Market Overview

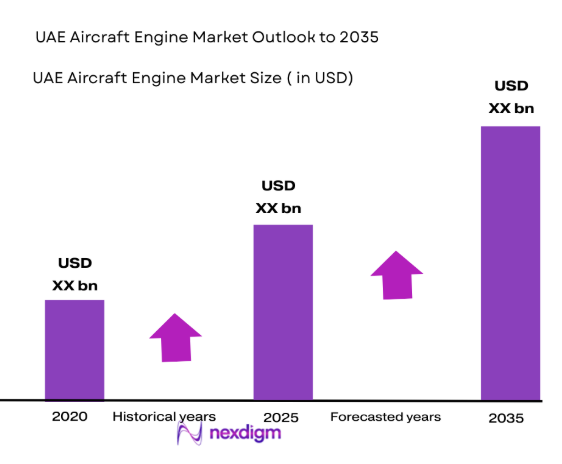

The UAE aircraft engine market is experiencing robust growth, driven by increasing demand in both the commercial and military sectors. The market size is expanding, with billions ~ USD being invested in new aircraft and engine technologies. This surge is fueled by advancements in aerospace engineering, rising air traffic, and the UAE’s strategic position as a key aviation hub in the Middle East. Global and regional investments in aircraft engine technologies, coupled with the ongoing growth of airline fleets, further contribute to the market’s expansion. The UAE stands as a leader in the aircraft engine market, primarily due to its rapidly developing aviation sector and state-of-the-art airport infrastructure. Major cities such as Dubai and Abu Dhabi are central to this dominance, supported by the UAE’s strategic initiatives, including significant investments in aerospace innovation. Additionally, the government’s vision for an advanced defense sector and its role in global aviation ensure the country’s continued prominence in the aircraft engine space, attracting both regional and international players.

Market Segmentation

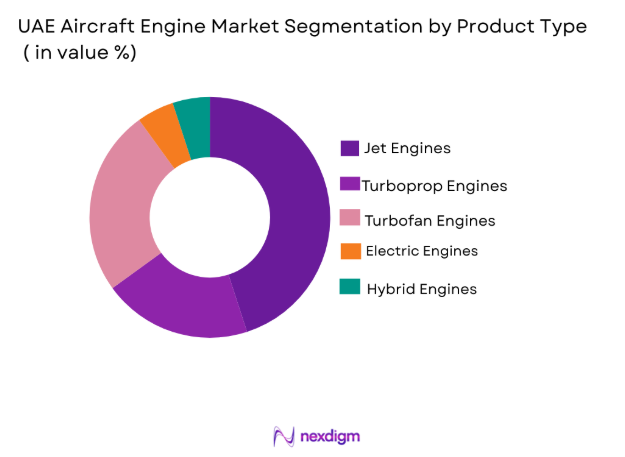

By Product Type:

UAE aircraft engine market is segmented by product type into jet engines, turboprop engines, turbofan engines, electric engines, and hybrid engines. Recently, jet engines have a dominant market share due to factors such as high demand from commercial airlines, technological advancements, and the UAE’s investment in large-scale aircraft projects. The preference for fuel-efficient, long-haul capabilities and advanced jet engine designs is driving this growth.

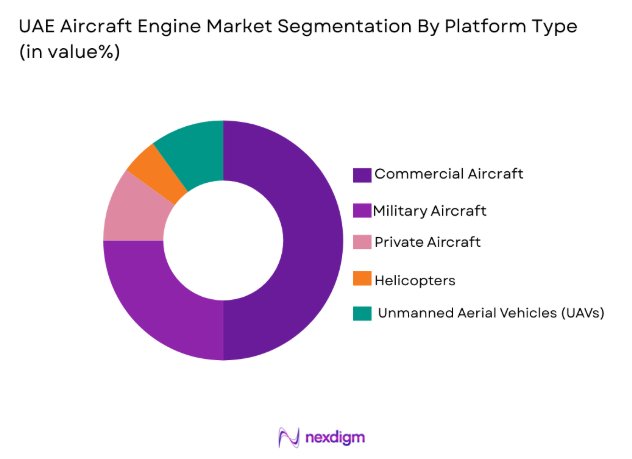

By Platform Type

UAE aircraft engine market is segmented by platform type into commercial aircraft, military aircraft, private aircraft, helicopters, and unmanned aerial vehicles (UAVs). Recently, commercial aircraft have a dominant market share due to increasing passenger demand, fleet expansion by major airlines, and the UAE’s growing role as a global aviation hub. The demand for efficient, long-haul aircraft engines is fueling this dominance, with commercial operators investing in next-generation engine technologies to meet sustainability goals.

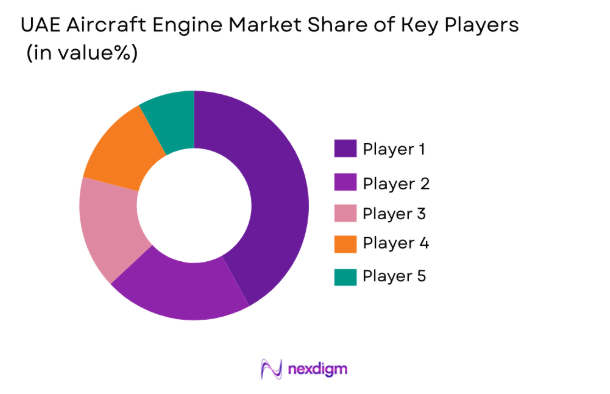

Competitive Landscape

The competitive landscape of the UAE aircraft engine market is characterized by a mix of global giants and regional players, with consolidation happening due to mergers, acquisitions, and partnerships. The market is highly influenced by key players that dominate technological advancements, manufacturing capacities, and supply chain management. These companies continue to innovate, particularly in terms of fuel efficiency and environmental sustainability, to maintain their competitive edge in a growing market.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) | Market-Specific Parameter |

| General Electric | 1892 | USA | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1904 | UK | ~ | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | USA | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

UAE Aircraft Engine Market Analysis

Growth Drivers

Technological Advancements in Aircraft Engine Design:

The demand for aircraft engines is significantly driven by the continuous advancements in engine technology, particularly in fuel efficiency and environmental performance. Engine manufacturers are investing heavily in developing new materials and technologies that reduce fuel consumption, emissions, and maintenance costs. This includes the integration of advanced composite materials, next-generation turbofan engines, and hybrid-electric propulsion systems. As the aviation industry seeks to meet global sustainability goals, more efficient engines have become a crucial area of focus. Not only does this improve environmental performance, but it also offers operators reduced operational costs, which drives demand in the commercial sector. In addition, innovations such as noise reduction technology and improved engine durability ensure that new aircraft engines perform better in terms of safety, efficiency, and environmental compliance. Consequently, aircraft operators, especially in the UAE, are increasingly adopting these advanced engine technologies, aligning with both global and regional regulatory standards.

Increasing Air Traffic and Fleet Expansion:

Another significant driver of the UAE aircraft engine market is the ongoing growth of air traffic and the expansion of airline fleets. As international travel continues to rise, the demand for new and more efficient aircraft engines increases, with airlines looking to modernize their fleets to meet passenger demands. The UAE, with its strategic geographical position and bustling hubs like Dubai and Abu Dhabi, sees substantial growth in both regional and international flights. Major airlines, such as Emirates and Etihad, are continuously expanding their fleet to include more fuel-efficient aircraft, which in turn drives the demand for modern aircraft engines. Additionally, the rapid growth of low-cost carriers and charter services also contributes to the growing demand for aircraft engines. This expansion is further supported by the UAE government’s emphasis on aviation infrastructure, contributing to a more competitive and dynamic market for aircraft engines.

Market Challenges

High Operational and Maintenance Costs:

One of the main challenges faced by the UAE aircraft engine market is the high operational and maintenance costs associated with advanced aircraft engines. As airlines and operators focus on increasing the efficiency of their fleets, the costs of maintaining and repairing high-performance engines can be significant. The complexity of modern engines, which include intricate systems of fuel efficiency technologies, turbines, and advanced materials, leads to higher maintenance requirements. Additionally, maintenance services often involve long lead times, specialized parts, and technical expertise, which can increase operational downtime for airlines. The need for regular, costly maintenance of advanced engines, coupled with the high price of spare parts and expert labor, represents a key challenge for operators. Despite the long-term benefits of lower fuel consumption, these high costs can discourage some smaller airlines and operators from adopting the latest engine technologies.

Stringent Environmental and Regulatory Standards:

Another major challenge in the UAE aircraft engine market is the stringent environmental and regulatory standards that manufacturers and operators must adhere to. With a global push towards reducing aviation’s carbon footprint, the aviation industry is facing increasing pressure from regulatory bodies to comply with emission reduction targets. This challenge is particularly significant for aircraft engine manufacturers, as they are required to develop engines that not only meet high-performance standards but also comply with international emissions standards. While the UAE has shown leadership in encouraging innovation, manufacturers in the region still face the task of meeting both local and international environmental regulations. Furthermore, the potential for new, more restrictive regulations can add uncertainty and additional costs to operations, particularly as manufacturers race to meet evolving emission standards and environmental goals. These factors make it difficult for both manufacturers and operators to predict future costs and market conditions.

Opportunities

Adoption of Hybrid and Electric Engine Technologies:

One of the most significant opportunities in the UAE aircraft engine market lies in the ongoing development and adoption of hybrid and electric engine technologies. As global environmental concerns increase, there is a growing demand for sustainable aviation solutions that reduce carbon emissions and fuel consumption. Hybrid-electric engines, which combine traditional jet engines with electric power systems, are seen as a viable solution to meeting sustainability targets without compromising operational efficiency. UAE-based companies and airlines are increasingly investing in the development of hybrid engines, with a focus on reducing the environmental impact of air travel. The UAE government has also shown strong support for green aviation initiatives, providing incentives for the adoption of cleaner technologies. This opportunity is expected to fuel innovation in the market, with hybrid and electric engines set to play a pivotal role in shaping the future of the UAE aviation industry. As a leader in technological advancements, the UAE is poised to become a hub for the development and deployment of these new propulsion technologies.

Growth in Military Aircraft Demand:

The rising demand for military aircraft is another significant opportunity for the UAE aircraft engine market. The UAE’s defense sector is rapidly expanding, driven by geopolitical factors and a desire to enhance national security. As the UAE invests in modernizing its military fleet, there is an increased demand for advanced aircraft engines that can support next-generation fighter jets, transport aircraft, and unmanned aerial vehicles (UAVs). The country’s military expansion and its strategic role in regional defense initiatives create an excellent opportunity for aircraft engine manufacturers to cater to this growing need. Moreover, the UAE’s strong defense partnerships with global powers, such as the United States and France, are facilitating the integration of cutting-edge engine technologies into the country’s military aircraft. This growing demand for military aircraft presents a lucrative opportunity for manufacturers and suppliers involved in the production and maintenance of aircraft engines. With continued investments and defense procurements, the military segment is expected to drive the market’s growth in the coming years.

Future Outlook

The future outlook for the UAE aircraft engine market is positive, with expected growth driven by advancements in engine technology, the expansion of air fleets, and increasing government support for the aerospace sector. Over the next five years, the market is anticipated to experience significant technological developments, particularly in hybrid and electric propulsion systems. As global sustainability goals continue to gain momentum, the demand for environmentally friendly engine solutions will increase, presenting opportunities for both manufacturers and operators. Additionally, with the UAE’s strategic position as an aviation hub, the growth of air traffic and military modernization programs will further fuel market demand, creating a thriving environment for the aerospace industry. The regulatory landscape is also expected to evolve, with policies supporting innovation and sustainability, further boosting market potential.

Major Players

- General Electric

- Rolls-Royce

- Pratt & Whitney

- Safran Aircraft Engines

- Honeywell Aerospace

- MTU Aero Engines

- GE Aviation

- United Technologies Corporation

- Lufthansa Technik

- Airbus S.A.S.

- Boeing

- CFM International

- International Aero Engines

- Embraer

- AeroVodochody

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Commercial airlines

- Aircraftmanufacturers

- Aircraft MRO service providers

- Military defense agencies

- Aerospacecomponentsuppliers

- Aviation technology firms

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying critical market factors, including technological trends, regulatory standards, and demand patterns, to understand the landscape.

Step 2: Market Analysis and Construction

The market is analyzed through data collection, historical market performance, and future growth projections, ensuring a comprehensive understanding.

Step 3: Hypothesis Validation and Expert Consultation

The identified hypotheses are validated by consulting with industry experts, stakeholders, and regulatory bodies to confirm assumptions.

Step 4: Research Synthesis and Final Output

The final output is synthesized from all gathered data, expert insights, and market analysis, culminating in a comprehensive report.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Air Travel in the UAE

Government Initiatives in Aerospace and Defense

Increasing Focus on Energy-Efficient Aircraft

Technological Advancements in Engine Design

Growing Demand for Military Aircraft - Market Challenges

High Operational and Maintenance Costs

Technological Integration in Legacy Systems

Stringent Environmental and Regulatory Standards

Long Development and Production Cycles

Competition from Global Aircraft Engine Manufacturers - Market Opportunities

Adoption of Hybrid and Electric Engine Technologies

Expansion of Regional Aviation Hubs

Growing Demand for Engine Maintenance Services - Trends

Shift Towards Green Aviation Technologies

Use of Artificial Intelligence in Engine Diagnostics

Increased Investment in Aircraft Fleet Modernization

Rising Demand for UAVs and Drones

Integration of Smart Technologies in Aircraft Engines - Government Regulations & Defense Policy

Aerospace Safety Regulations in the UAE

Sustainability and Carbon Emission Regulations

Defense Procurement Policies in the UAE - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Jet Engines

Turboprop Engines

Turbofan Engines

Electric Engines

Hybrid Engines - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Aircraft

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

MRO (Maintenance, Repair, and Overhaul)

Retrofit Solutions

Hybrid Fitments

Aftermarket Solutions - By EndUser Segment (In Value%)

Airlines

Military Forces

Private Aviation Companies

Cargo Operators

Aerospace & Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Third-Party Distributors

Online Bidding Platforms

Private Sector Procurement - By Material / Technology (In Value%)

Alloy Materials

Carbon Fiber Materials

Composite Materials

Additive Manufacturing Technology

Advanced Engine Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

General Electric

Rolls-Royce

Pratt & Whitney

Safran Aircraft Engines

Honeywell Aerospace

MTU Aero Engines

GE Aviation

United Technologies Corporation

Lufthansa Technik

Airbus S.A.S.

Boeing

CFM International

International Aero Engines

Embraer

Aero Vodochody

- Airlines’ Need for Cost-Effective and Efficient Engines

- Military Forces Seeking Advanced Engine Technologies

- Private Aviation Operators Increasing Fleet Sizes

- Aerospace and Defense Contractors Driving Innovation

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035