Market Overview

Based on a recent historical assessment, the Turkey laser range finder and laser designator market recorded an absolute market size of USD ~ billion, supported by confirmed defense electronics procurement programs, platform integration contracts, and delivery disclosures released through Turkish Ministry of National Defense activity reports and SIPRI-aligned defense equipment trade data. Market demand is driven by sustained investment in precision targeting systems for air, land, and unmanned platforms, increased integration of laser-guided munitions, and accelerated domestic defense electronics development under national industrialization initiatives.

Based on a recent historical assessment, Turkey dominates this market through a highly centralized and vertically integrated defense electronics ecosystem. Ankara functions as the primary command, procurement, and program management center, while Ankara, Konya, and Eskişehir host major R&D, testing, and production facilities. International relevance is reinforced through export programs supplying laser targeting systems to allied Middle Eastern, Central Asian, and NATO-partner countries, driven by combat-proven performance, cost competitiveness, and strong platform-level integration with Turkish-developed UAVs and land combat systems.

Market Segmentation

By Product Type

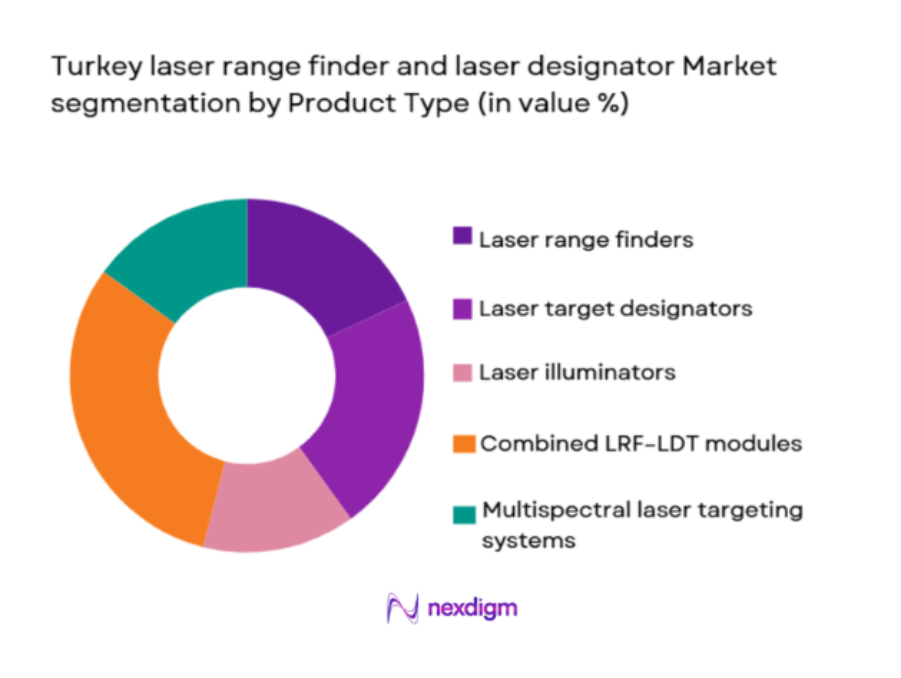

Turkey laser range finder and laser designator market is segmented by product type into laser range finders, laser target designators, laser illuminators, combined LRF–LDT modules, and multispectral laser targeting systems. Recently, combined LRF–LDT modules have demonstrated a dominant market share due to their ability to consolidate ranging, designation, and illumination functions into a single compact unit. This integration reduces payload weight, simplifies platform integration, and improves targeting efficiency across UAVs, armored vehicles, and airborne platforms. Turkish defense programs increasingly prioritize modular and multifunction systems to reduce lifecycle costs and logistics complexity. Strong domestic manufacturing capability, mature integration with electro-optical payloads, and compatibility with laser-guided munitions further reinforce adoption. Export customers also favor combined systems for ease of integration and standardized training, sustaining consistent procurement volumes.

By Platform Type

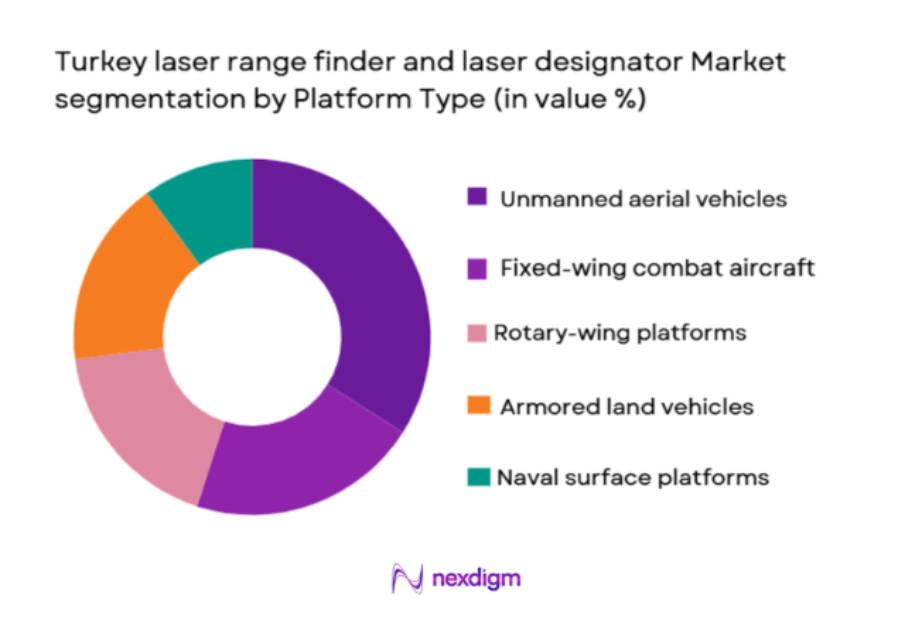

Turkey laser range finder and laser designator market is segmented by platform type into unmanned aerial vehicles, fixed-wing combat aircraft, rotary-wing platforms, armored land vehicles, and naval surface platforms. Recently, unmanned aerial vehicles have accounted for the dominant market share due to their central role in intelligence, surveillance, reconnaissance, and precision strike missions. Turkish UAV platforms are increasingly equipped with indigenous electro-optical payloads integrating laser range finding and designation functions. High operational deployment rates, continuous export demand, and rapid production cycles drive sustained system integration volumes. UAV-centric doctrines prioritize stabilized, lightweight, and long-range laser systems, reinforcing procurement momentum. The scalability of UAV programs across domestic and international users further sustains dominance within this segmentation.

Competitive Landscape

The Turkey laser range finder and laser designator market is moderately consolidated, dominated by a small group of domestic defense electronics manufacturers with strong vertical integration and close alignment with national procurement authorities. Competitive positioning is shaped by optical sensor expertise, stabilization performance, export readiness, and the ability to deliver fully integrated targeting subsystems for indigenous platforms.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary Platform Focus |

| ASELSAN | 1975 | Ankara | ~ | ~ | ~ | ~ | ~ |

| METEKSAN Defense | 2006 | Ankara | ~ | ~ | ~ | ~ | ~ |

| TUSAŞ | 1973 | Ankara | ~ | ~ | ~ | ~ | ~ |

| BAYKAR Technologies | 1984 | Istanbul | ~ | ~ | ~ | ~ | ~ |

| HAVELSAN | 1982 | Ankara | ~ | ~ | ~ | ~ | ~ |

Turkey Laser Range Finder and Laser Designator Market Analysis

Growth Drivers

Indigenous UAV and Precision Strike Program Expansion:

Indigenous UAV and Precision Strike Program Expansion is a primary growth driver for the Turkey laser range finder and laser designator market because UAV platforms increasingly form the backbone of national and export-oriented combat operations. Turkish UAVs rely heavily on onboard laser range finding and designation systems to support laser-guided munitions, real-time targeting, and battle damage assessment. Continuous UAV production generates recurring demand for integrated laser subsystems. Export sales further amplify volume requirements as each platform is delivered with certified targeting payloads. Operational success has strengthened confidence in indigenous laser technologies. Program standardization reduces qualification timelines and accelerates procurement. Payload upgrades drive replacement demand. Interoperability with guided munitions sustains system relevance. These combined factors create structurally sustained market growth.

Defense Electronics Localization and Export Orientation:

Defense Electronics Localization and Export Orientation drives market expansion by prioritizing domestic development of critical optical and laser technologies. Localization policies reduce reliance on foreign suppliers and mitigate export control risks. Indigenous design capability allows rapid customization for different platforms. Export programs benefit from reduced licensing constraints. Cost competitiveness improves international adoption. Government support accelerates certification. Lifecycle support remains centralized. Technology spillover strengthens product portfolios. These dynamics reinforce long-term demand growth.

Market Challenges

High Precision Optics Development and Qualification Costs:

High Precision Optics Development and Qualification Costs present a significant challenge for the Turkey laser range finder and laser designator market due to the complexity of optical manufacturing and calibration. Laser systems require advanced materials, coatings, and stabilization mechanisms. Development cycles are capital intensive. Qualification and environmental testing add cost and time. Yield rates in optical production affect margins. Rapid performance expectations increase R&D burden. Platform-specific customization adds complexity. Cost recovery depends on export volumes. These factors constrain smaller suppliers and slow scaling.

Export Controls and Technology Sensitivity Constraints:

Export Controls and Technology Sensitivity Constraints challenge market expansion by imposing compliance requirements on laser designation technologies. International laser safety and weapons regulations restrict some markets. Licensing delays affect delivery schedules. End-user restrictions limit flexibility. Compliance management increases administrative cost. Some technologies require downgrades for export. Negotiation timelines extend sales cycles. Regulatory uncertainty impacts planning. These challenges limit speed of international market penetration.

Opportunities

Rising Demand for Compact Multi-Function Targeting Modules:

Rising Demand for Compact Multi-Function Targeting Modules presents a strong opportunity as military platforms seek reduced payload weight and higher integration efficiency. Combined laser systems simplify logistics. Compact designs improve UAV endurance. Software-driven functionality enhances value. Export users favor standardized modules. Modular architecture accelerates upgrades. Higher unit value improves margins. Continuous innovation differentiates suppliers. This opportunity supports sustained growth.

Expansion into Naval and Land Vehicle Laser Integration:

Expansion into Naval and Land Vehicle Laser Integration offers growth potential beyond aerial platforms. Modern armored vehicles require advanced fire control. Naval guns and missiles benefit from precision designation. Indigenous platform programs create demand. Export naval programs add volume. Integration expertise enhances competitiveness. Long service life ensures recurring upgrades. This opportunity broadens market reach.

Future Outlook

Over the next five years, the Turkey laser range finder and laser designator market is expected to grow steadily, supported by UAV proliferation, export momentum, and continued localization of defense electronics. Technological progress will emphasize miniaturization, multispectral capability, and AI-assisted targeting. Regulatory backing for indigenous systems will remain strong. Demand will be reinforced by multi-platform integration and allied procurement programs.

Major Players

- ASELSAN

- METEKSAN Defense

- TUSAŞ

- BAYKAR Technologies

- HAVELSAN

- STM Savunma Teknolojileri

- Roketsan

- Kale Savunma

- FNSS

- Otokar

- BMC Defense

- Alp Aviation

- TEI

- MKE

- Sarsılmaz

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- UAV manufacturers

- Defense electronics OEMs

- Electro-optical system integrators

- Weapons platform manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including system types, platform integration volumes, pricing benchmarks, and export deliveries were identified using official defense disclosures and trade data.

Step 2: Market Analysis and Construction

Market sizing was conducted using bottom-up aggregation across platforms and system categories aligned with verified procurement and delivery records.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through consultations with defense electronics engineers, retired military targeting specialists, and industry analysts.

Step 4: Research Synthesis and Final Output

Validated data were synthesized into a structured market model ensuring accuracy, relevance, and strategic usability.

- Executive Summary

- Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Indigenous defense electronics development programs

Rising deployment of UAV based targeting systems

Integration of precision guided munitions

Expansion of export oriented defense manufacturing

Modernization of land and air combat platforms - Market Challenges

High development and qualification costs

Stringent export control and compliance requirements

Complex integration with legacy platforms

Dependence on advanced optical components

Rapid technology obsolescence cycles - Market Opportunities

Growth in UAV and loitering munition integration

Export demand from allied and partner nations

Development of compact multi function laser systems - Trends

Miniaturization of laser targeting systems

Increased use of multi spectral laser modules

AI assisted target acquisition integration

Emphasis on eye safe and low power consumption lasers

Interoperability with network centric warfare systems - Government Regulations & Defense Policy

Support for indigenous defense electronics production

Export promotion through defense cooperation agreements

Compliance with international laser safety standards

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Laser range finders

Laser target designators

Laser illuminators

Combined LRF LDT modules

Multi spectral laser targeting systems - By Platform Type (In Value%)

Unmanned aerial vehicles

Fixed wing combat aircraft

Rotary wing platforms

Armored land vehicles

Naval surface platforms - By Fitment Type (In Value%)

New platform integration

Mid life upgrade retrofitting

Modular mission pod installation

Indigenous platform fitment

Export oriented customized integration - By EndUser Segment (In Value%)

Turkish Armed Forces

Special operations units

Border security forces

Defense export customers

Allied military users - By Procurement Channel (In Value%)

Direct government procurement

Defense industry framework contracts

Program based system integration

Export sales through defense agencies

Joint development and co production agreements - By Material / Technology (in Value %)

Solid state laser technology

Eye safe laser wavelengths

Advanced beam stabilization modules

Integrated electro optical sensor fusion

Digital fire control and targeting software

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (laser range accuracy, designation range, wavelength type, platform compatibility, stabilization performance, system weight, power consumption, export readiness, lifecycle support) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

ASELSAN

Roketsan

TUSAŞ

HAVELSAN

METEKSAN Defense

BAYKAR Technologies

STM Savunma Teknolojileri

Kale Savunma

FNSS

Otokar

BMC Defense

MKE

Sarsılmaz

Alp Aviation

TEI

- Armed forces prioritize precision targeting and reliability

- Special forces demand lightweight and portable systems

- UAV operators focus on stabilized long-range designation

- Export users seek combat proven and modular solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035