Market Overview

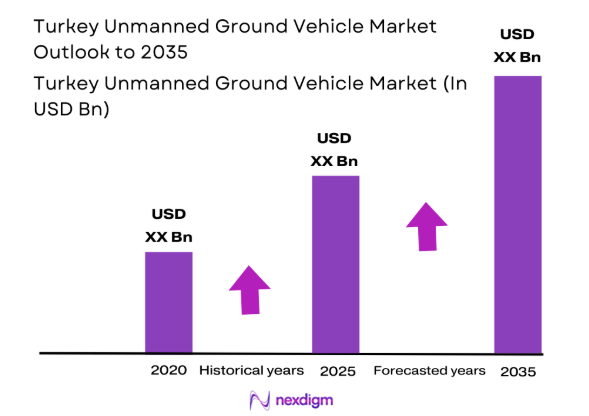

The Turkey Unmanned Ground Vehicle market current size stands at around USD ~ million, reflecting sustained defense procurement momentum and indigenous platform development activity. Deployment volumes expanded across multiple defense formations, with ~ units operational during the assessment period. Increased testing cycles, field trials, and operational readiness programs supported higher system utilization rates. Domestic manufacturing capacity expanded through modular production lines and localized component sourcing. Integration of autonomy software accelerated platform maturity. Procurement cycles remained aligned with multi-year defense modernization planning.

The market is concentrated across Ankara, Istanbul, and Konya due to defense industrial clustering and testing infrastructure availability. These regions benefit from mature supplier ecosystems, defense research centers, and command-level operational units. Strong logistics connectivity supports rapid deployment and maintenance cycles. Government-backed innovation programs enhance ecosystem maturity. Border security priorities and terrain diversity drive regional demand variations. Regulatory frameworks emphasize domestic sourcing and technology sovereignty.

Market Segmentation

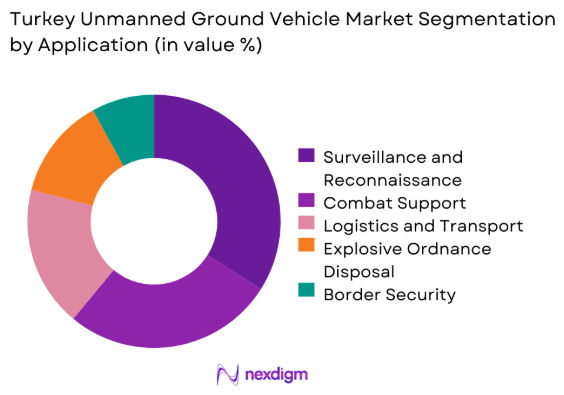

By Application

Combat and reconnaissance applications dominate demand due to persistent border security needs and asymmetric operational environments. Surveillance missions account for substantial deployment volumes because of continuous monitoring requirements across sensitive regions. Logistics and support roles are expanding as autonomy reliability improves. Explosive ordnance disposal platforms remain critical for urban and conflict-zone operations. Homeland security adoption is increasing through centralized procurement. Mission-specific customization drives segmentation depth across applications.

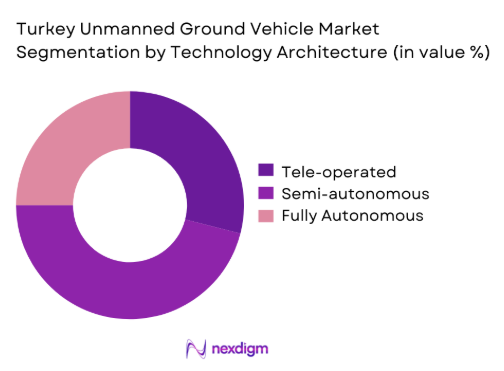

By Technology Architecture

Semi-autonomous systems dominate due to balanced operational control and regulatory acceptance. Tele-operated platforms remain relevant for high-risk missions requiring human oversight. Fully autonomous systems are expanding gradually as validation frameworks mature. Integration of artificial intelligence enhances navigation and target recognition capabilities. Hybrid architectures enable flexibility across mission profiles. Interoperability with existing command systems drives architecture selection decisions.

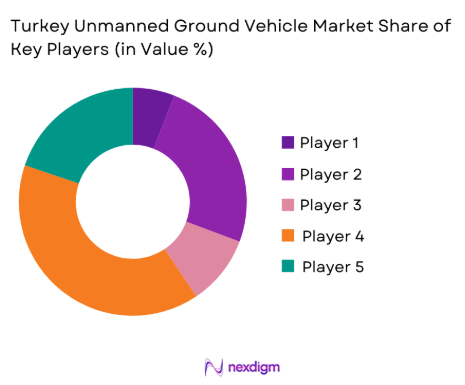

Competitive Landscape

The competitive environment is characterized by strong domestic manufacturing capabilities and vertically integrated system development. Companies focus on modularity, indigenous component sourcing, and defense compliance. Collaboration with defense agencies strengthens validation cycles. Competitive positioning emphasizes reliability, mission adaptability, and long-term service support.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ASELSAN | 1975 | Ankara | ~ | ~ | ~ | ~ | ~ | ~ |

| FNSS | 1988 | Ankara | ~ | ~ | ~ | ~ | ~ | ~ |

| Otokar | 1963 | Sakarya | ~ | ~ | ~ | ~ | ~ | ~ |

| BMC | 1964 | Izmir | ~ | ~ | ~ | ~ | ~ | ~ |

| HAVELSAN | 1982 | Ankara | ~ | ~ | ~ | ~ | ~ | ~ |

Turkey Unmanned Ground Vehicle Market Analysis

Growth Drivers

Rising defense modernization initiatives

Defense modernization programs continue prioritizing unmanned platforms to enhance operational efficiency across diverse terrain conditions. Strategic investments strengthen domestic production capabilities while reducing dependency on imported systems. Procurement cycles increasingly favor modular unmanned platforms with scalable payload integration. Military modernization roadmaps emphasize digital battlefield integration and autonomous support functions. Continuous platform upgrades enhance survivability and mission adaptability. National defense strategies allocate resources toward unmanned force multiplication concepts. Testing programs validate performance in varied operational scenarios. Local manufacturing incentives accelerate technology adoption cycles. System interoperability remains a central design objective. These initiatives collectively sustain consistent demand growth.

Increasing asymmetric warfare requirements

Operational environments increasingly demand unmanned platforms capable of operating under asymmetric threat conditions. Urban conflict scenarios drive demand for remote reconnaissance and engagement systems. UGVs reduce personnel exposure during high-risk missions. Border security challenges amplify the need for persistent ground surveillance. Tactical flexibility becomes essential for counterinsurgency operations. Autonomous mobility improves response times in complex terrain. Data-driven decision support enhances mission effectiveness. Rapid deployment capabilities remain critical for tactical superiority. System resilience supports extended operational endurance. These factors reinforce sustained platform adoption.

Challenges

High development and integration costs

Advanced sensor integration increases overall system development complexity and resource requirements. Testing and certification cycles demand significant technical validation efforts. Localization of critical subsystems elevates engineering investment burdens. Integration with legacy command systems introduces compatibility challenges. High-performance mobility platforms require extensive durability testing. Budget constraints can delay procurement timelines. Lifecycle support costs remain substantial. Specialized workforce requirements elevate operational expenses. Extended development timelines affect deployment schedules. These constraints collectively impact market scalability.

Limited interoperability standards

Absence of unified interoperability protocols complicates multi-platform coordination during operations. Proprietary communication architectures restrict cross-platform data exchange. Integration with allied systems requires additional adaptation layers. Standardization gaps increase system customization requirements. Interoperability testing extends validation timelines. Cross-agency coordination faces technical barriers. Limited common frameworks reduce deployment flexibility. Software harmonization remains resource intensive. Operational efficiency suffers without unified command interfaces. Addressing interoperability remains a structural challenge.

Opportunities

Export potential to allied and emerging markets

Growing demand for unmanned ground systems across allied nations creates export expansion opportunities. Competitive pricing enhances attractiveness in emerging defense markets. Modular designs allow customization for diverse operational requirements. Strategic partnerships facilitate international market entry. Defense cooperation agreements support technology transfer frameworks. Export approvals strengthen global market presence. Field-proven platforms increase buyer confidence. Regional security dynamics stimulate procurement interest. Long-term service contracts enhance revenue stability. Export growth supports domestic industry scaling.

Integration with unmanned aerial systems

Cross-domain integration enhances situational awareness and mission coordination capabilities. Combined air-ground operations improve reconnaissance effectiveness. Data fusion strengthens real-time decision-making processes. Autonomous coordination reduces operator workload. Interoperable command systems enable synchronized mission execution. Network-centric warfare doctrines support integrated deployments. Joint testing programs validate system compatibility. Operational efficiency improves through coordinated asset utilization. Enhanced mission success rates drive adoption. Integration potential expands operational value propositions.

Future Outlook

The Turkey unmanned ground vehicle market is expected to maintain steady expansion through advancing autonomy, indigenous innovation, and sustained defense modernization programs. Increased focus on multi-domain operations will drive system integration. Policy support and export diversification are likely to strengthen long-term market resilience and technological depth.

Major Players

- ASELSAN

- FNSS

- Otokar

- BMC

- HAVELSAN

- Baykar

- Roketsan

- STM

- Nurol Makina

- Katmerciler

- Meteksan Defense

- Sarsılmaz

- Albayrak Defense

- Ermaksan

- Titra Technology

Key Target Audience

- Turkish Ministry of National Defense

- Turkish Armed Forces Command Units

- Presidency of Defence Industries

- Border Security and Gendarmerie Commands

- Homeland Security Agencies

- Defense System Integrators

- Investments and venture capital firms

- Government procurement and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The study identifies platform types, deployment environments, operational roles, and technology maturity indicators. Defense procurement structures and capability roadmaps are mapped. Market boundaries are defined through application relevance. Key influencing parameters are established for analysis.

Step 2: Market Analysis and Construction

Data is structured through demand-side assessment and supply-side mapping. Platform deployment trends are evaluated across operational segments. Technology penetration levels are analyzed. Regional adoption dynamics are incorporated.

Step 3: Hypothesis Validation and Expert Consultation

Insights are validated through domain expert interactions and operational feedback loops. Assumptions are refined using deployment patterns. Cross-validation ensures consistency across datasets. Market logic is aligned with defense planning cycles.

Step 4: Research Synthesis and Final Output

Findings are consolidated into structured insights. Analytical consistency is maintained across sections. Market dynamics are interpreted through strategic frameworks. Final outputs reflect realistic industry positioning.

- Executive Summary

- Research Methodology (Market Definitions and Scope Alignment, Platform and Mission-Type Taxonomy Mapping, Bottom-Up Fleet and Procurement-Based Market Estimation, Revenue Attribution Across Defense and Dual-Use Programs, Primary Validation with Defense Integrators and Program Offices, Data Triangulation Using Contracts and Deployment Records, Assumptions and Limitations Based on Indigenous Development Programs)

- Definition and Scope

- Market evolution

- Usage and operational deployment landscape

- Ecosystem structure

- Supply chain and integration framework

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization initiatives

Increasing asymmetric warfare requirements

Expansion of indigenous defense manufacturing

Growing emphasis on force protection and unmanned missions

Integration of AI and autonomy in ground systems - Challenges

High development and integration costs

Limited interoperability standards

Operational reliability in complex terrains

Cybersecurity and electronic warfare vulnerabilities

Procurement and testing delays - Opportunities

Export potential to allied and emerging markets

Integration with unmanned aerial systems

Adoption in internal security and border patrol

Development of swarm and cooperative UGVs

Advancements in autonomous navigation technologies - Trends

Shift toward modular UGV platforms

Rising demand for multi-mission payloads

Increased use of AI-based perception systems

Growing emphasis on indigenous software stacks

Integration with network-centric warfare doctrines

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Tracked UGVs

Wheeled UGVs

Hybrid mobility platforms - By Application (in Value %)

Surveillance and reconnaissance

Combat and fire support

Logistics and supply transport

Explosive ordnance disposal

Border and perimeter security - By Technology Architecture (in Value %)

Tele-operated systems

Semi-autonomous systems

Fully autonomous systems - By End-Use Industry (in Value %)

Defense forces

Homeland security

Border control agencies

Critical infrastructure protection - By Connectivity Type (in Value %)

Line-of-sight communication

Satellite communication

Hybrid communication systems - By Region (in Value %)

Marmara

Central Anatolia

Aegean

Mediterranean

Eastern and Southeastern Anatolia

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Platform capability, Autonomy level, Payload capacity, Combat readiness, Integration flexibility, Export presence, After-sales support, Pricing strategy)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces

- Detailed Profiles of Major Companies

ASELSAN

FNSS

Otokar

BMC

HAVELSAN

Baykar

Roketsan

Nurol Makina

Katmerciler

Meteksan Defense

STM

Yapı Savunma

Erkunt Defense

Sarsılmaz

Albayrak Defense

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035