Market Overview

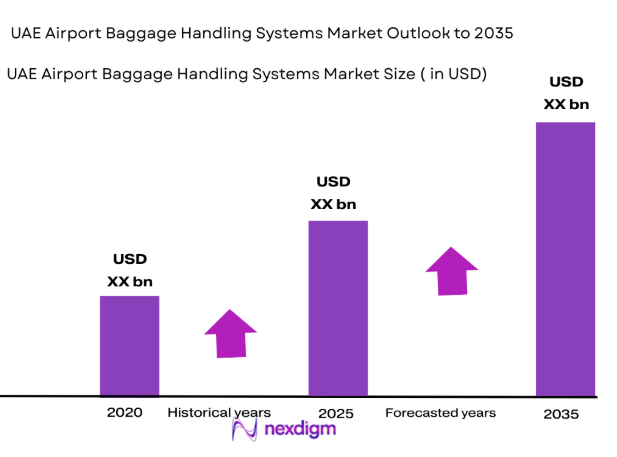

The UAE airport baggage handling systems market has witnessed significant growth, with the market size based on a recent historical assessment valued at USD ~ billion. This market is primarily driven by the increasing demand for automation in airport operations, the growing number of international passengers, and the expansion of UAE’s airport infrastructure. Technological advancements in baggage handling, such as RFID and automated sorting systems, play a key role in the market’s growth by enhancing operational efficiency and reducing baggage mishandling rates.

The UAE dominates the market for baggage handling systems, driven by key international airports such as Dubai International Airport and Abu Dhabi International Airport. These airports are known for their advanced infrastructure, ongoing expansion projects, and high passenger traffic. The UAE’s strategic geographic location as a hub for international travel further strengthens its position, with investments from both the government and private sector focusing on improving airport technologies and passenger experience.

Market Segmentation

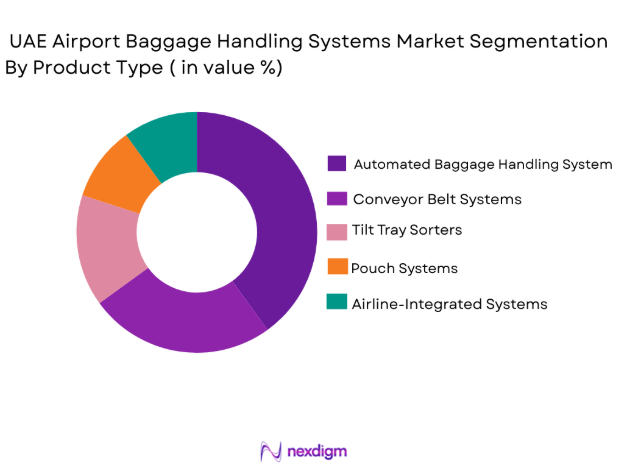

By Product Type:

The UAE airport baggage handling systems market is segmented by product type into automated baggage handling systems, conveyor belt systems, tilt tray sorters, pouch systems, and airline-integrated systems. Recently, automated baggage handling systems have a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, and consumer preference for seamless, efficient, and secure operations in airports.

By Platform Type:

The UAE airport baggage handling systems market is segmented by platform type into airport terminals, cargo handling areas, airside facilities, baggage claim areas, and check-in zones. Recently, airport terminals have dominated the market due to factors such as high passenger volumes, the demand for seamless travel experiences, and the increasing integration of automated and smart technologies to streamline baggage handling processes.

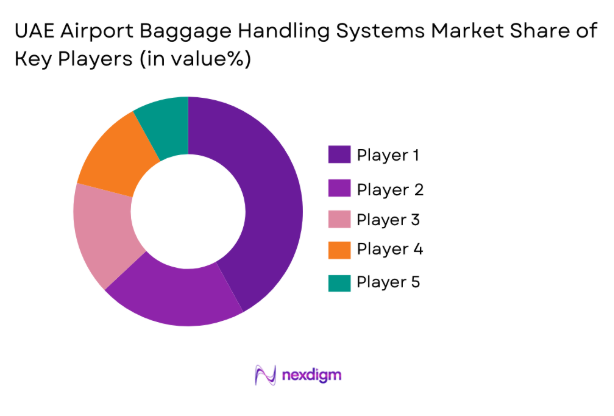

Competitive Landscape

The competitive landscape of the UAE airport baggage handling systems market is marked by significant consolidation, with leading players focusing on strategic partnerships and technological advancements to stay competitive. The market sees strong participation from both global and regional players. Major players invest heavily in automation and advanced baggage management technologies, ensuring a high level of system integration and operational efficiency.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Siemens | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

| Vanderlande | 1949 | Netherlands | ~ | ~ | ~ | ~ | ~ |

| Daifuku | 1937 | Japan | ~ | ~ | ~ | ~ | ~ |

| Beumer Group | 1935 | Germany | ~ | ~ | ~ | ~ | ~ |

| Swisslog | 1900 | Switzerland | ~ | ~ | ~ | ~ | ~ |

UAE Airport Baggage Handling Systems Market Analysis

Growth Drivers

Increase in Air Travel Demand:

The rapid growth of the air travel industry, particularly in the Middle East, has significantly boosted the demand for advanced baggage handling systems in the UAE. The UAE serves as a major transit hub, with Dubai International Airport ranking among the busiest airports globally. As more passengers travel through the region, the need for efficient, fast, and reliable baggage handling solutions continues to rise. The influx of tourists and business travelers into the UAE further exacerbates this demand, driving airport authorities to invest heavily in upgrading their baggage handling infrastructure to meet global standards and improve operational efficiency.

Technological Advancements in Baggage Handling:

The continuous advancements in automation and robotics technology have played a critical role in transforming the UAE airport baggage handling systems market. Technologies such as RFID tracking, automated baggage sortation, and AI-powered systems are not only enhancing operational efficiency but also minimizing the risk of human error and baggage mishandling. The UAE’s progressive infrastructure and focus on cutting-edge technologies, including smart airports, have made it a key market for these technological advancements. Furthermore, with the introduction of contactless check-in and automated baggage drop-off stations, airports are moving towards reducing human interaction, making baggage handling systems smarter and more efficient.

Market Challenges

High Initial Capital Investment:

One of the primary challenges facing the UAE airport baggage handling systems market is the high initial capital investment required for the installation and implementation of advanced baggage handling systems. Although automation technologies provide long-term operational cost savings, the upfront costs for developing and installing these systems can be prohibitively expensive, especially for smaller airports. Additionally, the complexity involved in integrating new systems into existing airport infrastructures can create significant financial hurdles. These high costs often result in delays in system upgrades or replacements, which can hinder overall growth in the market.

Regulatory Compliance and Security Standards:

The stringent regulatory compliance and security standards set by aviation authorities also present a challenge to the market. Baggage handling systems must adhere to a variety of international standards to ensure the safety and security of passengers and their belongings. The need to comply with these regulations can increase development timelines and costs, as well as limit the adoption of new technologies. Airports must also balance security measures with operational efficiency, which can be difficult when introducing new technologies. The ongoing changes in regulations add to the complexity of upgrading baggage handling systems, slowing down the pace of innovation in the market.

Opportunities

Emerging Demand for Smart Airports:

With the increasing adoption of digital technologies and automation in the aviation sector, the UAE is positioning itself as a leader in smart airports. The rise of smart cities and airports across the UAE offers immense growth opportunities for baggage handling systems. These smart systems integrate data analytics, AI, and IoT technologies to streamline airport operations, improve passenger experiences, and optimize the baggage handling process. The UAE’s focus on innovation and its investments in smart infrastructure present a significant opportunity for companies providing advanced baggage handling solutions, especially those that incorporate AI and machine learning.

Rising Investments in Airport Infrastructure:

The continuous expansion of UAE’s major airports, such as Dubai International Airport, Abu Dhabi International Airport, and Sharjah International Airport, presents an opportunity for the baggage handling systems market. As passenger traffic continues to grow, these airports are investing heavily in upgrading their baggage handling infrastructure. The expansion of terminals and the construction of new ones, along with an increasing emphasis on seamless passenger experiences, will drive the demand for more advanced and automated baggage handling systems. This trend is expected to continue as the UAE government pushes for infrastructure developments, making it an attractive market for both local and international suppliers.

Future Outlook

The future of the UAE airport baggage handling systems market looks promising, with significant growth expected due to rising passenger traffic, airport expansions, and technological advancements. Over the next five years, the market is set to benefit from further automation and AI-based solutions, as well as increasing demand for smart airports. With government initiatives supporting infrastructure development and technological upgrades, UAE airports are poised to lead the region in terms of innovation, efficiency, and sustainability in baggage handling systems.

Major Players

- Siemens

- Vanderlande

- Daifuku

- Beumer Group

- Swisslog

- Pteris Global

- Logplan

- Sotec

- Kardex

- Siemens Logistics

- Fives Group

- Roschmann

- Procter & Gamble

- Systematics Inc.

- Honeywell

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport authorities and operators

- Airlines

- Infrastructure developers

- Airport construction firms

- System integrators and technology providers

- Baggage handling solution providers

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the key variables impacting the UAE airport baggage handling systems market, including technological advancements, regulatory influences, and market demand patterns.

Step 2: Market Analysis and Construction

A detailed analysis is conducted, focusing on the market size, growth trends, and future forecasts based on both qualitative and quantitative data sourced from credible reports and industry insights.

Step 3: Hypothesis Validation and Expert Consultation

The collected data is validated by consulting with industry experts and stakeholders, ensuring the accuracy and relevance of the findings.

Step 4: Research Synthesis and Final Output

The final output synthesizes all research findings into a comprehensive report that accurately reflects the current state and future trends of the UAE airport baggage handling systems market.

- Executive Summary

- Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Growth Drivers

Increase in Air Travel Demand

Government Investment in Airport Infrastructure

Technological Advancements in Automation

Rising Need for Efficient Baggage Handling Systems

Expansion of Major Airports in UAE - Market Challenges

High Initial Capital Investment

Technological Integration and Interoperability Issues

Maintenance and Operational Costs

Security Concerns with Automated Systems

Regulatory Compliance and Certification Hurdles - Market Opportunities

Increase in Demand for Smart Airports

Rising Demand for Contactless Systems

Emerging Technologies in Robotics and AI - Trends

Automation in Baggage Handling Systems

Integration of AI and Machine Learning in Airport Operations

Increase in Use of RFID Technology for Tracking

Shift Towards Sustainable and Energy-Efficient Systems

Rise of Self-Service Kiosks and Automated Baggage Drop-off - Government Regulations & Defense Policy

Airport Security Regulations and Compliance

Global Standards for Baggage Handling Systems

Government Initiatives Supporting Airport Automation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Automated Baggage Handling Systems

Conveyor Belt Systems

Tilt Tray Sorters

Pouch Systems

Airline-Integrated Systems - By Platform Type (In Value%)

Airport Terminals

Cargo Handling Areas

Airside Facilities

Baggage Claim Areas

Check-in Zones - By Fitment Type (In Value%)

On-Premise Solutions

Cloud-Based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Commercial Airports

Private Airports

Cargo Airports

International Airport Operators

Regional Airport Operators - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-Party Distributors - By Material / Technology (in Value%)

Steel

Aluminum

Plastic

Integrated Control Systems

Automation Software

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Siemens

Vanderlande

Daifuku

SABRE

Pteris Global

Logplan

Sotec

Beumer Group

Kardex

Siemens Logistics

Fives Group

Roschmann

Swisslog

Proctor & Gamble

Systematics Inc

- Increased Demand from Major International Airports

- Private Airport Operators Expanding to Meet Growing Demand

- Integration of Smart Technology in Passenger Services

- Enhanced Focus on Sustainable and Energy-Efficient Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035