Market Overview

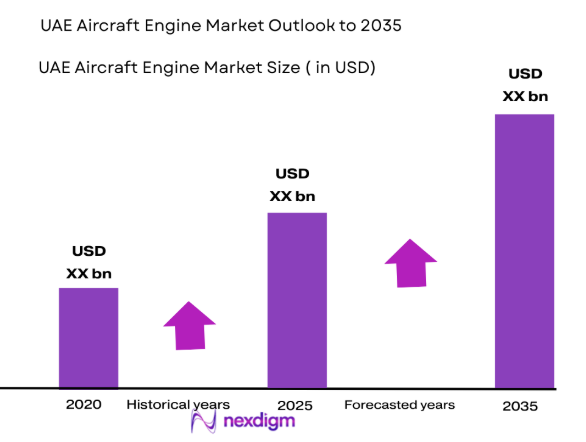

The UAE aircraft engine MRO market has experienced notable growth, driven by a significant increase in aviation traffic and the expansion of aircraft fleets across the region. This growth is also bolstered by technological advancements in engine maintenance and repairs, as well as the rising demand for fuel-efficient aircraft engines. Based on a recent historical assessment, the market size in 2024 is valued at approximately USD ~ billion, with continued investment in MRO services. The growing number of regional airports and aviation infrastructure upgrades contribute to this market’s robust expansion.

The UAE remains a dominant player in the Middle Eastern aviation industry due to its strategic location as a global aviation hub and the strong presence of airlines such as Emirates and Etihad Airways. The country’s extensive investment in its aviation sector and ongoing airport expansions, alongside its role as a major transit point for international travelers, strengthens its position in the global market. As the demand for aircraft maintenance services increases, particularly from commercial airlines and private operators, the UAE’s competitive advantage lies in its advanced MRO facilities and infrastructure.

Market Segmentation

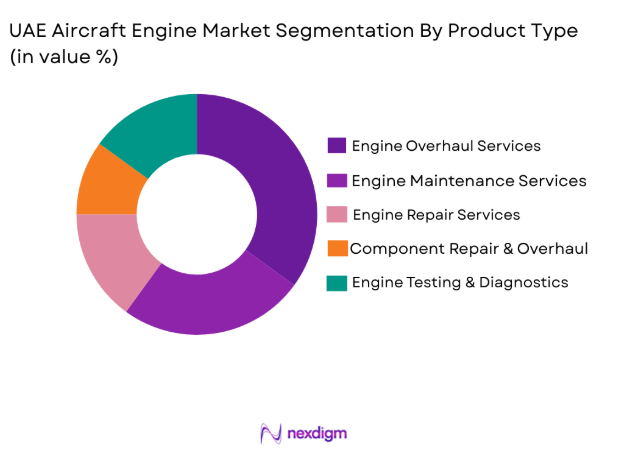

By Product Type:

The UAE aircraft engine MRO market is segmented by product type into engine overhaul services, engine maintenance services, engine repair services, component repair & overhaul, and engine testing & diagnostics. Recently, engine overhaul services have a dominant market share due to factors such as increasing fleet size, the complexity of modern engines, and the extended intervals between overhauls. The demand for engine overhauls is driven by the need to ensure aircraft safety and comply with international aviation standards, alongside the longer service lifespans of modern engines. This has led to a steady growth in the market for overhaul services, as aircraft operators and MRO service providers focus on maintaining optimal engine performance and longevity.

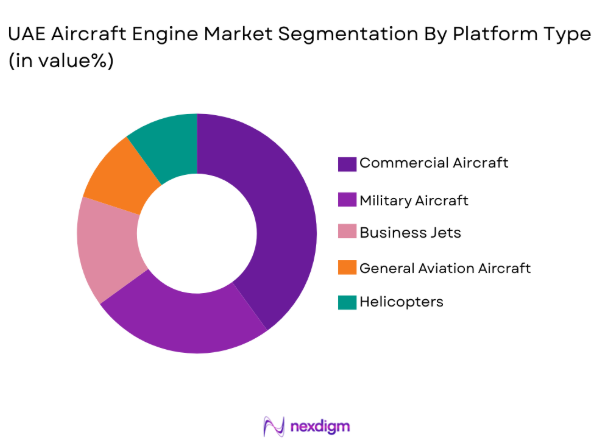

By Platform Type:

The UAE aircraft engine MRO market is segmented by platform type into commercial aircraft, military aircraft, business jets, general aviation aircraft, and helicopters. Recently, commercial aircraft has a dominant market share due to the rapid expansion of the airline industry in the UAE, with major airlines like Emirates and Etihad Airways continually increasing their fleets. The significant number of commercial aircraft in the region, driven by high demand for both domestic and international travel, has created a steady need for engine maintenance and overhaul services. As a result, MRO service providers in the UAE focus heavily on this segment, ensuring that commercial aircraft engines operate efficiently and safely, in line with global aviation standards.

Competitive Landscape

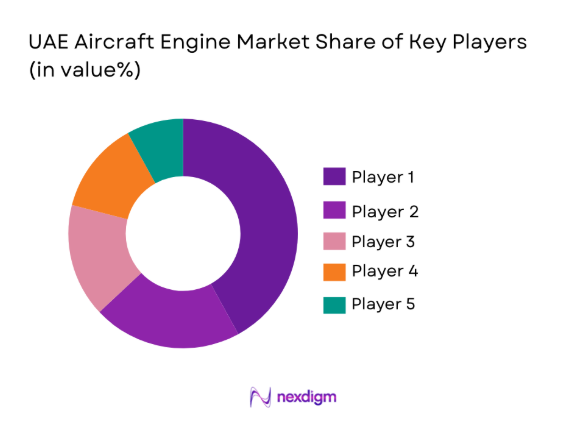

The UAE aircraft engine MRO market is characterized by a mix of global and regional players, contributing to a competitive landscape marked by consolidation and strong partnerships between service providers and airlines. Major players with established MRO facilities in the UAE benefit from the country’s strategic location, robust infrastructure, and access to a growing pool of customers. With the presence of key industry leaders, the market has seen increased mergers and collaborations to expand service capabilities and leverage technological innovations for enhanced engine maintenance.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | MRO Capabilities |

| Etihad Engineering | 2003 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1904 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Emirates Engineering | 1985 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1951 | Hamburg, Germany | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

UAE Aircraft Engine MRO Market Analysis

Growth Drivers

Increase in Aircraft Fleet Size:

The steady increase in the number of commercial and private aircraft in the UAE directly drives the demand for MRO services, particularly in engine maintenance and overhaul. With airlines such as Emirates expanding their fleets, there is an increasing need for maintenance services to keep engines running efficiently. This surge in fleet size is also accompanied by the introduction of newer, more complex engine technologies, which require specialized MRO services. The government’s continued investment in aviation infrastructure supports this trend, as airport and MRO facility expansions enable faster, more efficient services. The demand for comprehensive engine overhauls and repairs is fueled by the desire for operators to maintain the longevity and performance of their fleets. Furthermore, the competitive nature of the aviation sector in the UAE pushes airlines to ensure their aircraft are operationally ready and compliant with safety regulations, thus increasing the demand for high-quality MRO services.

Technological Advancements in MRO Services:

Advances in digitalization, predictive maintenance, and artificial intelligence have revolutionized the MRO services landscape. The ability to predict maintenance needs based on real-time data allows for more proactive and efficient engine servicing. The integration of AI and machine learning has made it possible to monitor engine health and detect issues before they lead to costly failures. This not only enhances the operational efficiency of airlines but also reduces downtime and costs associated with unexpected repairs. The adoption of 3D printing for manufacturing spare parts and the growing use of robotics in maintenance processes further streamline MRO operations. The ability to perform virtual inspections and diagnostics through digital tools is expanding the range of services available, thereby increasing the market’s growth potential. As these technologies become more widely adopted, they will continue to transform the MRO market by making operations more efficient and cost-effective.

Market Challenges

Skilled Labor Shortage:

One of the most significant challenges facing the UAE aircraft engine MRO market is the shortage of skilled labor. While the aviation sector continues to expand, the number of trained technicians capable of performing advanced engine repairs and overhauls remains limited. This shortage is exacerbated by the rapid technological advancements in engine systems, requiring MRO professionals to continuously update their skills. With the growing complexity of modern aircraft engines, the need for highly specialized labor is intensifying, leading to competition among MRO providers to attract and retain skilled workers. As the demand for MRO services rises, the challenge of meeting this demand with a skilled workforce becomes more pronounced. Additionally, the high cost of training and certification further hinders the availability of qualified technicians, creating a barrier to the growth of the MRO market. Addressing this skills gap is critical to ensuring the continued growth and sustainability of the UAE’s aircraft engine MRO market.

Economic Fluctuations:

Economic downturns and fluctuations in oil prices significantly impact the aviation industry, including the aircraft engine MRO market. The UAE’s reliance on oil exports makes it vulnerable to global price changes, which can directly affect airline profitability and, consequently, their investment in maintenance and overhaul services. During times of economic uncertainty, airlines may opt to delay or reduce the frequency of engine maintenance and overhaul services to cut costs, resulting in a decline in MRO market demand. While the aviation sector in the UAE is robust and resilient, external economic factors can cause a slowdown in the growth of the MRO market. Additionally, global events such as pandemics, political instability, or trade tensions can lead to reduced air travel, further limiting the demand for MRO services. The market must remain adaptable to mitigate these challenges, especially during periods of economic volatility.

Opportunities

Growth in Private Aviation:

The UAE’s private aviation sector has seen rapid expansion, driven by increasing demand for private jets and luxury aircraft. The growth in this segment offers significant opportunities for the aircraft engine MRO market. Private operators often require more frequent and specialized maintenance services, including engine overhauls, to ensure their aircraft remain in optimal condition. The rising number of high-net-worth individuals and corporate executives in the UAE fuels the demand for private aviation, which directly translates to an increase in MRO services for private aircraft. Furthermore, the government’s ongoing support for aviation infrastructure, including the development of new private terminals and hangars, creates a favorable environment for the growth of the MRO market. As more private aircraft are introduced to the region, the demand for comprehensive MRO services, including engine maintenance and repairs, is expected to rise, presenting lucrative opportunities for market players.

Investment in Sustainable Aviation Technologies:

As the UAE seeks to position itself as a leader in sustainability, the investment in green technologies and fuel-efficient engines presents a significant opportunity for the aircraft engine MRO market. The UAE’s commitment to reducing carbon emissions and advancing environmental technologies aligns with the growing demand for eco-friendly aircraft engines. MRO providers who specialize in the maintenance of these next-generation engines, including hybrid and electric propulsion systems, will benefit from this shift in the industry. As global regulations on emissions become stricter, the demand for engine maintenance and overhaul services that comply with environmental standards will increase. The introduction of new fuel-efficient engines also opens opportunities for MRO providers to expand their services to cater to these advanced technologies. By focusing on sustainability, MRO companies in the UAE can not only contribute to the country’s environmental goals but also capitalize on the growing demand for green aviation solutions.

Future Outlook

The UAE aircraft engine MRO market is expected to continue its upward trajectory over the next five years, driven by growing aviation demand and the expansion of both commercial and private aircraft fleets. Technological advancements in maintenance practices, particularly in predictive analytics and AI-driven solutions, will enhance efficiency and reduce operational costs. The market will also benefit from increased investments in MRO infrastructure, making the region a key hub for aircraft maintenance services. Government regulations supporting sustainability and innovation in the aviation sector will further spur growth, particularly with the development of eco-friendly engines and maintenance practices.

Major Players

- Etihad Engineering

- Rolls-Royce

- Emirates Engineering

- Lufthansa Technik

- Safran Aircraft Engines

- General Electric Aviation

- MTU Aero Engines

- Pratt & Whitney

- Boeing Global Services

- Honeywell Aerospace

- IAE (International Aero Engines)

- Air France Industries KLM Engineering & Maintenance

- Turkish Technic

- AeroVironment

- SIA Engineering Company

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and fleet operators

- Aircraft MRO service providers

- Private aviation companies

- Aircraft manufacturers

- Aviation infrastructure developers

- Airport operators

Research Methodology

Step 1: Identification of Key Variables

The identification of key market variables such as product types, end-user segments, and market trends, along with factors that influence the demand for MRO services in the UAE aircraft engine market, is the first step. These variables are essential for understanding the dynamics of the market.

Step 2: Market Analysis and Construction

A thorough analysis is conducted using primary and secondary research data to construct a clear market framework. This involves identifying trends, drivers, challenges, and segmentation data to build an accurate picture of the market’s current state.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted with industry leaders, stakeholders, and key players to validate hypotheses and gain insights into the most impactful factors driving or hindering the market’s growth.

Step 4: Research Synthesis and Final Output

The final output involves synthesizing all research findings into a comprehensive market report, which includes actionable insights, forecasts, and strategic recommendations for stakeholders in the UAE aircraft engine MRO market.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in air traffic and aircraft fleet size

Technological advancements in engine maintenance

Strong demand for cost-effective and efficient engine solutions

Rising investments in regional aviation infrastructure

Emerging trends in digitalization and automation for MRO services - Market Challenges

High operational costs in maintaining advanced engines

Skilled labor shortage and expertise gaps

Stringent regulatory compliance and certification requirements

Longer turnaround time for complex repairs

Vulnerability to economic fluctuations affecting aviation demand - Market Opportunities

Development of green engine technologies and fuel alternatives

Expansion of MRO facilities in key UAE airports

Growth in the private aviation sector driving MRO demand - Trends

Adoption of predictive maintenance technologies

Increased focus on engine performance optimization

Shift towards sustainable and eco-friendly MRO practices

Integration of AI and data analytics for maintenance processes

Growth of 3D printing in engine parts manufacturing - Government Regulations & Defense Policy

Aviation safety regulations and compliance standards

Subsidies and support for MRO businesses from the government

Export control policies and their impact on MRO operations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Engine Overhaul Services

Engine Maintenance Services

Engine Repair Services

Component Repair & Overhaul

Engine Testing & Diagnostics - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

General Aviation Aircraft

Helicopters - By Fitment Type (In Value%)

Line Maintenance

Base Maintenance

Heavy Maintenance

Component Level Maintenance

Overhaul & Modification - By EndUser Segment (In Value%)

Commercial Airlines

Private Operators

Military Operators

MRO Service Providers

OEMs (Original Equipment Manufacturers) - By Procurement Channel (In Value%)

Direct Procurement

Contractual Agreements

Third-party Suppliers

OEM Partners

Online Bidding Platforms - By Material / Technology (in Value%)

Advanced Composite Materials

Ceramic Matrix Composites

High-performance Alloys

Modular Engine Design

Fuel-efficient Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters [System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type]

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Etihad Engineering

Airbus MRO

Dubai Aerospace Enterprise

General Electric Aviation

Rolls-Royce

Pratt & Whitney

Boeing Global Services

Lufthansa Technik

Safran Aircraft Engines

MTU Aero Engines

Babcock International

Emirates Engineering

Mubadala Aerospace

Honeywell Aerospace

Leonardo Helicopters

- Increased demand for engine maintenance from regional airlines

- Growth of military aviation in the region driving demand for MRO services

- Private aviation market expansion increasing demand for maintenance

- Technological advances prompting MRO providers to adopt new systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035