Market Overview

The Turkey unmanned combat aerial vehicle market current size stands at around USD ~ million with sustained procurement momentum observed during 2024 and 2025. Platform deliveries increased steadily, supported by domestic production programs, rising operational deployments, and expanding export contracts. Fleet expansion accelerated due to growing demand for intelligence, surveillance, reconnaissance, and precision strike capabilities. Investments focused on endurance improvement, payload integration, and autonomous flight control. Government-backed procurement pipelines continued supporting production stability. Localized manufacturing strengthened supply chain resilience and reduced reliance on imported subsystems.

The market is primarily concentrated across Ankara, Istanbul, and key aerospace clusters supporting defense manufacturing and testing infrastructure. Operational demand is highest in southeastern regions due to active border surveillance requirements. Strong ecosystem maturity exists through vertically integrated manufacturers and subsystem suppliers. Defense policy alignment and long-term procurement frameworks encourage sustained production activity. Export-oriented manufacturing hubs benefit from logistical connectivity and defense trade agreements. Regulatory support and indigenous development mandates further reinforce domestic capability expansion.

Market Segmentation

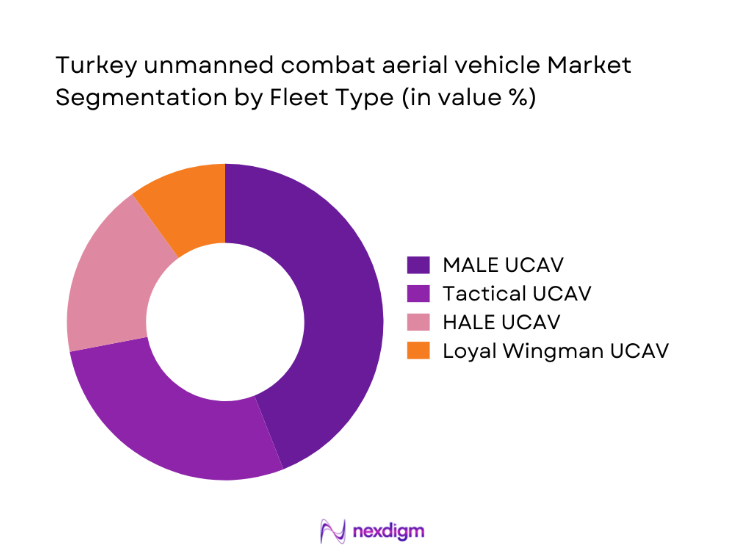

By Fleet Type

Medium altitude long endurance platforms dominate procurement due to balanced endurance, payload capacity, and operational flexibility. Tactical UCAVs follow with strong adoption for border security and counterterrorism missions. High altitude systems remain limited but strategically important for long-range surveillance. Loyal wingman platforms are emerging as experimental assets. Demand concentration remains highest for platforms supporting multi-role combat operations. Fleet modernization programs prioritize endurance, weapon compatibility, and autonomous navigation features.

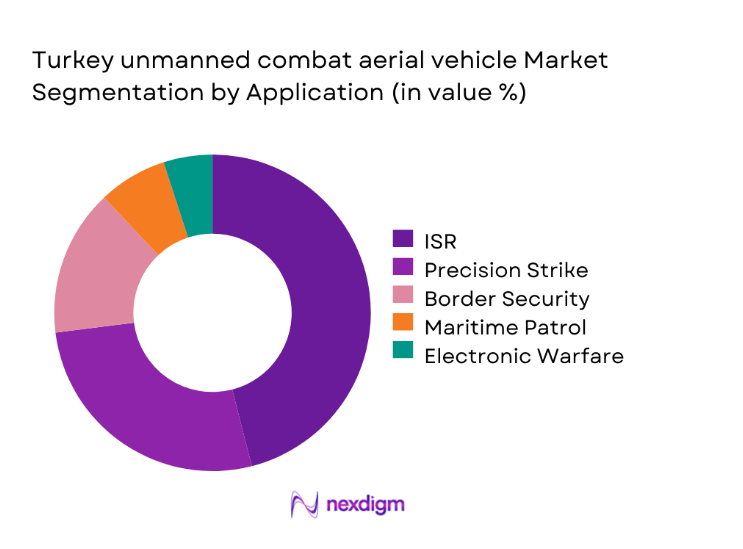

By Application

Intelligence, surveillance, and reconnaissance applications dominate operational usage due to persistent monitoring requirements. Precision strike missions represent the second-largest application segment driven by asymmetric warfare needs. Border security applications maintain steady demand across southeastern regions. Maritime surveillance adoption remains moderate but growing. Electronic warfare usage is increasing with sensor and payload advancements. Multi-mission adaptability drives procurement preference across defense forces.

Competitive Landscape

The competitive landscape is characterized by strong domestic manufacturers supported by state-led defense programs and export-oriented strategies. High entry barriers exist due to certification, technological complexity, and long development cycles. Competitive differentiation is driven by payload integration, autonomy levels, and combat-proven performance. Collaboration with subsystem suppliers and defense agencies strengthens market positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Baykar | 1984 | Istanbul | ~ | ~ | ~ | ~ | ~ | ~ |

| Turkish Aerospace Industries | 1973 | Ankara | ~ | ~ | ~ | ~ | ~ | ~ |

| ASELSAN | 1975 | Ankara | ~ | ~ | ~ | ~ | ~ | ~ |

| ROKETSAN | 1988 | Ankara | ~ | ~ | ~ | ~ | ~ | ~ |

| HAVELSAN | 1982 | Ankara | ~ | ~ | ~ | ~ | ~ | ~ |

Turkey unmanned combat aerial vehicle Market Analysis

Growth Drivers

Rising defense modernization and indigenous capability push

Turkey continues prioritizing domestic defense modernization to reduce reliance on foreign suppliers and technologies. Indigenous platform development has increased steadily through structured procurement and long-term defense planning. Government incentives support research, testing, and localized manufacturing infrastructure. Increased defense budgets allocate resources toward unmanned systems modernization. Domestic suppliers benefit from guaranteed procurement cycles and operational validation. Integration of locally produced subsystems strengthens technological independence. Enhanced testing facilities accelerate certification and deployment timelines. Political emphasis on strategic autonomy reinforces sustained UCAV investments. Operational feedback loops improve system reliability and mission performance. Long-term modernization frameworks ensure continuous demand visibility.

Increasing cross-border surveillance and strike requirements

Heightened regional security concerns have increased demand for persistent surveillance capabilities across border regions. UCAVs provide cost-effective solutions for continuous monitoring and rapid response missions. Cross-border operations require extended endurance and precision strike capabilities. Operational success has strengthened confidence in unmanned combat platforms. Intelligence-driven missions increasingly rely on real-time aerial data collection. Border security mandates support sustained fleet utilization. Integration with command systems enhances mission coordination efficiency. Persistent threat environments drive continuous operational deployment. Surveillance requirements encourage rapid technological upgrades. Operational success reinforces continued procurement momentum.

Challenges

Dependence on foreign subsystems and engines

Critical components such as engines and avionics remain partially dependent on external suppliers. Supply disruptions can impact production timelines and delivery schedules. Export restrictions occasionally affect subsystem availability and integration plans. Indigenous development cycles require extended validation and testing periods. Technology transfer limitations constrain rapid localization efforts. Certification delays affect deployment readiness and operational planning. Dependence increases vulnerability to geopolitical uncertainties. Replacement development requires significant investment and technical expertise. Supply chain diversification remains an ongoing challenge. Long-term self-sufficiency goals require sustained policy support.

Export restrictions and geopolitical constraints

International regulations influence export approvals and destination eligibility for UCAV platforms. Diplomatic relations affect defense trade agreements and delivery timelines. Sanctions risks create uncertainty for international contracts. Compliance with international arms regulations increases administrative complexity. Political developments influence buyer confidence and procurement decisions. Export limitations may restrict revenue diversification opportunities. Technology transfer constraints limit collaborative development prospects. Geopolitical shifts impact long-term market access strategies. Export dependency exposes manufacturers to policy volatility. Strategic alignment becomes critical for sustained export growth.

Opportunities

Expansion of UCAV exports to allied nations

Growing global demand for cost-effective UCAV solutions creates export opportunities. Allied nations seek proven platforms with operational track records. Competitive pricing enhances international attractiveness of domestic systems. Defense cooperation agreements support cross-border procurement initiatives. Export diversification reduces reliance on domestic demand cycles. Customizable configurations meet varied operational requirements. Training and maintenance services expand revenue streams. Political alignment facilitates smoother contract negotiations. Export success strengthens brand recognition globally. Long-term partnerships enhance market sustainability.

Integration of AI-driven mission autonomy

Advancements in artificial intelligence enhance mission planning and execution efficiency. Autonomous navigation reduces operator workload and improves response times. AI-enabled targeting improves mission accuracy and survivability. Data fusion capabilities strengthen situational awareness. Autonomous swarm operations represent future combat doctrines. AI integration enhances predictive maintenance efficiency. Adaptive learning systems improve mission outcomes over time. Development investments attract advanced defense collaborations. Automation reduces operational cost pressures. AI adoption strengthens technological leadership positioning.

Future Outlook

The Turkey unmanned combat aerial vehicle market is expected to maintain strong momentum through sustained defense investments and export growth. Continued emphasis on indigenous development will enhance technological maturity. Expansion of autonomous capabilities and international partnerships will shape future competitiveness. Regulatory support and evolving security dynamics will further influence market direction.

Major Players

- Baykar

- Turkish Aerospace Industries

- ASELSAN

- ROKETSAN

- HAVELSAN

- TEI

- Kale Group

- Meteksan Defense

- SDT Space and Defence

- STM

- BMC

- FNSS

- Alp Aviation

- TUSAŞ Engine Industries

- MKE

Key Target Audience

- Ministry of National Defense Turkey

- Turkish Armed Forces procurement units

- Defense export authorities

- Border security and surveillance agencies

- Aerospace and defense manufacturers

- Systems integrators and subsystem suppliers

- Investments and venture capital firms

- Presidency of Defence Industries

Research Methodology

Step 1: Identification of Key Variables

Market scope, platform classifications, application areas, and operational parameters were identified using defense procurement frameworks and deployment trends.

Step 2: Market Analysis and Construction

Data was structured through platform mapping, capability assessment, and deployment analysis across operational segments and regions.

Step 3: Hypothesis Validation and Expert Consultation

Inputs were validated through consultations with defense experts, industry professionals, and operational analysts with domain experience.

Step 4: Research Synthesis and Final Output

Findings were consolidated using triangulation techniques to ensure consistency, accuracy, and relevance across all analytical dimensions.

- Executive Summary

- Research Methodology (Market Definitions and UCAV platform scope alignment, Mission and payload-based segmentation framework, Bottom-up fleet and procurement-based market sizing, Revenue attribution by platform, payload and support contracts, Primary validation with defense OEMs and procurement officials, Triangulation using MoD budgets and export disclosures, Assumptions based on operational deployment and doctrine evolution)

- Definition and Scope

- Market evolution

- Operational and mission usage framework

- Ecosystem structure

- Supply chain and domestic production landscape

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization and indigenous capability push

Increasing cross-border surveillance and strike requirements

Government focus on self-reliant defense manufacturing

Growing export demand for cost-effective UCAVs

Advancements in autonomous flight and sensor fusion

Operational success in recent conflicts - Challenges

Dependence on foreign subsystems and engines

Export restrictions and geopolitical constraints

High R&D and testing costs

Airspace integration and safety concerns

Cybersecurity and electronic warfare threats - Opportunities

Expansion of UCAV exports to allied nations

Integration of AI-driven mission autonomy

Development of stealth and swarm-capable platforms

Public–private partnerships in defense manufacturing

Lifecycle support and MRO service expansion - Trends

Shift toward indigenous avionics and propulsion

Increasing use of UCAVs in asymmetric warfare

Integration of smart munitions and loitering weapons

Growth of swarm and collaborative combat systems

Rising investment in ISR payload miniaturization - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Medium Altitude Long Endurance UCAV

High Altitude Long Endurance UCAV

Tactical UCAV

Loyal Wingman UCAV - By Application (in Value %)

Intelligence Surveillance and Reconnaissance

Strike and Precision Attack

Border Security and Counterterrorism

Maritime Patrol and Anti-Submarine Warfare

Electronic Warfare and Signals Intelligence - By Technology Architecture (in Value %)

Line-of-Sight Controlled UCAV

Beyond Line-of-Sight UCAV

Satellite Communication Enabled UCAV

AI-Enabled Autonomous UCAV - By End-Use Industry (in Value %)

Defense Forces

Homeland Security

Paramilitary and Border Forces

Defense Export Customers - By Connectivity Type (in Value %)

SATCOM

LOS Data Link

Hybrid Communication Systems - By Region (in Value %)

Marmara Region

Ankara and Central Anatolia

Aegean Region

Southeastern Anatolia

Export Markets

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product portfolio, Combat range and endurance, Payload capacity, Autonomy level, Export footprint, Pricing strategy, Manufacturing capability, After-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Baykar Technologies

Turkish Aerospace Industries (TAI)

ASELSAN

ROKETSAN

HAVELSAN

TEI – TUSAŞ Engine Industries

General Atomics Aeronautical Systems

Israel Aerospace Industries

Elbit Systems

AVIC

Chengdu Aircraft Industry Group

Leonardo

Northrop Grumman

Saab

Thales

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035