Market Overview

The UAE armored vehicles market is driven by a robust demand for defense and security solutions, with the market size based on a recent historical assessment valued at approximately USD ~ billion. Growth is influenced by geopolitical tensions, military modernization initiatives, and increased government spending on defense. The demand for advanced armored vehicles stems from the need for enhanced security capabilities, including protection against emerging threats and regional instability.The UAE remains a dominant player in the market due to its strategic location in the Middle East, where the demand for military and security solutions is high. The country’s investment in defense modernization, particularly armored vehicles, is driven by its role as a key regional security force and its commitment to strengthening national defense capabilities. This demand is further supported by the UAE’s active participation in international peacekeeping missions and military alliances.

Market Segmentation

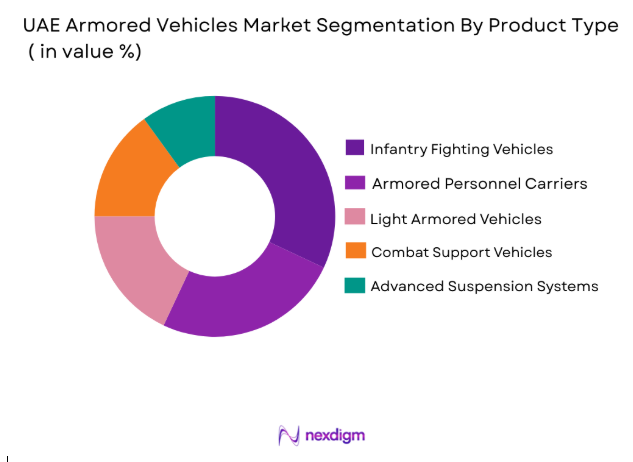

By Product Type:

The UAE armored vehicles market is segmented by product type into infantry fighting vehicles, armored personnel carriers, light armored vehicles, combat support vehicles, and mine-resistant ambush-protected vehicles. Recently, infantry fighting vehicles have seen a dominant market share due to the increasing need for versatile and highly mobile armored platforms capable of providing both firepower and troop protection in conflict zones.

By Platform Type:

The UAE armored vehicles market is segmented by platform type into land-based platforms, amphibious platforms, airliftable platforms, rail-mounted platforms, and multi-role platforms. Recently, land-based platforms have dominated the market due to their versatility and suitability for diverse terrains, such as deserts and urban environments, which are essential in the UAE’s defense operations. The demand for these platforms is further boosted by the UAE’s strategic focus on ground mobility in response to regional security concerns.

Competitive Landscape

The competitive landscape of the UAE armored vehicles market is marked by a mix of local and international defense manufacturers, with key players offering a wide range of advanced armored solutions. Major players are investing in technological innovations and collaborations with governments and defense organizations to maintain market dominance. The growing demand for defense systems in the UAE has led to significant consolidation within the market, with large firms capturing major contracts. Local players benefit from government support, while global players bring advanced technology and expertise, creating a dynamic competitive environment.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1899 | United States | ~ | ~ | ~ | ~ | ~ |

| Oshkosh Defense | 1917 | United States | ~ | ~ | ~ | ~ | ~ |

UAE Armored Vehicles Market Analysis

Growth Drivers

Government Defense Expenditure:

The UAE government continues to increase defense spending to fortify its national security, driving demand for armored vehicles. With a strategic focus on modernizing the military, the government prioritizes the procurement of advanced, versatile armored platforms. This rising defense budget fuels the development and acquisition of vehicles capable of responding to contemporary security challenges, ensuring the UAE remains resilient in an increasingly unstable geopolitical environment. Furthermore, the continuous push for technological advancements in armored vehicles contributes to the market’s growth, as the UAE seeks state-of-the-art protection and mobility solutions to bolster its defense forces.

Technological Advancements in Armored Vehicles:

The introduction of advanced armor technologies, such as reactive and composite armor, along with improvements in vehicle mobility and weaponry, has become a significant growth driver for the armored vehicles market in the UAE. The shift towards more agile, modular, and multi-functional armored vehicles caters to the evolving needs of military and law enforcement agencies. With increasing threats from asymmetric warfare, terrorism, and regional conflicts, the UAE invests heavily in armored vehicles equipped with cutting-edge defense technology. These advancements enhance the protection and operational efficiency of armored platforms, thereby supporting the market’s expansion.

Market Challenges

High Cost of Acquisition and Maintenance

The high initial cost of acquiring and maintaining advanced armored vehicles presents a significant challenge in the UAE market. Despite the government’s substantial defense budget, the cost of acquiring modern vehicles with advanced armor, weapon systems, and communication equipment remains a barrier for some defense organizations. Additionally, the maintenance and upgrades of these vehicles involve ongoing financial commitments. This challenge is compounded by the need for specialized training and spare parts for each platform, creating long-term financial pressures for military budgets.

Technological Integration and Interoperability:

The integration of new armored vehicles with existing systems and platforms often presents compatibility issues, particularly when dealing with legacy systems and infrastructures. The UAE’s military forces require armored vehicles that can seamlessly integrate with air, land, and sea-based defense systems. Achieving interoperability between different platforms and ensuring smooth communication between units is a complex challenge. Furthermore, the integration of emerging technologies, such as AI and automation, into armored vehicles requires substantial research, testing, and system adjustments, which can delay procurement and increase costs.

Opportunities

Adoption of Electric and Hybrid Armored Vehicles:

One of the key opportunities in the UAE armored vehicle market lies in the development and adoption of electric and hybrid armored vehicles. With growing concerns about environmental sustainability and the rising cost of fossil fuels, the shift towards hybrid and electric vehicles offers a promising alternative. These vehicles are expected to reduce operational costs, improve fuel efficiency, and decrease environmental impact. The UAE, with its focus on sustainability, is well-positioned to lead the adoption of electric and hybrid armored vehicles, which will contribute to the modernization of its military fleet.

Growing Demand for Advanced Protection Systems:

As security threats become more complex, the demand for armored vehicles with enhanced protection systems, such as active protection systems and improved blast resistance, is expected to rise. The UAE’s ongoing commitment to strengthening its defense infrastructure drives the demand for vehicles that offer higher levels of safety and survivability in battle. The market will benefit from advancements in armor technology and protection systems, ensuring that armored vehicles provide superior defense against modern weaponry, including anti-tank missiles and improvised explosive devices.

Future Outlook

The future of the UAE armored vehicles market looks promising, driven by increasing demand for advanced, multi-functional military platforms. Over the next five years, technological advancements, such as electric and hybrid systems, are expected to transform the market. The UAE’s continued focus on defense modernization and regional security dynamics will contribute to sustained growth. The development of next-generation armored vehicles with improved protection and mobility will be a key factor in shaping the future trajectory of the market.

Major Players

- Lockheed Martin

- BAE Systems

- Rheinmetall AG

- General Dynamics

- Oshkosh Defense

- Leonardo

- Saab Group

- Thales Group

- Navistar Defense

- Textron Systems

- IvecoDefenceVehicles

- Elbit Systems

- Hyundai Rotem

- ST Engineering

- Patria

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military and law enforcement agencies

- Armored vehicle manufacturers

- Private security firms

- Automotive and mobility technology firms

- Defense research and development organizations

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the primary factors affecting the armored vehicles market, such as defense spending, technological advancements, and geopolitical stability. We analyze the key variables that influence the demand for armored vehicles in the UAE and the Middle East region.

Step 2: Market Analysis and Construction

We conduct detailed market analysis using historical data, expert interviews, and primary research to construct a comprehensive view of the armored vehicles market. This includes analyzing market trends, consumer behavior, and competitive dynamics.

Step 3: Hypothesis Validation and Expert Consultation

We validate our hypotheses through consultations with industry experts, including defense contractors, military officials, and technology providers, ensuring that our findings reflect real-world market conditions.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the research findings, including detailed market insights, forecasts, and recommendations, to provide a comprehensive report on the UAE armored vehicles market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Armored Vehicle Protection

Rising Geopolitical Tensions

Growing Military Modernization Programs

Integration of Commercial Technologies into Defense Systems - Market Challenges

High Capital Expenditure in Defense Projects

Cybersecurity Threats and Vulnerabilities in Military Systems

Technological Integration and Interoperability Issues

Political and Social Resistance to Military Expansion

High Maintenance Costs of Armored Vehicles - Market Opportunities

Expansion in Artificial Intelligence-Driven Armored Vehicle Systems

Development of Hybrid and Electric Armored Vehicles

Rising Demand for Advanced Armor Technologies - Trends

Increase in Autonomous Vehicle Integration

Military Mobility Enhancements with Electric Drive Systems

Increased Demand for Mine-resistant Vehicles

Shift Toward Multi-role Armored Platforms

Technological Upgrades to C4ISR Systems in Armored Vehicles - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Infantry Fighting Vehicles

Armored Personnel Carriers

Light Armored Vehicles

Combat Support Vehicles

Mine-resistant Ambush-protected Vehicles - By Platform Type (In Value%)

Amphibious Platforms

Airliftable Platforms

Rail-mounted Platforms

Multi-role Platforms - By Fitment Type (In Value%)

on-premises Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Reactive Armor

Composite Armor

Modular Armor

Electromagnetic Shielding

Ballistic Protection Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems

Rheinmetall AG

General Dynamics

Oshkosh Defense

Leonardo

Saab Group

Thales Group

Navistar Defense

Textron Systems

Iveco Defence Vehicles

Elbit Systems

Hyundai Rotem

ST Engineering

Patria

- Military Forces’ Increasing Demand for Modern Armored Systems

- Government Agencies’ Role in Regulating and Procuring Armored Vehicles

- Defense Contractors’ Focus on Innovation and Integration

- Private Sector’s Growing Interest in Armored Vehicle Technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035