Market Overview

The UAE aerospace composites market is experiencing significant growth, driven by the increasing demand for lightweight, high-performance materials in the aerospace sector. The market is valued at USD ~ billion, with ongoing advancements in material technologies, such as carbon fiber and thermoplastics, enabling manufacturers to achieve superior strength-to-weight ratios. The growing need for fuel-efficient and environmentally sustainable aircraft is expected to continue supporting the expansion of the market. This market’s growth is further fueled by the UAE’s strategic positioning as a hub for both aviation and defense industries.

Dominant countries like the UAE, along with key regions such as North America and Europe, are leading the aerospace composites market due to their strong aerospace infrastructure and robust manufacturing capabilities. The UAE, in particular, benefits significant investments in its aerospace and defense sectors, as well as its state-of-the-art facilities that support composite material innovation. The country’s strategic alliances with global aerospace players and its ambitious vision for technological advancements in aviation further contribute to its dominance in this growing market.

Market Segmentation

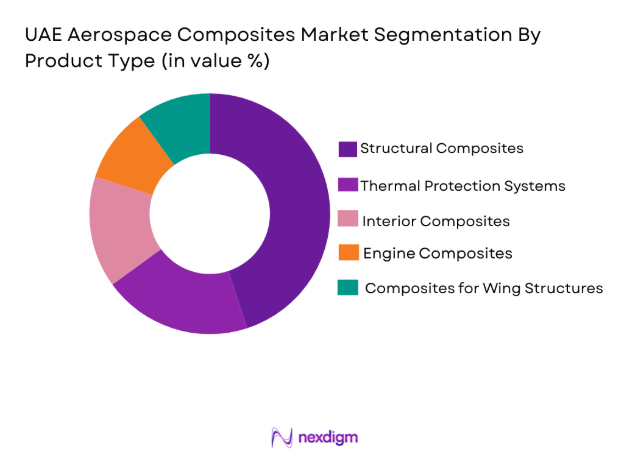

By Product Type:

The UAE aerospace composites market is segmented by product type into structural composites, thermal protection systems, interior composites, engine composites, and composites for wing structures. Recently, structural composites have a dominant market share due to factors such as high demand in aircraft manufacturing, superior strength-to-weight ratio, and growing investments in lightweight aircraft designs. These composites are integral in reducing fuel consumption and improving aircraft efficiency. The widespread adoption in both commercial and military aviation has further accelerated their dominance in the region.

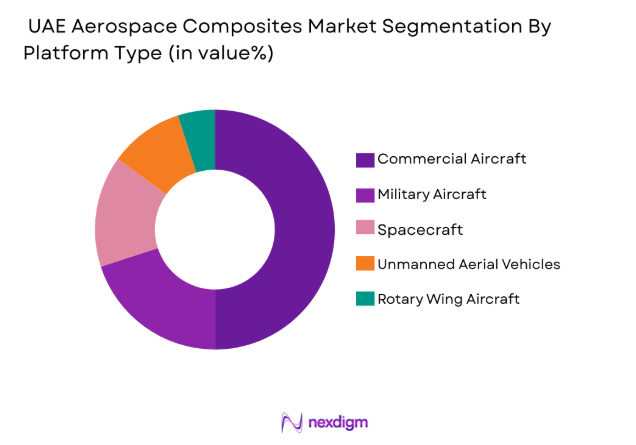

By Platform Type:

The UAE aerospace composites market is segmented by platform type into commercial aircraft, military aircraft, spacecraft, unmanned aerial vehicles (UAVs), and rotary wing aircraft. Recently, commercial aircraft have a dominant market share due to the high demand for lightweight, fuel-efficient solutions in the aviation industry. The continuous growth in air passenger traffic and the global push for eco-friendly aviation solutions have led to a higher adoption of advanced composite materials in aircraft manufacturing, making this segment the largest contributor to the market.

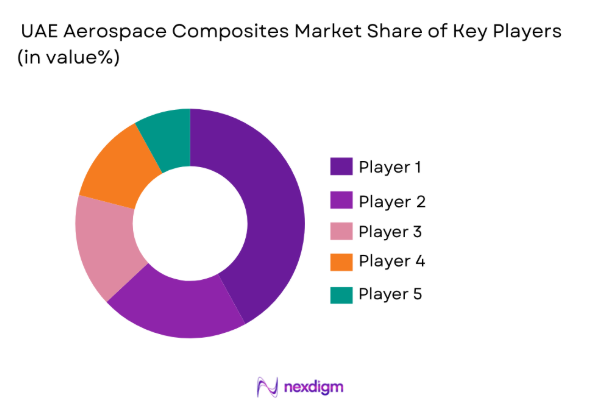

Competitive Landscape

The competitive landscape of the UAE aerospace composites market is characterized by a mix of established global players and regional manufacturers. Major aerospace companies are focusing on technological innovation and expanding their production capabilities to meet the growing demand for advanced composite materials. With numerous international partnerships and joint ventures, these players dominate market consolidation. The major players are also investing in R&D to develop sustainable, high-performance materials and expand their footprint in the UAE’s aerospace industry.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Technology Integration Focus |

| Lockheed Martin | 1912 | Bethesda, MD, USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, IL, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| SABIC | 1976 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Teijin Limited | 1918 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

UAE Aerospace Composites Market Analysis

Growth Drivers

Technological Advancements in Composite Materials:

The continuous development of advanced composite materials, particularly carbon fiber and thermoplastics, plays a significant role in driving the growth of the UAE aerospace composites market. These materials offer a combination of high strength, light weight, and excellent durability, making them essential for aerospace applications. Technological advancements have improved the efficiency of production processes, reduced costs, and expanded their applicability to a wider range of aircraft components. Furthermore, the ability of these materials to provide fuel-efficient solutions in aviation is a key driver as airlines and defense contractors seek to reduce operational costs and environmental impact. As aircraft manufacturers continue to push for innovations in design, the demand for advanced composites remains high, making them critical for the market’s growth.

Increased Demand for Fuel-Efficient Aircraft:

Another significant driver for the growth of the UAE aerospace composites market is the rising demand for fuel-efficient aircraft. With global pressure to reduce carbon emissions and lower fuel consumption, there is a strong shift towards more efficient aircraft designs. Lightweight composites play a crucial role in achieving these goals by reducing the overall weight of aircraft and consequently the fuel consumption. As the aviation industry increasingly adopts greener technologies and eco-friendly practices, composites become an integral part of designing next-generation aircraft. The push for sustainability and innovation in aircraft design further fuels the market’s expansion.

Market Challenges

High Initial Costs of Composite Manufacturing:

A major challenge hindering the growth of the UAE aerospace composites market is the high initial cost of composite material manufacturing. The production of advanced composites, particularly carbon fiber, requires significant investment in both raw materials and specialized manufacturing processes. The high costs associated with these materials can deter smaller companies or regional manufacturers from entering the market. This challenge is particularly pertinent in markets like the UAE, where large-scale production and mass adoption of composite materials require substantial upfront capital. Although the long-term benefits of using lightweight composites outweigh the initial costs, the financial barriers remain a concern for many companies in the aerospace industry.

Complexity in Recycling and Disposal of Composites:

Another challenge facing the UAE aerospace composites market is the difficulty in recycling and disposing of composite materials. While composites are known for their strength and durability, their disposal can be problematic. Unlike metals, which can be easily recycled, composites pose challenges due to their complex structure and the variety of materials used in their production. This makes end-of-life management of composite materials costly and environmentally challenging. As the aerospace industry continues to adopt composites in greater quantities, finding sustainable solutions for recycling and disposal will be essential to mitigate environmental impacts and ensure the market’s long-term growth.

Opportunities

Growth in the Space Industry Driving Aerospace Composite Demand:

One of the key opportunities in the UAE aerospace composites market is the rapid expansion of the space industry. The UAE has made significant investments in space exploration, including the establishment of its Mars mission and other satellite programs. The need for advanced materials that can withstand extreme temperatures and conditions in space has driven the demand for high-performance composites. These materials are essential in the construction of spacecraft, satellites, and related infrastructure. As the UAE continues to develop its space capabilities, the demand for aerospace composites will likely grow, providing significant opportunities for companies in this market.

Increasing Adoption of UAVs and Drones:

The growing adoption of unmanned aerial vehicles (UAVs) and drones in both commercial and military applications is creating new opportunities for the UAE aerospace composites market. UAVs, which require lightweight yet durable materials for flight efficiency, are increasingly being used in various sectors, including agriculture, defense, and surveillance. As the demand for UAVs and drones increases, the need for composite materials will grow as well. The UAE, with its strategic location and investment in cutting-edge defense technologies, is well-positioned to capitalize on this trend and expand its market for aerospace composites.

Future Outlook

The future outlook for the UAE aerospace composites market is promising, with expected growth driven by the expansion of the aviation, space, and defense industries. Technological advancements in composite material manufacturing, such as the use of thermoplastic composites and enhanced fiber materials, are likely to play a major role in shaping the market. Additionally, government support for the aerospace and defense sectors, along with increasing demand for fuel-efficient and environmentally friendly aircraft, will contribute to continued market expansion. As the UAE strengthens its position as a global aerospace hub, the market for aerospace composites will continue to experience growth.

Major Players

- Lockheed Martin

- Boeing

- Airbus

- SABIC

- Teijin Limited

- Northrop Grumman

- Spirit AeroSystems

- GKN Aerospace

- L3 Technologies

- Raytheon Technologies

- Hexcel Corporation

- Solvay

- Mitsubishi Chemical

- General Electric

- Safran

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace OEMs

- Defense contractors

- Space agencies

- Military forces

- Commercial airlines

- Aircraftcomponent suppliers

Research Methodology

Step 1: Identification of Key Variables

This step involves defining the key variables affecting the aerospace composites market, including material types, application sectors, and geographical considerations.

Step 2: Market Analysis and Construction

In this step, the data is compiled to construct the market size and segment the market by various factors such as product type and end-user demand.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts and stakeholders validate the assumptions and hypotheses developed during the market analysis.

Step 4: Research Synthesis and Final Output

The final output is synthesized from all findings, offering insights and projections that shape the detailed market report.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Lightweight and Fuel-Efficient Aircraft

Technological Advancements in Composite Materials

Expansion of the Aviation and Space Sectors in UAE

Government Investments in Aerospace and Defense

Increased Demand for Sustainable and Eco-friendly Aerospace Components - Market Challenges

High Initial Manufacturing Costs of Composites

Complexity in Recycling and Disposal of Composite Materials

Strict Regulatory Compliance for Aerospace Components

Dependence on Global Supply Chains for Raw Materials

Technological Barriers in Mass Production - Market Opportunities

Growth in the Space Industry Driving Aerospace Composite Demand

Emergence of Hybrid and Electric Aircraft Requiring Advanced Materials

Increasing Demand for UAVs and Drones Boosting Composite Usage - Trends

Increased Adoption of Carbon Fiber in Aircraft

Growth of Aerospace Composites in Space Missions

Use of Advanced Thermoplastic Composites in Aircraft Interiors

Shift Towards 3D Printing of Aerospace Components

Advancements in Resin and Fiber Technologies - Government Regulations & Defense Policy

Aerospace Certification for Composite Materials

Government Initiatives to Promote Aerospace Manufacturing

Environmental Regulations Promoting Sustainable Manufacturing - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Structural Composites

Thermal Protection Systems

Interior Composites

Engine Composites

Composites for Wing Structures - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Spacecraft

Unmanned Aerial Vehicles (UAVs)

Rotary Wing Aircraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket Solutions

Refurbishment

Upgrades

Maintenance, Repair, and Overhaul (MRO) - By EndUser Segment (In Value%)

Aerospace OEMs

Defense Contractors

Space Agencies

Maintenance Service Providers

End Users in Aviation & Defense Sectors - By Procurement Channel (In Value%)

Direct Procurement

Supplier Agreements

Online Procurement Platforms

Government Tenders

Distributors - By Material / Technology (in Value%)

Carbon Fiber Composites

Glass Fiber Composites

Aramid Fiber Composites

Thermoplastic Composites

Nanocomposites

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Material, Platform Type, End User, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing

Airbus

SABIC

Teijin Limited

Hexcel Corporation

Solvay

Toray Industries

Mitsubishi Chemical

Northrop Grumman

Spirit AeroSystems

GKN Aerospace

L3 Technologies

Raytheon Technologies

General Electric

- Aerospace OEMs Increasing Investment in Composite Materials

- Defense Contractors Integrating Lightweight Composites in Military Aircraft

- Government Agencies Supporting Advanced Composite Research

- Space Agencies Seeking Advanced Materials for Space Exploration

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035