Market Overview

As of 2024, the UAE agriculture tractor market is valued at USD 130.4 million, with a growing CAGR of 6.4% from 2024 to 2030, driven by an increase in agricultural mechanization, technological advancements, and a growing focus on enhancing productivity. The market’s growth is bolstered by rising investments in modern farming practices and an increasing number of agricultural projects aiming to fortify food security. This trend aligns with the government’s strategic plans to advance sustainable agriculture and enhance overall agricultural output in the region.

Cities such as Abu Dhabi and Dubai dominate the UAE agriculture tractor market due to their substantial agricultural activities and investment in advanced farming technologies. Abu Dhabi’s rich agricultural initiatives supported by its vast land area and robust infrastructure, coupled with Dubai’s strategic position as a regional trade hub, foster an environment ripe for market growth. Both cities are central to the UAE’s vision of integrating modern farming methods with traditional practices to improve yield and land use.

Market Segmentation

By Type of Tractor

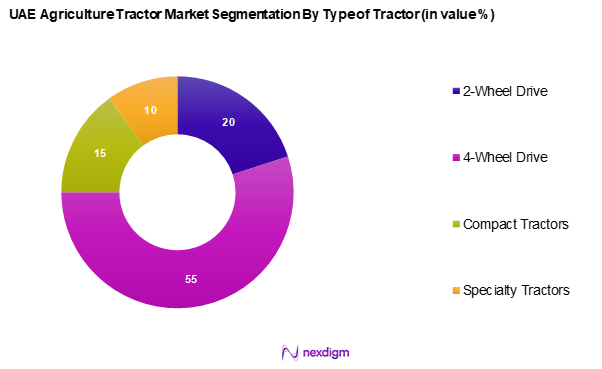

The UAE agriculture tractor market is segmented into 2-wheel drive, 4-wheel drive, compact tractors, and specialty tractors. Among these segments, the 4-wheel drive tractors have a dominant market share due to their superior performance and adaptability in various agricultural conditions. They are favored for their enhanced traction and power, making them ideal for extensive operations such as plowing, tilling, and harvesting. The robust durability and advanced technology incorporated in 4-wheel drive tractors further contribute to their popularity among farmers, ensuring that they remain the preferred choice for modern agricultural practices.

By Engine Power

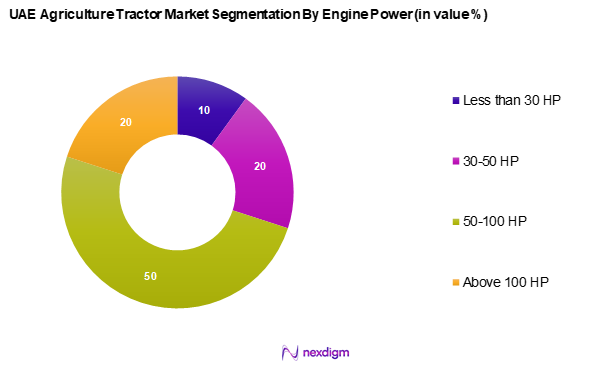

The UAE agriculture tractor market is segmented into less than 30 HP, 30-50 HP, 50-100 HP, and Above 100 HP. The 50-100 HP segment dominates the market, as these tractors strike a balance between power, efficiency, and affordability. Farmers prefer this segment for its versatility across different tasks, from tilling to heavy-duty harvesting. Moreover, the rise of small to medium-sized farms in the UAE, which require robust machinery without excessive cost, further elevates the demand for tractors within this power range, solidifying its leading position in the market.

Competitive Landscape

The UAE agriculture tractor market is characterized by a variety of players, both local and international, that enhance competitiveness. Major players include John Deere, AGCO Corporation, and Mahindra & Mahindra, among others. These companies leverage their technological advancements and extensive distribution networks to maintain significant market influence.

| Company | Establishment Year | Headquarters | Revenue

(USD Mn) |

Market Share (%) | Product Portfolio | Market Focus |

| John Deere | 1837 | Illinois, USA | – | – | – | – |

| AGCO Corporation | 1990 | Georgia, USA | – | – | – | – |

| Mahindra & Mahindra Ltd. | 1945 | Maharashtra, India | – | – | – | – |

| Kubota Corporation | 1890 | Osaka, Japan | – | – | – | – |

| CLAAS Group | 1913 | Harsewinkel, Germany | – | – | – | – |

UAE Agriculture Tractor Market Analysis

Growth Drivers

Technological Advancements

The agriculture sector in the UAE is increasingly benefiting from technological advancements, particularly in precision farming, which is transforming the productivity landscape. As of 2023, about 90% of farmers in the UAE have begun adopting precision agricultural technologies to increase yield and efficiency. The implementation of advanced sensor technology, drones, and automated machinery has played a pivotal role, with smart agriculture technologies reaching USD 1.5 billion in investment. The government’s focus on enhancing agricultural productivity through technology is evident in its push for mechanization, aided by an increase in agricultural output, reported at 9.6 million tons in 2022. These developments reflect the UAE’s commitment to revolutionizing its agricultural landscape through technology-driven solutions.

Increasing Agricultural Productivity

The UAE has been making strong efforts to enhance agricultural productivity as part of its broader food security strategy. With a growing emphasis on modernizing farming techniques, the country has introduced initiatives that support investment in advanced agricultural practices. Mechanization has significantly improved farming efficiency, leading to increased yields and productivity. Government-backed programs aimed at developing the agricultural sector continue to play a crucial role in ensuring sustainable growth, reinforcing the importance of mechanization in modern farming.

Market Challenges

High Initial Costs

The substantial financial investment required for acquiring agricultural tractors and related machinery remains a significant barrier for farmers in the UAE. Many small and medium-scale farmers struggle with securing funds for advanced equipment, often relying on personal savings due to limited financing options. The high costs associated with modern machinery deter a considerable portion of the farming community from adopting new technologies, affecting overall efficiency and agricultural output.

Maintenance and Repair Needs

Ongoing maintenance and repair of agricultural equipment present a considerable financial challenge for farmers. A significant portion of farm budgets is allocated to keeping machinery operational, creating economic pressure on agricultural enterprises. Equipment downtime due to repairs can result in productivity losses, making it difficult for farmers to meet market demands. Additionally, the shortage of skilled technicians further complicates maintenance efforts, highlighting a key issue that requires attention for long-term sustainability in the sector.

Opportunities

Increasing Use of Smart Technologies

The integration of smart technologies in farming is opening new growth opportunities within the UAE agriculture tractor market. Digital solutions such as IoT-based monitoring, automation, and data-driven decision-making are gaining traction, helping farmers optimize their operations. With ongoing government initiatives encouraging the adoption of digital agriculture, the shift toward smart farming is expected to accelerate, driving efficiency and improving overall agricultural performance.

Growth of Sustainable Agriculture Practices

The UAE’s commitment to sustainable agricultural practices is fostering new opportunities in the agriculture tractor market. Policies supporting eco-friendly farming and efficient resource utilization are encouraging the development of sustainable tractors and related equipment. Initiatives promoting organic farming and environmentally conscious practices are gaining momentum, leading to a gradual shift toward greener agricultural methods. As sustainability becomes a key focus, demand for advanced and eco-friendly farming solutions is expected to grow.

Future Outlook

Over the next five years, the UAE agriculture tractor market is projected to witness substantial growth fuelled by technological innovations, heightened demand for mechanization in agriculture, and strong governmental support for food security initiatives. Increasing investments in sustainable farming practices and green technologies are expected to further drive market expansion. Additionally, as consumer preferences across the region evolve, there is likely to be a greater demand for smart tractors integrated with IoT and automated systems, enhancing operational efficiency and crop yield.

Major Players

- John Deere

- AGCO Corporation

- Mahindra & Mahindra Ltd.

- Kubota Corporation

- CLAAS Group

- Case IH

- New Holland

- Massey

- J C Bamford Excavators Ltd.

- Deutz-Fahr

- SDF Group

- TAFE (Tractors and Farm Equipment Limited)

- ZETOR TRACTORS a.s.

- Al Ghandi Auto

- Foton Lovol International

Key Target Audience

- Agricultural Producers and Farmers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Climate Change and Environment, Abu Dhabi Agriculture and Food Safety Authority)

- Tractor Manufacturers and Suppliers

- Agricultural Technology Innovators

- Agricultural Equipment Distributors

- Industry Associations and Farming Cooperatives

- Agricultural Research Institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE agriculture tractor market. This step entails extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the UAE agriculture tractor market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. An evaluation of service quality statistics will ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATI) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple agriculture tractor manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction verifies and complements the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the UAE agriculture tractor market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Technological Advancements

Increasing Agricultural Productivity - Market Challenges

High Initial Costs

Maintenance and Repair Needs - Opportunities

Increasing Use of Smart Technologies

Growth of Sustainable Agriculture Practices - Trends

Adoption of Electric Tractors

Rise of Agricultural Drones - Government Regulation

Environmental Policies

Import Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type of Tractor (In Value %)

2-Wheel Drive

– Entry-Level Tractors

– Lightweight Field Operations

– Small-Scale Farms

4-Wheel Drive

– Heavy-Duty Agricultural Tractors

– All-Terrain Tractors for Desert Soil

– High-Traction Utility Tractors

Compact Tractors

– Orchard & Vineyard Tractors

– Landscaping and Gardening Tractors

– Small Plot/Greenhouse Tractors

Specialty Tractors

– Row Crop Tractors

– High Clearance Tractors

– Narrow Tractors for Specific Crops - By Engine Power (In Value %)

Less than 30 HP

30–50 HP

50–100 HP

Above 100 HP - By Application (In Value %)

Plowing

– Deep Plowing

– Strip Tillage

– Reversible Plow Operations

Tilling

– Power Harrow Operations

– Rotavator Use

– Seedbed Preparation

Harvesting

– Tractor-Mounted Harvesters

– Trolley Attachments for Crop Transport

Others

– Haulage

– Pesticide Spraying

– Irrigation Support Attachments - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Ajman

Ras Al Khaimah

Fujairah - By Distribution Channel (In Value %)

Direct Sales

– OEM & Manufacturer-Specific Deals

– Government Tenders and Contracts

Dealers

– Local Authorized Dealerships

– Spare Part & Maintenance Packages

Online Sales

– E-commerce Agriculture Platforms

– Remote Farming Equipment Portals

Auctions

– Used Tractor Market

– Agriculture Expo Sales & Trade Events - By Engine Capacity (In Value %)

Less than 1000 CC

1000–2000 CC

Above 2000 CC

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Tractor Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Tractor, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

John Deere

AGCO Corporation

Case IH

Mahindra&Mahindra Ltd.

Kubota Corporation

New Holland

CLAAS Group

Deutz-Fahr

Massey Ferguson

J C Bamford Excavators Ltd.

SDF Group

TAFE (Tractors and Farm Equipment Limited)

ZETOR TRACTORS a.s.

Al Ghandi Auto

Foton Lovol International

Titan Machinery Inc.

Escorts Ltd.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030