Market Overview

The Turkey Drones market is valued at USD ~ billion, driven by significant advancements in drone technologies, defense investments, and increasing applications in commercial sectors. The demand for drones in surveillance, agriculture, and infrastructure inspection is growing due to their cost-effectiveness, real-time data capabilities, and operational efficiency. Additionally, the Turkish government’s support in advancing local UAV manufacturing and increasing the adoption of drones in defense and civil applications plays a crucial role in market growth.

Istanbul and Ankara dominate the market, benefiting from their strong technological infrastructure, proximity to defense contractors, and active participation in UAV-related research and development. Turkey’s growing aerospace and defense sector, combined with strategic initiatives to improve UAV technology for both military and civilian use, places these cities as the center for drone innovation and development in the region. This dominance is also enhanced by the government’s investments in fostering the local drone industry.

Market Segmentation

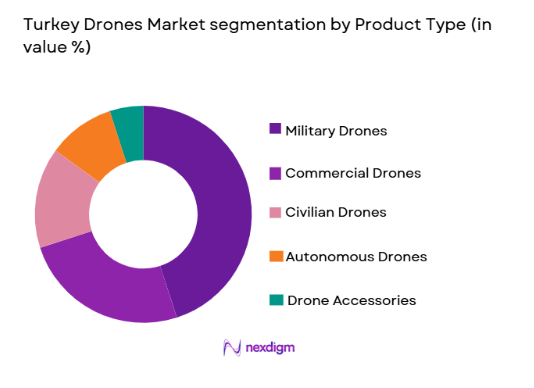

By Product Type

Turkey Drones market is segmented by product type into military drones, commercial drones, autonomous drones, agricultural drones, and drone accessories. Recently, military drones dominate the market share, largely due to the ongoing modernization of the Turkish defense sector. Turkey’s investments in defense and surveillance systems, including UAVs, have driven demand for more advanced military drones that support intelligence, surveillance, and reconnaissance operations. The increasing military expenditure in the country, alongside Turkey’s focus on enhancing its defense capabilities, is a key factor in the dominance of this sub-segment.

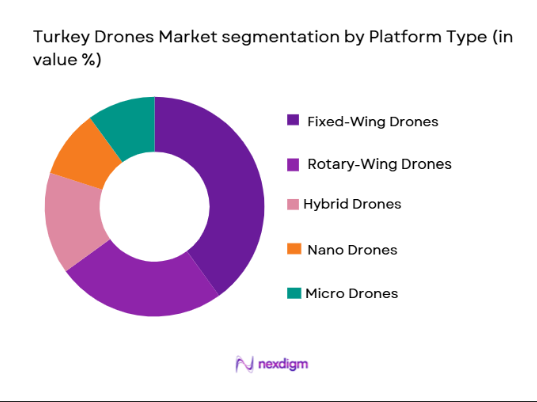

By Platform Type

Turkey Drones market is segmented by platform type into fixed-wing drones, rotary-wing drones, hybrid drones, nano drones, and micro drones. Recently, fixed-wing drones have a dominant market share due to their longer endurance, greater payload capacity, and ability to cover large areas for military surveillance and agricultural purposes. These drones are highly suited for applications requiring extended flight times and efficient operational ranges, such as border surveillance, mapping, and monitoring of vast agricultural lands. As these drones require advanced control systems, their growing use in both military and commercial applications is significantly boosting their market share.

Competitive Landscape

The Turkey Drones market is competitive, with a strong presence of both local and international players. Major players like Aselsan, STM, and TUSAS dominate the defense sector, while other companies focus on commercial drone applications in agriculture and infrastructure. Local firms benefit from government support for defense innovation, while international companies compete by offering advanced drone solutions for surveillance, mapping, and security. Market consolidation is occurring as companies seek partnerships to enhance product offerings and expand their market presence.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Aselsan | 1975 | Turkey | ~ | ~ | ~ | ~ |

| STM | 1991 | Turkey | ~ | ~ | ~ | ~ |

| TUSAS | 1984 | Turkey | ~ | ~ | ~ | ~ |

| General Atomics | 1955 | USA | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | USA | ~ | ~ | ~ | ~ |

Turkey Drones Market Analysis

Growth Drivers

Government Investment in Drone Technologies

The growth of the Turkey Drones market is significantly driven by government investment in drone technologies, especially in defense and military applications. The Turkish government has continuously allocated significant funds to enhance its national security and defense capabilities, particularly through the development and procurement of UAVs. This investment supports the creation of high-performance military drones used for surveillance, reconnaissance, and intelligence gathering. Furthermore, the government’s push for indigenous drone technology development has spurred local companies to innovate and design advanced drone systems tailored to the specific needs of the Turkish defense industry. As part of its broader strategic initiatives, Turkey is also investing in drone applications for commercial use, including agriculture, infrastructure inspection, and logistics, thus further boosting the demand for UAVs across various sectors.

Technological Advancements in Autonomous Systems

The Turkey Drones market is also benefiting from rapid advancements in autonomous UAV systems, particularly through the integration of artificial intelligence (AI), machine learning, and real-time data processing. These technologies enable drones to operate with minimal human intervention, making them highly efficient for military and commercial applications. In the defense sector, autonomous drones provide enhanced surveillance and reconnaissance capabilities, enabling long-duration operations in complex environments. In commercial sectors such as agriculture and infrastructure, the demand for autonomous drones is growing as these systems can collect and analyze data with high accuracy, reducing the need for human labor and increasing operational efficiency. As autonomous drone technologies continue to improve, their applications across various industries are expected to expand, driving further market growth.

Market Challenges

Regulatory and Certification Issues

One of the key challenges facing the Turkey Drones market is the evolving regulatory environment surrounding drone operations. The use of drones in commercial and military applications is subject to a wide range of national and international regulations. These regulations cover areas such as airspace management, drone safety, privacy issues, and the certification of UAV systems. In Turkey, the government has implemented regulatory frameworks to ensure safe drone operations, but compliance with these regulations can be complex and costly for manufacturers and operators. For companies looking to expand their UAV operations across borders, navigating different regulatory requirements can be a significant barrier to entry. Moreover, the lack of standardized global regulations for UAVs presents challenges in integrating drone operations on an international scale, limiting market growth opportunities.

High Development and Maintenance Costs

The development of advanced drone systems, especially those for military applications, requires significant financial investment in research and development (R&D), hardware, and software. The high cost of designing, manufacturing, and maintaining cutting-edge UAVs poses a challenge for companies entering the market, particularly smaller firms. The integration of sophisticated technologies, such as AI, autonomous flight control systems, and real-time data analytics, increases the cost of production, making drones expensive to produce and maintain. Additionally, the need for regular upgrades and compliance with changing regulations can further drive up operational costs. This financial barrier can limit the ability of small- and medium-sized enterprises to compete with larger players in the market, thus creating a challenge for market expansion.

Opportunities

Expanding Drone Applications in Agriculture

One of the most significant opportunities in the Turkey Drones market lies in the growing adoption of UAVs in agriculture. The use of drones in precision farming is transforming agricultural practices by enabling real-time monitoring of crop health, soil conditions, and water usage. These drones are equipped with advanced imaging and sensing technologies, which allow farmers to make data-driven decisions that optimize crop yields and reduce operational costs. As the demand for more efficient, sustainable, and data-driven farming practices increases, UAVs are expected to become an integral part of the agricultural sector. The Turkish government’s focus on enhancing agricultural productivity through technological innovations, coupled with the growing interest in smart farming solutions, presents a significant growth opportunity for drone manufacturers and software developers in the agriculture sector.

UAVs for Infrastructure Inspections

Another promising opportunity for the Turkey Drones market is the increasing use of drones for infrastructure inspections. Drones are becoming essential tools for inspecting critical infrastructure such as bridges, power lines, and oil pipelines. The ability of UAVs to access hard-to-reach locations, combined with their capability to capture high-resolution imagery and data, makes them ideal for monitoring the condition of infrastructure and performing safety assessments. Drones also offer significant advantages over traditional inspection methods, including reduced costs, faster turnaround times, and improved safety for workers. As Turkey continues to invest in infrastructure development and maintenance, the demand for drones capable of conducting inspections and monitoring infrastructure is expected to rise, presenting significant growth opportunities for drone companies.

Future Outlook

The Turkey Drones market is expected to experience robust growth over the next five years, driven by technological innovations, government support, and increasing adoption across various industries. The integration of autonomous systems and AI into drones will enhance operational efficiency, particularly in defense, agriculture, and infrastructure sectors. As regulations evolve to accommodate the growing use of drones, Turkey is well-positioned to become a regional leader in UAV technology, with increasing demand expected both domestically and internationally.

Major Players

- Aselsan

- STM

- TUSAS

- Boeing

- Lockheed Martin

- Elbit Systems

- Thales Group

- General Dynamics

- Northrop Grumman

- Intel

- L3 Technologies

- Rheinmetall

- Saab Group

- Israel Aerospace Industries

- Textron Inc.

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military organizations and agencies

- Aerospace and aviation companies

- Agriculture technology firms

- Infrastructure and construction companies

- Drone technology developers

- Security firms

Research Methodology

Step 1: Identification of Key Variables

Identifying the primary drivers, challenges, and technological trends influencing the Turkey Drones market.

Step 2: Market Analysis and Construction

Detailed analysis of market segmentation, competitive dynamics, and emerging trends to assess market potential and growth opportunities.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts to validate hypotheses and ensure alignment with current market conditions.

Step 4: Research Synthesis and Final Output

Synthesis of all findings into a comprehensive report that provides actionable insights for stakeholders and decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in UAV Technologies

Technological Advancements in Autonomous Systems

Rising Demand for Drones in Agriculture and Infrastructure - Market Challenges

Regulatory Barriers and Compliance

High Development and Maintenance Costs

Integration and Interoperability Issues - Market Opportunities

Expansion of UAV Applications in Agriculture

Growth of Drones in Infrastructure Inspections

Technological Integration of AI and Machine Learning in UAVs - Trends

Increased Use of AI and Machine Learning in UAVs

Rising Popularity of Drones in Search and Rescue

Development of Autonomous and Hybrid Drones - Government Regulations & Defense Policy

Regulations on Drone Airspace Management

Data Privacy and Protection Laws

Government Defense and Security Funding - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Military Drones

Commercial Drones

Autonomous Drones

Agricultural Drones

Drone Accessories - By Platform Type (In Value%)

Fixed-Wing Drones

Rotary-Wing Drones

Hybrid Drones

Nano Drones

Micro Drones - By Fitment Type (In Value%)

Cloud-based Solutions

On-premise Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military and Defense Agencies

Aerospace and Aviation

Agriculture and Environmental Monitoring

Infrastructure and Construction

Search and Rescue Operations - By Procurement Channel (In Value%)

Direct Procurement

Private Sector Procurement

Government Tenders

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Artificial Intelligence

Machine Learning Algorithms

Computer Vision Technologies

Cloud Computing Platforms

IoT Integration

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology, Product Innovation, Geographic Reach, Product Portfolio, Pricing Strategy)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Aselsan

STM

TUSAS

Boeing

Lockheed Martin

Elbit Systems

Thales Group

General Dynamics

Northrop Grumman

Intel

L3 Technologies

Rheinmetall

Saab Group

Israel Aerospace Industries

Textron Inc.

- Military and Defense Agencies Expanding Drone Programs

- Aerospace Sector Increasing UAV Utilization

- Agriculture Sector Adopting Drones for Monitoring and Analysis

- Infrastructure Sector Utilizing Drones for Inspections

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035