investment in R&D by companies such as Turkish Aerospace and STM Turkey has resulted in the commercialization of more robust and versatile drones. This has allowed the market to expand, with more industries looking to integrate drones into their logistics and transportation systems. With further developments in automation and AI, drones are expected to become even more efficient in the future, driving further growth in the sector.

Regulatory Support and Infrastructure Development:

Another key growth driver for the Turkey Drone Logistics and Transportation market is the increasing regulatory support and development of drone-friendly infrastructure. In recent years, Turkey has made significant strides in creating regulatory frameworks that support the safe and efficient use of drones for logistics and transportation. The government has implemented rules regarding airspace management, drone certification, and safety standards, creating a conducive environment for drone operations. These regulations have alleviated concerns related to safety and operational risks, encouraging more businesses to invest in drones for their logistics and transportation needs. In addition to regulatory support, infrastructure development is crucial for enabling widespread drone adoption. Turkey has been investing in establishing droneports, delivery hubs, and UAV infrastructure to ensure smooth operations and integration with existing logistics networks. This infrastructure development has made it easier for businesses to adopt drones in their supply chains and has positioned Turkey as a regional leader in drone logistics. With government support and continuous investment in infrastructure, the Turkey Drone Logistics and Transportation market is poised for substantial growth in the coming years.

Market Challenges

Regulatory Hurdles in Drone Operations:

One of the key challenges facing the Turkey Drone Logistics and Transportation market is navigating the complex regulatory environment. While Turkey has made strides in drone regulations, there are still significant hurdles to overcome. These include stringent airspace management laws, certification requirements for drones, and limitations on where and when drones can operate. These regulations can limit the scale of drone operations, especially in densely populated urban areas. The uncertainty around regulatory changes and the slow pace of approval for new drone models can deter businesses from investing heavily in drone logistics. Furthermore, international regulations may vary, creating challenges for Turkish companies looking to expand globally. While the regulatory environment is improving, it remains a challenge for the industry to adapt to evolving rules, and companies must continually ensure compliance to avoid fines or delays in operations.

High Initial Investment and Maintenance Costs:

Another significant challenge for the Turkey Drone Logistics and Transportation market is the high upfront investment required for drone fleets and the associated maintenance costs. While drones offer long-term cost savings through increased efficiency, the initial cost of acquiring high-quality drones, setting up the required infrastructure, and training personnel is substantial. Additionally, the ongoing costs related to maintenance, software updates, and repairs can add up over time, making it challenging for smaller companies to enter the market. Larger corporations may be better equipped to absorb these costs, but the barrier to entry remains high for new players, particularly in an industry where rapid technological advancements may quickly render older drones obsolete. This financial burden can limit the widespread adoption of drones in logistics and transportation, particularly for smaller firms that may not have the capital to invest in cutting-edge technologies.

Opportunities

Expansion of E-commerce Logistics:

The growth of e-commerce presents significant opportunities for the Turkey Drone Logistics and Transportation market. As the demand for faster deliveries continues to rise, drones are being increasingly seen as a viable solution for last-mile delivery. E-commerce companies are seeking ways to enhance customer satisfaction through faster and more efficient delivery options, and drones offer an ideal solution for meeting these demands. The ability of drones to deliver goods directly to consumers’ doorsteps without the need for human drivers is an attractive proposition for e-commerce companies, particularly in urban areas with heavy traffic congestion. Additionally, drones can help reduce the environmental impact of traditional delivery vehicles, as they are more energy-efficient and produce fewer emissions. With the rapid growth of e-commerce, particularly in Turkey’s urban centers, the demand for drone delivery services is expected to increase, creating new opportunities for drone logistics companies to expand their operations.

Collaboration with Military and Government Projects:

The Turkey Drone Logistics and Transportation market also has significant growth potential through collaboration with government and military projects. The Turkish government has been investing heavily in the development of unmanned aerial vehicles (UAVs) for defense purposes, and this technology is gradually being adapted for civilian logistics applications. By collaborating with defense agencies and integrating drone technologies into military projects, logistics companies can gain access to advanced drone systems and technologies that may not be readily available in the commercial market. Furthermore, military applications of drones often require high levels of security, reliability, and endurance, which can translate into superior capabilities for civilian drone logistics. Additionally, government investments in infrastructure and regulatory support for drone development provide a conducive environment for businesses to innovate and scale their operations. This collaboration with military and government sectors presents a significant opportunity for the drone logistics market to tap into advanced technologies and gain access to additional funding and resources.

Future Outlook

The Turkey Drone Logistics and Transportation market is expected to witness robust growth over the next five years, driven by technological advancements, increasing demand for faster delivery systems, and favorable regulatory developments. As drone technology continues to improve, with innovations in battery life, payload capacity, and AI integration, the market will see greater adoption across various industries. Additionally, government support for infrastructure development and regulatory frameworks will play a crucial role in ensuring the scalability and sustainability of drone logistics solutions. The growing focus on reducing carbon emissions and improving operational efficiencies will also drive demand for drones in the transportation and logistics sectors. With these factors in play, the market is poised to experience sustained growth, with new opportunities emerging in e-commerce, healthcare, and defense sectors.

Major Players

- Turkish Aerospace Industries

- STM Turkey

- Amazon Prime Air

- DJI Innovations

- FedEx Express

- Airbus

- Airbus Group

- Northrop Grumman

- Thales Group

- Lockheed Martin

- General Atomics

- AeroVironment

- Bluebird Aero Systems

- Parrot Drones

- Zipline

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Drone manufacturers and distributors

- E-commerce and logistics companies

- Defense contractors

- Healthcare organizations

- Agricultural firms

- Environmental organizations

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical factors such as market trends, growth drivers, technological advancements, and consumer preferences.

Step 2: Market Analysis and Construction

Data is collected from credible sources, and a market model is created based on historical data, technological trends, and current market behavior.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and stakeholders are consulted to validate hypotheses and gain insights into potential market shifts and emerging trends.

Step 4: Research Synthesis and Final Output

Final research output is compiled, synthesizing all findings into a comprehensive report with actionable insights, forecasts, and recommendations.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in Drone Technology

Increased Demand for E-commerce Logistics

Regulatory Support for Drone Deployment

Cost-Efficiency of Drones for Last-Mile Delivery

Rise in Demand for Autonomous Delivery Solutions - Market Challenges

Regulatory Hurdles in Drone Operations

Limited Battery Life and Payload Capacity

Security Concerns in Drone Data and Communication

High Initial Investment in Drone Fleet

Infrastructure Limitations for Drone Operations - Market Opportunities

Growth in Urban Drone Delivery Networks

Collaboration with E-commerce Giants for Last-Mile Delivery

Expanding Applications in Healthcare and Emergency Services - Trends

Increased Integration of AI in Drone Systems

Rising Focus on Drone Safety and Compliance

Growth in Drone Services for Healthcare Logistics

Adoption of Sustainable Drones in Delivery Systems

Expansion of Drone Delivery in Rural Areas - Government Regulations & Defense Policy

Drone Certification and Safety Regulations

Government Funding for Drone Development

Cross-border Drone Logistics Regulations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Cargo Drones

Autonomous Delivery Drones

Hybrid Delivery Systems

Last-Mile Delivery Solutions

Heavy Payload Drones - By Platform Type (In Value%)

Fixed-Wing Drones

Rotary-Wing Drones

Hybrid Drones

Multirotor Drones

Vertical Takeoff and Landing (VTOL) Drones - By Fitment Type (In Value%)

Drone-as-a-Service (DaaS)

On-Premise Drone Systems

Fleet Management Solutions

Integrated Drone Systems

Stand-Alone Drones - By EndUser Segment (In Value%)

E-commerce & Retail

Logistics Providers

Government & Military

Healthcare & Pharmaceuticals

Agriculture & Forestry - By Procurement Channel (In Value%)

Direct Procurement

Public Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Carbon Fiber Materials

Lithium-Polymer Batteries

AI and Machine Learning Technology

Autonomous Navigation Systems

Internet of Things (IoT) Integration

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, End-User Segment, Procurement Channel, Material/Technology, Fitment Type, Technology Adoption, Cost Efficiency, Payload Capacity, Operational Safety)

SWOT Analysis of Key Players

Pricing & Procurement Analysis - Key Players

Turkish Aerospace Industries

Drone Volt

Parrot Drones

AeroVironment

General Atomics

DJI Innovations

Quantum Systems

Aurora Flight Sciences

Amazon Prime Air

FedEx Express

Zipline

Walmart

Volocopter

Elbit Systems

Intel Corporation

- E-commerce and retail demand for fast delivery

- Logistics providers seeking cost-effective solutions

- Government applications for surveillance and security

- Agricultural sectors exploring autonomous drones

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035