Market Overview

The UAE aircraft MRO market has witnessed significant growth, driven by the expanding fleet of commercial and military aircraft in the region. This demand is fueled by the UAE’s role as a major aviation hub, with airports such as Dubai International leading the region in passenger traffic. The market size, based on recent historical assessments, is valued at approximately USD ~ billion, with growth driven by increasing air traffic, the expansion of low-cost carriers, and government initiatives supporting aviation infrastructure development. The demand for MRO services is closely linked to the rapid pace of fleet expansion, the adoption of newer technologies, and increased investments in airport facilities.

The UAE remains a dominant player in the aircraft MRO industry due to its strategic location as a global aviation center, supported by world-class airport infrastructure and strong government backing. Cities like Dubai and Abu Dhabi are central to this market’s growth, offering state-of-the-art MRO facilities that attract global airlines and private operators. Additionally, the UAE government’s focus on building a sustainable aviation ecosystem further solidifies its dominance. The nation’s investment in technological advancements and its thriving tourism and cargo sectors contribute to the increased demand for MRO services.

Market Segmentation

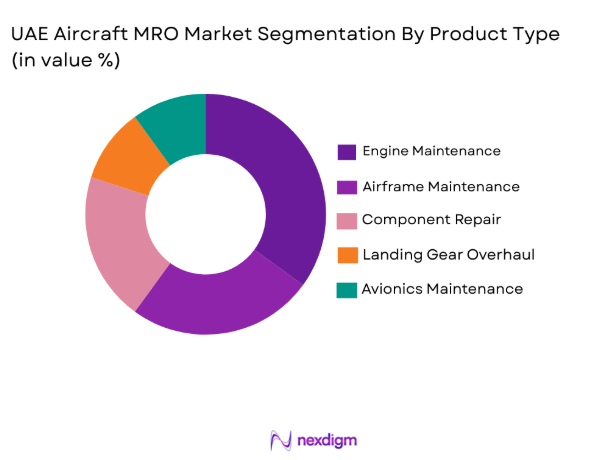

By Product Type:

The UAE aircraft MRO market is segmented by product type into engine maintenance, airframe maintenance, component repair, landing gear overhaul, and avionics maintenance. Engine maintenance has a dominant market share due to the region’s growing fleet of both commercial and private aircraft. This dominance is driven by the need for efficient and reliable engine performance to meet the increasing demands of long-haul flights and high-frequency air traffic. The importance of engine performance and the technological advancements in engine designs have resulted in significant investments in maintenance services.

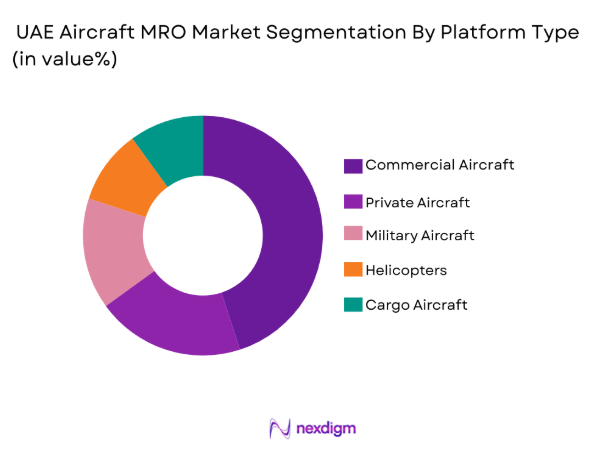

By Platform Type

The UAE aircraft MRO market is segmented by platform type into commercial aircraft, private aircraft, military aircraft, cargo aircraft, and helicopters. Commercial aircraft currently dominate the market share due to the high volume of both international and domestic flights operating out of UAE airports. The growth of major carriers such as Emirates and Etihad Airways, alongside the increasing number of low-cost carriers, has driven demand for regular MRO services. Additionally, the region’s strategic location as a global hub for air traffic further increases the reliance on commercial aircraft, which requires ongoing maintenance and support.

Competitive Landscape

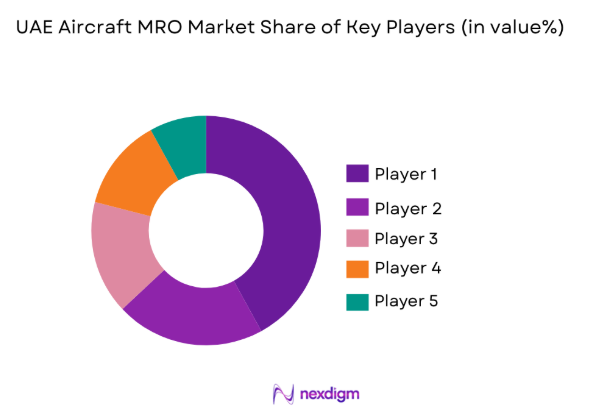

The UAE aircraft MRO market is highly competitive, with major players leveraging advanced technologies and service capabilities. Market consolidation is observed through strategic partnerships between local and international firms, allowing the expansion of service offerings and enhanced technological capacity. Leading players like Emirates Engineering, Etihad Airways Engineering, and Lufthansa Technik continue to influence the market through substantial investments in infrastructure and technological advancements. The competition is marked by players’ ability to provide cost-effective and high-quality MRO services, with a focus on minimizing aircraft downtime and improving service turnaround times.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Emirates Engineering | 1985 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ |

| Etihad Airways Engineering | 2000 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1951 | Frankfurt, Germany | ~ | ~ | ~ | ~ | ~ |

| SR Technics | 1931 | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ |

| AAR Corporation | 1955 | Wood Dale, USA | ~ | ~ | ~ | ~ | ~ |

UAE Aircraft MRO Market Analysis

Growth Drivers

Increased Air Traffic:

The rapid expansion of air travel in the UAE has been a major growth driver for the aircraft MRO market. The UAE has become a global aviation hub, with airlines such as Emirates and Etihad expanding their fleets to meet the growing demand for domestic and international flights. This growth in air traffic results in more frequent maintenance needs, driving the demand for MRO services. As airlines focus on maintaining aircraft safety and efficiency, the need for reliable MRO services becomes even more critical. With more aircraft in operation, there is also an increased requirement for comprehensive MRO services to ensure aircraft meet regulatory standards and operational readiness. The growth in low-cost carriers and the increased demand for long-haul flights further intensify the need for high-quality, efficient MRO solutions. Airlines are now looking for cost-effective yet technologically advanced solutions to handle their growing fleet sizes, pushing the MRO industry to innovate and improve its offerings. The UAE’s aviation infrastructure, including its airports and maintenance facilities, supports this surge in demand by attracting major players and creating a competitive environment.

Technological Advancements in MRO Services:

Another significant growth driver is the advancement in MRO technologies, particularly predictive maintenance and AI-driven diagnostics. The integration of artificial intelligence, machine learning, and data analytics into MRO services is revolutionizing the way aircraft maintenance is conducted. These technologies enable MRO providers to predict when components will need maintenance or replacement, reducing downtime and improving operational efficiency. The UAE, with its high focus on technological innovation, is quickly adopting these advancements, positioning the region as a leader in the MRO industry. The incorporation of drones, robotics, and 3D printing technologies further accelerates MRO service capabilities, enhancing the accuracy and speed of maintenance procedures. As a result, the market is witnessing an increased demand for technologically advanced MRO services that can deliver higher efficiency and cost savings. This trend also extends to non-invasive diagnostic methods and automated inspections, further reducing the reliance on manual labor and improving turnaround times.

Market Challenges

High Operational Costs:

One of the major challenges faced by the UAE aircraft MRO market is the high operational costs associated with maintenance services. The complexity of modern aircraft, along with the advanced technologies they incorporate, means that MRO providers must invest heavily in both equipment and expertise. As a result, the costs of maintenance services are higher than in other regions, which can deter some airlines, especially low-cost carriers, from utilizing local MRO services. Moreover, the price volatility of raw materials used in aircraft maintenance, such as composites and metals, can further escalate costs, making it challenging for MRO providers to remain competitive. The need for advanced training for technicians and continuous investment in new technologies adds another layer of financial burden. Additionally, the cost of regulatory compliance, which requires MRO providers to meet international safety and quality standards, can further increase expenses. While airlines recognize the value of high-quality MRO services, many are constantly seeking cost-effective solutions to keep maintenance costs under control without compromising safety.

Skilled Workforce Shortage:

Another significant challenge facing the UAE aircraft MRO market is the shortage of skilled technicians. As the demand for MRO services continues to rise, the need for highly trained personnel to handle advanced aircraft maintenance is critical. The rapid technological advancements in the aviation industry have made it increasingly difficult to find workers with the necessary expertise in new systems, including composite materials and AI-driven diagnostics. The UAE’s MRO sector competes with other regions that offer better pay or more advanced training programs, making it difficult to attract and retain talent. This shortage of skilled labor results in slower turnaround times and could impact the overall efficiency of MRO services. To address this, MRO companies are investing in training programs and collaborating with educational institutions, but the gap in workforce availability remains a challenge. The shortage also affects the ability of MRO providers to scale their operations, as they need sufficient human resources to handle the growing volume of maintenance tasks.

Opportunities

Growth in Sustainable Aviation:

The growing focus on sustainability in aviation presents a significant opportunity for the UAE aircraft MRO market. As global airlines strive to reduce their carbon footprint and increase operational efficiency, there is a rising demand for sustainable MRO practices. This includes the use of eco-friendly materials, waste reduction strategies, and fuel-efficient maintenance practices. The UAE, with its progressive stance on environmental issues, is poised to lead the way in adopting sustainable practices in aircraft maintenance. MRO providers that invest in green technologies, such as the use of biodegradable lubricants, recycling programs, and reducing energy consumption in maintenance facilities, are likely to attract environmentally conscious clients. Additionally, the adoption of electric aircraft and hybrid propulsion systems in the UAE will require specialized MRO services, providing further opportunities for growth. The government’s commitment to supporting sustainable aviation initiatives also presents a favorable regulatory environment for MRO providers looking to innovate and capture a share of the green aviation market.

Expanding Private and Business Aviation Sector:

Another opportunity lies in the expanding private and business aviation sector in the UAE. The country has become a leading destination for high-net-worth individuals seeking luxury travel experiences, fueling the demand for private jets and helicopters. As the fleet of private aircraft grows, so does the need for specialized MRO services. Private aircraft operators often require customized maintenance packages tailored to their specific needs, which presents a lucrative opportunity for MRO providers. The increasing adoption of business aviation for corporate travel and government-related activities in the UAE further contributes to this growth. As business aviation continues to expand, the demand for high-quality, quick-turnaround MRO services will rise, offering significant revenue potential for companies that specialize in this market segment. The availability of advanced MRO facilities and highly skilled technicians in the UAE enhances the country’s attractiveness as a hub for private aviation maintenance.

Future Outlook

The UAE aircraft MRO market is expected to experience steady growth over the next five years, driven by increased air traffic, technological advancements, and a strong focus on sustainability. The growing demand for private aviation and the continued expansion of the regional fleet will further fuel the need for comprehensive MRO services. Technological innovations such as AI-driven diagnostics, predictive maintenance, and sustainable practices will continue to shape the market, providing new opportunities for MRO providers. Additionally, the government’s commitment to expanding aviation infrastructure and supporting green technologies will create a favorable environment for the industry’s growth.

Major Players

- Airbus

- Boeing

- Emirates Engineering

- Etihad Airways Engineering

- Dubai Aerospace Enterprise

- Saudia Aerospace Engineering Industries

- Lufthansa Technik

- SR Technics

- AAR Corporation

- GE Aviation

- Rolls-Royce

- Honeywell Aerospace

- Turkish Technic

- Mubadala Investment Company

- Wings Aviation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airline operators

- Aircraft manufacturers

- Aviation technology firms

- MRO service providers

- Fleet operators

- Aviation infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

Identification of critical market drivers, challenges, and segmentation variables to guide the research.

Step 2: Market Analysis and Construction

Data collection from primary and secondary sources, constructing market size and trends based on current data.

Step 3: Hypothesis Validation and Expert Consultation

Engaging with industry experts to validate market assumptions and refine hypotheses.

Step 4: Research Synthesis and Final Output

Synthesis of gathered data to create a comprehensive and actionable market report.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growth in Regional Air Traffic

Increased Aircraft Fleet in the Region

Government Investments in Aviation Infrastructure

Technological Advancements in Maintenance Practices

Expansion of Low-Cost Carrier Networks - Market Challenges

High Costs of Aircraft Maintenance Services

Shortage of Skilled Technicians

Stringent Regulatory Standards

Dependency on Imported Spare Parts

Operational Complexity in Maintenance Scheduling - Market Opportunities

Investment in Green and Sustainable MRO Practices

Expansion of MRO Services for New Aircraft Models

Collaborations with International Airlines for Regional MRO Services - Trends

Increased Adoption of Predictive Maintenance

Rising Demand for Composite Material MRO Services

Growing Role of Artificial Intelligence in Diagnostics

Development of More Efficient Aircraft Components

Focus on Sustainability and Eco-friendly MRO Practices - Government Regulations & Defense Policy

Aviation Safety and Security Regulations

International Certification Requirements

Government Support for Domestic Aviation Manufacturing - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Engine Maintenance

Airframe Maintenance

Component Repair

Landing Gear Overhaul

Avionics Maintenance - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Military Aircraft

Cargo Aircraft

Helicopters - By Fitment Type (In Value%)

Scheduled Maintenance

Unscheduled Maintenance

Line Maintenance

Heavy Maintenance

Modification and Upgrades - By EndUser Segment (In Value%)

Airlines

Private Aviation Operators

Military

Cargo and Logistics Companies

Maintenance, Repair, and Overhaul Providers - By Procurement Channel (In Value%)

Direct Procurement

Third-party Suppliers

OEM Partnerships

Service Agreements

Online Platforms - By Material / Technology (in Value%)

Composite Materials

Lightweight Metals

Advanced Avionics

3D Printing for Parts

AI-driven Predictive Maintenance Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Service Range, Maintenance Capability, Geographical Reach, Customer Base, Technological Investment, Cost Efficiency, Service Speed, Regulatory Compliance, Quality Control)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

Boeing

Emirates Engineering

Etihad Airways Engineering

Dubai Aerospace Enterprise

Saudia Aerospace Engineering Industries

Lufthansa Technik

SR Technics

AAR Corporation

GE Aviation

Rolls-Royce

Honeywell Aerospace

Turkish Technic

Mubadala Investment Company

Wings Aviation

- Airlines’ Shift Towards In-house MRO Services

- Private Aviation’s Growing Demand for Specialized Maintenance

- Military’s Focus on Efficient Maintenance Scheduling

- Cargo Operators Investing in Cost-effective MRO Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035