Market Overview

The UAE airport ground handling systems market is expected to experience significant growth, driven by the increasing demand for efficient and advanced systems in response to the rising air traffic in the region. Based on a recent historical assessment, the market size is valued in the billions ~ USD, primarily fueled by investments in infrastructure and the modernization of airport facilities. This growth is supported by the continuous expansion of UAE airports, as well as technological advancements in automation and ground support equipment.

The UAE is a prominent player in the airport ground handling systems sector, with cities such as Dubai and Abu Dhabi leading the charge. The strategic location of these cities as major international air travel hubs makes them key drivers of demand. Additionally, the government’s ongoing initiatives to boost tourism, business travel, and the aviation sector contribute significantly to the dominance of these locations in the global market. The region’s focus on innovation and sustainability further reinforces its position as a leader in airport infrastructure.

Market Segmentation

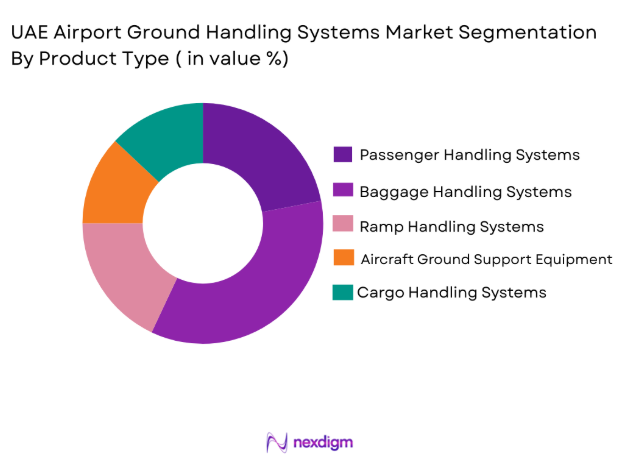

By Product Type:

The UAE airport ground handling systems market is segmented by product type into passenger handling systems, baggage handling systems, ramp handling systems, aircraft ground support equipment, and cargo handling systems. Recently, the baggage handling systems segment has a dominant market share due to its essential role in managing the growing number of passengers and the demand for efficiency in airports. Factors such as advancements in automation, the need for error-free operations, and the implementation of RFID technology have contributed to the expansion of this sub-segment. Additionally, the rise in international and domestic air travel, along with regulatory requirements for efficient baggage handling, has further solidified its dominant position in the market.

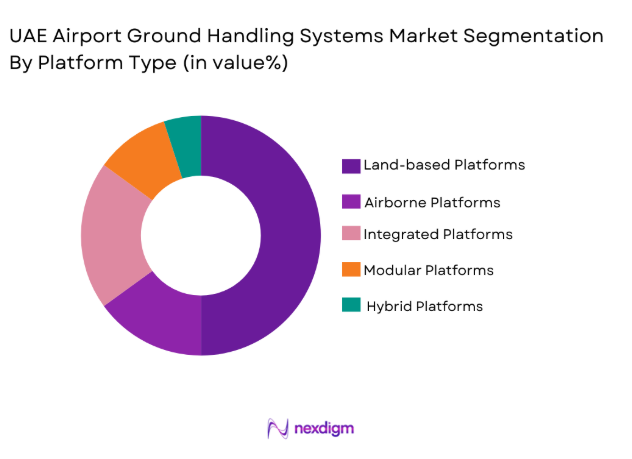

By Platform Type:

The UAE airport ground handling systems market is segmented by platform type into land-based platforms, airborne platforms, integrated platforms, modular platforms, and hybrid platforms. The land-based platforms sub-segment currently holds a dominant share due to the substantial infrastructure investments in ground support equipment and the increasing volume of air traffic. Airports in the UAE, especially in cities like Dubai, have adopted these platforms to streamline ground operations, improve passenger handling efficiency, and reduce turnaround times. The demand for land-based solutions remains high due to their ability to offer cost-effective and scalable operations in busy airport environments.

Competitive Landscape

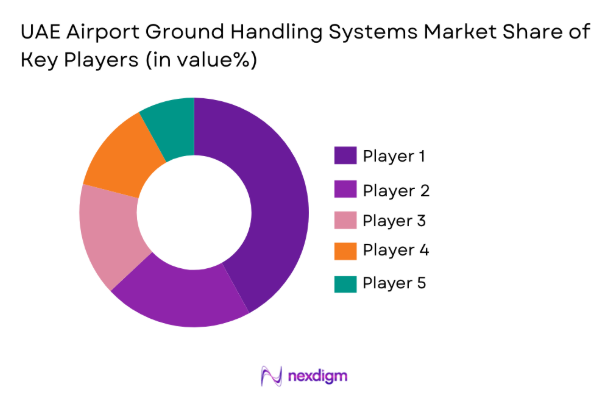

The UAE airport ground handling systems market is characterized by a competitive landscape that includes a mix of well-established players and new entrants focused on delivering innovative solutions. The sector is seeing increasing consolidation, with major players partnering with regional players to expand their reach and capabilities. Key players are continuously adopting advanced technologies, including automation, robotics, and AI, to improve operational efficiency and reduce costs. These technological advancements, coupled with increasing demand for sustainability and green practices, are driving significant competition in the market.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Dnata | 1959 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ |

| Swissport | 1996 | Geneva, Switzerland | ~ | ~ | ~ | ~ | ~ |

| Menzies Aviation | 1833 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Abu Dhabi Airports | 2006 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ |

| JBT Corporation | 1960 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

UAE Airport Ground Handling Systems Market Analysis

Growth Drivers

Government Investments in Airport Infrastructure:

The UAE government’s continuous investments in airport infrastructure have played a crucial role in driving the market growth for airport ground handling systems. With the UAE positioned as a key global air transit hub, airports in cities like Dubai and Abu Dhabi have seen massive expansions. The government’s commitment to making the UAE a global travel and tourism leader has spurred developments that include modernizing terminals, expanding airport capacities, and upgrading ground handling technologies. These investments are essential for ensuring that the country’s airports remain competitive in terms of efficiency and passenger experience. As air traffic continues to rise, the need for advanced ground handling systems to accommodate the growth is paramount. Additionally, these developments are accompanied by regulatory support to meet international standards for safety and operational efficiency. As part of its strategy, the government also prioritizes sustainability and innovation, which further fuels demand for cutting-edge ground handling technologies. These efforts align with the UAE’s Vision 2030 objectives to diversify the economy and enhance its position as a global aviation hub.

Technological Advancements in Ground Handling Systems:

Technological advancements in airport ground handling systems are driving the market forward, particularly with innovations in automation and robotics. Automation in baggage handling, cargo processing, and aircraft support operations is a key factor in improving operational efficiency and reducing human error. The adoption of AI and robotics in these systems not only enhances performance but also contributes to cost reduction by optimizing resources and minimizing operational delays. The shift towards digital technologies such as RFID tracking, real-time monitoring, and predictive analytics is transforming the way ground handling operations are conducted, providing greater visibility and control over processes. These innovations also facilitate smoother integration between different airport systems, creating a more cohesive and streamlined operation. With the rising demand for faster and more efficient airport services, the development and implementation of automated solutions have become essential. Furthermore, these technologies offer long-term benefits, such as reducing carbon emissions and improving sustainability, which aligns with the growing emphasis on environmental responsibility within the aviation industry.

Market Challenges

High Operational Costs of Ground Handling Equipment:

One of the main challenges facing the UAE airport ground handling systems market is the high cost of acquiring and maintaining advanced ground handling equipment. While automation and robotics promise to improve efficiency, the initial capital expenditure required to implement these technologies can be significant. Many airport operators must balance the need for state-of-the-art equipment with budget constraints, especially given the rising operational costs associated with maintenance and training. These costs can be a deterrent for smaller airports or ground handling service providers that may not have the resources to invest in these technologies. Furthermore, the need for specialized parts and frequent updates to maintain high-performance standards adds to the overall operational costs. Additionally, the procurement of sustainable ground handling equipment, such as electric-powered vehicles, often comes at a premium price, further burdening airport operators and service providers. Despite these challenges, the long-term benefits of adopting advanced technologies in ground handling are clear, but the cost barrier remains a significant hurdle in the short term.

Regulatory and Compliance Challenges in Ground Handling Operations:

Another significant challenge in the market is the stringent regulatory and compliance standards that ground handling systems must meet. These regulations are designed to ensure the safety, security, and environmental sustainability of airport operations, but they can often be complex and burdensome for operators. Compliance with international safety standards and environmental regulations requires continuous updates to equipment and processes, which can be costly and time-consuming. Moreover, the regulations can vary by country and region, creating difficulties for ground handling service providers operating in multiple jurisdictions. The challenge of maintaining compliance while managing costs and operational efficiency is a delicate balance for airport authorities and service providers. Additionally, the increasing focus on data protection and privacy adds another layer of complexity to the regulatory landscape, as ground handling systems become more interconnected and data-driven. Ensuring compliance with evolving regulations while adopting cutting-edge technologies is a significant challenge that the industry must address in the coming years.

Opportunities

Expansion in Regional Tourism Driving Airport Demand:

The UAE’s growing status as a global tourist destination presents significant opportunities for the airport ground handling systems market. With tourism being a key driver of the UAE’s economy, particularly in cities like Dubai, the demand for efficient and effective airport services has surged. The increased volume of international travelers requires advanced systems to handle baggage, manage passenger flow, and ensure timely aircraft servicing. This demand for improved ground handling services is expected to rise with the expansion of tourism infrastructure and air travel connections, which will drive the need for modern and automated systems. Additionally, the UAE government has prioritized the growth of tourism as part of its Vision 2030, providing ample opportunities for investment in airport facilities and ground handling solutions. As tourism continues to grow, so too will the demand for seamless airport operations, making the UAE airport ground handling systems market an attractive segment for innovation and development. Companies that invest in next-generation technologies to improve operational efficiency and enhance the passenger experience will be well-positioned to capitalize on this opportunity.

Technological Advancements in Sustainable Ground Handling Solutions:

The increasing focus on sustainability in the aviation industry presents a unique opportunity for the UAE airport ground handling systems market. With governments and regulatory bodies implementing stricter environmental regulations, the demand for eco-friendly ground handling solutions has grown. Sustainable technologies, such as electric-powered ground support equipment (GSE), energy-efficient baggage handling systems, and low-emission vehicles, are gaining traction in the market. The UAE’s commitment to reducing its carbon footprint aligns with global efforts to achieve sustainability goals, making it an ideal market for the adoption of green technologies. Moreover, advancements in automation, such as the use of robotic systems in ground operations, contribute to reducing resource consumption and improving overall efficiency. By embracing sustainability, airport operators can reduce their environmental impact, lower operational costs in the long run, and comply with international environmental standards. The shift towards sustainable ground handling systems represents a significant growth opportunity for market players that prioritize innovation in green technologies and practices.

Future Outlook

The future of the UAE airport ground handling systems market looks promising, with significant growth expected over the next five years. Demand will be driven by the increasing passenger traffic, infrastructure expansions, and a shift toward automation and sustainability. Airports in major UAE cities are set to continue their modernization efforts, incorporating advanced technologies like AI, robotics, and electric-powered vehicles to improve operational efficiency and reduce carbon emissions. The regulatory landscape will also evolve, providing further opportunities for the market to innovate.

Major Players

- Dnata

- Swissport

- Menzies Aviation

- Abu Dhabi Airports

- JBT Corporation

- Cavotec

- ICTS Europe

- Beumer Group

- Vanderlande

- Flughafen Zürich AG

- SITA

- TLD Group

- Liebherr

- Harlan Global Manufacturing

- Rexnord

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport authorities and operators

- Airlines and airline service providers

- Ground handling service providers

- Manufacturers of ground support equipment

- Infrastructure developers in aviation

- Technology solution providers for airport operations

Research Methodology

Step 1: Identification of Key Variables

Identify the most relevant factors influencing market dynamics, including technological advancements, demand patterns, and regulatory frameworks.

Step 2: Market Analysis and Construction

Perform a detailed analysis of market size, segmentation, and trends using primary and secondary data sources to create a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Validate findings through expert consultations, surveys, and interviews with industry leaders to ensure the accuracy and relevance of the data.

Step 4: Research Synthesis and Final Output

Consolidate research findings into a cohesive report, providing actionable insights for stakeholders and addressing any remaining research gaps

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Air Traffic and Passenger Volume

Expansion of Airport Infrastructure

Adoption of Automation and Robotics in Ground Handling

Rising Demand for Sustainable Ground Handling Solutions

Government Investments in Airport Modernization - Market Challenges

High Initial Investment for Automation Systems

Regulatory and Compliance Issues

Lack of Skilled Workforce for Advanced Technologies

Maintenance and Repair Costs of Ground Support Equipment

Operational Efficiency and Safety Concerns - Market Opportunities

Growth in Regional Tourism Driving Airport Expansion

Technological Advancements in Automation and AI

Development of Green and Sustainable Ground Handling Solutions - Trends

Integration of AI and Machine Learning in Ground Handling Systems

Increase in Adoption of Electric-powered Ground Support Equipment

Surge in Automation and Robotics Deployment in Airports

Focus on Sustainability and Carbon Emission Reduction

Growth in Data-driven Airport Operations - Government Regulations & Defense Policy

Airport Security and Safety Regulations

Environmental and Sustainability Policies

Regulatory Standards for Ground Handling Equipment - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Passenger Handling Systems

Baggage Handling Systems

Ramp Handling Systems

Aircraft Ground Support Equipment

Cargo Handling Systems - By Platform Type (In Value%)

Land-based Platforms

Airborne Platforms

Integrated Platforms

Modular Platforms

Hybrid Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Airports

Ground Handling Service Providers

Airlines

Airport Authorities

Logistics Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Automation Technologies

Robotics and AI Technologies

Electric-powered Ground Support Equipment

Software Systems

Sensor and IoT Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

SWOT Analysis of Key Competitors

Pricing & Procurement Analysis - Key Players

Dubai Airports

Abu Dhabi Airports

Qatar Airways

Emirates Airlines

Swissport International

Menzies Aviation

Dnata

Boeing

Lufthansa Technik

Menzies Aviation

UTC Aerospace Systems

Cavotec

Husky

JBT Corporation

Honeywell

- Airports’ Need for Integrated Ground Handling Solutions

- Airlines’ Adoption of Technology to Improve Efficiency

- Ground Handling Service Providers’ Focus on Automation

- Logistics Providers’ Increasing Demand for Efficient Cargo Handling

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035