Market Overview

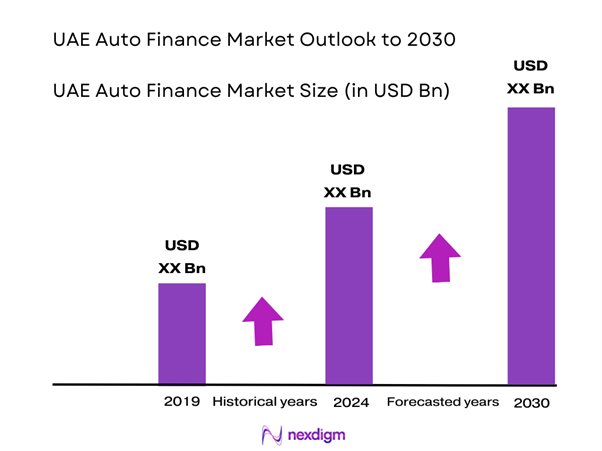

The UAE Auto Finance Market is valued at USD 12.5 billion, based on comprehensive market analysis. This market is predominantly driven by the rising vehicle ownership rates as consumer confidence improves and access to auto financing becomes easier through digital platforms. Additionally, banks and financial institutions are increasingly offering competitive interest rates and tailored financing solutions, further stimulating market growth.

The key cities dominating the UAE Auto Finance Market are Dubai and Abu Dhabi. Dubai’s status as a commercial hub attracts significant foreign investment and a diverse population, leading to high demand for vehicles. Similarly, Abu Dhabi contributes to market dominance due to its wealth generated from oil revenues, making luxury and premium vehicles more accessible to residents. These factors position the UAE as a leading market for auto finance in the Gulf region.

The global push towards sustainability is reflected in the UAE market, with electric vehicles (EVs) gaining traction. In 2022, EV registrations grew by 30%, and the government is forecasting that electric vehicles will represent 20% of the total vehicle market by end of 2025. With local manufacturers like Al-Futtaim and international brands launching new EV models, there is a growing need for tailored financing solutions to facilitate these purchases. This trend is prompting banks to develop specific financial products aimed at EV buyers, thus expanding the market and promoting eco-friendly vehicle adoption.

Market Segmentation

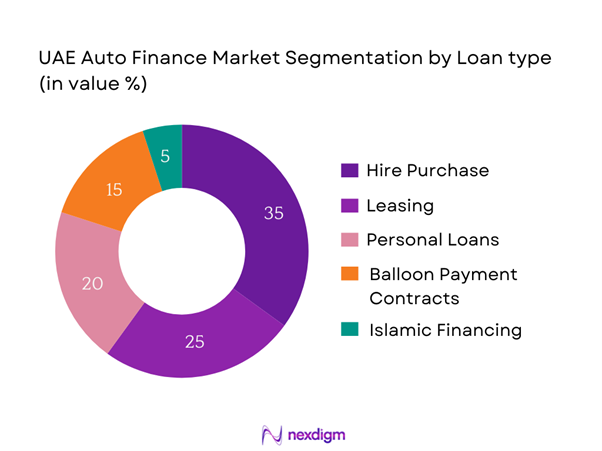

By Loan Type

The UAE Auto Finance Market is segmented by loan type into hire purchase, leasing, personal loans, balloon payment contracts, and Islamic financing. The hire purchase segment holds a dominant market share due to its beneficial structure that allows consumers to pay for vehicles in installments while retaining ownership. This financing method is appealing for many consumers as it provides flexibility and lower upfront costs, making it an attractive option for both individuals and businesses.

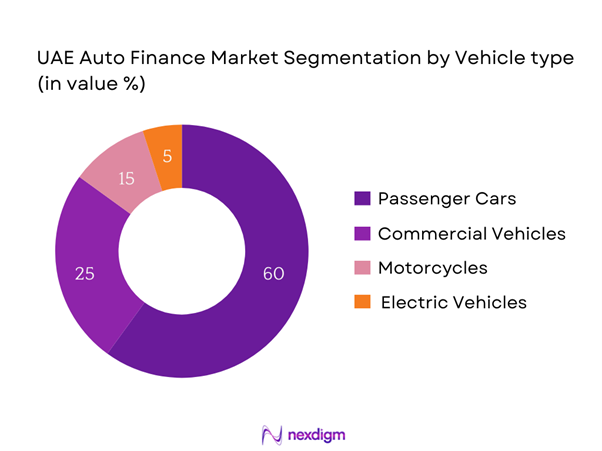

By Vehicle Type

The market is also segmented based on vehicle type, including passenger cars, commercial vehicles, motorcycles, and electric vehicles. The passenger cars segment dominates the market share due to the high consumer preference for personal vehicles driven by increasing urbanization and disposable income. The convenience and independence offered by owning a passenger car makes it the go-to option for a majority of consumers, bolstered by the wide availability of financing options tailored for this segment.

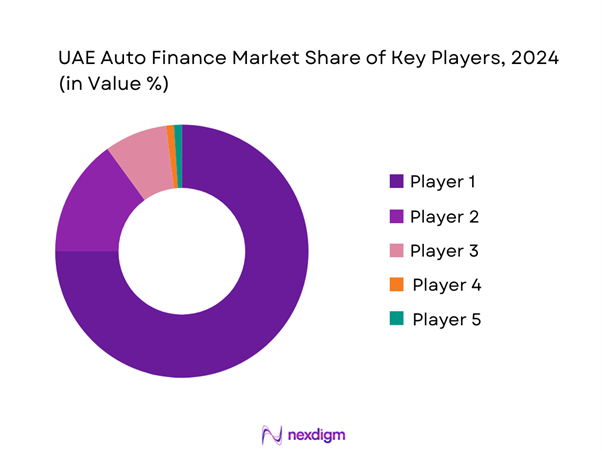

Competitive Landscape

The UAE Auto Finance Market is dominated by a few major players, including Emirates NBD, Abu Dhabi Commercial Bank, Dubai Islamic Bank, and National Bank of Fujairah. This consolidation highlights the significant influence these key companies have as they offer a variety of financing options tailored to meet consumer needs.

| Company | Establishment Year | Headquarters | Market Share (%) | Loan Types Offered | Customer Types | Special Offers |

| Emirates NBD | 2007 | Dubai | – | – | – | – |

| Abu Dhabi Commercial Bank | 1985 | Abu Dhabi | – | – | – | – |

| Dubai Islamic Bank | 1975 | Dubai | – | – | – | – |

| National Bank of Fujairah | 1982 | Fujairah | – | – | – | – |

| Abu Dhabi Islamic Bank | 1997 | Abu Dhabi | – | – | – | – |

UAE Auto Finance Market Analysis

Growth Drivers

Increasing Car Ownership

The rate of car ownership in the UAE has significantly increased, with data indicating that approximately 76% of households owned a car in 2023. This increase is driven by economic prosperity, with GDP per capita standing at around USD 43,000 in 2022, reflecting a robust economy that encourages consumer spending on vehicles. As disposable incomes rise, the demand for personal and luxury vehicles is correspondingly increasing. Moreover, there are over 3 million registered vehicles in the UAE, underscoring the strong car ownership culture among Emiratis and expatriates alike.

Government Initiatives for Sustainable Transportation

The UAE government is implementing various initiatives to promote sustainable transportation methods, such as its national strategy to generate 50% of the total energy from clean sources by 2050. Also, Dubai’s Roads and Transport Authority announced plans to have 42,000 electric vehicles on the roads by 2030, reflecting a commitment to reducing carbon emissions. In 2022, the government allocated AED 600 million (approx. USD 163 million) to promote electric vehicle adaptations and infrastructure, directly impacting the auto finance market by encouraging electric car purchases through attractive financing solutions.

Market Challenges

Economic Fluctuations and Consumer Confidence

Economic stability in the UAE has been challenged by fluctuations in global oil prices, impacting government reserves and investments. In 2022, the IMF reported that the UAE’s economy contracted by around 0.1% due to downturns in oil markets, which directly affects consumer spending power. Additionally, the rising inflation rate, projected to reach 4.5% in 2023, erodes consumer confidence. Consequently, potential car buyers exhibit hesitation in taking loans for vehicle purchases, directly impacting the auto financing sector. Stability in the oil sector is critical for restoring consumer confidence and sustaining vehicle financing growth.

Regulatory Compliance

The auto finance sector in the UAE is subject to stringent regulatory oversight, with the Central Bank of the UAE enforcing various guidelines aimed at protecting consumers. In 2023, the Central Bank announced updates to its financing regulations, requiring greater transparency and consumer protection practices among lenders. Compliance with these regulations increases operational costs for financial institutions, which could lead to tighter lending policies. The regulatory framework aims to enhance financial stability but also creates challenges for banks in adopting flexible loan products that would cater to diverse consumer needs.

Opportunities

Rise in E-commerce and Online Lending Solutions

The rapid expansion of e-commerce in the UAE, with a 53% increase in online spending reported in 2022, presents significant opportunities for the auto finance market. Concurrently, more than 70% of consumers are now comfortable with online financial transactions, indicating a strong shift towards digital financing solutions. Financial institutions are responding by introducing streamlined online platforms for auto loans, providing faster approval processes and more accessible financing options, meeting the demands of a tech-savvy population. This trend not only boosts the auto finance market but also positions lenders to capitalize on the growing digital economy.

Future Outlook

Over the next five years, the UAE Auto Finance Market is expected to show significant growth driven by continuous government support, advancements in digital banking technologies, and increasing consumer demand for accessible and flexible financing solutions. The introduction of innovative loan products, coupled with an expanding base of potential customers eager for vehicle ownership, will further propel the market’s growth trajectory.

Major Players

- Emirates NBD

- Abu Dhabi Commercial Bank

- Dubai Islamic Bank

- National Bank of Fujairah

- Abu Dhabi Islamic Bank

- First Abu Dhabi Bank

- Mashreq Bank

- RAK Bank

- Noor Bank

- Union National Bank

- Al-Futtaim Auto & Machinery Company

- Al Hilal Bank

- Emirates Islamic Bank

- Al Ansari Exchange

- Emirates Motor Company

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (UAE Central Bank)

- Financial Institutions

- Automotive Manufacturers

- Car Dealerships

- Leasing Companies

- Insurance Providers

- Consumer Advocacy Groups

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing a comprehensive ecosystem map of all significant stakeholders within the UAE Auto Finance Market. It encompasses an extensive desk research approach that utilizes a mixture of secondary and proprietary databases to gather relevant industry-level information. The objective of this step is to identify and define critical variables that shape market dynamics, such as consumer behavior, economic indicators, and technological trends.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the UAE Auto Finance Market will be compiled and analyzed. This includes evaluating market penetration rates, the ratio of financing methods utilized by consumers, and the resultant volume of revenues generated by each sector. The goal is to provide an accurate overview of the current state of the market along with insights regarding service quality and customer satisfaction metrics, which are crucial for reliability in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

This step involves developing market hypotheses and validating them through structured interviews with industry experts. This includes utilizing Computer-Assisted Telephone Interviewing System (CATIS) to gather insights from professionals representing a broad spectrum of companies within the auto finance sector. These consultations not only provide operational insights but also help in refining and corroborating existing market data, ensuring accuracy in the analysis.

Step 4: Research Synthesis and Final Output

The final phase requires engaging with auto manufacturers and financing companies to gather detailed insights on product segments, sales figures, consumer preferences, and other pertinent factors influencing the market. This interaction serves to not only verify but also enhance statistics from the bottom-up approach, thereby ensuring a holistic and validated analysis of the UAE Auto Finance Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Car Ownership

Government Initiatives for Sustainable Transportation - Market Challenges

Economic Fluctuations and Consumer Confidence

Regulatory Compliance - Opportunities

Rise in E-commerce and Online Lending Solutions - Trends

Shift Towards Electric Vehicle Financing - Government Regulation

Financial Conduct Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Loan Amount, 2019-2024

- By Loan Type (In Value %)

Hire Purchase

– Standard Hire Purchase

– Balloon Hire Purchase

Leasing

– Operational Leasing

– Financial Leasing

Personal Loans

– Secured Auto Loans

– Unsecured Auto Loans

Balloon Payment Contracts

– With Guaranteed Future Value

– Without Guaranteed Future Value

Islamic Financing

– Murabaha-Based Auto Financing

– Ijara-Based Auto Financing - By Vehicle Type (In Value %)

Passenger Cars

– Economy Segment

– Mid-Range Segment

– Luxury Segment

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Heavy Commercial Vehicles (HCVs)

Motorcycles

– Standard Bikes

– Sports Bikes

Electric Vehicles

– Hybrid Electric Vehicles (HEVs)

– Battery Electric Vehicles (BEVs) - By Distribution Channel (In Value %)

Banks

– Public Sector Banks

– Private Sector Banks

Non-Banking Financial Companies (NBFCs)

– Standalone NBFCs

– Captive Finance Arms

Direct Online Platforms

– Fintech Auto Loan Aggregators

– Direct-to-Consumer Loan Portals

Car Dealerships

– Brand-Owned Dealers

– Multi-Brand Franchise Dealers - By Customer Type (In Value %)

Individual Customers

– Salaried Professionals

– Self-Employed Individuals

Corporate Clients

– Fleet Operators

– Leasing Companies - By Region (In Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Annual Revenues and Revenue by Financing Type, Loan Portfolio Mix, Distribution Channels, Number of Touchpoints, Unique Value Proposition, Digital Capabilities & Fintech Integrations, Delinquency Ratios / NPA Metrics, Regulatory Compliance and Risk Management, Partnership Ecosystem)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players in UAE Auto Finance Market

- Detailed Profiles of Major Companies

Emirates NBD

Abu Dhabi Commercial Bank

Dubai Islamic Bank

National Bank of Fujairah

Mashreq Bank

Al-Futtaim Auto & Machinery Company

Abu Dhabi Islamic Bank

Bank of Sharjah

Emirates Islamic Bank

First Abu Dhabi Bank

Noor Bank

RAK Bank

Union National Bank

Al Hilal Bank

Dubai’s Car Dealerships (Various)

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Loan Amount, 2025-2030