Market Overview

The UAE Aircraft Avionics Market is valued at USD ~ billion in 2025, based on an in-depth analysis of the aviation industry and avionics sector dynamics. Growth is driven by the expansion of the UAE’s aviation infrastructure, including Emirates Airlines’ fleet modernization and the ongoing retrofit demand in both commercial and military aircraft. Moreover, the increasing trend of digital cockpit solutions and AI-powered systems has bolstered avionics demand, along with the growing focus on safety, communication, and surveillance technologies in aviation. As a result, the market is expected to witness significant growth over the next few years, supported by regional aviation policies and technological advancements.

The UAE’s aircraft avionics market is predominantly influenced by Dubai and Abu Dhabi. Dubai, being a global aviation hub with Emirates Airlines, is a major player, driving demand for high-performance avionics systems. Abu Dhabi, with Etihad Airways and its role in military aviation, adds to the market’s size. These cities benefit from a strategic location that connects global air traffic, substantial investments in aviation infrastructure, and government-backed initiatives like the Dubai Aviation City project. The government’s regulatory policies, including the General Civil Aviation Authority (GCAA) standards, also contribute to these cities’ dominance in the market.

Market Segmentation

By Avionics System Type

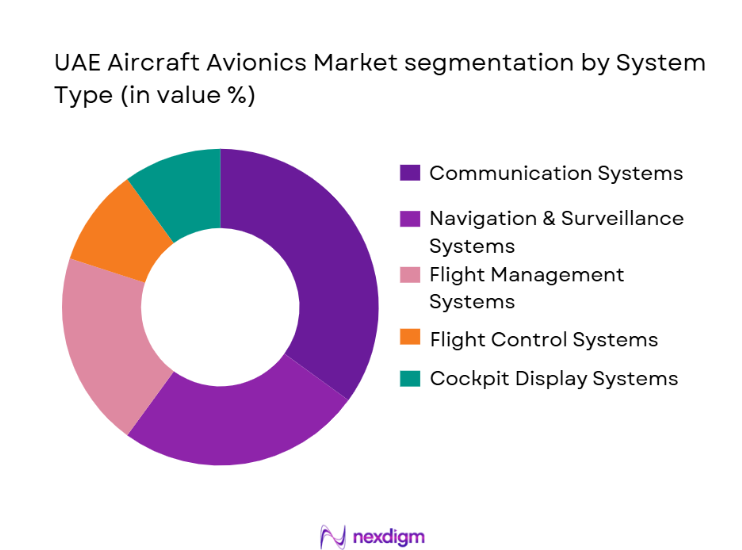

The UAE Aircraft Avionics Market is primarily segmented by avionics system type, including communication systems, navigation and surveillance systems, flight management systems, flight control systems, and cockpit display systems. Among these, communication systems dominate the market. The demand for advanced communication systems like satellite communication (SATCOM) and VHF systems has surged due to the region’s strategic geographical location and the rapid growth in air traffic. These systems enable enhanced safety and efficiency in both commercial and military aircraft. The region’s commitment to meeting ICAO and GCAA regulations further drives the need for sophisticated communication systems, solidifying their market dominance.

By Aircraft Platform

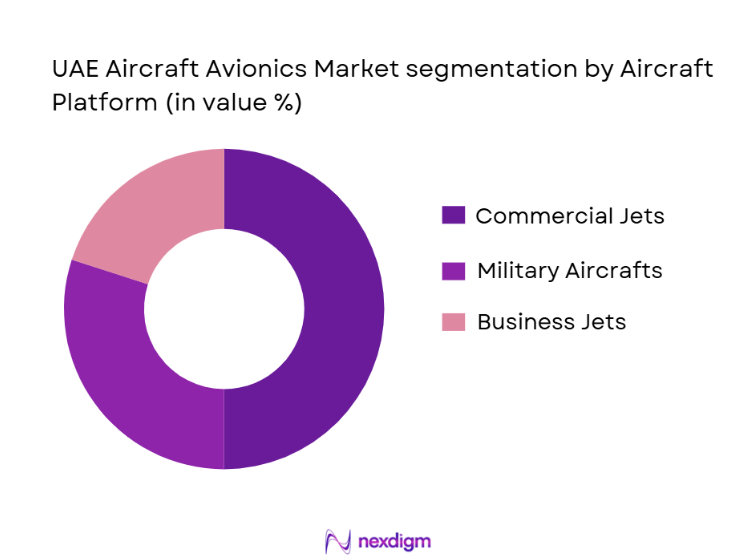

The market is segmented by aircraft platform into commercial jets, military aircraft, and business jets. Commercial jets dominate the market share. The UAE has one of the largest fleets of commercial aircraft in the Middle East, led by Emirates and Etihad Airways. The demand for avionics in commercial jets is driven by the need for aircraft fleet modernization, compliance with international aviation standards, and increasing air traffic. The UAE’s strategic location for long-haul flights further supports the demand for advanced avionics systems for navigation, communication, and safety in commercial aircraft.

Competitive Landscape

The UAE Aircraft Avionics Market is dominated by several global and regional players. The market landscape is highly consolidated, with major players like Honeywell Aerospace, Thales Group, and Collins Aerospace leading the market in terms of technological advancements, product portfolio, and regional presence. These companies are involved in providing integrated avionics systems and maintenance, repair, and overhaul (MRO) services, catering to the growing demand for advanced systems in commercial and military aircraft.

| Company | Establishment Year | Headquarters | Product Portfolio | R&D Investment | Market Focus | Partnerships | Revenue | Strategic Initiatives |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1939 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin International | 1989 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Aircraft Avionics Market Analysis

Growth Drivers

Fleet Modernization and Aircraft Retrofit Demand

The UAE’s aviation sector is witnessing a surge in demand for advanced avionics systems as airlines like Emirates and Etihad modernize their fleets. Retrofitting existing aircraft with next-gen avionics, such as digital cockpit systems, satellite communication (SATCOM), and enhanced navigation systems, is a major growth driver. This demand is fueled by airlines’ efforts to comply with international aviation standards and improve operational efficiency.

Government Support and Infrastructure Development

The UAE government’s ongoing investments in aviation infrastructure, such as the expansion of Dubai International Airport and Abu Dhabi International Airport, as well as its efforts to enhance air traffic control systems, significantly contribute to the growth of the aircraft avionics market. The government’s push for modernization and its support for technological adoption across both commercial and military aviation segments further boosts the market.

Market Challenges

High Capital and Maintenance Costs

The upfront investment required for advanced avionics systems is significant, posing a barrier for many smaller operators. Additionally, the maintenance and service costs associated with high-tech avionics systems, including regular updates and certifications, can be prohibitively expensive, limiting their widespread adoption in the region.

Regulatory Compliance and Certification Hurdles

Avionics systems in the UAE must meet strict regulatory requirements set by bodies like the General Civil Aviation Authority (GCAA) and international standards such as those from the International Civil Aviation Organization (ICAO). These certification processes can be lengthy and costly, presenting a challenge to manufacturers and suppliers trying to enter the market or update existing systems.

Opportunities

Integration of AI and IoT in Avionics Systems

The growing demand for autonomous flight systems and artificial intelligence (AI)-powered avionics offers a significant opportunity in the UAE market. Aircraft manufacturers and avionics providers can capitalize on the integration of AI for predictive maintenance, real-time data analytics, and automation, creating more efficient and cost-effective solutions.

Expansion of Military and Defense Aviation

The UAE’s defense sector is increasingly adopting advanced avionics solutions for military aircraft and unmanned aerial vehicles (UAVs). The demand for state-of-the-art surveillance, communication, and navigation systems in defense applications presents an opportunity for avionics suppliers to expand their market share in this high-growth segment, particularly in the face of increasing regional security concerns.

Future Outlook

Over the next five years, the UAE Aircraft Avionics Market is expected to show significant growth, driven by continuous advancements in avionics technology and the region’s expanding aviation industry. The demand for innovative avionics solutions like AI-powered flight management systems, next-generation communication systems, and autonomous flight systems will fuel market expansion. Furthermore, the UAE’s continued investment in both commercial and military aviation, along with the adoption of sustainable aviation practices, will continue to drive growth in the avionics sector.

Major Players

- Honeywell Aerospace

- Thales Group

- Collins Aerospace

- Raytheon Technologies

- Garmin International

- L3Harris Technologies

- Safran Electronics & Defense

- Boeing Avionics

- Airbus Avionics

- Rockwell Collins (Collins Aerospace)

- Rockwell Automation

- Universal Avionics Systems Corporation

- Leonardo S.p.A.

- General Electric Aviation

- Safran Electronics

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aviation Industry Manufacturers

- Airlines and Aircraft Operators

- Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

- Defense Ministries and Military Aviation Departments

- Aircraft System Integrators

- Air Navigation and Aviation Communication Service Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out key stakeholders and market variables within the UAE Aircraft Avionics Market. Data collection from secondary sources, such as government aviation regulations and industry reports, forms the foundation of understanding the aviation ecosystem in the UAE. The objective is to identify variables such as avionics system types, regulatory impacts, and growth drivers.

Step 2: Market Analysis and Construction

This phase involves an analysis of historical trends, focusing on the adoption of avionics in different aircraft platforms. The data is then used to segment the market into key categories such as system types, aircraft platforms, and procurement channels. Insights from industry participants are gathered to refine revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

To validate the data, consultations are conducted with experts from leading avionics firms, regulatory bodies, and aviation authorities. These consultations help verify the assumptions made in the initial stages and ensure the robustness of the findings.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the data collected from secondary sources and expert consultations to create a complete, verified market report. The output includes detailed market size, trends, and future projections, providing valuable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, UAE Aviation & Avionics Market Sizing Approach, Primary and Secondary Research Framework, Data Collection and Verification Protocol, Analytic Models and Forecast Methodology, Limitations and Research Validity Checks)

- Market Definition and Scope

- Avionics Value Chain & Stakeholder Ecosystem

- Regulatory and Certification Landscape (GCAA, ICAO Compliance)

- Aviation Sector Dynamics Affecting Avionics Demand

- Strategic Government Initiatives & Aviation Infrastructure Growth

- Growth Drivers

Increasing Air Traffic & Fleet Expansion (Passenger & Cargo)

Regulatory Push for ADSB & NextGen Avionics

Digital Cockpit & Autonomous Flight Technology Adoption

Airline Retrofit Demand for Fuel Efficiency & Safety - Market Challenges

High Capital Costs for Avionics Upgrades

Certification & Compliance Barriers

Limited Local Manufacturing & Components Sourcing - Market Opportunities

Smart Avionics Solutions Integrated with IoT/AI

Local Avionics Assembly & Component Partnerships

Defense Modernization & ISR Avionics Demand - Trends

Digital Cockpit & Glass Display Growth

Predictive Maintenance & HUMS Adoption

Sustainable Avionics Systems & Lightweight Components - UAE Aircraft Avionics Market EndUser Analysis

UAE Geographical Demand Analysis

EndUser Decision Framework

Budgeting & Procurement Cycles

Pain Point Analysis (Integration, Certification, Lifecycle Costs)

- By Market Value 2020-2025

- By Installed Avionics Units 2020-2025

- By Average Avionics System Price 2020-2025

- By Avionics System Complexity Tier 2020-2025

- By Avionics System Type (In Value%)

Flight Management Systems (FMS)

Navigation & Surveillance Systems (GNSS/ADSB)

Communication Systems (VHF/UHF SATCOM)

Flight Control & Autopilot Systems

Cockpit Display & HumanMachine Interface Systems

Power & Data Management Systems

Health & Usage Monitoring Systems (HUMS) - By Aircraft Platform (In Value%)

Commercial Jets & NarrowBody Aircraft

WideBody & LongRange Aircraft

Military FixedWing

Military RotaryWing

Business Jets & General Aviation - By Fitment Type (In Value%)

OEM LineFit Avionics

Aftermarket Retrofit & Upgrades

MRO & Service Contracts - By End User Segment (In Value%)

National Airlines & Flag Carriers

Defense & Government Aviation Units (UAE Air Force/ADSA)

Private Business Jet Operators

MRO Providers & Avionics Specialists - By Procurement Channel (In Value%)

Direct OEM Contracts

Systems Integrators

MRO/Aftermarket Suppliers

Leasing/Financing Arrangements

- Market Share Analysis

- CrossComparison Parameters (Company Overview, Avionics Product Portfolio Breadth, Regional Certifications & GCAA Approvals, Integration Capabilities, Aftermarket & Service Contracts, Strategic Partnerships & UAE Presence, R&D Investment Focus, Installed Base Growth Rate)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

Thales Group

Raytheon Technologies (RTX)

L3Harris Technologies

Garmin International

Rockwell Collins

Safran Electronics & Defense

Boeing Avionics (Integrated Systems)

Airbus Avionics Division

Collins Aerospace (UTC)

Elbit Systems (Avionics Solutions)

Leonardo S.p.A.

Universal Avionics Systems

Panasonic Avionics

Cobham Avionics Systems

- UAE Geographical Demand Analysis

- EndUser Decision Framework

- Budgeting & Procurement Cycles

- Pain Point Analysis (Integration, Certification, Lifecycle Costs)

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035