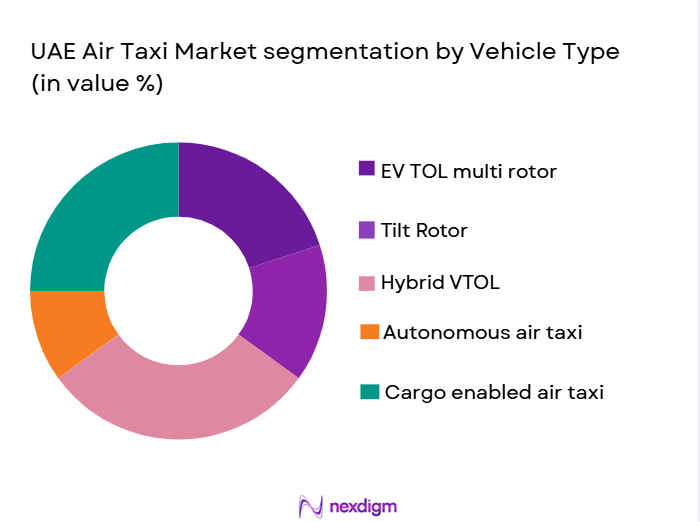

By Vehicle Types (In Value %)

- eVTOL multi-rotor (urban hops)

- Tilt-rotor (airport transfers)

- Hybrid-VTOL (intercity routes)

- Autonomous air taxis (future fleets)

- Cargo-enabled air taxis (last-mile logistics)

- Medical/emergency variants

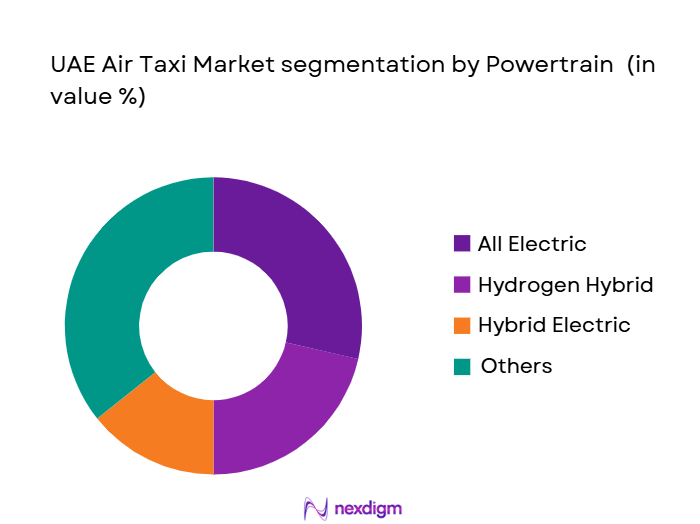

By Powertrain Types (In Value %)

- All-electric (zero-emission urban ops)

- Hybrid-electric (extended range)

- Hydrogen hybrid (long-term sustainability)

- Battery-dominant systems (short routes)

- Multi-energy systems (operational flexibility)

By Service Modes (In Value %)

- On-demand urban rides (city commuting)

- Airport shuttle services (scheduled links)

- Tourism air shuttles (sightseeing routes)

- Premium charter services (VIP travel)

- Emergency/medical services (air ambulance)

- Inter-emirate connectivity

By End-User Categories (In Value %)

- Private air taxi operators

- Government & public safety agencies

- Ride-sharing mobility platforms

- Tourism & hospitality providers

- Logistics & cargo integrators

- Corporate/business users

By Infrastructure Deployment (In Value %)

- Operational vertiports

- Vertiports under construction

- Planned vertiports

- Airport-integrated vertiports

- Rooftop/commercial vertiports

By Pricing Tiers (In Value %)

- Premium pricing (luxury users)

- Mass-market pricing (urban commuters)

- B2B pricing (enterprise contracts)

- Subscription models (frequent users)

- Dynamic pricing (peak demand)