Market Overview

The Turkey Unmanned Systems market current size stands at around USD ~ million with strong deployment intensity across defense, security, and industrial surveillance segments. Platform demand increased across aerial, ground, and maritime systems, supported by rising operational missions, domestic manufacturing programs, and export-oriented production. System deliveries and operational deployments expanded steadily, supported by sustained government procurement cycles and modernization priorities. Technological investments focused on autonomy, sensor fusion, and mission endurance. Integration of indigenous subsystems increased platform reliability. Operational usage expanded across border security, intelligence missions, and tactical operations.

The market is geographically concentrated around Ankara, Istanbul, and key industrial zones hosting defense manufacturing clusters. These regions benefit from mature supplier ecosystems, defense infrastructure, and skilled engineering talent pools. Strong coordination between defense agencies, research centers, and manufacturing firms drives sustained innovation. Coastal regions exhibit higher adoption of maritime unmanned platforms due to surveillance needs. Policy support, export facilitation, and domestic production mandates further strengthen regional concentration and ecosystem maturity across Turkey.

Market Segmentation

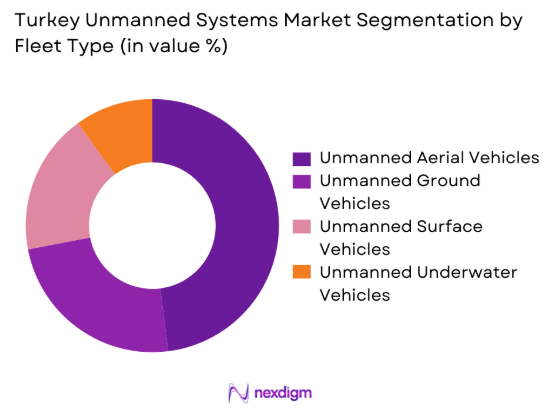

By Fleet Type

The unmanned aerial vehicle segment dominates due to extensive deployment across surveillance, reconnaissance, and tactical missions. Unmanned ground systems are increasingly adopted for logistics, explosive disposal, and reconnaissance applications. Unmanned surface and underwater systems are expanding steadily, driven by maritime security and offshore monitoring needs. Fleet diversification is supported by domestic manufacturing capabilities, operational flexibility, and modular platform architectures. Growing emphasis on multi-domain operations continues to strengthen demand across all fleet types while supporting integration across defense and civil use cases.

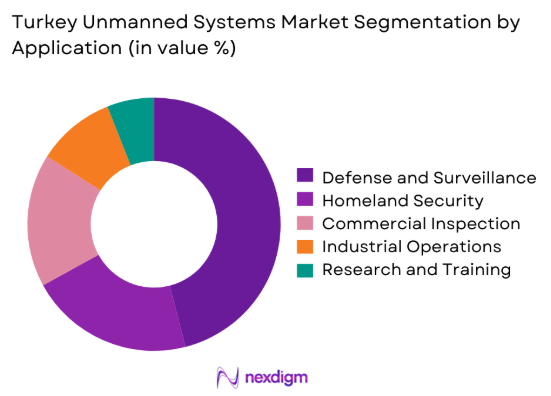

By Application

Defense and intelligence applications dominate market usage due to persistent border security and surveillance requirements. Civil and commercial applications are expanding across infrastructure monitoring, disaster management, and energy inspection. Law enforcement adoption is increasing for situational awareness and tactical operations. Industrial usage continues to grow with automation and monitoring needs. Technological adaptability and mission customization support increasing penetration across diversified operational applications.

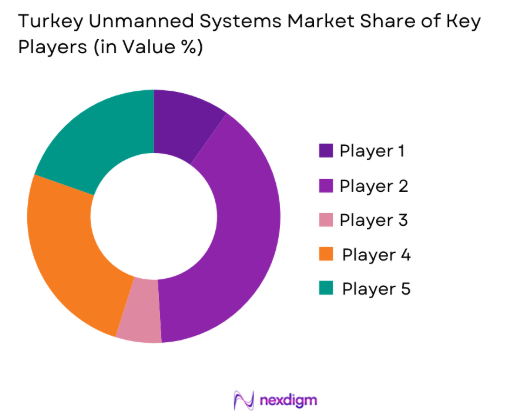

Competitive Landscape

The Turkey unmanned systems market is moderately consolidated with strong domestic manufacturing dominance. Local players maintain competitive advantages through government backing, indigenous technology development, and integrated production capabilities. Competitive differentiation is driven by platform endurance, autonomy levels, payload flexibility, and system reliability. Strategic collaborations and export-oriented programs further enhance market positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Baykar | 1984 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

| Turkish Aerospace Industries | 1973 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

| Aselsan | 1975 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

| Roketsan | 1988 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

| STM | 1991 | Turkey | ~ | ~ | ~ | ~ | ~ | ~ |

Turkey Unmanned Systems Market Analysis

Growth Drivers

Rising defense modernization initiatives

Defense modernization programs accelerated platform procurement across air, land, and naval forces during 2024 and 2025. Strategic defense planning emphasized indigenous unmanned capabilities to reduce foreign dependency and enhance operational autonomy. Increased allocation toward surveillance missions expanded deployment across border and maritime zones. Military doctrine evolution promoted unmanned integration for reconnaissance and tactical operations. Joint force requirements supported multi-platform adoption across services. Continuous technology upgrades sustained platform replacement cycles. Interoperability requirements drove standardized system deployment. Advanced payload integration improved mission efficiency. Government-backed programs accelerated testing and field deployment cycles. Sustained geopolitical considerations continued supporting long-term unmanned systems investments.

Expansion of indigenous UAV development programs

Domestic UAV development accelerated through public-private collaboration frameworks across multiple production facilities. Local manufacturers expanded design capabilities focused on endurance and payload efficiency. Indigenous software development strengthened autonomy and navigation performance. Government incentives encouraged localization of critical subsystems. Export-oriented designs increased production scalability and technological maturity. Research institutions contributed to propulsion and sensor innovation. Testing infrastructure improved validation timelines significantly. Operational feedback loops enhanced platform reliability. Modular architectures supported rapid customization across missions. Continued program funding sustained long-term development momentum.

Challenges

Regulatory constraints on autonomous operations

Regulatory frameworks governing autonomous operations remained conservative during recent evaluation cycles. Airspace management policies limited fully autonomous mission execution. Certification processes extended approval timelines for new systems. Compliance requirements increased testing complexity and documentation burden. Export regulations introduced additional operational constraints. Cross-border operational approvals remained limited. Interoperability standards required continuous updates. Policy harmonization challenges slowed deployment speed. Legal accountability frameworks remained under development. Regulatory uncertainty constrained rapid commercial adoption.

Dependence on critical electronic and propulsion components

Supply chain dependency on specialized electronic components impacted production consistency. Limited domestic availability of advanced semiconductors created sourcing challenges. Propulsion system imports affected manufacturing timelines. Global component shortages influenced delivery schedules. Cost volatility impacted procurement planning stability. Localization efforts required extended qualification timelines. Technology transfer limitations slowed subsystem integration. Quality assurance requirements increased development cycles. Inventory management complexity affected scaling efficiency. Supply diversification remained a strategic necessity.

Opportunities

Expansion into civilian and commercial applications

Civil sector adoption increased across infrastructure inspection and disaster response activities. Municipal agencies explored unmanned platforms for monitoring applications. Energy sector demand supported inspection and surveillance deployments. Agricultural monitoring applications expanded operational scope. Commercial logistics trials demonstrated operational feasibility. Urban planning initiatives integrated aerial data collection. Environmental monitoring applications gained institutional support. Regulatory pilots encouraged controlled civilian usage. Technology miniaturization improved cost efficiency. Market diversification reduced defense dependency.

Growth of swarm and AI-enabled systems

Swarm technology development gained momentum through coordinated research programs. Artificial intelligence integration enhanced autonomous decision-making capabilities. Cooperative mission execution improved operational efficiency. Sensor fusion technologies expanded situational awareness. Testing environments validated multi-unit coordination capabilities. Algorithmic advancements improved obstacle avoidance and navigation. Defense agencies prioritized swarm capability development. Export demand increased for AI-enabled platforms. Software-driven upgrades reduced lifecycle costs. Innovation pipelines strengthened long-term competitiveness.

Future Outlook

The Turkey unmanned systems market is expected to experience sustained expansion through continued defense modernization and technological innovation. Increased emphasis on autonomy, artificial intelligence, and multi-domain integration will shape platform development. Civil and commercial adoption is projected to rise steadily as regulatory clarity improves. Export demand is expected to strengthen as indigenous platforms gain international acceptance. Long-term growth will be supported by domestic manufacturing and strategic defense priorities.

Major Players

- Baykar

- Turkish Aerospace Industries

- Aselsan

- Roketsan

- STM

- FNSS

- Otokar

- BMC

- Vestel Defense

- Meteksan Defense

- Kale Group

- Titra Technology

- Altinay Defense

- Yonca-Onuk

- Havelsan

Key Target Audience

- Ministry of National Defense of Turkey

- Turkish Armed Forces Command Units

- Presidency of Defence Industries

- Border Security and Coast Guard Agencies

- Homeland Security and Law Enforcement Bodies

- Energy and Infrastructure Operators

- Aerospace and Defense OEMs

- Investment and Venture Capital Firms

Research Methodology

Step 1: Identification of Key Variables

Core variables were identified through platform classification, application mapping, and operational deployment analysis. Data inputs were structured to reflect system types, mission roles, and adoption drivers. Market boundaries were defined based on operational deployment scope and regulatory alignment.

Step 2: Market Analysis and Construction

Data was synthesized using bottom-up assessment across fleet types and applications. Deployment trends, procurement cycles, and technology integration levels were evaluated. Market structure was constructed using operational demand patterns and manufacturing capacity analysis.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense planners, system integrators, and industry specialists. Assumptions were refined based on operational feedback and deployment realities. Validation focused on technology adoption and demand sustainability.

Step 4: Research Synthesis and Final Output

Insights were consolidated through triangulation of qualitative and quantitative inputs. Analytical frameworks were applied to ensure consistency and accuracy. Final outputs were structured to support strategic decision-making and market evaluation

- Executive Summary

- Research Methodology (Market Definitions and Operational Scope for Unmanned Systems, Platform and Payload Segmentation Framework, Bottom-Up Fleet and Deployment-Based Market Estimation, Revenue Attribution by Application and End User, Primary Validation through Defense and Industrial Stakeholder Interviews, Data Triangulation Using Procurement and Program Tracking, Assumptions Based on Platform Lifecycle and Mission Profiles)

- Definition and Scope

- Market evolution

- Usage and operational deployment landscape

- Ecosystem structure

- Supply chain and procurement channels

- Regulatory and policy environment

- Growth Drivers

Rising defense modernization initiatives

Expansion of indigenous UAV development programs

Increasing border surveillance and security needs

Growing adoption in intelligence and reconnaissance missions

Export demand for combat-proven unmanned platforms - Challenges

Regulatory constraints on autonomous operations

Dependence on critical electronic and propulsion components

Export restrictions and geopolitical sensitivities

Cybersecurity and data vulnerability risks

High development and integration costs - Opportunities

Expansion into civilian and commercial applications

Growth of swarm and AI-enabled systems

Rising demand for maritime surveillance platforms

Export partnerships with allied nations

Integration with space and satellite systems - Trends

Increased autonomy and AI integration

Shift toward multi-mission platforms

Rising use of swarm technologies

Domestic manufacturing localization

Integration of unmanned systems into joint force operations - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Unmanned Aerial Vehicles

Unmanned Ground Vehicles

Unmanned Surface Vehicles

Unmanned Underwater Vehicles - By Application (in Value %)

Intelligence Surveillance and Reconnaissance

Combat and Strike Operations

Border and Maritime Security

Logistics and Resupply

Civil and Commercial Operations - By Technology Architecture (in Value %)

Remotely Piloted Systems

Semi-Autonomous Systems

Fully Autonomous Systems - By End-Use Industry (in Value %)

Defense Forces

Homeland Security

Law Enforcement

Energy and Infrastructure

Commercial and Industrial Users - By Connectivity Type (in Value %)

Line of Sight

Beyond Line of Sight

Satellite-Based Communication - By Region (in Value %)

Marmara Region

Central Anatolia

Aegean Region

Mediterranean Region

Eastern and Southeastern Anatolia

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product Portfolio Depth, Platform Autonomy Level, Defense Certification Status, Domestic Manufacturing Capability, Export Footprint, R&D Intensity, After-Sales Support, Strategic Partnerships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces Analysis

- Detailed Profiles of Major Companies

Baykar

Turkish Aerospace Industries

Aselsan

Roketsan

Havelsan

STM

FNSS

Otokar

BMC

Vestel Defense

Meteksan Defense

Kale Group

Titra Technology

Altinay Defense

Yonca-Onuk

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035