Market Overview

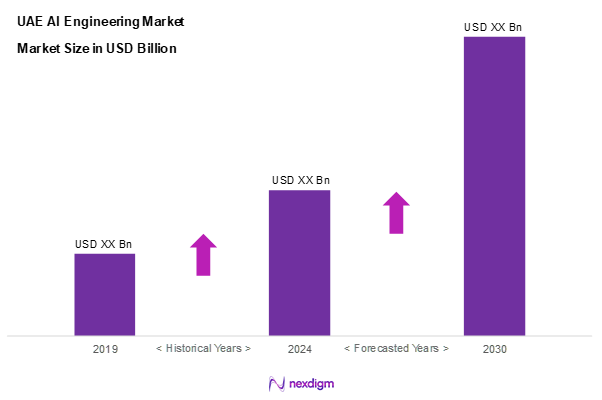

As of 2024, the UAE AI engineering market is valued at USD ~ billion, with a growing CAGR of 47.4% from 2024 to 2030. This market is chiefly driven by the government’s commitment to establishing the country as a global hub for AI technology, fostering innovation through significant investments, policies, and strategic frameworks. Additionally, growing demand for automation and smart solutions among businesses across various industries further propels the sector, underlining the pivotal role of AI in driving operational efficiencies and enhancing customer experiences.

Key cities contributing to the UAE AI engineering market include Dubai and Abu Dhabi. Dubai stands out due to its rapid advancements in technology, startup ecosystem, and extensive government support for AI initiatives, creating a conducive environment for innovation. Meanwhile, Abu Dhabi’s strategic investments in smart city projects and research institutions foster a robust AI landscape, attracting both local and international tech firms. This concentration of resources and talent in these cities facilitates accelerated market growth and operational efficiencies.

Market Segmentation

By AI Technology

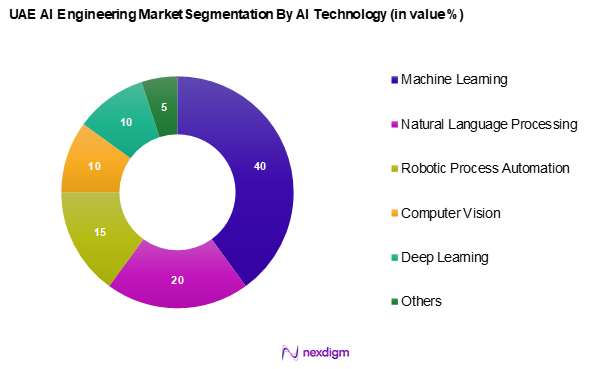

The UAE AI engineering market is segmented into machine learning, natural language processing, robotic process automation, computer vision, deep learning, and others. Among these, machine learning is the dominant segment due to its versatility and extensive applications across industries ranging from finance to healthcare. Organizations are increasingly harnessing machine learning algorithms for predictive analytics, thereby driving efficiency and enabling data-driven decision-making. This segment’s ability to evolve and adapt to diverse industry needs further solidifies its leading position within the overall AI technology landscape in the UAE.

By End-User Industry

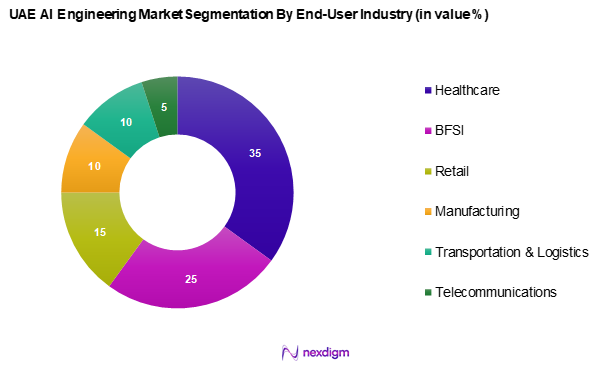

The UAE AI engineering market is segmented into healthcare, BFSI (Banking, Financial Services, and Insurance), retail, manufacturing, transportation & logistics, telecommunications, and others. The healthcare sector leads this segmentation, propelled by increased demand for automated diagnostic tools, patient data analytics, and operation optimizations. Advancements in AI technologies facilitate improved patient care, operational efficiencies, and decision-making processes, making AI integration a crucial element in modern healthcare strategies in the UAE.

Competitive Landscape

The UAE AI engineering market is dominated by major players, including global tech leaders and specialized firms. This consolidation emphasizes the significant influence of these key companies, as they harness advanced resources and innovation strategies to capture market opportunities effectively.

| Company Name | Establishment Year | Headquarters | AI Technology Focus | Market Strategies | Revenue (2024) | Number of Projects |

| IBM | 1911 | New York, U.S.A. | – | – | – | – |

| Microsoft | 1975 | Washington, U.S.A. | – | – | – | – |

| Oracle | 1977 | Texas, U.S.A. | – | – | – | – |

| Accenture | 1989 | Dublin, Ireland | – | – | – | – |

| Amazon Web Services | 2006 | Washington, U.S.A. | – | – | – | – |

UAE AI Engineering Market Analysis

Growth Drivers

Increasing Adoption of Smart Technologies

The UAE is at the forefront of adopting smart technologies, a trend underscored by its Vision 2021 initiative, which aims to enhance the quality of life through innovation. By 2023, the UAE’s smart technology adoption rate in business has reached approximately 85%, in such sectors as healthcare and transportation. This extensive integration is facilitated by investments from both the public and private sectors that exceeded USD 1.5 billion in 2022. The implementation of Internet of Things (IoT) solutions across infrastructure projects is notably fuelling this growth. The UAE’s population is projected to reach around 9.4 million by 2025, further boosting demand for smart technology solutions.

Investment in AI by Government and Private Sector

The UAE government is heavily investing in artificial intelligence, with plans to allocate around USD 2 billion in AI research and development by 2025. This initiative is part of the country’s broader strategy to diversify its economy and reduce dependency on oil. The government has also established AI partnerships with major tech firms, driving innovation across diverse industries. Furthermore, the private sector’s investments are expected to reach USD 1.7 billion, facilitating the deployment of AI solutions tailored to various industries including healthcare and finance. The growth in AI start-ups is indicative of this robust investment ecosystem.

Market Challenges

Skills Gap and Talent Shortage

A pervasive skills gap in the UAE significantly hinders the advancement of AI technologies. As of 2023, approximately 70% of UAE companies reported difficulty in finding skilled candidates with the necessary AI expertise. On the global stage, the World Economic Forum anticipates that 97 million new jobs will emerge due to a shift in labor towards technology sectors by 2025. The demand for AI specialists is particularly high, with vacancies expected to grow by 43% over the next three years. Consequently, initiatives to advance AI literacy and workforce training are crucial for overcoming these challenges.

High Implementation Costs

The financial barriers associated with implementing AI technologies pose a significant challenge in the UAE. The investment required for AI infrastructure, including hardware and software, is notably high, estimated to reach USD 1.2 billion by 2025. Moreover, ongoing operational costs for AI systems, which include maintenance and updates, further strain financial resources—particularly for small and medium enterprises. This cost concern creates reluctance among businesses to adopt AI solutions, with 60% expressing hesitance due to anticipated ROI challenges in 2023.

Opportunities

Expansion in Smart Cities

The ongoing expansion of smart city initiatives presents a significant growth opportunity for the UAE AI engineering market. By 2023, the government has committed over USD 3 billion towards smart city projects across various emirates. These projects aim to improve urban infrastructure and services through AI technologies such as real-time data analytics and IoT frameworks. The UAE aims to develop more than 30 smart cities by 2025, which will require comprehensive AI solutions to enhance security, traffic management, and energy efficiency, thereby creating a conducive environment for AI growth.

Growth of AI Start-ups

The rise of AI start-ups in the UAE showcases the vibrant entrepreneurial ecosystem that fosters innovation. As of 2023, more than 200 AI start-ups have emerged, collectively attracting approximately USD 1 billion in funding. This trend is bolstered by the supportive regulatory framework and initiatives like the Dubai Future Foundation, promoting research and entrepreneurship in AI. The growing number of AI-focused incubators and accelerators indicates a healthy competitive landscape, encouraging continuous innovation and collaboration that could drive further advancements in the market.

Future Outlook

Over the next five years, the UAE AI engineering market is expected to witness substantial growth driven by ongoing government investments in technology infrastructure, increasing integration of AI across various sectors, and the rising popularity of automation technologies. As businesses continue to seek efficiencies and innovative solutions, the market is poised for resilient development, reflecting global trends in AI adoption and application.

Major Players

- IBM

- Microsoft

- Oracle

- Accenture

- Amazon Web Services

- Alphabet (Google)

- Infosys

- Deloitte

- SAP

- PwC

- Huawei

- NVIDIA

- Intel

- Fujitsu

- OpenAI

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (UAE Ministry of Artificial Intelligence)

- Technology Start-ups

- Healthcare Institutions

- Financial Institutions (Banks)

- Retail Corporations

- Transportation and Logistics Firms

- Telecommunication Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the UAE AI engineering market. This process utilizes both secondary and proprietary databases to compile comprehensive industry-level insights. The primary aim is to identify and delineate the critical variables influencing the dynamics of the market.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the UAE AI engineering market will be compiled and analyzed. This will include examining market penetration, the ratio of technology adopters to service providers, and revenue generation outcomes. An assessment of service quality indicators will also be conducted to ensure accuracy in revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through in-depth consultations via computer-assisted telephone interviews (CATI) with industry experts from diverse company types. These consultations will provide dynamic operational and financial insights directly from industry practitioners, which will be invaluable in refining the market data.

Step 4: Research Synthesis and Final Output

The final phase will involve direct engagements with several AI technology firms to gather detailed insights about product segments, sales performances, consumer preferences, and other key factors. This interaction is essential for verifying and complementing the statistics obtained from the bottom-up approach, ensuring a comprehensive and validated overview of the UAE AI engineering market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Adoption of Smart Technologies

Investment in AI by Government and Private Sector - Market Challenges

Skills Gap and Talent Shortage

High Implementation Costs - Opportunities

Expansion in Smart Cities

Growth of AI Start-ups - Trends

Rise of AI Ethics and Governance Models

Increased Focus on Explainable AI - Government Regulation

AI Standards and Compliance

Data Protection Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Average Project Size, 2019-2024

- By AI Technology, (In Value %)

Machine Learning

Natural Language Processing

Robotic Process Automation

Computer Vision

Deep Learning

Others - By End-User Industry, (In Value %)

Healthcare

BFSI

Retail

Manufacturing

Transportation & Logistics

Telecommunications

Others - By Deployment Model, (In Value %)

On-Premises

Cloud-Based

Hybrid - By Region, (In Value %)

Dubai

Abu Dhabi

Sharjah

Ras Al Khaimah

Others - By Enterprise Size, (In Value %)

Small and Medium Enterprises (SMEs)

Large Enterprises

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of AI Technology Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of AI Projects, Distribution Channels, Research and Development Investments, Unique Value Offerings)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

IBM

Alphabet

Microsoft

Oracle

Accenture

PwC

Infosys

Deloitte

SAP

Amazon Web Services

Huawei

NVIDIA

Intel

Fujitsu

OpenAI

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Average Project Size, 2025-2030