Market Overview

The Turkey Drone Sensor market is valued at approximately USD ~ billion based on a recent historical assessment. The growth is driven by the increasing adoption of drones in defense, agriculture, and environmental monitoring, alongside the advancements in sensor technology, such as LiDAR, radar, and thermal imaging. These developments are fostering greater efficiency, accuracy, and autonomy in drone operations, particularly in the military and commercial sectors.

Key cities like Istanbul, Ankara, and Izmir are central to the growth of the drone sensor market, with robust infrastructure supporting the adoption of drone technologies. Turkey’s strategic location, strong defense sector, and government initiatives to boost innovation in drone technologies play a vital role in its dominance. The country’s regulatory framework further supports the growth of drones in both military and civilian applications, positioning Turkey as a competitive hub for drone sensor advancements.

Market Segmentation

By Product Type:

The Turkey Drone Sensor market is segmented by product type into radar sensors, LiDAR sensors, vision-based sensors, infrared sensors, and thermal imaging sensors. Recently, radar sensors dominate the market due to their ability to provide accurate data in challenging environments such as low visibility, high wind conditions, or complex terrain. Radar sensors are particularly valuable in military and security applications, where real-time, reliable data is essential. The growing defense sector, combined with the demand for surveillance and reconnaissance systems, significantly contributes to the high adoption of radar sensors, making them the leading choice in the drone sensor market.

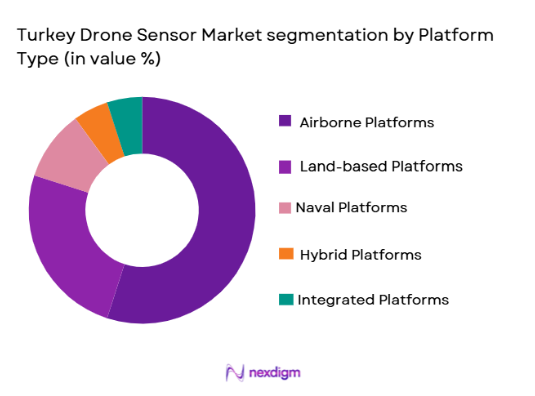

By Platform Type:

The Turkey Drone Sensor market is segmented by platform type into airborne, land-based, naval, hybrid, and integrated platforms. Airborne platforms dominate the market due to their ability to cover larger areas more efficiently and provide real-time data for surveillance, reconnaissance, and environmental monitoring. These platforms are preferred in defense applications, where aerial surveillance and rapid response are crucial. The use of airborne drones for precision agriculture, delivery services, and border surveillance further fuels the market demand for airborne platforms, solidifying their dominance in the sector.

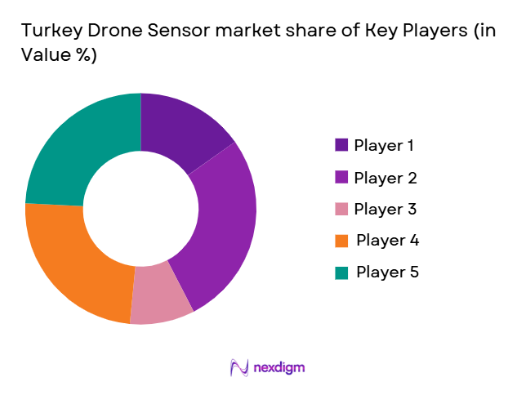

Competitive Landscape

The competitive landscape of the Turkey Drone Sensor market is characterized by the presence of both established defense contractors and emerging technology firms. Major players focus on technological innovation and form strategic partnerships to expand their market share. The market is witnessing consolidation, where larger firms acquire smaller, specialized companies to integrate advanced sensor technologies with their drones, improving their offerings in military and commercial applications. These developments ensure that the competition remains intense, driving growth and innovation.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Turkish Aerospace Industries | 1984 | Ankara, Turkey | ~ | ~ | ~ | ~ | ~ |

| Baykar | 1986 | Istanbul, Turkey | ~ | ~ | ~ | ~ | ~ |

| Aselsan | 1975 | Ankara, Turkey | ~ | ~ | ~ | ~ | ~ |

| PeraDrone | 2015 | Istanbul, Turkey | ~ | ~ | ~ | ~ | ~ |

| Flytrex | 2013 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

Turkey Drone Sensor Market Analysis

Growth Drivers

Technological Advancements in Sensor Technology:

The Turkey Drone Sensor market is expanding due to advancements in sensor technologies such as radar, LiDAR, and infrared. These sensors allow drones to capture detailed, high-quality data that is critical for various applications, including military surveillance, environmental monitoring, and precision agriculture. As the demand for drones increases across multiple sectors, there is a growing need for advanced sensors that can provide accurate and reliable data in real-time. Radar and LiDAR sensors, for instance, are now capable of operating in low visibility conditions, enabling drones to perform tasks that were previously challenging for traditional methods. This technological progress has resulted in drones becoming more efficient and versatile, broadening their scope of application in defense, agriculture, and infrastructure monitoring. Furthermore, miniaturization of sensors and improvements in battery life allow for greater payload capacity and longer operational hours, thus enhancing the overall performance and utility of drones. As these technologies continue to evolve, they will further fuel the adoption of drones equipped with advanced sensors, contributing to the market’s growth.

Government Initiatives and Regulatory Support:

Another major growth driver for the Turkey Drone Sensor market is the government’s support for drone technology and the development of regulatory frameworks to ensure the safe and efficient operation of drones. The Turkish government has made significant strides in promoting the use of drones, especially in defense and agricultural sectors. Policies that support drone testing and certification, along with efforts to regulate airspace for unmanned aerial vehicles (UAVs), have created a favorable environment for drone companies to develop and deploy their technologies. These initiatives are complemented by financial incentives and research grants for companies working on drone innovations, particularly those focused on sensor integration. The government’s proactive approach has not only helped domestic companies but also attracted foreign investment and partnerships. This supportive environment is encouraging innovation and fueling the market’s growth. As regulations continue to evolve, the legal framework will provide clearer guidelines for drone operations, thereby further fostering growth in the drone sensor market, particularly for applications in surveillance, monitoring, and delivery systems.

Market Challenges

High Manufacturing Costs:

A significant challenge facing the Turkey Drone Sensor market is the high cost of manufacturing advanced sensors. While technological advancements have improved the performance and capabilities of sensors, the production costs remain high due to the complexity of the components, precision required, and the need for specialized materials. The sensors used in drones, particularly LiDAR, radar, and thermal imaging systems, require sophisticated manufacturing processes and stringent quality control standards. The high upfront costs associated with these sensors make it difficult for smaller companies or startups to compete, limiting the adoption of drone technology in industries where cost efficiency is crucial, such as agriculture and logistics. Additionally, the cost of integrating advanced sensors with drones can be prohibitive for smaller enterprises. While the prices of these sensors may gradually decrease with mass production and technological breakthroughs, the current cost barrier remains a significant challenge to widespread market adoption.

Regulatory and Airspace Management Issues:

Regulatory and airspace management issues represent another major challenge for the Turkey Drone Sensor market. While the Turkish government has made strides in creating a regulatory framework for drone operations, managing an increasing number of drones in the airspace remains a complex task. As the use of drones expands, concerns regarding airspace congestion, safety, and the integration of drones into existing air traffic management systems become more prominent. In particular, drones must be able to navigate urban environments safely, avoiding obstacles and ensuring that they do not interfere with manned aircraft operations. Regulatory bodies must ensure that drones operate within designated flight zones and that they comply with safety standards. The development of efficient airspace management solutions, as well as the creation of clear guidelines for drone operators, is crucial to ensuring safe and efficient drone operations. Until these challenges are addressed, regulatory uncertainty will continue to slow the widespread adoption of drone technologies and sensors.

Opportunities

Expansion of Drone Usage in Agriculture:

One of the most significant opportunities in the Turkey Drone Sensor market is the expansion of drone usage in the agricultural sector. Precision agriculture, which involves using drones equipped with advanced sensors to monitor crop health, soil conditions, and irrigation levels, is gaining traction in Turkey. The use of drones allows farmers to collect real-time data, which can be used to make informed decisions regarding planting, fertilizing, and harvesting. Drones equipped with sensors such as multispectral cameras, LiDAR, and thermal imaging can detect early signs of disease, pests, and water stress, enabling farmers to take preventative measures before issues escalate. This ability to monitor large areas efficiently and in detail has made drones an essential tool in modern agriculture. As the agriculture sector in Turkey continues to adopt these technologies, the demand for advanced sensors is expected to grow, providing significant opportunities for market players to develop and supply sensor technologies tailored to the agricultural industry. Moreover, government support for agricultural modernization and sustainable farming practices is expected to further accelerate the adoption of drone technologies, driving growth in the drone sensor market.

Military and Defense Applications:

Another significant opportunity for the Turkey Drone Sensor market lies in the military and defense sector. Turkey has a well-established defense industry, and the demand for advanced drone sensors in military applications continues to rise. Drones equipped with high-performance sensors, such as radar, thermal imaging, and multispectral sensors, are essential for surveillance, reconnaissance, and intelligence gathering. The Turkish government’s ongoing investments in defense technology, as well as its strategic location in the Middle East, have led to an increasing demand for drone systems capable of providing real-time data in complex, high-risk environments. Furthermore, advancements in autonomous drones and AI-driven sensor systems are opening new possibilities for military operations, including border surveillance, tracking, and combat support. The Turkish military’s focus on enhancing its technological capabilities and expanding its UAV fleet presents substantial opportunities for companies specializing in drone sensors. The growth of military drone usage is expected to drive demand for sensor systems, creating a lucrative market for sensor providers and innovators in the defense sector.

Future Outlook

The Turkey Drone Sensor market is poised for substantial growth over the next five years, driven by advancements in sensor technology, increasing demand for drones in both military and commercial applications, and regulatory support. The agriculture sector is expected to see significant expansion in drone usage, while military and defense applications will continue to drive the demand for high-performance sensors. As airspace management solutions and regulations evolve, the market will benefit from improved drone operations. Technological advancements in AI and machine learning will further enhance the capabilities of drones, particularly in autonomous operations, further driving market growth.

Major Players

- Turkish Aerospace Industries

- Baykar

- Aselsan

- PeraDrone

- Flytrex

- Matternet

- Zipline

- DHL

- UPS

- Amazon Prime Air

- Skyports

- DroneUp

- Wing

- Swoop Aero

- FedEx

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Agricultural companies

- Logistics and delivery firms

- Environmental monitoring agencies

- Defense contractors

- Drone manufacturers

- AI and machine learning companies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables that influence the market, such as sensor types, drone applications, and technological advancements in the sector.

Step 2: Market Analysis and Construction

A comprehensive analysis of the market dynamics, trends, and demand patterns is conducted, using both primary and secondary research methods to develop an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are held with industry professionals, stakeholders, and market participants to validate the market model and ensure the accuracy of the forecast.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a detailed report, including market forecasts, segmentation analysis, and strategic insights for key players in the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Autonomous Drones

Technological Advancements in Sensor Systems

Government Support and Investment in Drone Technologies - Market Challenges

High Manufacturing Costs

Regulatory and Airspace Management Issues

Privacy and Security Concerns - Market Opportunities

Integration of AI and Machine Learning in Drone Sensors

Expansion of Drone Applications in Non-defense Sectors

Growth of Drone-based Environmental Monitoring - Trends

Increased Use of LiDAR Sensors in Commercial Applications

Adoption of Drones for Precision Agriculture

Advancements in AI-driven Sensor Technologies

Expansion of Drone Sensor Use in Logistics

Rising Investment in Autonomous Drone Solutions - Government Regulations & Defense Policy

Regulation of Airspace for Drone Operations

Data Protection and Privacy Regulations

Government Funding for Drone Innovations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Radar Sensors

LiDAR Sensors

Vision-based Sensors

Infrared Sensors

Thermal Imaging Sensors - By Platform Type (In Value%)

Airborne Platforms

Land-based Platforms

Naval Platforms

Hybrid Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Integrated Solutions

Modular Solutions

Custom-built Solutions - By EndUser Segment (In Value%)

Military & Defense

Agriculture & Forestry

Energy & Utilities

Environmental Monitoring

Logistics & Delivery - By Procurement Channel (In Value%)

Direct Procurement

Private Sector Procurement

Government Tenders

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

LiDAR Technology

Radar Technology

Thermal Imaging Technology

Multispectral Sensors

AI-driven Sensors

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology, Product Performance, Service Quality, Pricing Strategy)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Turkish Aerospace Industries

Baykar

Aselsan

PeraDrone

Flytrex

Matternet

Zipline

DHL

UPS

Amazon Prime Air

Skyports

DroneUp

Wing

Swoop Aero

FedEx

- Military’s Increasing Reliance on Drone Surveillance

- Agriculture’s Growing Adoption of Precision Farming Drones

- Energy Sector’s Need for Drone-based Inspections

- Logistics Companies Integrating Drones for Efficient Delivery

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035