Market Overview

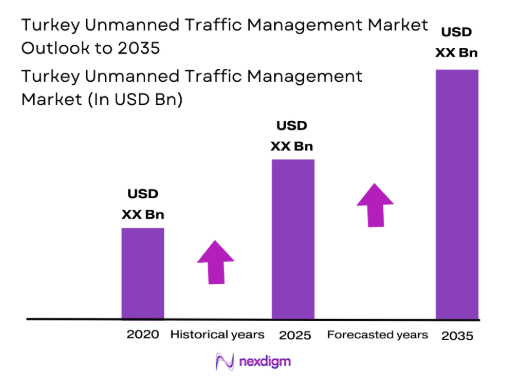

The Turkey Unmanned Traffic Management Market current size stands at around USD ~ million and reflects steady system adoption across controlled and uncontrolled airspaces. Activity levels expanded during 2024 and 2025 as regulatory pilots increased and drone traffic density rose. Operational deployments grew across civil, defense, and commercial domains supported by policy alignment. Platform utilization improved through automated authorization and monitoring capabilities. Technology maturity improved with integration of surveillance, communication, and identification modules. The market remains in a structured development phase driven by operational validation programs.

Deployment concentration remains highest in metropolitan air corridors, logistics hubs, and strategic infrastructure zones. Ankara and Istanbul dominate implementation due to regulatory presence and airspace complexity. Coastal regions support surveillance and emergency response deployments. Industrial zones show growing demand driven by inspection and monitoring requirements. Ecosystem maturity is supported by defense-linked innovation clusters. Government-backed digital aviation initiatives continue shaping standardized UTM adoption pathways.

Market Segmentation

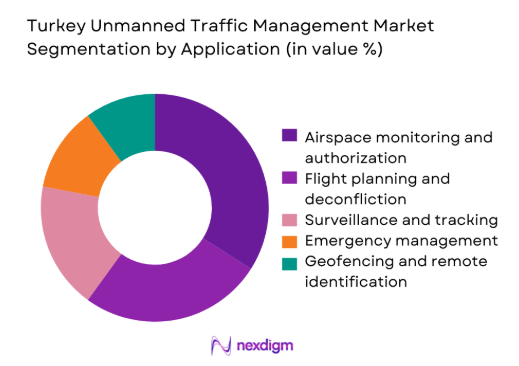

By Application

Airspace monitoring and authorization dominates usage due to regulatory compliance requirements and growing drone density. Flight planning and deconfliction applications expanded rapidly during 2025 as operational complexity increased. Surveillance and tracking remain essential for security-focused missions. Emergency response coordination gained relevance due to disaster preparedness initiatives. Geofencing and remote identification continue expanding as mandatory operational features. Application dominance is influenced by safety mandates, airspace digitization, and cross-agency coordination needs.

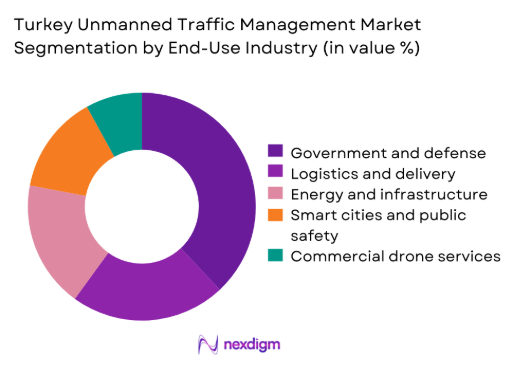

By End-Use Industry

Government and defense agencies represent the dominant end users due to security-driven deployment needs. Logistics and delivery operators show increasing adoption as last-mile aerial trials expand. Infrastructure and energy operators use UTM for inspection coordination and risk management. Smart city programs contribute through traffic and emergency monitoring applications. Commercial service providers adopt UTM to ensure regulatory compliance and operational scalability.

Competitive Landscape

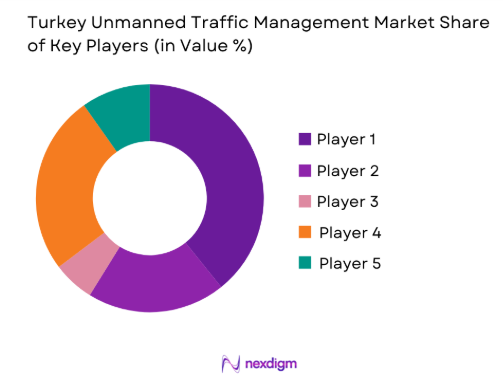

The competitive environment is characterized by a mix of defense-oriented technology providers and specialized UTM platform developers. Market positioning depends on regulatory alignment, system interoperability, and integration depth with national aviation infrastructure.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1993 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2014 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Frequentis AG | 1947 | Austria | ~ | ~ | ~ | ~ | ~ | ~ |

Turkey Unmanned Traffic Management Market Analysis

Growth Drivers

Expansion of drone operations and BVLOS approvals

Increasing drone registrations during 2025 expanded operational complexity across controlled and uncontrolled Turkish airspaces. Regulatory approvals for beyond visual line operations accelerated multi-mission deployment requirements nationwide. UTM platforms became necessary to manage flight density and safety compliance. Public sector trials supported large scale validation of digital traffic coordination systems. Drone usage expanded across logistics, surveillance, and infrastructure inspection sectors. Airspace authorities prioritized automation to replace manual authorization processes. Operational transparency improved through real-time tracking integration. System interoperability became essential to support simultaneous drone operations. Technology investments increased to support rising mission volumes. These developments collectively strengthened demand for structured unmanned traffic management systems.

Government-led airspace digitalization initiatives

National aviation digitization programs gained momentum through coordinated policy frameworks during 2025. Government-backed platforms encouraged standardized airspace management architecture adoption. Integration with civil aviation systems improved data exchange efficiency. Regulatory bodies supported automated authorization and monitoring tools. Digital transformation strategies emphasized safety, traceability, and compliance enforcement. Cross-agency collaboration enabled unified traffic visibility. Public funding supported pilot deployments across strategic regions. Digital airspace corridors were introduced for controlled drone operations. System testing enhanced reliability and operational confidence. These initiatives accelerated structured UTM market development.

Challenges

Fragmented regulatory implementation

Regional variations in regulatory interpretation slowed uniform system deployment across Turkey. Inconsistent approval processes created operational uncertainty for service providers. Limited harmonization between civil and defense authorities impacted scalability. Technology vendors faced challenges aligning solutions with evolving rules. Operational approvals required extensive coordination with multiple agencies. Fragmentation reduced deployment speed in high-traffic zones. Cross-border regulatory alignment remained limited. Policy updates often lagged technological advancement. Stakeholders faced uncertainty during transition phases. These factors constrained seamless market expansion.

Limited UTM interoperability standards

Absence of unified technical standards restricted seamless platform integration across operators. Proprietary architectures limited cross-system communication efficiency. Interoperability challenges increased system customization costs. Stakeholders faced difficulties aligning software with national airspace systems. Integration testing required extended validation cycles. Fragmentation reduced scalability for nationwide deployments. Interoperability gaps affected data exchange reliability. Standardization efforts progressed slowly due to regulatory complexity. Technology upgrades required continuous reconfiguration. These limitations restrained full ecosystem optimization.

Opportunities

National UTM platform development

Development of a centralized national platform offers long-term operational efficiency gains. Unified architecture would streamline regulatory oversight and data exchange. Government ownership can ensure standardized compliance mechanisms. National platforms enable integration with smart city infrastructure. Centralization supports scalable drone traffic management. Local technology firms can participate through modular system contributions. Platform development strengthens domestic aviation technology capabilities. Data consolidation improves safety analytics and forecasting. Policy alignment becomes easier under centralized governance. This opportunity supports sustainable long-term market growth.

Integration with smart city ecosystems

Smart city expansion creates strong demand for coordinated aerial traffic management solutions. UTM integration supports surveillance, traffic monitoring, and emergency response use cases. Municipal digital infrastructure enables seamless data exchange. Urban planning increasingly incorporates aerial mobility considerations. Sensor networks complement drone traffic management systems. City-level digitization programs accelerate adoption readiness. Integrated platforms improve public safety and operational efficiency. Urban airspace optimization supports future mobility concepts. Collaboration with municipalities enhances deployment scalability. These factors create strong growth potential for UTM integration.

Future Outlook

The market is expected to evolve through deeper regulatory integration and increased automation levels. Advancements in airspace digitization will strengthen nationwide deployment consistency. Public and private collaboration will expand application diversity. Technology convergence will support higher traffic volumes. The outlook remains positive as policy clarity and operational maturity improve.

Major Players

- Thales Group

- Leonardo S.p.A.

- Indra Sistemas

- Airbus Defence and Space

- Frequentis AG

- Aselsan

- Havelsan

- Turkish Aerospace Industries

- Baykar Technologies

- Unifly

- ANRA Technologies

- Altitude Angel

- Honeywell Aerospace

- SITA

- CNSI OneSky

Key Target Audience

- Civil Aviation Directorate General of Turkey

- Ministry of Transport and Infrastructure

- Defense and homeland security agencies

- Urban air mobility operators

- Drone service providers

- Smart city development authorities

- Logistics and infrastructure operators

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market boundaries were defined through operational scope analysis, regulatory frameworks, and technology classification. Key performance indicators were identified across application, deployment, and governance dimensions. Industry terminology and functional segmentation were standardized.

Step 2: Market Analysis and Construction

Qualitative and quantitative indicators were synthesized to evaluate adoption patterns and deployment intensity. Data triangulation incorporated regulatory releases, operational trends, and technology implementation levels. Structural relationships between stakeholders were mapped.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through domain expert discussions and policy framework reviews. Assumptions were refined using industry feedback and operational case assessments. Consistency checks ensured logical alignment across segments.

Step 4: Research Synthesis and Final Output

Insights were consolidated into structured analytical frameworks. Market dynamics were aligned with regulatory and technological trends. Final outputs were reviewed for accuracy, coherence, and strategic relevance.

- Executive Summary

- Research Methodology (Market Definitions and airspace management scope alignment, UTM taxonomy and functional segmentation mapping, bottom-up traffic and infrastructure sizing methodology, revenue attribution across software and services layers, primary validation with civil aviation authorities and UAS operators, triangulation using regulatory filings and flight activity data, market limitations and airspace policy assumptions)

- Definition and Scope

- Market evolution

- Usage and operational integration pathways

- Ecosystem structure

- Value chain and service delivery model

- Regulatory and airspace governance environment

- Growth Drivers

Expansion of drone operations and BVLOS approvals

Government-led airspace digitalization initiatives

Rising demand for urban air mobility readiness

Increasing defense and border surveillance deployments

Growth in commercial drone logistics and inspection use cases - Challenges

Fragmented regulatory implementation

Limited UTM interoperability standards

Airspace integration complexity

High infrastructure deployment costs

Cybersecurity and data sovereignty concerns - Opportunities

National UTM platform development

Integration with smart city ecosystems

Public-private partnerships for airspace management

Export of Turkish UTM solutions to regional markets

AI-driven traffic optimization solutions - Trends

Shift toward automated traffic orchestration

Integration of UTM with ATM systems

Use of AI and predictive analytics

Adoption of remote ID compliance systems

Growth of cloud-native UTM platforms - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Civil drones

Commercial drones

Government and defense drones

Urban air mobility platforms - By Application (in Value %)

Airspace monitoring and authorization

Flight planning and deconfliction

Surveillance and tracking

Geofencing and remote identification

Emergency and contingency management - By Technology Architecture (in Value %)

Centralized UTM systems

Distributed UTM platforms

Cloud-based UTM

Hybrid architecture - By End-Use Industry (in Value %)

Aviation authorities

Defense and homeland security

Logistics and delivery

Energy and infrastructure

Smart cities and public safety - By Connectivity Type (in Value %)

Cellular-based connectivity

Satellite-based connectivity

Hybrid communication networks - By Region (in Value %)

Marmara Region

Central Anatolia

Aegean Region

Mediterranean Region

Eastern and Southeastern Anatolia

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (technology maturity, regulatory compliance, scalability, interoperability, deployment footprint, pricing model, local partnership strength, innovation capability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces Analysis

- Detailed Profiles of Major Companies

Thales Group

Leonardo S.p.A.

Indra Sistemas

Airbus Defence and Space

Honeywell Aerospace

Frequentis AG

Altitude Angel

Unifly

ANRA Technologies

CNSI OneSky

Havelsan

Aselsan

Turkish Aerospace Industries

Baykar Technologies

SITA

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035