Market Overview

The UAE ANA Testing market current size stands at around USD ~ million, supported by steady diagnostic demand across tertiary hospitals and specialized laboratories. In the most recent period, testing activity exceeded ~ tests, while analyzer installations crossed ~ systems, reflecting growing clinical reliance on autoimmune screening. Reagent consumption reached ~ units, driven by expanding rheumatology caseloads and broader insurance coverage for immunology diagnostics. Capital inflows of nearly USD ~ million into laboratory expansion have further strengthened testing capacity across the healthcare ecosystem.

Market activity is concentrated in Dubai and Abu Dhabi due to advanced hospital infrastructure, dense specialist networks, and higher patient inflow for complex autoimmune care. These cities host the majority of reference laboratories and high-throughput immunoassay platforms, enabling faster turnaround times and wider test menus. Sharjah and the Northern Emirates are emerging growth zones, supported by government-led healthcare investments, new specialty clinics, and improved diagnostic accessibility that is gradually balancing the national testing landscape.

Market Segmentation

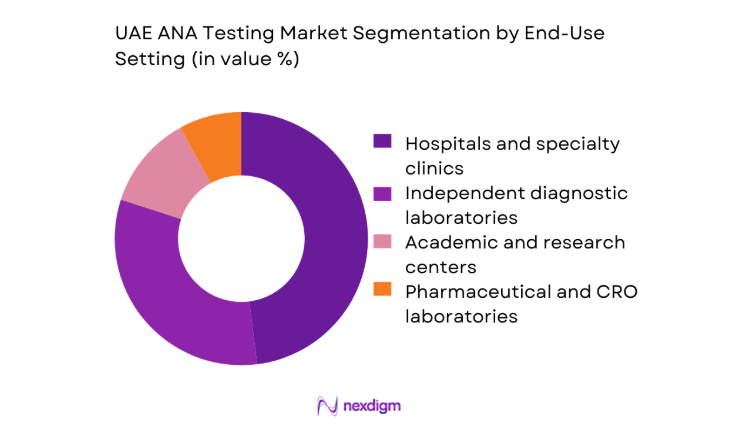

By End-Use Setting

Hospitals and specialty clinics dominate ANA testing demand due to their role in early diagnosis and long-term management of autoimmune diseases. These facilities handle the bulk of rheumatology referrals and benefit from in-house immunology labs that prioritize rapid turnaround and clinical integration. Independent diagnostic laboratories follow closely, driven by their ability to centralize testing, optimize reagent utilization, and serve multiple care providers. Research institutions and pharmaceutical labs contribute a smaller but strategic share, primarily linked to clinical trials and biomarker validation activities that support innovation in autoimmune diagnostics.

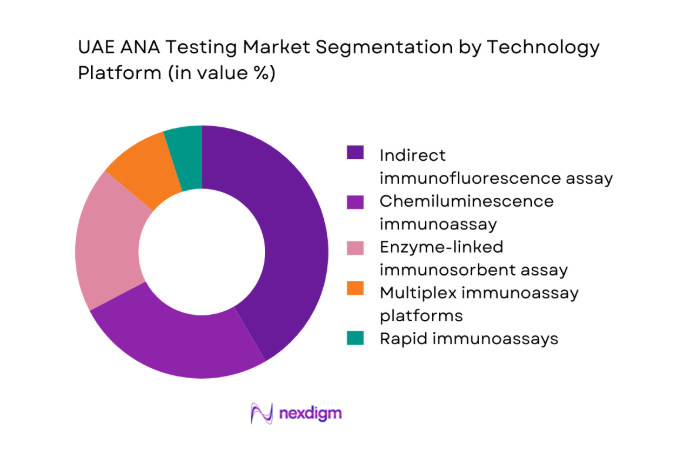

By Technology Platform

Indirect immunofluorescence remains the cornerstone technology due to its clinical acceptance and diagnostic breadth, particularly for complex autoimmune profiles. However, automated chemiluminescence and ELISA platforms are gaining traction as laboratories seek higher throughput, consistency, and reduced manual variability. Multiplex immunoassays are emerging in large reference labs where comprehensive panels improve diagnostic efficiency. Rapid immunoassays play a niche role in outpatient and point-of-care environments, supporting faster preliminary screening while confirmatory testing continues to rely on centralized platforms.

Competitive Landscape

The UAE ANA testing market reflects a moderately concentrated structure, led by global diagnostic manufacturers with strong regional distribution partners. Market dynamics are shaped by technological depth, service responsiveness, and regulatory alignment, while local distributors play a pivotal role in tender access and post-installation support across public and private healthcare facilities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott Diagnostics | 1888 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Bio-Rad Laboratories | 1952 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

UAE ANA Testing Market Analysis

Growth Drivers

Rising prevalence of autoimmune diseases in the UAE

Clinical data from major hospitals indicates that patient referrals for suspected autoimmune conditions surpassed ~ cases in the recent assessment period, with laboratory confirmations exceeding ~ diagnoses. The expanding patient pool has driven ANA testing volumes beyond ~ tests annually, supported by rising outpatient visits and specialist consultations that crossed ~ encounters. Increased awareness among primary care physicians has also led to earlier testing, contributing to reagent utilization of more than ~ units across public and private laboratories.

Increasing physician awareness of early autoimmune diagnostics

Continuing medical education programs reached over ~ clinicians across rheumatology and internal medicine specialties, leading to higher test ordering frequency. Diagnostic pathways now integrate ANA screening at earlier clinical stages, resulting in laboratory throughput growth of ~ tests in leading hospitals. Automated analyzer deployment increased by ~ systems to support faster workflows, while digital reporting tools now serve ~ physicians, improving clinical confidence in early diagnostic intervention.

Challenges

High cost of advanced immunoassay systems and reagents

Capital expenditure for automated ANA platforms exceeded USD ~ million across major healthcare groups, creating budgetary pressure on mid-sized laboratories. Annual reagent procurement reached ~ units, with logistics and import dependencies elevating operational outlays. Service contracts for high-throughput analyzers added recurring commitments of nearly USD ~ million, limiting technology upgrades in secondary care facilities and slowing the adoption of next-generation immunoassay solutions.

Shortage of skilled laboratory technologists

The certified immunology technologist workforce remains limited at around ~ professionals nationwide, creating staffing gaps in expanding diagnostic centers. Training programs currently graduate only ~ specialists annually, insufficient to match the installation of ~ new analyzers in recent cycles. This imbalance has increased workload per technologist to ~ tests per month, raising concerns over burnout, workflow delays, and long-term sustainability of quality standards.

Opportunities

Expansion of autoimmune disease screening programs

Public health initiatives targeting early detection are projected to enroll over ~ patients annually into structured screening pathways. Pilot programs in major emirates have already facilitated ~ additional ANA tests, improving early-stage diagnosis rates. Scaling these initiatives nationally could require deployment of ~ new analyzers and procurement of ~ reagent units, creating significant growth avenues for diagnostic service providers and healthcare systems alike.

Localization of reagent manufacturing and assembly

Plans for regional production hubs could support output of ~ reagent kits annually, reducing import dependency and lead times. Initial feasibility assessments indicate potential capital commitments of USD ~ million toward local assembly lines, with workforce requirements estimated at ~ skilled technicians. This shift can stabilize supply chains, lower operational costs for laboratories, and improve market resilience during global logistics disruptions.

Future Outlook

The UAE ANA testing market is positioned for steady advancement through the remainder of the decade, driven by healthcare digitization, rising autoimmune disease awareness, and stronger integration of diagnostics into preventive care models. Continued investments in laboratory automation, workforce development, and local manufacturing capabilities are expected to enhance service efficiency and national self-reliance. Regulatory alignment and public-private collaboration will further shape a more robust and accessible autoimmune diagnostics ecosystem.

Major Players

- Roche Diagnostics

- Abbott Diagnostics

- Siemens Healthineers

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- EUROIMMUN

- Inova Diagnostics

- DiaSorin

- Beckman Coulter

- Sysmex Corporation

- Randox Laboratories

- Orgentec Diagnostika

- Trinity Biotech

- Zeus Scientific

- MBL International

Key Target Audience

- Hospital networks and specialty clinics

- Independent diagnostic laboratory chains

- Government and regulatory bodies such as the Ministry of Health and Prevention and the Dubai Health Authority

- Health insurance providers and payer organizations

- Pharmaceutical and contract research organizations

- Medical device distributors and channel partners

- Investments and venture capital firms focused on healthcare

- Digital health and laboratory information system providers

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined by mapping diagnostic workflows, technology adoption levels, and end-user demand patterns across public and private healthcare facilities. Key variables included test utilization intensity, platform penetration, and service delivery models influencing ANA testing adoption.

Step 2: Market Analysis and Construction

Data points were consolidated to build a structured market framework covering supply-side capabilities, demand drivers, and regulatory context. Analytical models aligned testing volumes with healthcare infrastructure expansion and clinical referral dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through consultations with laboratory managers, clinicians, and procurement professionals. Feedback loops refined assumptions on technology uptake, workforce constraints, and evolving diagnostic pathways.

Step 4: Research Synthesis and Final Output

Findings were synthesized into an integrated market narrative highlighting structural trends, competitive dynamics, and strategic opportunities. Final outputs were aligned with consulting-grade standards for decision support and investment evaluation.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, ANA testing taxonomy across IFA ELISA and CLIA methods, market sizing logic by test volume and reagent utilization, revenue attribution across assays analyzers and controls, primary interview program with immunology labs hospitals and distributors, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care and diagnostic pathways

- Ecosystem structure

- Supply chain and distribution channels

- Regulatory environment

- Growth Drivers

Rising prevalence of autoimmune diseases in the UAE

Increasing physician awareness of early autoimmune diagnostics

Expansion of private diagnostic laboratory networks

Growth in health insurance coverage and screening programs

Adoption of advanced immunoassay platforms

Government investment in preventive healthcare - Challenges

High cost of advanced immunoassay systems and reagents

Shortage of skilled laboratory technologists

Variability in test standardization and result interpretation

Reimbursement limitations for specialized autoimmune panels

Dependence on imported reagents and consumables

Lengthy procurement cycles in public hospitals - Opportunities

Expansion of autoimmune disease screening programs

Localization of reagent manufacturing and assembly

Integration of AI-assisted pattern recognition in IFA

Growth of specialized rheumatology and immunology clinics

Public-private partnerships in diagnostic infrastructure

Rising demand for multiplex autoimmune panels - Trends

Shift from manual IFA to automated digital microscopy

Increasing adoption of multiplex and reflex testing algorithms

Growth of centralized reference laboratories

Rising use of cloud-based LIS integration

Preference for high-throughput analyzers in large hospitals

Emphasis on quality accreditation and proficiency testing - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Installed Base of Active Immunoassay Systems, 2019–2024

- By Revenue per Test, 2019–2024

- By Fleet Type (in Value %)

Public hospitals

Private hospitals and clinics

Independent diagnostic laboratories

Reference laboratories

Academic and research institutions - By Application (in Value %)

Systemic lupus erythematosus diagnosis and monitoring

Rheumatoid arthritis and connective tissue disorders

Autoimmune hepatitis and primary biliary cholangitis

Sjögren’s syndrome and mixed connective tissue disease

Drug-induced autoimmune screening - By Technology Architecture (in Value %)

Indirect immunofluorescence assay (IFA)

Enzyme-linked immunosorbent assay (ELISA)

Chemiluminescence immunoassay (CLIA)

Multiplex immunoassay platforms

Rapid and point-of-care immunoassays - By End-Use Industry (in Value %)

Hospitals and specialty clinics

Standalone diagnostic laboratories

Academic and research centers

Pharmaceutical and CRO laboratories

Blood banks and transfusion centers - By Connectivity Type (in Value %)

Laboratory information system integrated platforms

Standalone analyzers

Cloud-connected diagnostic systems

Hub-and-spoke laboratory networks

Offline point-of-care testing devices - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (test menu breadth, automation level, turnaround time, reagent cost per test, service and maintenance coverage, LIS integration capability, regulatory approvals, local distribution strength)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Roche Diagnostics

Abbott Diagnostics

Siemens Healthineers

Thermo Fisher Scientific

Bio-Rad Laboratories

EUROIMMUN (Revvity)

Inova Diagnostics (Werfen)

DiaSorin

Beckman Coulter

Sysmex Corporation

Randox Laboratories

Orgentec Diagnostika

Trinity Biotech

Zeus Scientific

MBL International

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Installed Base of Active Immunoassay Systems, 2025–2030

- By Revenue per Test, 2025–2030