Market Overview

Turkey’s small unmanned aerial systems market recorded an approximate value of USD ~billion based on a recent historical assessment, supported by disclosures from the Turkish Presidency of Defence Industries, defense budget allocations, and reported procurement contracts. The market is driven by sustained military modernization programs, operational deployment of domestically developed UAVs, and continuous investments in indigenous platforms. Additional momentum comes from export contracts, iterative upgrades to existing fleets, and integration of advanced sensors, autonomy, and secure communication technologies across tactical and operational missions.

Ankara remains the primary hub for the Turkey small unmanned aerial systems market due to the concentration of defense headquarters, procurement authorities, and system integrators. Istanbul contributes through private-sector innovation, manufacturing, and supplier ecosystems, while regions such as Eskisehir and Konya support testing, training, and aerospace production. Turkey’s dominance is reinforced by a strong domestic industrial base, centralized defense procurement, combat-proven operational experience, and a policy-driven focus on self-reliance, which collectively sustain high adoption across military and security agencies.

Market Segmentation

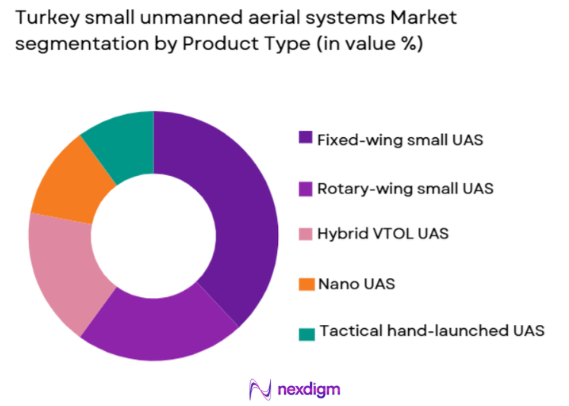

By Product Type:

Turkey small unmanned aerial systems market is segmented by product type into fixed-wing systems, rotary-wing systems, hybrid VTOL systems, nano and micro UAVs, and hand-launched tactical UAVs. Recently, fixed-wing small unmanned aerial systems have shown dominant market share due to their extended endurance, longer operational range, and suitability for intelligence, surveillance, and reconnaissance missions. These platforms align well with Turkey’s emphasis on persistent border monitoring, cross-domain situational awareness, and expeditionary operations. Fixed-wing systems also benefit from established domestic manufacturing capabilities, proven operational deployment, and continuous payload upgrades. Their cost-effectiveness per flight hour and adaptability to various mission profiles further strengthen demand. Additionally, export success of fixed-wing UAVs has reinforced production scale, supply chain maturity, and platform standardization, allowing them to maintain a leading position within overall procurement and deployment strategies.

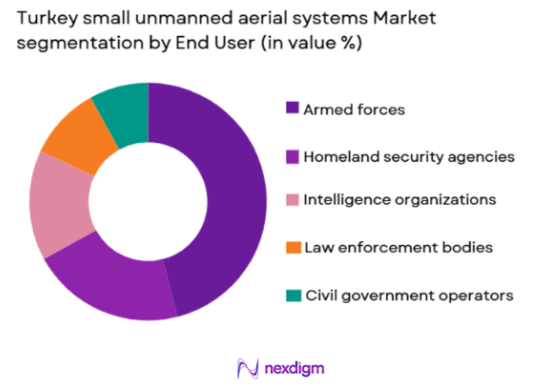

By End User:

Turkey small unmanned aerial systems market is segmented by end user into armed forces, homeland security agencies, intelligence organizations, law enforcement bodies, and civil government authorities. Recently, armed forces have held a dominant market share due to sustained operational requirements, continuous fleet expansion, and integration of UAVs into core doctrine. Military demand is reinforced by the need for real-time ISR, target acquisition, and force protection across land and maritime domains. Armed forces also benefit from dedicated funding streams, rapid procurement cycles, and close coordination with domestic manufacturers. The ability to customize platforms for mission-specific requirements, combined with training infrastructure and operational feedback loops, ensures that military users remain the primary drivers of volume, value, and technological advancement in the market.

Competitive Landscape

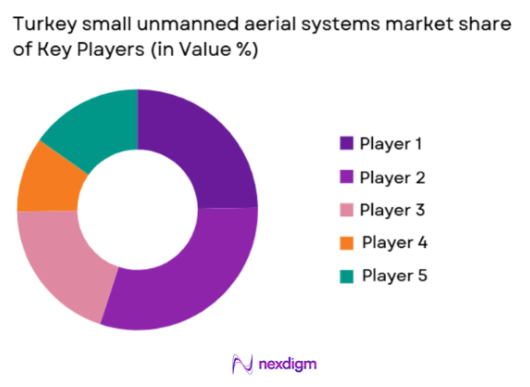

The Turkey small unmanned aerial systems market is moderately consolidated, with a limited number of domestic players exerting strong influence through vertically integrated capabilities and close alignment with defense authorities. Major companies benefit from long-term government contracts, export pipelines, and continuous platform upgrades, creating high entry barriers. Collaboration between system developers, electronics suppliers, and software firms further strengthens competitive positioning, while smaller firms focus on niche payloads, subsystems, and support services.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Baykar Technologies | 1984 | Istanbul | ~ | ~ | ~ | ~ | ~ |

| Turkish Aerospace Industries | 1973 | Ankara | ~ | ~ | ~ | ~ | ~ |

| Aselsan | 1975 | Ankara | ~ | ~ | ~ | ~ | ~ |

| Havelsan | 1982 | Ankara | ~ | ~ | ~ | ~ | ~ |

| Vestel Defense | 2003 | Manisa | ~ | ~ | ~ | ~ | ~ |

Turkey Small Unmanned Aerial Systems Market Analysis

Growth Drivers

Defense Modernization and Indigenous Capability Development:

Defense modernization and indigenous capability development are central to the expansion of the Turkey small unmanned aerial systems market as national policy prioritizes self-reliance and reduced external dependency. Sustained investment in domestic R&D programs enables continuous upgrades in airframes, propulsion, sensors, and autonomy. Indigenous production shortens procurement timelines and improves lifecycle support. Combat deployment experience accelerates iterative improvements and operational trust. Government-backed funding mechanisms stabilize demand cycles. Export success further reinforces scale efficiencies and technology reinvestment. Close coordination between armed forces and manufacturers ensures alignment with evolving mission needs. This ecosystem-driven approach sustains long-term growth momentum.

Operational Demand for Persistent ISR Capabilities:

Operational demand for persistent intelligence, surveillance, and reconnaissance capabilities significantly drives adoption across Turkey’s security architecture. Small unmanned aerial systems provide continuous situational awareness at lower cost compared to manned assets. Their ability to operate in contested and remote environments enhances mission effectiveness. Integration with command networks enables real-time decision support. High operational tempo necessitates fleet expansion and redundancy. Advances in endurance and payload miniaturization increase mission flexibility. These factors collectively sustain strong procurement demand across multiple agencies.

Market Challenges

Electronic Warfare and Counter-UAS Threat Exposure:

Electronic warfare and counter-UAS threats present a significant challenge as adversaries invest in jamming, spoofing, and kinetic interception capabilities. Small unmanned aerial systems are inherently vulnerable due to size and power constraints. Continuous upgrades to secure datalinks and navigation are required. These enhancements increase development costs and complexity. Operational survivability demands redundancy and hardened systems. Rapid threat evolution shortens technology lifecycles. Balancing affordability with resilience remains difficult. This challenge pressures margins and deployment strategies.

Regulatory and Airspace Integration Constraints:

Regulatory and airspace integration constraints limit broader operational flexibility, particularly for non-military users. Airspace deconfliction requires coordination with civil aviation authorities. Compliance with safety and certification standards increases administrative burden. Restrictions on beyond-visual-line-of-sight operations reduce efficiency. Harmonization across agencies remains complex. These factors slow adoption outside core defense missions. Policy adaptation is ongoing but gradual. Regulatory friction continues to constrain expansion.

Opportunities

Expansion into Export-Oriented Defense Markets:

Expansion into export-oriented defense markets represents a major opportunity as Turkey leverages combat-proven systems and competitive pricing. Demand from allied and emerging economies is increasing. Government-to-government agreements facilitate market access. Localization and offset arrangements enhance competitiveness. Export revenues support domestic R&D reinvestment. Platform customization strengthens customer relationships. This opportunity diversifies revenue streams and stabilizes production volumes. Long-term export pipelines enhance industry resilience.

Development of Swarm-Enabled and Autonomous Operations:

Development of swarm-enabled and autonomous operations offers significant growth potential by enhancing mission effectiveness. Advances in artificial intelligence enable coordinated multi-UAV missions. Swarm concepts reduce reliance on individual platform survivability. Autonomy lowers operator workload and training requirements. These capabilities align with future battlefield concepts. Early investment positions Turkey competitively. Integration with existing platforms accelerates adoption. This opportunity drives next-generation system demand.

Future Outlook

Over the next five years, the Turkey small unmanned aerial systems market is expected to experience steady expansion driven by defense modernization, export growth, and technological advancement. Increased autonomy, improved survivability, and regulatory adaptation will shape adoption. Government support for indigenous production will remain strong. Demand from security agencies will diversify applications. Overall market fundamentals indicate sustained momentum.

Major Players

- Baykar Technologies

- Turkish Aerospace Industries

- Aselsan

- Havelsan

- Vestel Defense

- Roketsan

- STM Defense Technologies

- Kale Group Defense

- Meteksan Defense

- Armelsan

- Onur Engineering

- Bites Defense

- Titra Technology

- MKE

- Zyrone Dynamics

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Homeland security organizations

- Intelligence agencies

- Law enforcement authorities

- Border security forces

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including platform types, end users, procurement volumes, and technology trends were identified through structured data mapping and industry review.

Step 2: Market Analysis and Construction

Primary and secondary data were synthesized to construct market structure, validate segmentation, and align demand drivers with procurement patterns.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and defense sector stakeholders were consulted to validate assumptions, reconcile data points, and refine market interpretation.

Step 4: Research Synthesis and Final Output

All findings were consolidated into a coherent analytical framework, ensuring internal consistency, relevance, and clarity of insights.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense modernization and indigenous capability development

Operational demand for persistent intelligence surveillance and reconnaissance

Export growth of combat-proven unmanned systems

Integration of artificial intelligence and autonomy

Expansion of border and maritime security operations - Market Challenges

Electronic warfare and counter-unmanned system threats

Regulatory and airspace integration constraints

High research and development cost intensity

Supply chain dependencies for critical components

Export licensing and geopolitical restrictions - Market Opportunities

Expansion into allied and emerging defense markets

Development of swarm-enabled unmanned operations

Dual-use applications for civil and security missions - Trends

Increased autonomy and artificial intelligence integration

Miniaturization of sensors and payloads

Network-centric unmanned system operations

Growing use of hybrid VTOL platforms

Lifecycle upgrades through software-driven capabilities - Government Regulations & Defense Policy

Strengthening indigenous defense production policies

Export promotion through government-to-government agreements

Enhanced cybersecurity and data sovereignty regulations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed-wing small unmanned aerial systems

Rotary-wing small unmanned aerial systems

Hybrid VTOL small unmanned aerial systems

Nano and micro unmanned aerial systems

Tactical hand-launched unmanned aerial systems - By Platform Type (In Value%)

Land-based unmanned aerial systems

Naval ship-launched unmanned aerial systems

Vehicle-mounted unmanned aerial systems

Man-portable unmanned aerial systems

Forward operating base deployed unmanned aerial systems - By Fitment Type (In Value%)

Line-fit military integration

Retrofit upgrades on legacy platforms

Modular payload fitment

Mission-specific temporary fitment

Training and simulation fitment - By EndUser Segment (In Value%)

Armed forces

Homeland security agencies

Intelligence and surveillance units

Law enforcement organizations

Civil government authorities - By Procurement Channel (In Value%)

Direct government contracts

Inter-government defense agreements

Domestic defense manufacturers

Defense system integrators

Export and offset-based procurement - By Material / Technology (in Value %)

Composite airframes

Advanced propulsion systems

Electro-optical and infrared payloads

Autonomous navigation software

Secure data link and communication systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Platform endurance, Payload capacity, Autonomy level, Communication security, Export reach, Indigenous content ratio, Cost competitiveness, Integration flexibility, Operational maturity)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Baykar Technologies

Turkish Aerospace Industries

Aselsan

Roketsan

Havelsan

Vestel Defense

Bites Defense

STM Defense Technologies

Kale Group Defense

MKE

Titra Technology

Zyrone Dynamics

Onur Engineering

Armelsan

Meteksan Defense

- Defense forces driving continuous fleet expansion

- Homeland security adoption for border surveillance

- Intelligence agencies prioritizing covert reconnaissance capabilities

- Law enforcement usage for tactical and monitoring missions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035