Market Overview

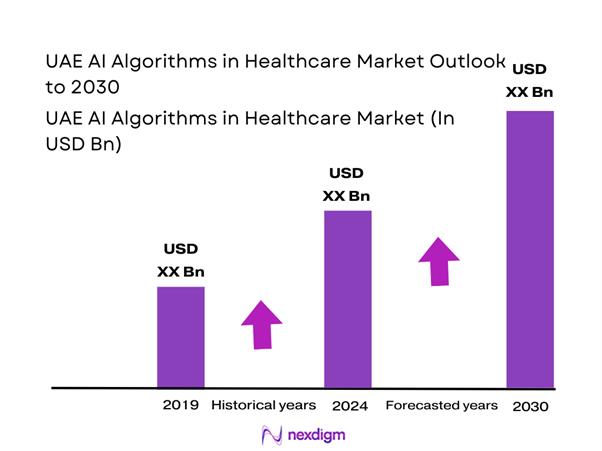

The UAE AI Algorithms in Healthcare market is valued at USD ~ million, reflecting accelerated commercialization of algorithms embedded in imaging workflows, clinical decision support, and administrative automation, as tracked by IMARC’s country market model. Adoption is supported by a broader digital-health spending base: the UAE digital health market is sized at USD ~ million (2023) and USD ~ million (2024), indicating expanding budgets for data platforms, interoperability, and AI-ready infrastructure that pull algorithm deployments into routine care pathways.

Dubai and Abu Dhabi dominate adoption because they concentrate tertiary hospitals, specialist diagnostics, payer decision centers, and large-scale health-system digitization programs that make algorithms easier to validate, procure, and integrate. The densest ecosystem of enterprise buyers and innovation platforms sits in these hubs, while multi-facility groups headquartered there can scale a validated model across networks. In addition, the UAE’s broader AI build-out—valued at USD ~ billion—supports local compute capacity, partnerships, and faster time-to-deployment for healthcare-grade models.

Market Segmentation

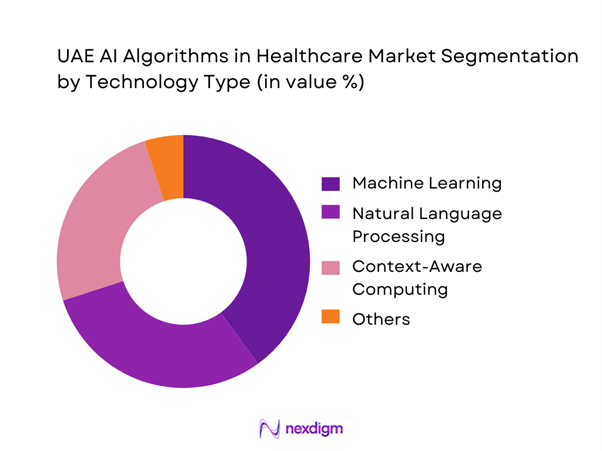

By Technology Type

The UAE AI Algorithms in Healthcare market is segmented by technology type into machine learning, natural language processing (NLP), context-aware computing, and other AI techniques (including deep learning variants under broader ML groupings used in many country models). In practice, machine learning tends to dominate enterprise deployments because it underpins the highest-volume “operational AI” use cases: imaging triage/worklist prioritization, deterioration risk scoring, denial/claims anomaly detection, and throughput optimization. These workflows generate repeatable, measurable KPIs (turnaround time, coding accuracy, capacity utilization), making procurement easier than frontier-only models. ML also integrates cleanly with PACS/RIS/EMR APIs and can be monitored via MLOps controls, which reduces clinical risk and accelerates hospital-wide scale-up.

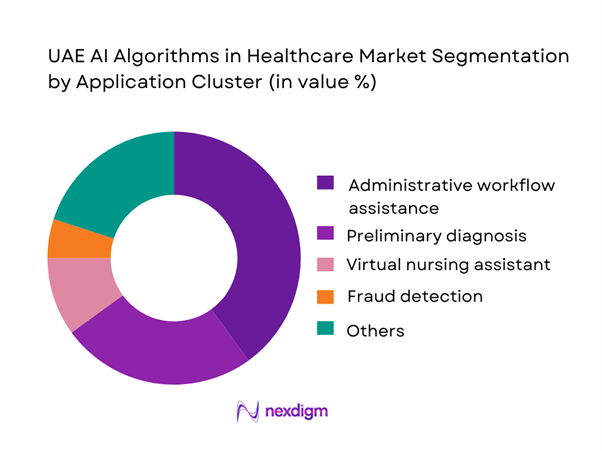

By Application Cluster

The market is also segmented by application cluster into robot-assisted surgery, virtual nursing assistants, administrative workflow assistance, fraud detection, dosage error reduction, clinical trial participant identification, preliminary diagnosis, and other use cases. Across UAE provider networks, administrative workflow assistance and preliminary diagnosis often emerge as the fastest-to-industrialize clusters because they attack immediate bottlenecks: documentation burden, coding, triage, radiology/pathology backlogs, and scheduling friction. They are also easier to deploy at scale because they can be layered on top of existing EMR/PACS systems without requiring full care-pathway redesign. Where hospitals are pursuing measurable ROI, algorithmic automation in revenue-cycle and clinical documentation can deliver quicker payback than specialty-only solutions, while still improving patient experience through faster turnaround and reduced queuing.

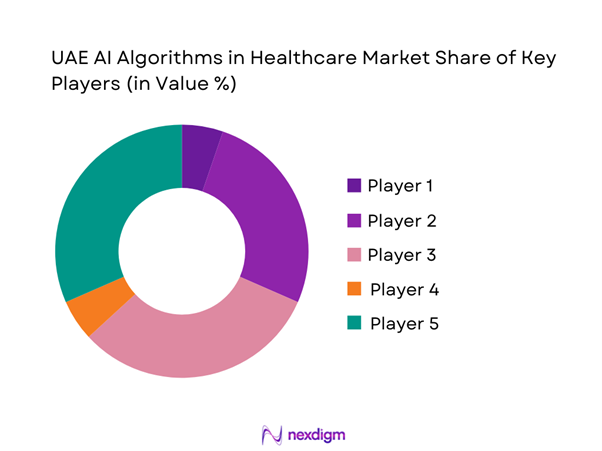

Competitive Landscape

The UAE AI Algorithms in Healthcare market is increasingly shaped by a mix of UAE-native health platforms and global medtech/AI infrastructure firms. Local champions anchor large data assets, hospital footprints, and national programs, while multinationals bring device-embedded algorithms, PACS/RIS ecosystems, cloud/compute stacks, and mature validation playbooks. A visible pattern is co-development and co-commercialization—for example, UAE health platforms pairing with global imaging leaders to accelerate regulated AI deployments and scale across multi-facility networks. This creates a “partnered consolidation” dynamic where a smaller set of ecosystems wins large enterprise rollouts.

| Company | Established | Headquarters | Core AI-Algorithm Focus | Primary Modalities | Integration Surface | Typical Deployment | UAE-Scale Proof Points | Regulatory / Quality Signals |

| M42 (G42 Healthcare + Mubadala Health combination) | 2023 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994 | Chicago, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 2017 | Erlangen, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Qure.ai | 2016 | Mumbai, India | ~ | ~ | ~ | ~ | ~ | ~ |

UAE AI Algorithms in Healthcare Market Analysis

Growth Drivers

HIE Penetration

UAE’s health data backbone is now large enough to make real-world AI training, validation, and deployment operationally feasible across provider networks. The UAE economy generates USD ~ in output and supports a resident base of ~ people—scale that sustains continuous clinical data flows across payers and providers. Within Abu Dhabi, Malaffi connects ~ healthcare facilities and enables access for ~ users, while its longitudinal dataset has reached ~ clinical records (~). In Dubai, NABIDH holds ~ patient records and links ~ facilities, which materially improves AI algorithm portability across care settings by expanding coverage of lab, imaging, pharmacy, and encounter histories. As these HIE rails mature, algorithm developers can move from single-hospital pilots to multi-facility validation, tightening bias checks and drift monitoring using multi-site cohorts instead of isolated datasets.

Imaging Backlogs

Imaging intensity in public systems is high enough that radiology workflow automation (triage, prioritization, structured reporting, incidental findings detection) becomes an immediate ROI case—without relying on pricing claims. The UAE’s per-capita purchasing power (USD ~ GDP per capita) supports high utilization of advanced diagnostics and specialist pathways. In Emirates Health Services facilities alone, radiology throughput includes ~ examinations in a year, comprising ~ general X-rays, ~ CT scans, ~ MRI scans, and ~ ultrasound exams—a workload profile where queue compression and report standardization are high-value targets for AI. As imaging volumes concentrate in tertiary hospitals, algorithms that reduce “time-to-read,” pre-populate measurements, and route cases based on urgency can lift capacity without adding equivalent headcount—particularly relevant when CT and MRI pipelines must coordinate contrast safety checks, protocoling, and subspecialty reads.

Challenges

Clinical Liability Exposure

Clinical AI in the UAE operates under high accountability expectations because healthcare delivery is regulated at emirate and federal levels, and patient complaint/medical error pathways are formalized. The delivery footprint is large: Dubai’s private sector alone has ~ medical facilities, increasing the number of potential AI-influenced clinical touchpoints where adverse outcomes could trigger investigation. Regulatory processes also hard-code dispute timelines; for example, within DHA’s medical complaints flow, once outcomes are issued, parties are given ~ days to appeal—tight windows that push providers to maintain strong audit trails of model outputs, clinician overrides, and validation evidence. The macro scale of the economy (USD ~ GDP) and population (~) amplifies scrutiny because algorithm deployment can affect large cohorts quickly. Practically, this drives demand for “defensible AI”: documented clinical governance, robust human-in-the-loop designs, continuous monitoring, and clearly defined accountability between vendors, hospitals, and clinicians—without which procurement and clinical adoption slow materially.

Model Drift and Validation Risk

Model performance drift is a material operational risk in the UAE because algorithms are increasingly deployed across multi-facility environments, where patient mix, imaging protocols, and documentation styles vary by emirate and provider group. Abu Dhabi’s HIE scale—~ connected facilities and ~ clinical records—enables broad deployment, but also increases variability exposure that can degrade model calibration if monitoring is not systematic. Dubai adds another large data domain with ~ NABIDH patient records across ~ facilities, meaning vendors must prove cross-domain generalizability, not just single-hospital performance. High-throughput modalities such as ~ CT scans and ~ MRI scans (EHS facilities) further elevate drift risk because protocol changes, scanner upgrades, and evolving clinical thresholds can shift input distributions rapidly.

Opportunities

Federated Learning Models

Federated learning is a highly “UAE-fit” opportunity because it aligns with data localization requirements while still enabling multi-site model improvement across disparate provider networks. The UAE ICT Health Law explicitly restricts transferring/processing health data outside the State without authorization, with penalties of AED ~ for violating the relevant provision—making centralized offshore training architectures risky. At the same time, the clinical data scale is large enough to make federation valuable: Abu Dhabi’s HIE has ~ connected facilities, ~ users, and ~ clinical records, while Dubai’s HIE has ~ patient records across ~ facilities. Federated approaches let models learn from distributed cohorts without moving raw patient data, which can accelerate expansion of imaging AI, risk stratification, and pathway optimization across systems with heterogeneous EMRs and protocols. The opportunity is reinforced by high diagnostic throughput (e.g., ~ CT and ~ MRI exams in EHS facilities), which creates continuous streams for model refinement when governance is strong.

Multi-Emirate Scale Programs

Multi-emirate AI programs are a practical growth opportunity because operational baselines (HIE connectivity, screening infrastructure, and large health spending pools) already exist, allowing governments and large provider groups to standardize algorithms across regions without needing speculative future projections. The UAE’s macro base—USD ~ GDP and ~ residents—supports centralized program funding and the ability to operationalize national guidelines through digital platforms. On readiness, Abu Dhabi’s ~ Malaffi-connected facilities and Dubai’s ~ NABIDH-connected facilities indicate that two of the largest care ecosystems already have the data highways needed for cross-facility rollouts, performance monitoring, and outcome audits. Programmatically, preventive care scale is visible via operational counts like ~ e-Etmnan transactions and high radiology throughput (~ exams in EHS facilities), both of which can be converted into standardized algorithm pathways (risk scoring, recall orchestration, imaging prioritization).

Future Outlook

Over the next planning cycle, the UAE’s healthcare AI algorithms demand is expected to expand from pilot-heavy deployments into scaled, governed operating models—especially where clinical AI is tied to measurable throughput and safety outcomes. The strongest momentum will come from imaging and diagnostics automation, administrative/RCM intelligence, and multi-modal risk engines linked to unified patient records and population health programs. Parallel investments in national AI infrastructure and large compute campuses further improve model training, inference latency, and secure deployment options, enabling more enterprise-grade rollouts.

Major Players

- M42

- PureHealth

- Injazat

- GE HealthCare

- Siemens Healthineers

- Philips

- Oracle Health

- Microsoft

- NVIDIA

- SAS

- Dell Technologies

- Aidoc

- Qure.ai

- Lunit

Key Target Audience

- Chief Executive Officers / Managing Directors

- Chief Medical Information Officers (CMIO) / Digital Transformation Heads

- Heads of Radiology & Diagnostic Imaging Networks

- Chief Financial Officers / Revenue Cycle Heads

- Payers, TPAs, and Managed Care Leaders

- Investments and venture capitalist firms

- Government and regulatory bodies

- Chief Information Security Officers / Data Protection Officers

Research Methodology

Step 1: Identification of Key Variables

We build a UAE ecosystem map across regulators, provider networks, payers/TPAs, HIE operators, and AI vendors. Desk research consolidates segment definitions (algorithm categories, use cases, deployment models) and procurement pathways. The goal is to isolate variables that drive adoption: data readiness, validation requirements, and integration complexity.

Step 2: Market Analysis and Construction

We compile historical commercialization signals using a bottom-up structure: algorithm deployments, active contracts, and installed enterprise platforms. We cross-map demand indicators such as digital health spend and AI infrastructure readiness to triangulate the revenue pool. This step also structures the segmentation logic and buyer archetypes.

Step 3: Hypothesis Validation and Expert Consultation

We validate market assumptions via CATIs with hospital digital leaders, radiology heads, payer analytics teams, and vendor implementation leads. Interviews focus on contract models, integration timelines, governance requirements, and measurable KPIs used to justify scaling. Insights are used to refine adoption curves by use case.

Step 4: Research Synthesis and Final Output

We synthesize findings into a unified market model and stress-test it with multiple stakeholder perspectives. The final output is checked for definitional consistency (what qualifies as “AI algorithms revenue”), duplication removal, and alignment to UAE procurement realities. Outputs include strategy implications, competitive positioning, and investment whitespace mapping.

- Executive Summary

- Research Methodology (Market Definitions & Boundary Conditions, AI Algorithm Taxonomy, UAE Regulatory Mapping Approach, Data Triangulation Framework, Primary Interview Universe Providers Payers Regulators Vendors, Pipeline Tracking of Deployments and POCs, Assumptions and Sensitivity Logic, Limitations and Validation Controls)

- Definition and Scope

- Overview Genesis UAE Digital Health and AI Enablement Landscape

- Timeline of Major Players and Deployments

- Business Cycle Innovation Clinical Validation Procurement Deployment Monitoring

- Healthcare AI Value Chain Data Model Workflow Outcomes

- Stakeholder Ecosystem MOHAP DHA DoH Providers Payers HIEs Cloud Compute Academia

- Growth Drivers

HIE Penetration

Imaging Backlogs

Healthcare Workforce Productivity Pressure

National Screening Programs

Payer Cost Containment Focus - Challenges

Clinical Liability Exposure

Model Drift and Validation Risk

Data Fragmentation

Patient Consent and Privacy Constraints

Procurement Complexity - Opportunities

Federated Learning Models

Multi Emirate Scale Programs

Arabic Clinical NLP

Population Health Risk Engines

Device Embedded AI - Trends

Responsible AI Standards

Generative AI Clinical Documentation

Multi Modal Foundation Models

Synthetic Data Pipelines

Healthcare MLOps Adoption - Regulatory & Policy Landscape

- By Value, 2019–2024

- By Volume Deployments Installations Active Algorithms, 2019–2024

- By Average Contract Metrics, 2019–2024

- By Technology Architecture (in Value %)

Classical ML Risk Scores Claims Utilization Models

Deep Learning Imaging and Signal Models

Natural Language Processing Arabic and English Clinical Text Coding Summarization

Computer Vision Radiology Pathology Endoscopy

Generative AI Clinical Documentation Virtual Assistants Synthetic Data - By Application (in Value %)

Radiology AI Triage Detection Worklist Prioritization

Pathology AI Digital Slide Analysis Tumor Profiling Support

Cardiology AI ECG Imaging Interpretation Risk Stratification

Oncology AI Screening Care Pathway Optimization Recurrence Risk

Emergency and Acute Care AI Sepsis Stroke Alerts Capacity Routing - By Connectivity Type (in Value %)

Medical Imaging Data X ray CT MRI Ultrasound

Waveform Data ECG ICU Monitors

Clinical Text Data Notes Discharge Summaries Referral Letters

Laboratory and IVD Data Trend Analysis Abnormality Flags Panel Interpretation

Multi Modal Data Imaging Text Labs Claims - By Deployment Model (in Value %)

On Premise Hospital Data Center

Cloud UAE Region Sovereign Cloud

Edge Imaging Workstations Devices Remote Sites

Embedded in OEM Modalities

API Based Plug ins - By End-Use Industry (in Value %)

Government Provider Networks

Private Hospital Groups

Specialty Clinics and Diagnostic Centers

Payers and TPAs

Public Health and Screening Programs - By Region (in Value %)

Abu Dhabi

Dubai

Northern Emirates

- Competitive Landscape Structure

- Cross Comparison Parameters (UAE regulatory positioning, local clinical evidence strength, HIE and EMR integration readiness, data residency and PDPL compliance controls, model governance and MLOps maturity, cybersecurity posture, Arabic and English clinical NLP capability, compute footprint and latency fit)

- Competitive Benchmarking Matrix

- SWOT of Major Players

- Pricing and Commercial Terms Benchmarking

- Detailed Profiles of Major Companies

M42 G42 Healthcare

PureHealth

Injazat

GE HealthCare

Siemens Healthineers

Philips

Canon Medical Systems

Fujifilm Healthcare

Aidoc

Qure.ai

Lunit

Microsoft Azure AI Healthcare

NVIDIA Clara

Oracle Health

Epic

- Demand Hotspots by Facility Type

- Buyer Personas and Decision Roles

- Budget Ownership and Approval Thresholds

- Pain Point Mapping

- Implementation Playbooks

- Key Performance Indicator Framework

- By Value, 2025–2030

- By Volume Deployments Active Algorithms, 2025–2030

- By Average Contract Metrics, 2025–2030