Market Overview

As of 2024, the UAE Alexandrite lasers market is valued at USD ~ million, with a growing CAGR of 16.4% from 2024 to 2030. The growth of this market is driven by the increasing demand for aesthetic procedures and advancements in laser technologies, which facilitate non-invasive treatment options for patients. Additionally, government support for healthcare infrastructure and the burgeoning medical tourism industry contribute positively to market expansion, making it an attractive segment for investment.

Dominant cities in the UAE, particularly Dubai and Abu Dhabi, significantly influence the Alexandrite lasers market due to their status as major healthcare hubs. These cities possess advanced medical facilities and a high concentration of dermatology and cosmetic surgery clinics, which utilize Alexandrite lasers extensively. The influx of international patients seeking high-quality aesthetic treatments further enhances the market dynamics, emphasizing the need for cutting-edge laser technology.

Market Segmentation

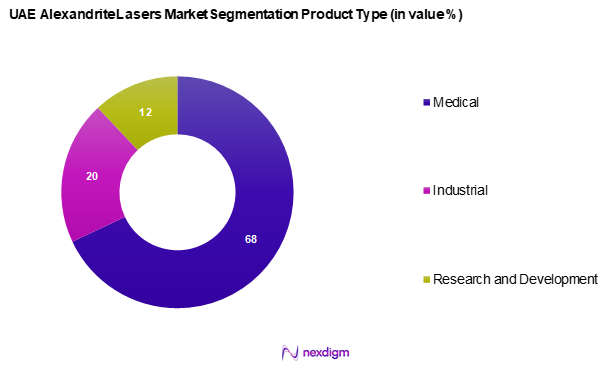

By Product Type

The UAE Alexandrite lasers market is segmented into medical, industrial, and research and development. In this segmentation, the medical segment holds a dominant market share, primarily attributed to the growing number of cosmetic procedures performed in clinics and hospitals across the UAE. Dermatologists and cosmetic surgeons favour Alexandrite lasers for their effectiveness in hair removal, skin rejuvenation, and tattoo removal, leading to stronger demand for medical-grade lasers.

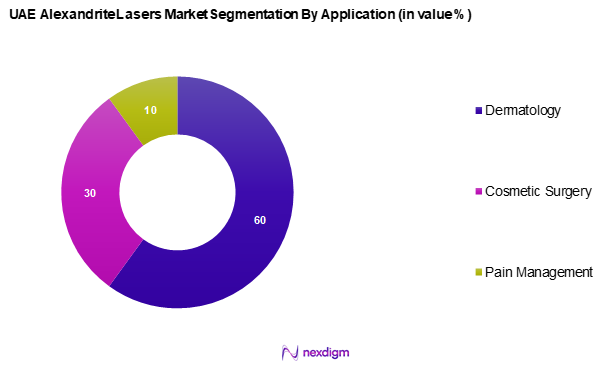

By Application

The UAE Alexandrite lasers market is segmented into dermatology, cosmetic surgery, and pain management. The dermatology application segment dominates the market share, primarily due to rising consumer awareness regarding skin health and aesthetic enhancements. Treatments such as laser hair removal and skin resurfacing drive the demand for Alexandrite lasers in clinics, establishing dermatology as the leading application within the market.

Competitive Landscape

The UAE Alexandrite lasers market is competitive and characterized by a few major players, including global brands and specialized local manufacturers. Companies like Candela Corporation, Lumenis, and Cynosure dominate the market, leveraging their strong R&D capabilities and extensive distribution networks. This consolidation highlights the significant influence of these key players in shaping market trends and driving the introduction of innovative products.

| Company Name | Establishment Year | Headquarters | Market Cap | Revenue (USD) | R&D Investments | Product Range |

| Candela Corporation | 1970 | Massachusetts, USA | – | – | – | – |

| Lumenis | 1991 | Yokneam, Israel | – | – | – | – |

| Cynosure | 1991 | Massachusetts, USA | – | – | – | – |

| Sciton | 1997 | California, USA | – | – | – | – |

| Alma Lasers | 2005 | Hefa, Israel | – | – | – | – |

UAE Alexandrite Lasers Market Analysis

Growth Drivers

Rising Demand for Cosmetic Procedures

The increasing preference for aesthetic enhancements is driving the demand for cosmetic procedures in the UAE. Both surgical and non-surgical treatments are witnessing strong growth, supported by a rising consumer interest in personal appearance. Additionally, the country’s large expatriate community shows a significant inclination towards cosmetic enhancements, further fueling market expansion. The UAE is also emerging as a key destination for medical tourism, with international patients seeking high-quality cosmetic treatments. This trend is supporting the growing demand for Alexandrite lasers in clinics and hospitals.

Technological Advancements in Laser Technology

Ongoing innovations in laser technology are enhancing the efficiency and effectiveness of Alexandrite lasers. The introduction of advanced features, such as multi-wavelength options and shorter pulse durations, has broadened their applications in areas like hair removal and skin rejuvenation. The UAE healthcare sector is proactively adopting cutting-edge technologies, with increasing investments from both public and private entities. This emphasis on technological progress is ensuring greater accessibility and utilization of advanced Alexandrite laser systems in aesthetic clinics and hospitals.

Market Challenges

High Initial Cost of Equipment

One of the key challenges in the UAE Alexandrite lasers market is the high upfront investment required to acquire advanced laser systems. Smaller clinics and independent practitioners often face difficulties in financing these high-end devices, which can hinder their adoption. Although laser treatments offer significant financial returns, the substantial initial costs act as a barrier for many healthcare providers. The broader healthcare sector continues to expand, but the need for cost-effective solutions remains a crucial consideration, especially for smaller facilities aiming to integrate advanced laser technologies.

Regulatory Compliance Issues

Strict regulatory frameworks govern the use and sale of laser devices in the UAE, making compliance a crucial challenge for market players. Healthcare authorities require clinics to meet rigorous certification and training requirements, which necessitate additional investments. Non-compliance can lead to severe penalties, including license revocation, adding to operational costs. With regulatory oversight expected to intensify in the coming years, clinics must continuously adapt to evolving guidelines. These compliance-related expenses can disproportionately impact smaller and mid-sized clinics, making it essential for businesses to allocate resources effectively for regulatory adherence.

Opportunities

Expansion in Developing Regions

The ongoing development of healthcare infrastructure in emerging regions of the UAE presents a significant opportunity for the Alexandrite lasers market. Government-led investments in state-of-the-art medical facilities across regions such as Sharjah and Ajman are creating new avenues for aesthetic treatments. These areas are experiencing an increase in healthcare providers focusing on cosmetic procedures, driven by a growing middle-class population. As healthcare spending rises, the demand for Alexandrite lasers in newly established medical centers is expected to grow, providing opportunities for market expansion.

Growing Awareness of Aesthetic Procedures

The increasing awareness and social acceptance of cosmetic treatments are shaping a favorable environment for the Alexandrite lasers market. Social media and digital platforms play a pivotal role in promoting aesthetic procedures, influencing consumer behavior and encouraging more individuals to explore cosmetic enhancements. The impact of influencers and targeted online marketing campaigns has led to a notable rise in inquiries and bookings for treatments. With personal care and aesthetic treatments becoming integral to consumer lifestyles, the adoption of Alexandrite laser technology in cosmetic clinics is set to witness sustained growth.

Future Outlook

Over the next five years, the UAE Alexandrite lasers market is expected to show significant growth driven by increased investments in healthcare infrastructure, continuous technological advancements, and rising consumer demand for aesthetic treatments. The growing trend of medical tourism also provides a substantial growth opportunity, as patients from neighboring countries seek advanced laser treatments in the UAE. Furthermore, ongoing research and development efforts will continuously enhance the efficacy and safety of Alexandrite lasers, driving further adoption in various healthcare settings.

Major Players

- Candela Corporation

- Lumenis

- Cynosure

- Sciton

- Alma Lasers

- Cutera, Inc.

- Syneron Medical

- InMode

- Medtronic

- Dentsply Sirona

- Fotona

- Biolitec AG

- Merz Pharmaceuticals

- ThermiGen

- National Medical Laser Center

Key Target Audience

- Cosmetic Clinics and Dermatology Centers

- Hospitals and Healthcare Facilities

- Medical Equipment Distributors

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Health Authority of Abu Dhabi , Ministry of Health and Prevention)

- Aesthetic Treatment Providers

- Research Institutions and Laboratories

- Medical Device Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE Alexandrite lasers market. This step is underpinned by extensive desk research, utilizing a combination of secondary sources and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including technology trends, regulatory frameworks, and consumer preferences.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the UAE Alexandrite lasers market. This includes assessing market penetration rates, translating technological advancements into market opportunities, and examining revenue generation across different segments. Additionally, an evaluation of service quality indicators is conducted to ensure the reliability and accuracy of the revenue estimates and market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of organizations within the sector. These consultations will provide valuable operational and financial insights directly from industry practitioners. Their perspectives will be instrumental in refining the market data and ensuring its relevance in an evolving landscape.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with numerous Alexandrite laser manufacturers and suppliers to acquire detailed insights into product segments, sales performance, consumer preferences, and emerging trends. This interactive engagement will serve to confirm and complement the statistics gathered through both bottom-up and top-down research methodologies, ensuring a comprehensive, accurate, and validated analysis of the UAE Alexandrite lasers market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Demand for Cosmetic Procedures

Technological Advancements in Laser Technology - Market Challenges

High Initial Cost of Equipment

Regulatory Compliance Issues - Opportunities

Expansion in Developing Regions

Growing Awareness of Aesthetic Procedures - Trends

Increase in Non-Invasive Treatments

Rising Popularity of Aesthetic Clinics - SWOT Analysis

- Porter’s Five Forces

- Competitive Dynamics

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type of Alexandrite Laser, (In Value %)

Medical

Industrial

Research and Development - By Application, (In Value %)

Dermatology

Cosmetic Surgery

Pain Management - By End-User, (In Value %)

Hospitals

Clinics

Research Institutes - By Region, (In Value %)

Dubai

Abu Dhabi

Sharjah

Others - By Distribution Channel, (In Value %)

Direct Sales

Online Retailers

Medical Equipment Distributors

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Alexandrite Laser Segment, 2024 - Cross Comparison Parameters (Company Overview, Product Range, Recent Innovations, Market Strategies, Key Strengths & Weaknesses, Distribution Networks, Revenue Insights, Customer Base, Global Reach)

- SWOT Analysis of Major Players

- Pricing Strategies of Key Competitors

- Detailed Profiles of Major Companies

Candela Corporation

Cutera, Inc.

Lumenis

Cynosure, Inc.

Solta Medical (Bausch Health)

Syneron Medical

Sciton

InMode

Fotona

Alma Lasers

Dentsply Sirona

Medtronic

Biolitec AG

Thermage (Solta Medical)

Merz Pharmaceuticals

- Patient Demographics and Preferences

- Budget Allocations for Medical Treatments

- Regulatory and Compliance Requirements

- Customer Needs and Expectations

- Decision-Making Process for Equipment Purchase

- By Value Forecast, 2025-2030

- By Volume Forecast, 2025-2030

- By Average Price Forecast, 2025-2030