Market Overview

The Turkey Inspection Drones Market was valued at USD ~ million based on a recent historical assessment derived from globally reported inspection drone revenues and Turkey’s proportional participation in commercial drone services activity. Demand is driven by expanding inspection requirements across power transmission networks, renewable energy assets, transport corridors, industrial plants, and urban infrastructure, where drones reduce downtime, enhance worker safety, and enable frequent monitoring. Adoption is further supported by improvements in imaging sensors, flight endurance, and analytics software integration across inspection workflows nationwide.

Turkey’s inspection drones activity is concentrated around Istanbul, Ankara, Izmir, Bursa, and Kocaeli due to dense industrial clusters, logistics infrastructure, and government-led smart city and infrastructure programs. Istanbul dominates as a technology and services hub with strong private sector demand, while Ankara benefits from public sector procurement and regulatory oversight. Izmir and Bursa support energy, manufacturing, and construction inspections, whereas Kocaeli’s heavy industrial base drives consistent demand for asset monitoring and compliance-related inspection operations.

Market Segmentation

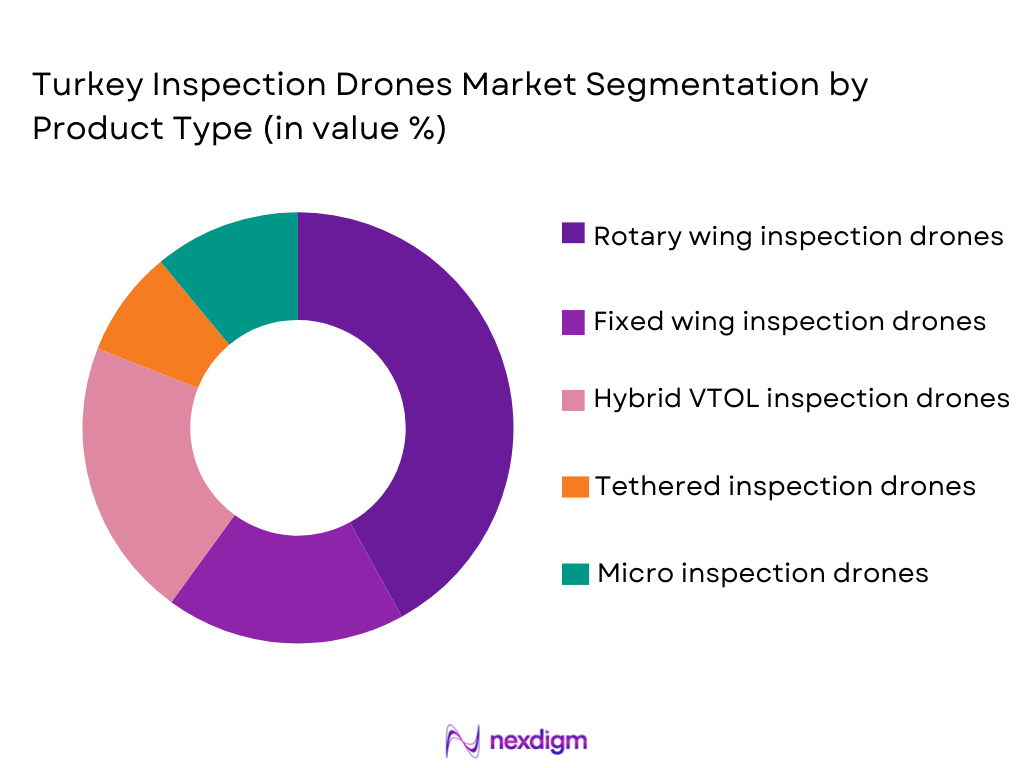

By Product Type

Turkey Inspection Drones market is segmented by product type into fixed-wing inspection drones, rotary-wing inspection drones, hybrid VTOL inspection drones, micro inspection drones, and tethered inspection drones. Recently, rotary-wing inspection drones have a dominant market share due to their vertical takeoff capability, superior maneuverability in confined industrial environments, and compatibility with high-resolution imaging payloads. These systems are widely preferred for power line inspection, industrial facility monitoring, and construction site assessment where hovering and precise positioning are required. Their adaptability to diverse inspection scenarios, ease of operator training, and strong OEM availability within Turkey further reinforce adoption across both government and private inspection programs.

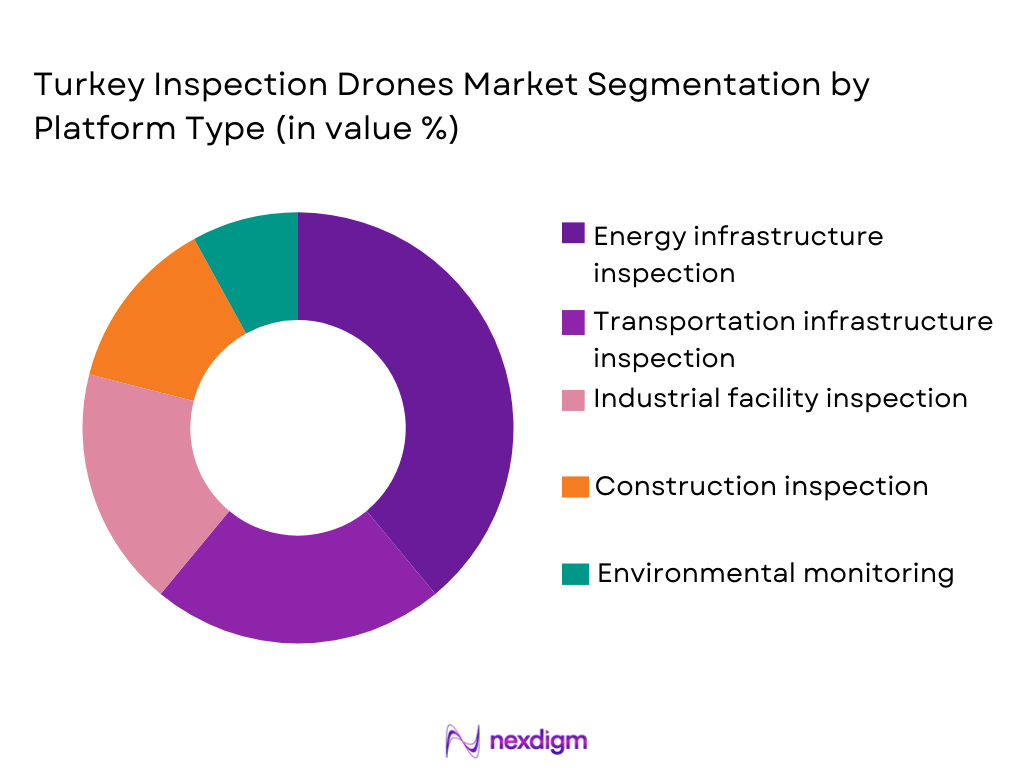

By Platform Type

Turkey Inspection Drones market is segmented by platform type into energy infrastructure inspection, transportation infrastructure inspection, industrial facility inspection, construction inspection, and environmental monitoring platforms. Recently, energy infrastructure inspection platforms have a dominant market share due to Turkey’s extensive electricity transmission network, renewable energy expansion, and routine inspection mandates for wind turbines, solar plants, and substations. Energy operators increasingly rely on drones to minimize outages, improve predictive maintenance, and meet regulatory compliance requirements. The scale of national energy assets, combined with safety and efficiency benefits, sustains continuous demand for drone-based inspection platforms across the country.

Competitive Landscape

The Turkey Inspection Drones Market shows moderate consolidation, with a mix of domestic UAV manufacturers, technology integrators, and specialized service providers competing alongside global technology suppliers. Local firms benefit from regulatory familiarity and customization capabilities, while larger players influence technology standards, analytics integration, and long-term service contracts, creating a competitive yet collaborative ecosystem.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Inspection Specialization |

| Baykar Technologies | 1984 | Turkey | ~ | ~ | ~ | ~ | ~ |

| Turkish Aerospace Industries | 1973 | Turkey | ~

|

~

|

~

|

~

|

~

|

| Asisguard | 2007 | Turkey | ~

|

~

|

~

|

~

|

~

|

| Vestel Defense | 2003 | Turkey | ~

|

~

|

~

|

~

|

~

|

| Hexagon Turkey | 1975 | Turkey | ~

|

~

|

~

|

~

|

~

|

Turkey Inspection Drones Market Analysis

Growth Drivers

Infrastructure Modernization and Safety Compliance Requirements:

Infrastructure modernization and safety compliance requirements are a critical growth driver for the Turkey Inspection Drones Market as nationwide investments continue across electricity transmission networks, renewable energy assets, transportation corridors, industrial plants, and urban infrastructure systems that require frequent, precise, and traceable inspection activities. Regulatory authorities increasingly mandate routine condition monitoring, preventive maintenance documentation, and safety audits, pushing asset owners to adopt drone-based inspection methods instead of manual and equipment-intensive processes. Inspection drones significantly reduce operational downtime by enabling inspections without shutting down power lines, production units, or transport infrastructure. Improved worker safety is another decisive factor, as drones minimize exposure to heights, confined spaces, corrosive environments, and hazardous operating conditions. Public sector infrastructure programs integrate drone inspections within standardized monitoring frameworks, reinforcing institutional adoption. Private operators mirror these practices to meet contractual performance obligations and insurance compliance requirements. Turkey’s geographically dispersed and often difficult terrain further increases the cost efficiency and practicality of aerial inspection compared to ground-based alternatives. As inspection frequency rises, drones become embedded into routine maintenance workflows rather than discretionary tools. The scalability of drone inspections allows operators to expand coverage without proportional labor increases. This structural dependence on automated inspection solutions ensures sustained long-term demand and market expansion.

Technological Advancements in Imaging and Data Analytics Capabilities:

Technological advancements in imaging and data analytics capabilities are significantly accelerating adoption in the Turkey Inspection Drones Market by transforming drones from simple visual tools into comprehensive decision-support platforms. High-resolution optical cameras, thermal imaging sensors, LiDAR payloads, and multispectral systems allow detection of microcracks, heat anomalies, corrosion patterns, and structural deformation with increasing accuracy. Artificial intelligence algorithms automate defect identification, reducing reliance on manual interpretation and lowering inspection error rates. Cloud-based data platforms enable centralized storage, processing, and retrieval of large inspection datasets across multiple assets and locations. Automated flight planning, obstacle avoidance, and waypoint navigation reduce operational complexity and training requirements. Improvements in battery efficiency and power management extend flight endurance and inspection coverage per mission. Integration with enterprise asset management and maintenance planning systems enhances operational decision-making. Declining sensor costs improve affordability for mid-sized inspection providers. Standardized data outputs support regulatory reporting. Continuous innovation across hardware and software layers strengthens return on investment and sustains long-term market growth momentum.

Market Challenges

Regulatory Complexity and Airspace Authorization Constraints:

Regulatory complexity and airspace authorization constraints represent a significant challenge for the Turkey Inspection Drones Market, as operators must comply with evolving civil aviation regulations, licensing frameworks, and operational restrictions governing unmanned aerial systems. Inspection missions near urban areas, industrial zones, ports, and energy facilities often require multiple permits, increasing administrative effort and delaying deployment schedules. Airspace congestion around airports and restricted military zones limits operational flexibility and inspection coverage. Compliance with altitude ceilings, visual line-of-sight requirements, and pilot certification standards adds operational rigidity. Regulatory updates require continuous training and compliance investments. Smaller service providers face disproportionately high administrative burdens relative to revenue scale. Public sector inspection projects may involve additional security clearances and coordination layers. Cross-border inspection activities remain highly restricted. Data transmission and storage regulations further complicate analytics workflows. Uncertainty around future regulatory changes affects investment planning. These regulatory barriers collectively slow scalability and moderate market expansion despite strong underlying demand.

High Capital Investment and Skilled Workforce Limitations:

High capital investment requirements and skilled workforce limitations constrain growth in the Turkey Inspection Drones Market, particularly for advanced inspection solutions using specialized sensors and analytics software. LiDAR, thermal imaging, and multispectral payloads substantially increase upfront acquisition costs. Dependence on imported components exposes operators to currency volatility and supply chain risks. Ongoing expenses related to maintenance, calibration, software licensing, and system upgrades raise total cost of ownership. Skilled drone pilots, data analysts, and system technicians are required to operate advanced inspection platforms effectively. Training programs increase time-to-deployment and operational expenditure. Insurance, liability coverage, and compliance costs add further financial pressure. Rapid technological advancement increases the risk of hardware obsolescence. Budget constraints limit adoption among municipalities and small enterprises. Clients may delay procurement decisions during economic uncertainty. These financial and capability constraints slow adoption rates and create uneven market participation.

Opportunities

Expansion of Renewable Energy Asset Inspection Services:

Expansion of renewable energy asset inspection services presents a major opportunity for the Turkey Inspection Drones Market as wind, solar, and hybrid renewable installations continue to scale nationwide. Wind turbines require frequent blade inspections to identify erosion, cracking, and lightning damage that affect efficiency and safety. Solar power plants demand regular panel inspections to detect heat loss, shading issues, and electrical faults. Drone-based inspections enable rapid data collection without interrupting energy generation operations. Thermal imaging improves fault detection accuracy and maintenance planning. Government renewable energy targets support sustained asset deployment across multiple regions. Long-term operation and maintenance contracts generate recurring inspection demand. Specialized inspection services allow providers to develop niche technical expertise. Predictive maintenance analytics improve asset performance and investor confidence. Local service capabilities reduce dependency on external contractors. This expanding renewable asset base supports stable and long-term inspection revenue growth.

Development of Integrated Inspection Service and Data Platform Models:

Development of integrated inspection service and data platform models offers strong growth potential for the Turkey Inspection Drones Market as asset owners increasingly prefer outsourced, end-to-end inspection solutions. Managed inspection services reduce capital expenditure for utilities, industrial operators, and infrastructure owners. Subscription-based analytics platforms create predictable recurring revenue streams. Standardized reporting formats support regulatory compliance and audit requirements. Integration with digital twins and enterprise asset management systems enhances operational value. Partnerships between drone manufacturers, software providers, and service firms expand solution depth. Service ecosystems lower entry barriers for small and medium enterprises. Long-term service contracts improve revenue stability. Data-driven insights enhance asset lifecycle optimization. Market competition increasingly shifts from hardware performance to analytical intelligence. This structural transformation supports scalable and sustainable market expansion.

Future Outlook

The Turkey Inspection Drones Market is expected to experience steady expansion over the next five years, supported by infrastructure investments, renewable energy growth, and digital inspection adoption. Advancements in autonomous flight, AI analytics, and sensor integration will improve inspection efficiency. Regulatory clarity is anticipated to enhance operational scalability. Demand from energy, transportation, and industrial sectors will remain strong, positioning inspection drones as a core component of Turkey’s asset management ecosystem.

Major Players

- Baykar Technologies

- Turkish Aerospace Industries

- Asisguard

- Vestel Defense

- Hexagon Turkey

- BMS Defense

- Dronetix

- Skytech UAV

- Robit Teknoloji

- FlyBVLOS

- Ekin Smart City Technologies

- Anka Robotics

- Mavrik Drone Systems

- Ulak UAV Solutions

- Arvento UAV Solutions

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Energy utilities

- Infrastructure developers

- Industrial manufacturers

- Smart city authorities

- Defense and homeland security agencies

- Logistics and transportation operators

Research Methodology

Step 1: Identification of Key Variables

Key variables related to demand, technology adoption, regulation, and end-user behavior were identified through secondary research. Industry classifications and inspection use cases were mapped. Data points were validated through multiple sources. Assumptions were standardized for consistency.

Step 2: Market Analysis and Construction

Market structure was developed by aligning global inspection drone data with regional adoption indicators. Segmentation logic was applied across product and platform categories. Market sizing followed a top-down approach. Internal consistency checks ensured coherence.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through expert interviews and industry commentary. Assumptions were refined based on practitioner feedback. Discrepancies were resolved through triangulation. Final hypotheses reflected consensus insights.

Step 4: Research Synthesis and Final Output

Validated data was synthesized into structured sections. Analytical insights were integrated with qualitative trends. Formatting and compliance checks were conducted. The final report reflects market realities accurately.

- Executive Summary

- Turkey Inspection Drones Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of critical infrastructure inspection requirements

Rising adoption of automation in industrial operations

Government support for domestic UAV manufacturing

Increasing safety and cost efficiency benefits of drone inspections

Advancements in sensor and data analytics capabilities - Market Challenges

Regulatory constraints on commercial drone operations

Airspace management and safety compliance issues

High initial investment for advanced inspection systems

Data security and privacy concerns

Limited skilled workforce for drone operations and analytics - Market Opportunities

Growth in renewable energy infrastructure inspections

Integration of AI and machine learning for predictive maintenance

Export potential for domestically developed inspection drones - Trends

Increased use of autonomous inspection missions

Adoption of real-time data transmission and cloud analytics

Miniaturization of high-resolution sensors

Hybrid VTOL designs for complex inspection environments

Growth of service-based inspection drone offerings - Government Regulations & Defense Policy

Strengthening of UAV certification and licensing frameworks

Supportive policies for indigenous drone development

Alignment of civilian UAV regulations with international standards - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed-wing inspection drones

Rotary-wing inspection drones

Hybrid VTOL inspection drones

Tethered inspection drones

Micro and nano inspection drones - By Platform Type (In Value%)

Infrastructure inspection platforms

Energy and utilities inspection platforms

Industrial facility inspection platforms

Transportation and logistics inspection platforms

Environmental and agricultural inspection platforms - By Fitment Type (In Value%)

Factory-integrated inspection drones

Payload-customized inspection drones

Sensor-retrofitted inspection drones

Software-upgraded inspection drones

Modular inspection drone systems - By EndUser Segment (In Value%)

Energy and utilities operators

Construction and infrastructure developers

Manufacturing and industrial enterprises

Government and municipal agencies

Agriculture and environmental monitoring bodies - By Procurement Channel (In Value%)

Direct OEM procurement

Government tenders and contracts

System integrator procurement

Distributor and reseller networks

Leasing and service-based procurement - By Material / Technology (in Value %)

Composite airframe materials

Carbon fiber structures

Advanced imaging sensors

LiDAR and laser scanning technology

AI-enabled analytics and autonomy software

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Product Portfolio Breadth, Sensor Integration Capability, Autonomy Level, Regulatory Compliance Strength, Local Manufacturing Presence, AfterSales Support Quality, Pricing Competitiveness, Data Analytics Capability, Customization Flexibility, Partnership Ecosystem) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Baykar Technologies

Turkish Aerospace Industries

Asisguard

Vestel Defense

BMS Defense Technologies

Hexagon Turkey

Dronetix

Skytech UAV

Robit Teknoloji

Ekin Smart City Technologies

FlyBVLOS

Mavrik Drone Systems

Ulak UAV Solutions

Anka Robotics

Arvento UAV Solutions

- Energy operators prioritizing predictive maintenance and safety compliance

- Construction firms leveraging drones for progress monitoring and quality control

- Industrial manufacturers adopting drones for asset management efficiency

- Public agencies utilizing drones for infrastructure and environmental oversight

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035