Market Overview

The Turkey target unmanned aerial vehicles market current size stands at around USD ~ million and reflects stable procurement activity. Demand levels during recent periods have been supported by consistent military training schedules and testing programs. Domestic manufacturing capacity has expanded steadily, supporting higher utilization of locally produced systems. Procurement cycles remained active due to modernization requirements within defense training infrastructure. Integration of target UAVs into air defense exercises has reinforced recurring demand. Development programs have focused on improving maneuverability, endurance, and radar simulation accuracy. Operational deployment volumes remained stable due to controlled fleet replacement cycles. System upgrades continued to influence replacement demand across training bases.

The market is primarily concentrated around Ankara, Istanbul, and coastal defense regions where military infrastructure is established. These areas benefit from proximity to defense manufacturers, testing zones, and operational command centers. Demand concentration is supported by air force bases and naval training commands. Industrial clusters facilitate integration, maintenance, and system upgrades. Regulatory support and defense procurement frameworks further strengthen regional dominance. Local supply ecosystems and testing corridors enable faster deployment and operational readiness.

Market Segmentation

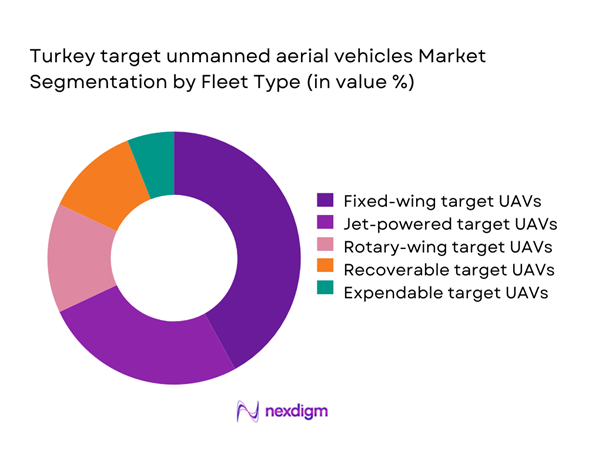

By Fleet Type

The fleet type segmentation is primarily driven by operational training requirements and mission simulation complexity. Fixed-wing target UAVs dominate usage due to extended endurance and realistic aerial threat simulation. Jet-powered variants are increasingly adopted for advanced missile testing scenarios. Rotary-wing targets are used selectively for close-range and low-altitude training missions. Recoverable platforms remain preferred due to cost efficiency and reusability. Expendable systems continue to support high-intensity exercises. Fleet selection is influenced by training doctrine, mission realism requirements, and maintenance infrastructure availability.

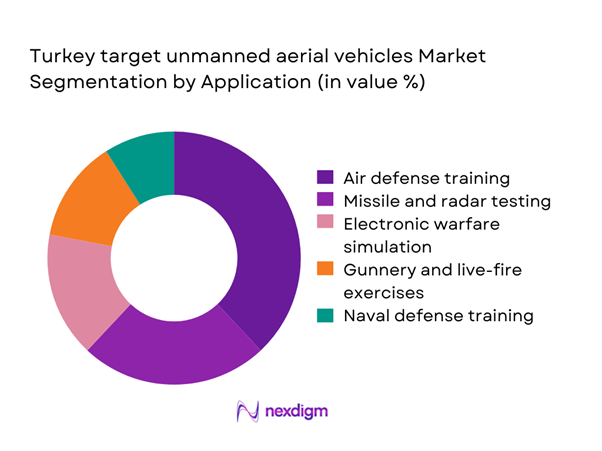

By Application

Application-based segmentation is driven by evolving defense training requirements and testing complexity. Air defense training represents the largest usage segment due to continuous readiness requirements. Missile and radar testing applications show steady growth with modernization of tracking systems. Electronic warfare simulation is expanding with increased focus on countermeasure validation. Gunnery and live-fire training remains consistent across defense units. Naval defense training applications are growing with expanded maritime security programs. Application diversity supports sustained procurement cycles across multiple defense branches.

Competitive Landscape

The competitive landscape is characterized by a mix of domestic defense manufacturers and established international suppliers. Local companies benefit from defense procurement preferences and strong integration with national programs. International firms participate through technology partnerships and specialized platforms. Competition is driven by platform reliability, mission customization capability, and compliance with defense standards. Long-term service support and system upgrade potential strongly influence supplier positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Baykar Technologies | 1984 | Türkiye | ~ | ~ | ~ | ~ | ~ | ~ |

| Turkish Aerospace Industries | 1973 | Türkiye | ~ | ~ | ~ | ~ | ~ | ~ |

| Roketsan | 1988 | Türkiye | ~ | ~ | ~ | ~ | ~ | ~ |

| ASELSAN | 1975 | Türkiye | ~ | ~ | ~ | ~ | ~ | ~ |

| STM | 1991 | Türkiye | ~ | ~ | ~ | ~ | ~ | ~ |

Turkey target unmanned aerial vehicles Market Analysis

Growth Drivers

Rising investment in air defense readiness

Increasing focus on national defense readiness continues to strengthen procurement of advanced training platforms. Defense planners emphasize realistic aerial threat simulation to improve response accuracy and combat preparedness. Modernization programs have increased emphasis on indigenous system development. Local production capabilities have expanded steadily across recent periods. Training intensity has grown in response to evolving regional security dynamics. Advanced threat simulation has become essential for modern air defense systems. Integration with missile testing frameworks supports consistent demand growth. Continuous upgrades in radar and tracking systems require compatible aerial targets. Defense exercises increasingly rely on autonomous target platforms. These factors collectively sustain procurement momentum across military branches.

Expansion of indigenous UAV development programs

Domestic UAV programs have accelerated development of specialized target platforms for training applications. Government-backed initiatives support technology localization and system self-reliance. Local manufacturers have increased R&D investment in propulsion and guidance technologies. Indigenous platforms reduce dependency on imported systems and enhance operational flexibility. Production scalability has improved through modular manufacturing approaches. Technology transfer initiatives have strengthened domestic engineering capabilities. Collaboration between defense agencies and manufacturers supports rapid prototyping. Indigenous programs also support export readiness for allied markets. Testing infrastructure expansion further reinforces domestic platform adoption. These developments continue to strengthen long-term market stability.

Challenges

High development and testing costs

Development of advanced target UAVs requires significant engineering resources and extended testing cycles. System validation involves multiple flight trials and safety certifications. High-performance propulsion systems increase development complexity. Integration of advanced avionics further elevates design costs. Testing infrastructure requires specialized facilities and skilled personnel. Budget constraints limit rapid fleet expansion. Cost sensitivity affects procurement volumes across training units. Maintenance expenses add long-term financial pressure. Balancing performance with affordability remains challenging. These factors collectively restrain accelerated market expansion.

Regulatory constraints on airspace usage

Airspace management regulations limit flight testing frequency and operational flexibility. Coordination with civil aviation authorities is mandatory for testing activities. Restricted airspace availability delays development schedules. Compliance procedures increase administrative overhead for manufacturers. Night and high-altitude operations face additional restrictions. Regulatory approvals require extensive documentation and safety validation. These constraints affect both development and operational deployment timelines. Limited testing windows impact iteration speed. Regulatory alignment across agencies remains complex. These challenges slow technology deployment cycles.

Opportunities

Integration of AI-based maneuvering systems

Advancements in artificial intelligence enable realistic threat emulation and autonomous maneuvering. AI integration improves training realism and mission variability. Adaptive flight behavior enhances simulation accuracy for air defense exercises. Domestic AI development capabilities continue to strengthen. Integration reduces operator workload during training missions. Intelligent systems allow dynamic response to tracking systems. Increased automation improves cost efficiency over time. Defense agencies increasingly prioritize AI-enabled platforms. AI integration supports export competitiveness in advanced markets. These developments create strong growth potential.

Rising demand for supersonic target drones

Modern missile systems require high-speed targets for accurate performance evaluation. Supersonic platforms provide realistic engagement scenarios for advanced defenses. Development efforts are expanding to meet evolving test requirements. Indigenous engineering capabilities are advancing in high-speed aerodynamics. Demand is supported by missile modernization initiatives. Supersonic targets enhance training effectiveness for interceptor systems. Operational readiness improves through realistic testing conditions. Export interest also supports development investments. These factors create strong long-term opportunity potential.

Future Outlook

The market is expected to maintain steady growth through the forecast period supported by defense modernization initiatives. Continued emphasis on indigenous production will strengthen supply resilience. Integration of advanced autonomy and simulation technologies will enhance training effectiveness. Export potential is expected to improve as platforms mature. Regulatory alignment and infrastructure development will further support sustained market expansion.

Major Players

- Baykar Technologies

- Turkish Aerospace Industries

- Roketsan

- ASELSAN

- STM

- Kale Aerospace

- QinetiQ

- Kratos Defense & Security Solutions

- BAE Systems

- Elbit Systems

- Israel Aerospace Industries

- Leonardo

- Airbus Defence and Space

- Northrop Grumman

- Aerotargets

Key Target Audience

- Turkish Ministry of National Defense

- Turkish Air Force Command

- Turkish Naval Forces Command

- Defense procurement and acquisition agencies

- Domestic defense manufacturing firms

- System integrators and testing facilities

- Export-oriented defense contractors

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through platform type, application areas, and deployment environments. Key performance and adoption indicators were identified. Data points were aligned with defense procurement and training structures.

Step 2: Market Analysis and Construction

Market structure was analyzed using production capacity, deployment patterns, and operational demand. Segmentation logic was developed based on platform usage and mission profiles.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through industry discussions and defense sector insights. Operational trends were cross-verified with procurement behavior and technology adoption patterns.

Step 4: Research Synthesis and Final Output

Findings were consolidated through qualitative assessment and data triangulation. Final insights were structured to reflect realistic market behavior and future outlook.

- Executive Summary

- Research Methodology (Market Definitions and operational scope for target UAVs in defense training, segmentation framework by platform and mission role, bottom-up market sizing using procurement and contract data, revenue attribution across domestic production and imports, primary validation through defense OEMs and military stakeholders, data triangulation using defense budgets and flight activity logs, assumptions based on Turkish defense modernization programs)

- Definition and Scope

- Market evolution

- Usage and training integration across armed forces

- Ecosystem structure

- Supply chain and procurement framework

- Regulatory and defense compliance environment

- Growth Drivers

Rising investment in air defense readiness

Expansion of indigenous UAV development programs

Increasing frequency of military training exercises

Modernization of missile and radar testing infrastructure

Growing export focus of Turkish defense OEMs - Challenges

High development and testing costs

Regulatory constraints on airspace usage

Dependence on advanced propulsion and avionics

Limited interoperability standards

Export control and certification barriers - Opportunities

Integration of AI-based maneuvering systems

Rising demand for supersonic target drones

Collaboration with NATO training programs

Growth in naval air defense testing

Export potential to Middle East and Asia - Trends

Shift toward reusable and recoverable targets

Increased use of autonomous flight profiles

Integration with live-virtual-constructive training

Adoption of modular payload architectures

Rising domestic content ratio - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-wing target drones

Jet-powered target drones

Rotary-wing target UAVs

Recoverable target drones

Expendable target drones - By Application (in Value %)

Air defense training

Missile and radar testing

Electronic warfare simulation

Gunnery and live-fire exercises

Naval defense training - By Technology Architecture (in Value %)

Autonomous flight systems

Remote-controlled systems

GPS-guided platforms

AI-enabled maneuvering systems - By End-Use Industry (in Value %)

Air force

Navy

Army

Defense research agencies

Private defense contractors - By Connectivity Type (in Value %)

Line-of-sight communication

Beyond visual line-of-sight communication

Satellite-enabled control links - By Region (in Value %)

Marmara Region

Central Anatolia

Aegean Region

Mediterranean Region

Eastern Anatolia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product range, technological capability, defense certifications, production scale, export footprint, pricing strategy, customization capability, after-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Baykar Technologies

Turkish Aerospace Industries (TUSAŞ)

Roketsan

ASELSAN

STM Savunma Teknolojileri

Kale Aerospace

QinetiQ

Kratos Defense & Security Solutions

BAE Systems

Elbit Systems

Israel Aerospace Industries

Leonardo S.p.A.

Airbus Defence and Space

Northrop Grumman

Aerotargets

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035