Market Overview

The UAE AI in Clinical Decision Support Market is valued at USD ~ billion, based on a five-year historical analysis published via a UAE clinical AI decision support market dataset. The market’s scale is underpinned by broad national AI investment momentum—the UAE artificial intelligence market is estimated at USD ~ billion and is expected to reach USD ~ billion, strengthening compute capacity, cloud availability, and enterprise adoption readiness that directly enables hospital-grade clinical AI deployments.

Within the UAE, Abu Dhabi and Dubai dominate enterprise healthcare AI rollouts because they concentrate health-system scale, digital hospital maturity, and national AI infrastructure. Abu Dhabi benefits from the presence of sovereign-backed AI ecosystem builders and large public-provider footprints, enabling standardized deployments across multi-hospital networks and data-sharing programs. Dubai leads in private multi-specialty hospital density and care pathways requiring real-time decision support, reinforced by government programs accelerating AI adoption in the health system.

Market Segmentation

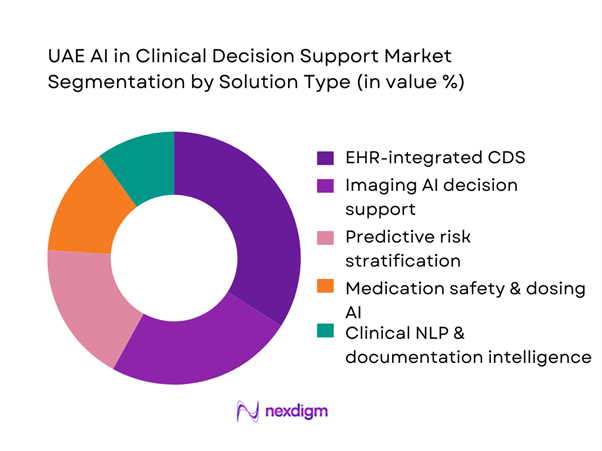

By Solution Type

UAE AI in Clinical Decision Support market is segmented by solution type into EHR-integrated CDS (orders/alerts/guidelines), Imaging AI decision support, Predictive risk stratification, Medication safety & dosing AI, and Clinical NLP/documentation intelligence. Recently, EHR-integrated CDS holds the dominant share because UAE hospitals prioritize AI that is embedded directly into clinician workflows (ordering, alerts, clinical pathways) rather than standalone dashboards. As large providers standardize EHR environments, integrated CDS accelerates adoption via lower switching cost, better auditability, and measurable reductions in preventable events. It also aligns with regulatory expectations for traceability and clinical governance: clinicians can see decision prompts at the point of care, while CMIO/CQI teams can monitor adherence, override rates, and clinical protocol compliance. This “workflow-native” advantage sustains higher renewal rates and expands through add-on modules across specialties (ED triage, ICU deterioration, sepsis bundles, oncology pathways, antimicrobial stewardship).

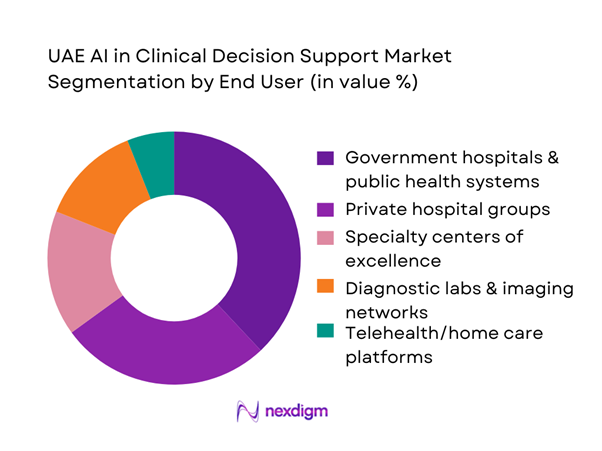

By End User

UAE AI in Clinical Decision Support market is segmented by end user into Government hospitals & public health systems, Private hospital groups, Specialty centers of excellence, Diagnostic labs & imaging networks, and Telehealth/home care platforms. Recently, government hospitals & public health systems dominate because they control large multi-facility patient volumes, centralized procurement, and system-wide standardization of clinical pathways. Their scale makes AI CDS ROI more visible through reduced length of stay variation, protocol adherence, and earlier risk detection across a broad population base. Public systems also tend to have structured governance (clinical safety committees, HTA-style evaluations, audit trails) that matches the operational requirements of clinical AI deployments. Once a model is validated in one flagship facility, it can be rolled out across sister hospitals and linked clinics through unified EHR/hospital information environments. This “single-buyer, multi-site expansion” dynamic results in higher contract values and faster replication than fragmented single-site deployments.

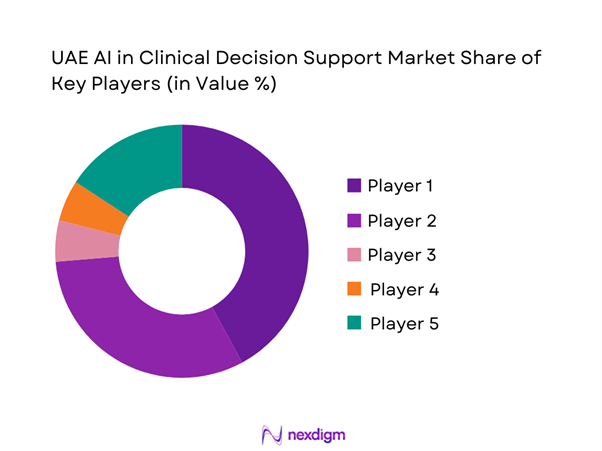

Competitive Landscape

The UAE AI in Clinical Decision Support market shows consolidation around global clinical platforms (EHR-integrated CDS + imaging AI) and hyperscaler ecosystems, with local execution driven by UAE health-system scale and national AI infrastructure. Global vendors win through interoperability, safety tooling, and embedded workflow modules; imaging AI specialists compete on time-to-diagnosis, triage prioritization, and modality coverage; and cloud/compute ecosystems influence procurement through hosting, security, and sovereign-cloud alignment. UAE adoption is further supported by government-led acceleration of AI uptake in healthcare and the country’s broader AI infrastructure buildout.

| Company | Est. Year | HQ | UAE delivery model | Primary CDS focus | Integration surface | Clinical validation approach | Data governance posture | Typical buyer fit |

| Oracle Health (Cerner) | 1979 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Epic Systems | 1979 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

UAE AI in Clinical Decision Support Market Analysis

Growth Drivers

Rising Clinical Workload and Physician Shortages

UAE hospitals are operating under mounting service load while workforce expansion remains a constant constraint at the point of care. In Dubai alone, the number of licensed doctors reached ~, reflecting the scale of demand concentration in the country’s busiest clinical hub and the pressure on physician time for triage, ordering, and escalation decisions. At a national level, the UAE recorded GDP of USD ~ billion and GDP per capita of USD ~, which supports sustained public and private healthcare investment capacity, but it also raises patient expectations for faster, safer, evidence-backed decisions. Clinical decision support (CDS) AI becomes a practical response: it reduces “search time” during consults, standardizes high-frequency decisions (sepsis flags, anticoagulant checks, imaging triage), and helps stretch scarce specialist attention across larger caseloads without compromising governance. The macroeconomic context matters because high-income systems tend to expand advanced diagnostics and specialty pathways, which increases decision complexity (more imaging studies, polypharmacy, chronic comorbidities) and intensifies alert/triage burden—exactly where AI-enabled CDS is deployed to compress time-to-decision and reduce preventable variations in care.

National Digital Health and AI Mandates

The UAE’s health system has been building the national digital rails required for CDS AI to scale—most importantly, large health information exchange datasets that enable longitudinal decisioning across providers. In Dubai, the DHA reported that the NABIDH platform holds ~ medical records and includes ~ healthcare facilities, signaling a high-volume clinical data backbone that can support AI prompts, medication safety checks, and care-pathway standardization at the point of care. In Abu Dhabi, the emirate’s HIE backbone is also scaling rapidly, with Malaffi reporting ~ clinical records, creating a longitudinal dataset environment suited for risk stratification and event prediction workflows (readmission risk, deterioration risk, and chronic program adherence). This mandate-driven digitization is reinforced by the UAE’s macro position—GDP of USD ~ billion—which supports the infrastructure spend required for interoperability, cybersecurity, and compute availability. In practical terms, the “mandate effect” is that hospitals are increasingly expected to participate in data exchange environments, and once data is structured and exchangeable, CDS AI can be embedded inside workflows (ED triage, ICU escalation, oncology pathways) with governance controls and audit trails.

Challenges

Clinical Validation and Algorithm Bias Risk

Clinical AI must prove safety, reliability, and generalizability across real-world patient diversity, comorbidity profiles, and practice patterns—especially in high-stakes workflows (ED triage, ICU deterioration alerts, oncology treatment support). The UAE’s chronic burden raises the validation bar: reports indicate ~ adults with diabetes, and ~ new cancer cases, both of which create complex decision environments where false positives and missed-risk alerts can have immediate clinical consequences. The UAE’s national income position (GDP per capita USD ~) also increases expectations for medical quality and governance, typically translating into stricter clinical oversight and demand for documented evidence. Bias risk intensifies when models are trained on incomplete or non-representative datasets; hence, validation increasingly requires local data benchmarking, continuous monitoring, and transparent explainability. In practice, hospitals demand performance evidence in local workflows, documented model update policies, and audit logs for clinical governance committees. Without this, deployments stall at pilot stage even when the technology is available, because the operational risk of “unverified recommendations” is unacceptable in regulated clinical environments.

Data Interoperability with Legacy HIS and EHRs

Interoperability is a structural challenge because UAE healthcare is distributed across multiple licensing bodies and provider networks, with mixed generations of HIS/EHR and imaging stacks. The scale of Dubai’s operating environment shows the integration burden: ~ licensed healthcare facilities and ~ hospitals exist within Dubai alone, and NABIDH includes ~ facilities, indicating how many endpoints may need standardized interfaces, terminology alignment, and secure data exchange to make AI CDS consistent across encounters. Abu Dhabi’s Malaffi reporting ~ clinical records underscores the volume of longitudinal history that must be cleanly mapped to avoid “garbage-in, garbage-out” decision prompts. The macro context (GDP per capita USD ~) supports investment capacity, but it does not eliminate the reality that legacy systems remain embedded and upgrades are staged over time. As a result, AI CDS projects often face extended integration timelines: data normalization, vocabulary mapping, event-time reconciliation, and clinical workflow embedding inside order entry or radiology worklists. These become gating factors more often than the AI model itself.

Opportunities

AI-Driven Precision Medicine Enablement

Precision medicine becomes a high-potential growth lane for UAE clinical decision support because it expands the “data types” available for decisioning—from encounters and labs to genomics and longitudinal risk profiles. Abu Dhabi’s genomics efforts are now materially large, with ~ genomes sequenced, creating a clinically meaningful dataset that can be combined with health records to improve risk stratification, pharmacogenomic decision support, and earlier detection of high-burden diseases. This opportunity is reinforced by current chronic load, with ~ adults living with diabetes and ~ new cancer cases, both areas where individualized risk scoring and pathway selection can reduce complications and variation. The macro environment supports the compute and governance needed (GDP of USD ~ billion). The near-term opportunity for CDS vendors is not “future hype”; it is present-day readiness: hospitals can start with targeted decision workflows (oncology therapy support, cardiometabolic risk scoring, adverse drug reaction flags) and expand as clinical governance teams validate performance on UAE datasets.

National-Scale Clinical AI Platforms

The UAE is structurally positioned to move from isolated AI pilots to national-scale CDS platforms because the country already operates large clinical data rails across emirate-wide ecosystems. Dubai’s NABIDH reports ~ medical records across ~ facilities, and Abu Dhabi’s Malaffi reports ~ clinical records, a scale that enables cross-provider longitudinal decision support, population risk registries, and standardized care pathway enforcement. The immediate commercial opportunity is platformization: vendors that can deploy CDS modules “once” and scale across multiple hospitals, clinics, and diagnostic endpoints gain disproportionate growth because governance, hosting, and integration investments are amortized across many sites. The macroeconomic environment (GDP of USD ~ billion) supports the infrastructure needed for secure compute, interoperability, and continuous model monitoring. Importantly, the opportunity is anchored in current operational reality: providers already manage exchange-connected patient flows, so AI that can operate inside exchange-enabled workflows (ED triage, medication safety, imaging prioritization, chronic program adherence) can scale faster than standalone tools, provided it meets auditability and localization requirements.

Future Outlook

Over the next five years, the UAE AI in Clinical Decision Support market is expected to expand as hospitals move from pilot models to scaled, governance-led deployments integrated into EHR and imaging workflows. Growth will be reinforced by stronger compute availability, sovereign-aligned cloud capacity, and national AI ecosystem investments supporting clinical-grade deployment readiness. In parallel, providers will prioritize explainability, auditability, and safety monitoring to satisfy clinical governance and data protection expectations, shifting vendor selection toward platforms that can prove real-world performance and operational integration.

Major Players

- Oracle Health

- Epic Systems

- Philips

- Siemens Healthineers

- GE HealthCare

- Microsoft

- Google Health

- NVIDIA

- IBM / Merative

- Aidoc

- Viz.ai

- Tempus

- Qure.ai

- Nuance

Key Target Audience

- Government and regulatory bodies

- Investments and venture capitalist firms

- Hospital group CEOs / Strategy heads

- Chief Medical Information Officers (CMIO) / Clinical Informatics leadership

- Chief Information Officers (CIO) / Digital transformation leadership

- Healthcare payers and insurers

- Diagnostic & imaging network operators

- Cloud / data-center / sovereign hosting decision-makers supporting healthcare workloads

Research Methodology

Step 1: Identification of Key Variables

We build a UAE clinical AI ecosystem map covering providers, payers, regulators, EHR stacks, imaging platforms, and AI vendors. Secondary research is used to identify decision workflows (ED triage, ICU, oncology, radiology) and the variables that drive adoption—interoperability, governance, and hosting constraints.

Step 2: Market Analysis and Construction

We compile historical commercialization signals and procurement patterns across government and private systems. The model is constructed using bottom-up adoption nodes (hospital networks, imaging chains) and validated against platform deployment footprints and module-level revenue mapping.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through structured interviews with CMIOs, radiology heads, clinical governance leaders, and health IT implementers. These discussions refine assumptions on decision-support utilization, model monitoring requirements, and integration costs across EHR and PACS/RIS environments.

Step 4: Research Synthesis and Final Output

Findings are triangulated across vendor capability benchmarking, deployment case patterns, and stakeholder feedback. Final outputs include segmentation splits, competitive positioning, and buyer-oriented recommendations emphasizing clinical safety, explainability, auditability, and deployment scalability.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Clinical AI Scope Delineation, Abbreviations, Market Sizing Logic, Bottom-Up Model Using Hospital Adoption Nodes, Top-Down Digital Health Budget Mapping, Primary Interviews with Hospital CIOs/CMIOs, AI Vendors and Regulators, Secondary Validation Sources, Data Triangulation, Assumptions and Limitations)

- Definition and Scope

- Market Genesis and Evolution of AI-Driven Clinical Decisioning

- Timeline of AI Adoption Across Public and Private Healthcare Systems

- Clinical Decision Pathway Integration Landscape

- AI Healthcare Value Chain and Data Flow Architecture

- Growth Drivers

Rising Clinical Workload and Physician Shortages

National Digital Health and AI Mandates

High Burden of Chronic and Complex Diseases

Demand for Evidence-Based and Standardized Care

Expansion of Smart Hospitals and Paperless Care Models - Challenges

Clinical Validation and Algorithm Bias Risk

Data Interoperability with Legacy HIS and EHRs

Data Localization and Patient Privacy Compliance

AI Explainability and Physician Trust Barriers

Integration into Existing Clinical Workflows - Opportunities

AI-Driven Precision Medicine Enablement

National-Scale Clinical AI Platforms

Arabic Language Clinical NLP Development

Predictive AI for Preventive Healthcare Programs

AI-Enabled Remote and Virtual Care Decisioning - Trends

Shift from Assistive to Autonomous Decision Systems

Convergence of AI CDS with Remote Patient Monitoring

Embedded AI in EHR and Imaging Platforms

Outcomes-Based AI Contracting Models - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base by Deployed Clinical AI Systems, 2019–2024

- Service Revenue Mix by Clinical Workflow, 2019–2024

- By Fleet Type (in Value %)

Diagnostic Decision Support Systems

Predictive Risk Stratification Engines

Treatment Recommendation Engines

Clinical Workflow Optimization AI

Population Health Decision Platforms - By Application (in Value %)

Radiology and Imaging Interpretation

Oncology Treatment Pathway Optimization

Cardiology Risk Scoring and Alerts

Critical Care and ICU Decision Support

Emergency and Triage Decision Systems - By Technology Architecture (in Value %)

Machine Learning-Based Models

Deep Learning and Neural Networks

Natural Language Processing for Clinical Notes

Computer Vision for Imaging-Led Decisions

Hybrid and Ensemble AI Models - By Connectivity Type (in Value %)

On-Premise Hospital AI Systems

Private Cloud Deployments

Hybrid Cloud Architectures

Sovereign Cloud-Based AI Platforms - By End-Use Industry (in Value %)

Government Hospitals and Health Authorities

Private Hospital Chains

Specialty Clinics and Centers of Excellence

Diagnostic Laboratories and Imaging Centers

Academic Medical and Research Institutions - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

- Market Share Analysis by Revenue Contribution

- Cross Comparison Parameters (Clinical Accuracy and Validation Depth, AI Explainability Capability, EHR Integration Breadth, Data Localization Compliance, Model Training Dataset Diversity, Deployment Flexibility, Clinical Workflow Coverage, Total Cost of Ownership)

- SWOT Analysis of Major Players

- Pricing and Commercial Models Analysis

Subscription Models

Per-Bed Pricing Models

Per-Use Licensing Models

Outcome-Based Contracts - Detailed Profiles of Major Companies

Epic Systems

Oracle Health (Cerner)

Philips Healthcare

GE HealthCare

Siemens Healthineers

IBM Watson Health

Microsoft Azure Health AI

Google Health

NVIDIA Healthcare AI

Aidoc

Viz.ai

Tempus

Babylon Health

DeepMind Health

DXC Technology Healthcare

- Clinical Decision Demand and Utilization Patterns

- Budget Allocation and IT Spend Prioritization

- AI Procurement and Vendor Evaluation Criteria

- Pain Points in Clinical Decision-Making Processes

- Buying Journey and Adoption Lifecycle

- By Value, 2025–2030

- Installed Base by Deployed Clinical AI Systems, 2025–2030

- Service Revenue Mix by Clinical Workflow, 2025–2030