Market Overview

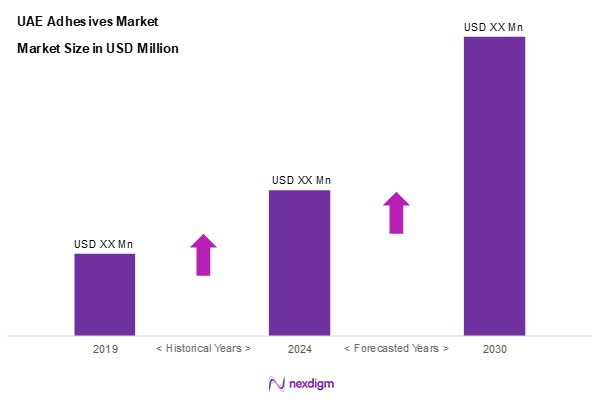

As of 2024, the UAE adhesives market is valued at USD 250.6 million, with a growing CAGR of 7.4% from 2024 to 2030, supported by robust growth in the construction and automotive sectors, which account for a significant portion of adhesive consumption. This growth is driven by increasing urbanization, government initiatives in infrastructure development, and a rising trend of using adhesives in various industries to replace traditional fastening methods.

Major cities such as Dubai and Abu Dhabi dominate the UAE adhesives market due to their status as economic and commercial hubs. These cities benefit from substantial investments in construction and infrastructure projects, which create a high demand for adhesives in applications such as construction, furniture, packaging, and automotive production. The concentration of major businesses and industries in these metropolitan regions enhances market activity and growth opportunities.

Market Segmentation

By Resin Type

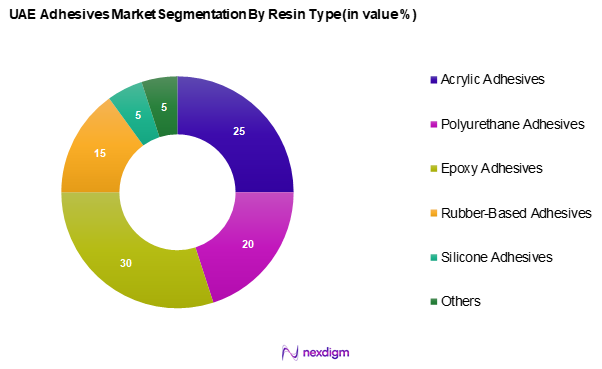

The UAE adhesives market is segmented into acrylic adhesives, polyurethane adhesives, epoxy adhesives, rubber-based adhesives, silicone adhesives, and others. Among these, epoxy adhesives have emerged as a dominant segment due to their exceptional bonding strength and durability. They are widely used in various applications, including construction and automotive, where strong and long-lasting adhesive properties are essential. This segment benefits from the increasing demand for high-performance bonding solutions and the growing trend towards using advanced materials in manufacturing processes.

By Application:

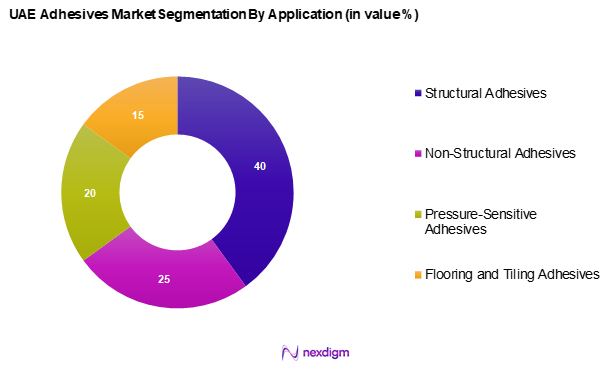

The UAE adhesives market is segmented into structural adhesives, non-structural adhesives, pressure-sensitive adhesives, and flooring and tiling adhesives. Structural adhesives dominate this segment due to their critical role in ensuring the integrity and safety of constructions and infrastructure projects. The rising trend of using adhesives in structural applications stems from their ability to distribute stress evenly and improve overall structural performance, making them preferable over traditional mechanical fastening methods, particularly in high-performance environments.

Competitive Landscape

The UAE adhesives market is dominated by several key players, each contributing significantly to market dynamics through innovation and strategic positioning. Major companies in the adhesive segment include Henkel AG & Co. KGaA, Sika AG, 3M, H.B. Fuller, and DuPont. Their established market presence is achieved through extensive distribution networks, diversified product portfolios, and a strong emphasis on R&D that caters to various end-use industries.

| Company | Establishment Year | Headquarters | Product Types | Annual Revenue

(USD Mn) |

Market

Share (%) |

Business Strategies |

| Henkel AG & Co. KGaA | 1876 | Düsseldorf, Germany | – | – | – | – |

| Sika AG | 1910 | Baar, Switzerland | – | – | – | – |

| 3M | 1902 | Minnesota, USA | – | – | – | – |

| H.B. Fuller | 1887 | Minnesota, USA | – | – | – | – |

| DuPont | 1802 | Delaware, USA | – | – | – | – |

UAE Adhesives Market Analysis

Growth Drivers

Rising Construction Activities

The UAE is witnessing significant growth in construction activities, driven by major infrastructure projects and continuous investments in residential and commercial developments. The expansion of urban spaces, particularly in cities like Dubai and Abu Dhabi, has heightened the demand for adhesives used in bonding materials. Additionally, the emphasis on sustainable and innovative construction practices is fostering the adoption of advanced adhesives that align with global efficiency and environmental standards.

Growth in Automotive Production

The automotive industry in the UAE is undergoing rapid expansion, supported by increasing local manufacturing capabilities and the establishment of new assembly plants by international automotive companies. With the evolution of vehicle manufacturing, high-performance adhesives are playing a crucial role in ensuring durability, weight reduction, and structural integrity. Technological advancements in adhesive solutions are becoming integral to meeting modern automotive production requirements.

Market Challenges

Regulatory Compliance Issues

The UAE adhesives industry faces complex regulatory requirements, with stringent safety and environmental standards set by government agencies. Recent regulations mandate adherence to specific safety measures, impacting production processes and operational costs. Compliance is essential to avoid penalties, compelling manufacturers to invest in technologies and practices that meet regulatory expectations. The evolving landscape of environmental regulations further adds to the challenges faced by adhesive manufacturers.

Competitive Landscape

The market is becoming increasingly competitive with the presence of numerous domestic and international players. The influx of global suppliers has intensified competition, leading to price fluctuations that impact profit margins. Reports indicate that more than 75 companies operate in the UAE adhesives sector, making it challenging for smaller local companies to differentiate themselves. To stay competitive, businesses are compelled to invest substantially in marketing and product development. The competitive landscape, influenced by the entry of new suppliers and aggressive pricing strategies, creates added pressure on established companies to innovate continuously.

Opportunities

Technological Advancements in Adhesives

Innovation in adhesive technology is opening new growth avenues, with the development of smart adhesives and bio-based solutions gaining prominence. These advancements enhance performance characteristics such as superior bonding capabilities, faster curing times, and increased resistance to environmental factors. Research and development efforts by major chemical companies are driving the emergence of cutting-edge adhesive products, enabling manufacturers to cater to evolving customer demands effectively.

Eco-friendly Adhesive Products

The increasing focus on sustainability is fuelling demand for environmentally friendly adhesive solutions. The UAE’s national vision for sustainable development emphasizes green technologies, encouraging industries to adopt eco-conscious practices. The shift toward low-VOC, water-based, and biodegradable adhesives aligns with global sustainability goals, providing manufacturers with a competitive edge. Companies prioritizing eco-friendly products are well-positioned to capitalize on this growing market trend, catering to the needs of environmentally conscious consumers and industries.

Future Outlook

Over the next five years, the UAE adhesives market is anticipated to experience robust growth, driven by an increase in construction activities, especially due to ongoing government initiatives in infrastructure and urban development. The trend toward using eco-friendly adhesives and innovations in product formulations will further propel market expansion. As industries evolve, the demand for advanced adhesive solutions that meet safety and performance standards will play a crucial role in shaping this market.

Major Players

- Henkel AG & Co. KGaA

- Sika AG

- 3M

- B. Fuller

- DuPont

- RPM International

- Avery Dennison Corporation

- Bostik S.A.

- Lord Corporation

- BASF SE

- Arkema S.A.

- Wacker Chemie AG

- DOW Chemical Company

- Mitsubishi Chemical Corporation

- Huntsman Corporation

Key Target Audience

- Investments and venture capitalist firms

- Construction companies

- Packaging manufacturers

- Automotive manufacturers

- Electronics and appliance manufacturers

- Government agencies (Ministry of Economy, Ministry of Infrastructure Development)

- Retail distributors

- Contractors and builders

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE adhesives market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the UAE adhesives market. This includes assessing market penetration, the ratio of marketplace participants to service providers, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing various companies in the adhesives sector. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple adhesive manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the UAE adhesives market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Construction Activities

Growth in Automotive Production - Market Challenges

Regulatory Compliance Issues

Competitive Landscape - Opportunities

Technological Advancements in Adhesives

Eco-friendly Adhesive Products - Trends

Growth in E-commerce Packaging

Shift Towards Sustainable Materials - Government Regulations

Environmental Laws

Product Safety Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Resin Type (In Value %)

Acrylic Adhesives

– Water-based Acrylic

– Solvent-based Acrylic

– UV-curable Acrylic

– Pressure-sensitive Acrylic

Polyurethane Adhesives

– One-Component PU

– Two-Component PU

– Moisture-Curing PU

– Hot-Melt PU

Epoxy Adhesives

– One-Part Epoxy

– Two-Part Epoxy

– UV-Curing Epoxy

– High-Temperature Resistant Epoxy

Rubber-Based Adhesives

– Natural Rubber

– Synthetic Rubber (e.g., SBR, NBR)

– Pressure-sensitive Rubber

Silicone Adhesives

– Acetoxy Silicone

– Neutral Cure Silicone

– High-Temperature Silicone

Others

– Cyanoacrylates

– Polyvinyl Acetate (PVA)

– Phenolic Resins - By Application (In Value %)

Structural Adhesives

– Load-bearing Construction

– Metal Bonding

– Composite Panel Assembly

– Aerospace/Automotive Assembly

Non-Structural Adhesives

– Decorative Laminates

– Temporary Bonding

– Foam & Fabric Bonding

Pressure-Sensitive Adhesives (PSA)

– Labels & Tapes

– Graphics & Films

– Medical PSA

– Packaging PSA

Flooring and Tiling Adhesives

– Ceramic Tile Adhesives

– Wood & Laminate Flooring Adhesives

– Vinyl Flooring Adhesives

– Epoxy Flooring Adhesives - By End-Use Industry (In Value %)

Construction

Packaging

Aerospace

Furniture

Automotive

Electronics and Appliances

Others

– Footwear

– DIY Consumer Products

– Bookbinding - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Ajman

Ras Al Khaimah - By Formulation (In Value %)

Solvent-Based

– Chloroprene-Based

– Rubber-Based Contact Adhesives

Water-Based

– PVA and Acrylic Dispersions

– Latex-Based Formulations

Hot Melt

– EVA-Based

– Polyolefin-Based

– Polyamide-Based

Reactive Adhesives

– Epoxy (2K)

– Polyurethane (1K/2K)

– Anaerobic and Cyanoacrylates

UV Cured

– Acrylic UV

– Epoxy UV

Others

– Pressure Sensitive Systems

– Heat-Activated Films - By Form (In Value %)

Paste

– Tiling Adhesives

– Woodworking Glues

Liquid

– Sprayable Adhesives

– Injectable Resin Adhesives

Film

– Structural Bonding Films

– Pre-formed Thermosetting Tapes

Others

– Powder-Based (for mixing)

– Granules (for hot melt extrusion) - By Sales Channel (In Value %)

B2B

– Industrial Distributors

– OEM Direct Sales

– Project Contractors/Builders

– Institutional Procurement

B2C

– Hardware Stores

– Online Retailers

– DIY Chains (e.g., Ace Hardware)

– Paint & Construction Retail Outlets

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Market Share of Major Players by Resin Type Segment, 2024

- Cross Comparison Parameters (Company Overview, Total Revenue, Adhesives Segment Revenue, Revenue by Product Type, Key End-Use Industries Served, Geographical Presence / Operational Regions, Distribution Channels, Production Capacity, Business Strategies, R&D Investment / Innovation Focus, Technology / Patent Portfolio, Customer Segments)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Henkel AG & Co. KGaA

Sika AG

3M

H.B. Fuller

Bostik S.A.

DuPont

RPM International

Avery Dennison Corporation

Scott Bader Company

Lord Corporation

BASF SE

Arkema S.A.

Wacker Chemie AG

DOW Chemical Company

Mitsubishi Chemical Corporation

Huntsman Corporation

Ashland Global Holdings Inc.

Pidilite MEA Chemicals LLC

Al Muqarram Group

LATICRETE Middle East

LLCFalcon Chemicals (L.L.C.)

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030