Market Overview

The Turkey Drone Simulation market is valued at USD ~ billion, with the increasing focus on defense modernization driving demand. The demand for simulation tools in unmanned aerial vehicle (UAV) operations, especially in training military personnel, is a key driver. The expansion of defense budgets, integration of UAVs into national security systems, and adoption of simulation software are crucial components supporting market growth.

The dominance of cities like Istanbul and Ankara is attributed to their well-established technological infrastructures and proximity to military and defense agencies. These regions play a central role in advancing UAV technology. The country’s strategic location, coupled with its growing defense initiatives and investments in advanced simulation technologies, fuels the market’s expansion, making Turkey a leading player in the region for drone simulation technologies.

Market Segmentation

By Product Type

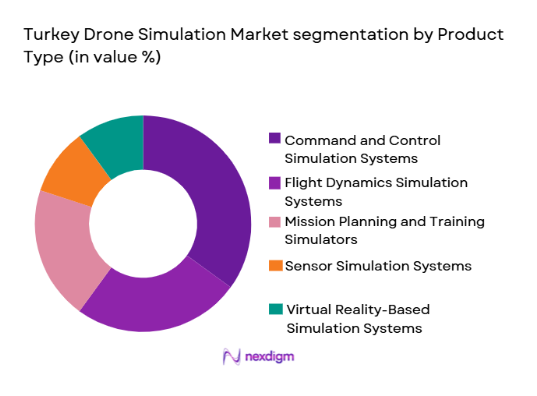

Turkey Drone Simulation market is segmented by product type into command and control simulation systems, flight dynamics simulation systems, mission planning and training simulators, sensor simulation systems, and virtual reality-based simulation systems. Recently, command and control simulation systems have a dominant market share due to their critical role in military operations, enhanced by growing demand for comprehensive training environments. This sub-segment continues to thrive due to increasing defense investments, sophisticated technological adoption, and the importance of real-time operational simulation in military training.

By Platform Type

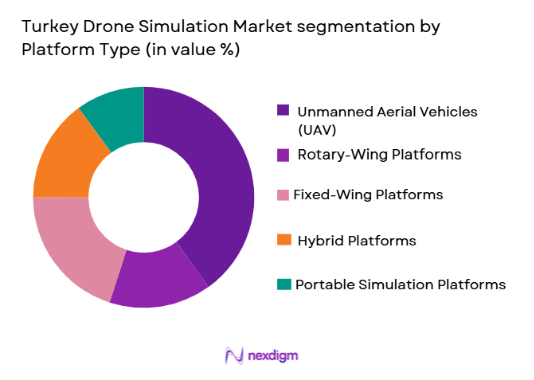

Turkey Drone Simulation market is segmented by platform type into unmanned aerial vehicles (UAV), rotary-wing platforms, fixed-wing platforms, hybrid platforms, and portable simulation platforms. Recently, UAVs dominate the market share as they are increasingly integrated into defense strategies and training systems. The consistent advancement in drone capabilities and government contracts focusing on UAVs make this sub-segment the largest contributor to market growth, particularly in military simulations, where real-time data and operational rehearsals are crucial.

Competitive Landscape

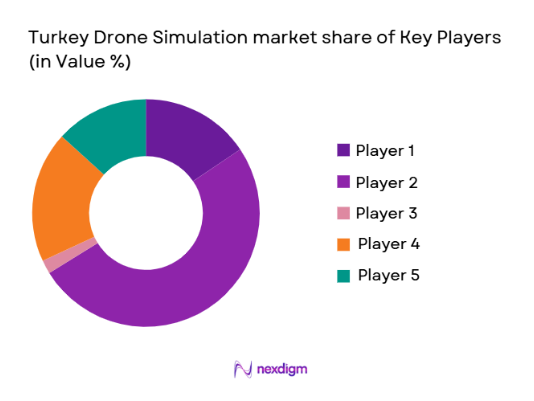

The competitive landscape of the Turkey Drone Simulation market is highly influenced by both local and international players. Market consolidation is driven by the presence of a few major defense contractors that have a significant influence in the development and supply of simulation technologies for drone systems. Companies like Thales Group, Lockheed Martin, and Turkish defense firms are key players. These companies drive innovation, providing advanced simulation systems tailored to the evolving needs of military and defense sectors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| ASELSAN | 1975 | Turkey | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ |

| L3 Technologies | 2002 | USA | ~ | ~ | ~ | ~ |

Turkey Drone Simulation Market Analysis

Growth Drivers

Increased Government Investment in Defense Technologies

The Turkish government’s increased budget allocations for defense and security have significantly contributed to the growth of the drone simulation market. With growing national security concerns and rising geopolitical tensions, there is an urgent demand for advanced training systems to enhance the operational efficiency of military personnel. As drones play an increasingly vital role in defense operations, the Turkish government has allocated substantial resources to develop and procure cutting-edge simulation technologies. Investments in R&D and partnerships with defense contractors have facilitated the creation of advanced simulation systems that improve the realism and effectiveness of UAV training programs. These investments are expected to fuel growth in the market, particularly for UAV and command and control systems.

Technological Advancements in UAV Simulation Tools

Advancements in UAV technology and simulation systems are driving significant growth in the Turkey Drone Simulation market. Innovations in artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) have enhanced the performance of drone simulations. These technological improvements make simulations more realistic, enabling the training of operators in a variety of complex scenarios. AI integration into simulation systems allows for adaptive learning, where the simulation environment can evolve based on the trainee’s actions, providing a personalized learning experience. As these technologies continue to evolve, their incorporation into drone training systems is expected to boost market demand, making simulations more accurate and valuable for military and defense sectors.

Market Challenges

High Capital Expenditure for Drone Simulation Systems

One of the key challenges facing the Turkey Drone Simulation market is the high initial investment required for sophisticated simulation systems. These systems involve advanced hardware and software components, including high-performance computing, motion platforms, and immersive virtual environments. The development, installation, and maintenance costs associated with these systems are significant, which can restrict adoption, particularly among smaller defense contractors and private sector firms. Moreover, continuous advancements in technology necessitate regular system upgrades, further adding to the financial burden for organizations. This high capital expenditure can act as a barrier to entry for smaller players in the market, limiting competition and slowing the overall growth rate.

Technological Integration and Interoperability Issues

Another major challenge facing the Turkey Drone Simulation market is the difficulty in ensuring seamless integration of various simulation technologies. The market is characterized by the need for a wide range of simulation systems, each serving a different purpose, from UAV flight dynamics to mission planning and command control. Ensuring interoperability between these systems is a complex task, as each product may have different software protocols, hardware requirements, and technical specifications. The lack of standardization across platforms can lead to inefficiencies and increased operational costs. Additionally, the rapid pace of technological advancements means that simulation systems often face challenges in keeping up with new drone technologies and evolving defense needs.

Opportunities

Advancements in Artificial Intelligence for Enhanced Simulations

The integration of AI into drone simulation systems presents a significant opportunity for growth in the market. AI-powered simulations offer adaptive learning capabilities, where the system adjusts based on a trainee’s performance. This allows for more customized training, increasing the efficiency and effectiveness of drone operator education. Furthermore, AI can enhance the realism of simulations by generating dynamic, real-time scenarios that respond to the actions of the trainee. The incorporation of AI into simulation systems enables the creation of highly advanced training programs that mirror real-world conditions. This provides significant benefits for military training programs, where realistic scenarios are critical. As AI technologies continue to mature, their incorporation into drone simulation systems is expected to create new market opportunities.

Partnerships with Private Tech Firms for Enhanced Cybersecurity

As drones become an integral part of military and commercial operations, cybersecurity has become a critical concern. Ensuring the safety and security of drone operations through simulation-based training is a growing opportunity in the Turkey Drone Simulation market. Partnerships between defense organizations and private cybersecurity firms are crucial for developing secure UAV systems and simulation technologies. By combining expertise in defense, cybersecurity, and drone technology, these partnerships can create robust simulation environments where military personnel can be trained to handle potential cyber threats in real-time. With the increasing reliance on UAVs for sensitive operations, the demand for secure simulation systems is expected to rise, creating new opportunities for market growth.

Future Outlook

The Turkey Drone Simulation market is expected to experience steady growth over the next five years. Key trends include continued government investment in defense technologies, advancements in AI and VR, and the increasing adoption of drones in military operations. With continuous technological advancements, particularly in AI and cybersecurity, the demand for advanced simulation systems is expected to rise. The market will benefit from regulatory support, increasing defense budgets, and the growing need for comprehensive drone training solutions in military and civilian sectors.

Major Players

- Thales Group

- Lockheed Martin

- ASELSAN

- BAE Systems

- L3 Technologies

- Leonardo

- Northrop Grumman

- Airbus

- Raytheon Technologies

- General Dynamics

- Elbit Systems

- Saab Group

- Rheinmetall AG

- Honeywell

- Israel Aerospace Industries

Key Target Audience

- Government and defense contractors

- Military organizations and agencies

- Drone technology developers

- Aerospace & aviation companies

- Private sector firms interested in UAV training

- Security and defense consultants

- Technology integration firms

- Cybersecurity firms

Research Methodology

Step 1: Identification of Key Variables

Identifying the key market drivers, challenges, and technologies influencing the Turkey Drone Simulation market.

Step 2: Market Analysis and Construction

Analyzing the segmentation, competitive landscape, and emerging trends within the market.

Step 3: Hypothesis Validation and Expert Consultation

Consulting with industry experts to validate hypotheses and ensure alignment with market conditions.

Step 4: Research Synthesis and Final Output

Synthesizing findings into a comprehensive report and drawing conclusions for actionable insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Government Investment in Defense Technologies

Technological Advancements in UAVs and Simulation Tools

Increasing Demand for Training & Simulation in Aerospace

Enhancement of National Security & Defense Forces

Growing Adoption of UAVs in Civilian Applications - Market Challenges

High Capital Investment in Drone Simulation Systems

Regulatory Barriers and Certification Processes

Integration of Advanced Simulation Technologies

Lack of Skilled Workforce for Advanced Simulation Tools

Technological Complexity and Interoperability Issues - Market Opportunities

Advancements in Artificial Intelligence for Enhanced Simulations

Partnerships Between Government and Private Sector for R&D

Increased Application of Drone Simulations in Non-Military Sectors - Trends

Increased Integration of VR and AR in Training Simulations

Shift Towards Cloud-Based Simulation Solutions

Rising Adoption of AI for Mission Planning and Training

Development of More Advanced UAV Flight Simulators

Growth of Autonomous Drone Capabilities in Simulation - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Simulation Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Simulation Systems

Flight Dynamics Simulation Systems

Mission Planning and Training Simulators

Sensor Simulation Systems

Virtual Reality-Based Simulation Systems - By Platform Type (In Value%)

Unmanned Aerial Vehicles (UAV)

Rotary-Wing Platforms

Fixed-Wing Platforms

Hybrid Platforms

Portable Simulation Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Aerospace & Aviation Organizations

Government Agencies

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Hardware Components

Simulation Software

Real-Time Data Integration

Immersive VR/AR Technology

Advanced Motion Platforms

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Technology, Product Innovation, Geographic Presence, Product Portfolio, Pricing Strategy)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Boeing

Lockheed Martin

Thales Group

Airbus

Raytheon Technologies

General Dynamics

Northrop Grumman

L3 Technologies

Saab Group

Leonardo

Elbit Systems

BAE Systems

Harris Corporation

Simlat

Quantum Systems

- Military Forces’ Increasing Demand for Advanced Simulation

- Government Agencies’ Role in Regulating and Procuring Simulation Systems

- Aerospace & Aviation Organizations Leveraging Simulations for Pilot Training

- Private Sector’s Growing Interest in UAV Training and Simulation Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035