Market Overview

The UAE airport passenger screening systems market is projected to experience significant growth, driven by the increasing need for enhanced security measures across airports. With rising concerns about terrorism, smuggling, and overall passenger safety, the demand for advanced screening technologies such as body scanners, x-ray machines, and explosive detection systems is growing. The market size for these systems is expected to reach USD ~ billion by the latest historical assessment, with key factors such as airport modernization projects, technological innovation, and higher passenger volumes driving this expansion.

Dominant players in the market are located in regions with major international airports such as Dubai, Abu Dhabi, and Sharjah. The UAE’s strategic position as a global aviation hub, coupled with heavy investments in infrastructure, bolsters its dominance. The country’s extensive airport expansion and renovation projects further strengthen the demand for state-of-the-art screening systems. Key airports in the region also benefit from government-backed security initiatives, ensuring the sustained growth of the market in these cities.

Market Segmentation

By Product Type

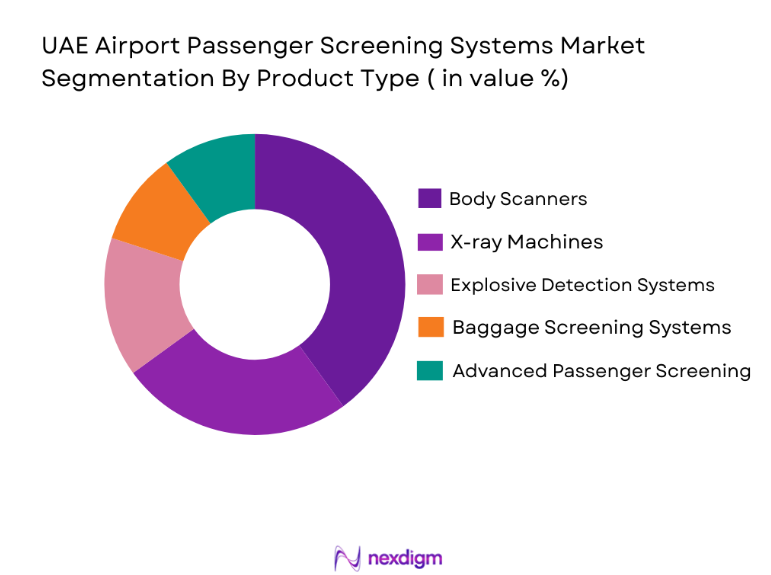

The UAE airport passenger screening systems market is segmented by product type into body scanners, x-ray machines, explosive detection systems, baggage screening systems, and advanced passenger screening systems. Recently, body scanners have a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, and consumer preference. These scanners provide enhanced security by detecting concealed items while allowing for a smoother and faster passenger experience, which has become a priority for airports handling large volumes of travelers.

By Platform Type

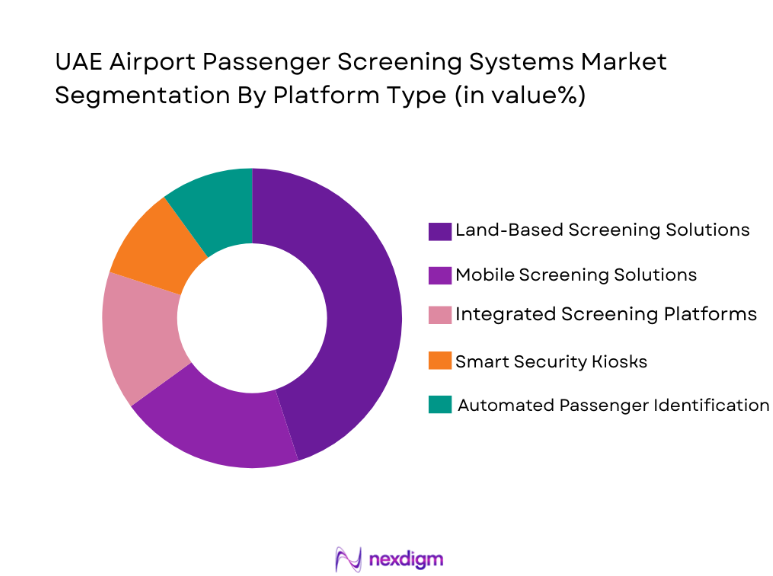

The UAE airport passenger screening systems market is segmented by platform type into land-based screening solutions, mobile screening solutions, integrated screening platforms, smart security kiosks, and automated passenger identification systems. The demand for land-based screening solutions has been dominant in the market, as these platforms offer robust and scalable options for large airports. Their ability to handle high passenger traffic efficiently and seamlessly integrate with other security infrastructure makes them the preferred choice for many major airports in the UAE.

Competitive Landscape

The UAE airport passenger screening systems market is highly competitive, with leading players focusing on technological advancements and high-efficiency products. Major companies are consolidating their position by offering integrated solutions that combine several screening technologies into one cohesive system. Collaboration between global tech firms and airport operators is driving market dynamics, as companies seek to enhance product offerings and increase market penetration.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| L3 Technologies | 1958 | USA | ~ | ~ | ~ | ~ |

| Smiths Detection | 1987 | UK | ~ | ~ | ~ | ~ |

| Rapiscan Systems | 1993 | USA | ~ | ~ | ~ | ~ |

| Leidos | 1969 | USA | ~ | ~ | ~ | ~ |

| AS&E | 1993 | USA | ~ | ~ | ~ | ~ |

UAE Airport Passenger Screening Systems Market Analysis

Growth Drivers

Rising Passenger Traffic

The rapid increase in air passenger traffic is one of the primary growth drivers for the UAE airport passenger screening systems market. As international air travel continues to expand, airports are increasingly adopting advanced screening technologies to ensure the security of passengers. The growing number of passengers in major airports, such as Dubai International and Abu Dhabi International, has made it necessary to enhance security infrastructure. With the surge in global travel, airports are under pressure to improve their security measures without causing delays or long waiting times. This pressure has driven demand for screening solutions that offer fast, efficient, and effective screening without compromising on security. Additionally, the heightened threat landscape has made it essential for airports to adopt technologies capable of detecting a wide range of threats, including explosives and weapons. The increasing focus on the convenience and safety of travelers, combined with growing security concerns, has therefore bolstered the demand for sophisticated screening technologies, further accelerating market growth.

Technological Advancements in Security Screening

Another significant driver of the market’s growth is the rapid advancement in security screening technologies. In recent years, innovations such as 3D X-ray imaging, automated body scanners, and AI-powered systems have revolutionized airport security operations. These advancements allow for faster, more accurate threat detection while reducing the need for physical interaction, enhancing the overall passenger experience. The UAE, with its strategic location as a global aviation hub, is keen to adopt cutting-edge technology to maintain its position as a leader in airport security. The government’s focus on security innovation is also facilitating the growth of the market, with airports opting for high-tech solutions that provide quick screening while maintaining a high level of accuracy. Additionally, the adoption of biometric screening technology is expected to gain momentum as it offers an efficient and secure method of identifying passengers. This trend toward automation and integration of AI technologies in passenger screening systems is expected to play a significant role in market expansion.

Market Challenges

High Installation and Maintenance Costs

One of the key challenges facing the UAE airport passenger screening systems market is the high installation and maintenance costs of advanced security technologies. While these systems offer significant improvements in security and efficiency, the upfront capital investment required to implement such technologies can be prohibitively expensive. Airports must allocate substantial budgets for purchasing and installing advanced screening systems, which can include costs for infrastructure upgrades, system integration, and staff training. Furthermore, maintaining these complex systems over time requires a continuous financial commitment, as regular calibration, software updates, and hardware replacements are necessary to ensure optimal performance. This financial burden can be especially challenging for smaller airports or those operating under constrained budgets, potentially slowing down the adoption of cutting-edge screening solutions in certain regions. The ongoing costs associated with maintaining advanced security systems may also deter some airports from fully embracing the latest technologies, limiting their ability to keep up with industry advancements.

Regulatory Compliance and Certification Issues

Another challenge hindering the growth of the UAE airport passenger screening systems market is the complexity of regulatory compliance and certification processes. Airports must comply with strict international security standards and certifications when implementing new screening technologies. These regulations are set by various national and international bodies, including the International Civil Aviation Organization (ICAO) and the European Union Aviation Safety Agency (EASA). The process of obtaining the necessary certifications for new screening systems can be lengthy and complex, requiring extensive testing, validation, and documentation. Additionally, these standards are constantly evolving, and airports must stay up to date with any changes to ensure ongoing compliance. Failure to meet regulatory requirements could lead to delays in the deployment of new technologies or even the disqualification of certain systems from being used at airports. This regulatory burden adds an extra layer of complexity to the procurement and implementation process, creating a barrier to market growth for certain players.

Opportunities

Expansion of Touchless Screening Solutions

One of the key opportunities in the UAE airport passenger screening systems market lies in the expansion of touchless screening solutions. In the wake of the COVID-19 pandemic, the demand for contactless technologies has surged, as passengers and airport authorities alike seek to minimize physical contact during the screening process. Touchless solutions, such as biometric facial recognition and automated passenger identification systems, offer significant advantages in terms of passenger convenience and safety. These systems not only reduce the need for physical interaction but also speed up the screening process, allowing airports to handle increasing passenger volumes more efficiently. As health and safety concerns remain a priority, the adoption of touchless screening solutions is expected to rise across airports globally, including in the UAE, where airports are increasingly investing in innovative solutions to enhance the passenger experience. The growth of this segment presents a significant opportunity for both existing and new players in the airport screening systems market to develop and deploy cutting-edge, contactless security technologies.

Partnerships Between Airports and Tech Firms

Another lucrative opportunity in the market is the growing trend of partnerships between airports and technology firms to develop and implement advanced screening solutions. These collaborations are driven by the need for customized, scalable, and efficient security systems that can meet the unique requirements of each airport. By working together, airports and tech companies can leverage each other’s expertise to develop innovative solutions that improve security and streamline operations. Partnerships also allow for the integration of new technologies such as artificial intelligence, machine learning, and predictive analytics into existing screening systems, enhancing their performance and accuracy. This trend is particularly prominent in the UAE, where airports are constantly seeking ways to stay at the forefront of technology and security. As airports seek to modernize their facilities and offer state-of-the-art security measures, the demand for customized, high-tech screening solutions is expected to increase, creating significant growth opportunities for technology firms specializing in airport security.

Future Outlook

Over the next five years, the UAE airport passenger screening systems market is expected to experience continued growth driven by technological advancements, increased passenger traffic, and regulatory support for enhanced security measures. Airports in the region are likely to continue investing in the latest screening technologies, including AI-driven systems and biometric solutions, to improve both security and efficiency. The adoption of touchless screening solutions is anticipated to rise, driven by ongoing health and safety concerns. Furthermore, strategic partnerships between airports and technology providers are expected to play a pivotal role in shaping the future of the market, enabling the development of integrated, innovative security solutions that cater to the evolving needs of modern airports.

Major Players

- L3 Technologies

- Smiths Detection

- Rapiscan Systems

- Leidos

- AS&E

- COGNITEC SYSTEMS

- Optosecurity

- American Science and Engineering

- Vanderlande

- Nuctech

- S2 Global

- Aventura Technologies

- X-Ray Systems Inc.

- Threat Detection Systems

- McKinsey & Co.

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport operators

- Airlines

- Security system integrators

- Manufacturers of airport security equipment

- Airport service providers

- Infrastructure development firms

Research Methodology

Step 1: Identification of Key Variables

Key market variables such as system types, technological advancements, and regulatory frameworks are identified to establish the foundational aspects of the research.

Step 2: Market Analysis and Construction

Data is gathered through secondary research, industry reports, and interviews with stakeholders to understand the current market size, trends, and competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

The gathered data is validated through discussions with industry experts and stakeholders, refining the hypotheses to ensure the reliability of the findings.

Step 4: Research Synthesis and Final Output

The research is synthesized to create the final market report, with detailed insights into the market dynamics, competitive landscape, growth drivers, challenges, and opportunities.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Passenger Traffic

Government Investment in Airport Security

Technological Advancements in Screening Systems

Rising Threats of Terrorism and Smuggling

Integration of AI and Automation in Security - Market Challenges

High Installation and Maintenance Costs

Regulatory Compliance and Certification Issues

Privacy Concerns with Biometric Screening

Integration of New Technology with Legacy Systems

Resistance to Change from Airport Operators - Market Opportunities

Emerging Demand for Touchless Screening Solutions

Development of AI-powered Screening Systems

Partnerships Between Airports and Tech Firms - Trends

Rise in Smart Security and Automation in Airports

Increased Investment in High-Resolution Screening Systems

Growing Focus on Biometric Authentication

Adoption of Cloud-Based Security Solutions

Expansion of AI and Machine Learning in Security - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Airport Security Compliance Standards

Government Funding for Advanced Security Solutions - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Body Scanners

X-Ray Machines

Explosive Detection Systems

Baggage Screening Systems

Advanced Passenger Screening Systems - By Platform Type (In Value%)

Land-Based Screening Solutions

Mobile Screening Solutions

Integrated Screening Platforms

Smart Security Kiosks

Automated Passenger Identification Systems - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Airports

Airlines

Government Agencies

Security Contractors

System Integrators - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Millimeter Wave Technology

Computed Tomography (CT)

Backscatter X-Ray Technology

Biometric Screening Technology

Artificial Intelligence and Machine Learning

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

L3 Technologies

Smiths Detection

Rapiscan Systems

S2 Global

Vanderlande

Leidos

AS&E

Cognitec Systems

X-Ray Systems Inc.

Optosecurity

Aventura Technologies

Nuctech

Terrorist Screening Center

3M

American Science and Engineering

- Increased Adoption of Advanced Screening by Major Airports

- Government Regulations Driving System Integrations

- Airlines’ Role in Implementing Screening Solutions

- Security Contractors and their Role in Service Delivery

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035