Market Overview

The UAE ammunition market current size stands at around USD ~ million and reflects sustained procurement cycles driven by defense modernization programs, platform upgrades, and readiness mandates. Demand is anchored in multi-domain force requirements across land, naval, and airborne systems, supported by localization policies that favor domestic assembly and licensed manufacturing. Supply dynamics are shaped by controlled imports, compliance frameworks, and lifecycle management practices emphasizing safety, storage integrity, and quality assurance across operational and training use cases.

Demand concentration is highest across Abu Dhabi and Dubai due to the presence of defense headquarters, logistics hubs, testing ranges, and manufacturing clusters. These cities benefit from advanced port infrastructure, air cargo connectivity, and specialized free zones supporting defense industrial activities. A maturing supplier ecosystem, proximity to operational units, and streamlined licensing processes reinforce localized fulfillment. Policy alignment around defense industrialization further consolidates ecosystem depth, enabling faster qualification cycles, integration testing, and responsive replenishment within secure channels.

Market Segmentation

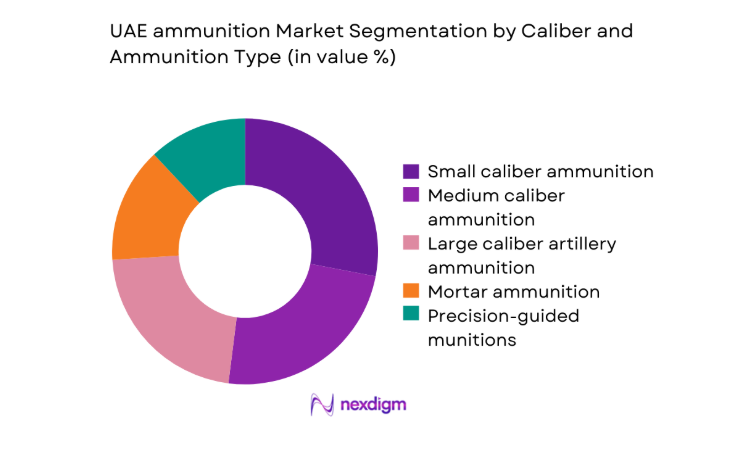

By Caliber and Ammunition Type

Large caliber artillery and medium caliber rounds dominate value contribution due to integration with armored platforms, artillery brigades, and naval systems, supported by sustained readiness cycles and stock rotation mandates. Precision-guided munitions increasingly shape procurement mix as networked fire control adoption expands across platforms. Mortar ammunition retains steady utilization for training and rapid response units, while small caliber volumes remain structurally significant for training throughput and operational readiness. Platform compatibility, safety certifications, and shelf-life management influence mix optimization, with local assembly prioritizing standardized calibers to improve logistics resilience and reduce dependency risks.

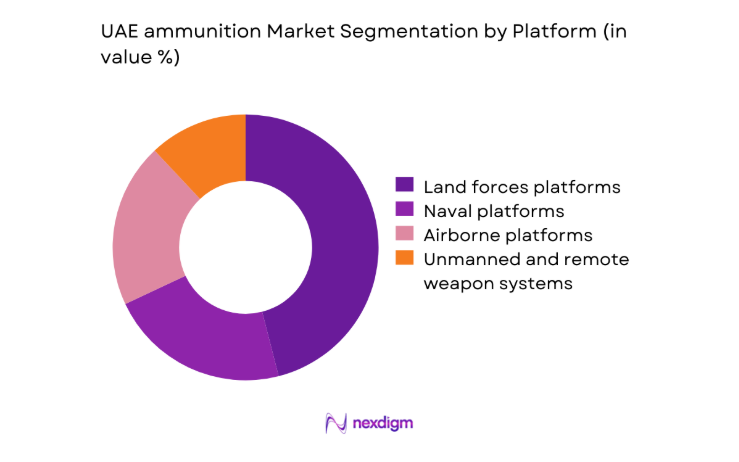

By Platform

Land forces platforms account for the largest value contribution given fleet modernization of armored vehicles and artillery systems, driving sustained replenishment and testing cycles. Naval platforms require specialized munitions with higher certification thresholds, reinforcing supplier qualification depth. Airborne platforms emphasize precision compatibility and safety protocols aligned with avionics integration. Unmanned and remote weapon systems are emerging contributors as doctrine evolves toward distributed lethality and remote engagement. Platform-specific storage, interoperability standards, and training pipelines shape procurement cadence and influence localized manufacturing priorities across standardized variants.

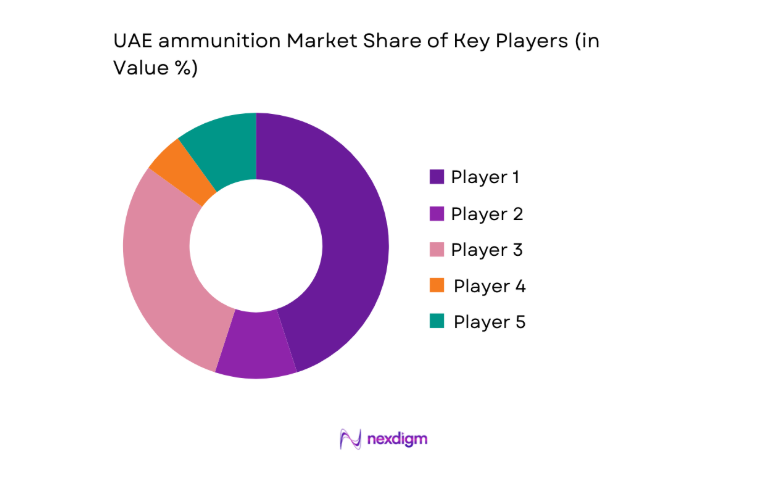

Competitive Landscape

The competitive environment features a blend of localized manufacturing, licensed production, and compliant import channels aligned with national industrialization objectives. Differentiation centers on caliber breadth, platform certifications, delivery reliability, and regulatory readiness, supported by after-sales services and lifecycle management capabilities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| EDGE Group | 2019 | Abu Dhabi | ~ | ~ | ~ | ~ | ~ | ~ |

| Caracal International | 2007 | Abu Dhabi | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Denel Munitions | 2008 | Wellington | ~ | ~ | ~ | ~ | ~ | ~ |

| Nammo | 1998 | Raufoss | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris | ~ | ~ | ~ | ~ | ~ | ~ |

UAE ammunition Market Analysis

Growth Drivers

Modernization of UAE armed forces and multi-domain capability upgrades

Modernization programs accelerated across land, naval, and air domains following 2022 capability assessments that documented 41 new armored vehicles inducted into service and 18 artillery system upgrades across brigade formations. Platform refresh cycles in 2023 expanded interoperability requirements across 6 calibers, driving replenishment schedules for training and operational readiness. Infrastructure investments added 3 certified storage depots near operational hubs to meet safety compliance mandates. By 2024, digital inventory systems were deployed across 12 logistics nodes, reducing stock variance events by 9 incidents annually. Integration testing protocols expanded to 27 standardized procedures, tightening qualification timelines and reinforcing predictable procurement cadence across service branches.

Expansion of armored vehicle and artillery fleets

Fleet expansion initiatives intensified following 2022 operational readiness reviews that authorized 24 additional armored platforms and refurbishment of 16 artillery units across mechanized brigades. By 2023, 7 new firing ranges achieved certification for medium and large caliber testing, expanding throughput for qualification cycles. Training pipelines in 2024 increased live-fire rotations across 9 battalions, elevating ammunition utilization planning complexity. Maintenance depots processed 21 platform overhauls during 2025 readiness cycles, reinforcing synchronization between fleet availability and munitions compatibility. Interoperability validation across 5 allied standards strengthened platform integration requirements, anchoring sustained procurement tied to fleet expansion and qualification schedules.

Challenges

Export controls and international arms trade restrictions

Export controls tightened in 2022 across 4 supplier jurisdictions, extending licensing timelines by 45 days on average for controlled munitions categories. In 2023, compliance audits expanded to 11 documentation checkpoints, increasing administrative burden for inbound shipments. Transit approvals through 3 major logistics corridors faced periodic suspensions tied to geopolitical developments, delaying replenishment cycles by up to 28 days. By 2024, end-use certification requirements were updated across 2 regulatory frameworks, requiring additional verification steps. These constraints compress delivery windows for operational units and complicate synchronization with training cycles, elevating risk exposure during readiness peaks and scheduled qualification programs.

High dependency on foreign technology for advanced munitions

Advanced guidance kits and fuzing technologies remain sourced from 5 external technology clusters, limiting domestic substitution options. In 2022, 14 critical components lacked local certification pathways, constraining assembly flexibility. By 2023, technology transfer approvals covered only 3 component families, slowing localization roadmaps. Testing facilities validated 9 advanced munition configurations in 2024, yet integration relied on foreign firmware updates across 4 systems. Skilled workforce pipelines produced 120 specialized technicians in 2025, insufficient to cover parallel validation programs. This dependency elevates supply risk, lengthens qualification cycles, and constrains rapid adaptation to evolving interoperability standards across platforms.

Opportunities

Expansion of local manufacturing and licensed production facilities

Licensed production capacity expanded across 2 industrial zones in 2022, enabling parallel assembly lines for 4 standardized calibers. By 2023, certification audits approved 6 new production cells, reducing inbound dependency for routine replenishment. In 2024, workforce training pipelines accredited 180 technicians across explosives safety, quality assurance, and ballistic testing. Test ranges added 5 instrumentation upgrades in 2025, improving validation throughput for localized variants. Localization targets align with national industrialization objectives supported by 3 policy instruments encouraging technology partnerships. These developments enable shorter lead times, improved compliance control, and scalable capacity to support readiness cycles across service branches.

Technology transfer partnerships with global ammunition OEMs

Technology partnerships formalized in 2022 covered 4 munition subsystems, enabling controlled access to manufacturing processes and quality protocols. In 2023, joint engineering teams completed 12 process validations across assembly and ballistic testing workflows. Certification bodies approved 7 localized process deviations in 2024, aligning with safety and performance benchmarks. Training exchanges in 2025 rotated 36 engineers through partner facilities, accelerating know-how diffusion. These partnerships improve platform compatibility across 5 calibers, shorten qualification cycles, and enhance resilience against external supply disruptions. Institutional backing through industrial cooperation frameworks supports deeper co-development pathways and sustained localization momentum.

Future Outlook

The period through 2035 reflects continued alignment between force modernization, localization mandates, and interoperability standards. Procurement cycles are expected to prioritize precision integration, compliant localization, and resilient logistics. Regulatory harmonization and technology partnerships will shape qualification speed, while platform refresh programs sustain steady replenishment needs. Ecosystem depth in Abu Dhabi and Dubai will continue to anchor capacity expansion and testing throughput.

Major Players

- EDGE Group

- Caracal International

- Rheinmetall Denel Munitions

- Nammo

- Thales Group

- SAAB Bofors Dynamics

- Elbit Systems

- Leonardo

- Poongsan Corporation

- MKE

- General Dynamics Ordnance and Tactical Systems

- Northrop Grumman

- BAE Systems

- CBC Global Ammunition

- Winchester Ammunition

Key Target Audience

- Investments and venture capital firms

- Ministry of Defence, UAE

- Tawazun Council

- Ministry of Interior, UAE

- Armed Forces Logistics Command

- Border Security and Coast Guard authorities

- Defense manufacturing and assembly operators

- Secure logistics and storage service providers

Research Methodology

Step 1: Identification of Key Variables

Platform compatibility requirements, caliber coverage, safety certifications, storage compliance, and lifecycle management parameters were mapped across operational and training use cases. Regulatory constraints and localization mandates were incorporated to define procurement pathways and qualification dependencies.

Step 2: Market Analysis and Construction

Demand drivers were constructed from platform modernization programs, training throughput indicators, and depot utilization metrics. Supply-side assessment focused on licensed production capacity, certification throughput, and logistics node readiness across industrial zones and operational hubs.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through consultations with procurement, compliance, and testing specialists. Scenario checks assessed interoperability constraints, qualification timelines, and resilience under export control tightening across logistics corridors.

Step 4: Research Synthesis and Final Output

Insights were synthesized to align drivers, constraints, and opportunities with policy instruments and industrialization objectives. Outputs emphasize compliance-ready localization, platform integration depth, and ecosystem resilience across procurement cycles.

- Executive Summary

- Research Methodology (Market Definitions and caliber and platform scope alignment, Primary interviews with UAE defense procurement authorities and armed forces logistics units, Tender and offset contract analysis across UAE defense programs)

- Definition and Scope

- Market evolution

- Usage and deployment pathways

- Ecosystem structure

- Supply chain and distribution structure

- Growth Drivers

Modernization of UAE armed forces and multi-domain capability upgrades

Expansion of armored vehicle and artillery fleets

Rising regional security threats and border protection needs - Challenges

Export controls and international arms trade restrictions

High dependency on foreign technology for advanced munitions

Complex procurement cycles and lengthy tender processes - Opportunities

Expansion of local manufacturing and licensed production facilities

Technology transfer partnerships with global ammunition OEMs

Development of smart and precision-guided munitions - Trends

Shift toward precision-guided and smart munitions

Increasing localization of ammunition assembly and testing

Digitization of inventory and lifecycle management - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Platforms, 2020–2025

- By Average Selling Price, 2020–2025

- By Caliber and Ammunition Type (in Value %)

Small caliber ammunition

Medium caliber ammunition

Large caliber artillery ammunition

Mortar ammunition

Tank and armored vehicle ammunition - By Platform (in Value %)

Land forces platforms

Naval platforms

Airborne platforms

Unmanned and remote weapon systems - By End Use (in Value %)

Military and defense forces

Internal security and police

Border security and coast guard

Training and simulation - By Application (in Value %)

Combat and operational use

Training and drills

Testing and qualification

Stockpiling and reserves - By Sourcing Model (in Value %)

Domestic production

Licensed manufacturing

Direct imports

- Market share of major players

- Cross Comparison Parameters (product portfolio breadth, caliber coverage, local manufacturing presence, technology transfer capabilities, pricing competitiveness, delivery lead times, compliance and licensing strength, after-sales support depth)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

EDGE Group

Caracal International

Rheinmetall Denel Munitions

Nammo

BAE Systems

Northrop Grumman

General Dynamics Ordnance and Tactical Systems

CBC Global Ammunition

Winchester Ammunition

Thales Group

SAAB Bofors Dynamics

Elbit Systems

Leonardo

Poongsan Corporation

MKE

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Platforms, 2026–2035

- By Average Selling Price, 2026–2035