Market Overview

The UAE Autoantibody Panels market current size stands at around USD ~ million, reflecting steady expansion from a recent baseline of nearly USD ~ million driven by growing diagnostic demand and broader clinical adoption. Annual test volumes now exceed ~ tests, supported by an installed base of over ~ automated immunoassay systems across hospital and reference laboratories. Rising case identification for autoimmune and inflammatory disorders continues to push panel-based testing, with laboratories prioritizing efficiency gains and standardized workflows to manage increasing diagnostic throughput.

Market dominance is concentrated in Dubai and Abu Dhabi due to their advanced healthcare infrastructure, dense network of tertiary hospitals, and high concentration of accredited diagnostic laboratories. These cities benefit from stronger clinical referral ecosystems, faster adoption of automated immunology platforms, and greater access to specialized rheumatology and endocrinology services. Supportive health policies streamlined product registration processes, and a mature private healthcare sector further reinforce their leadership in advanced diagnostic testing adoption.

Market Segmentation

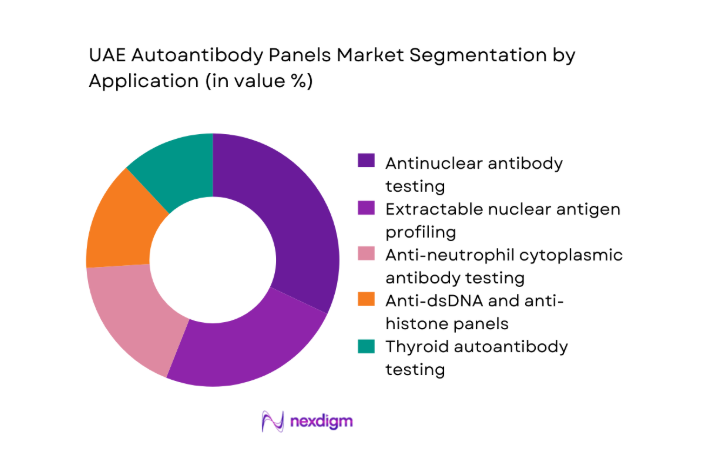

By Application

ANA and ENA-based testing dominates the UAE Autoantibody Panels market due to its central role in screening and monitoring systemic autoimmune diseases. Hospitals and specialty clinics increasingly rely on comprehensive panels rather than single-analyte tests to improve diagnostic accuracy and reduce repeat testing. The rising burden of rheumatologic and endocrine disorders has accelerated routine use of dsDNA, ANCA, and thyroid antibody panels, particularly in urban tertiary care centers. Independent diagnostic chains have also expanded bundled autoimmune profiles to attract preventive health screening clients. This broadening application base has positioned multi-marker panels as the preferred diagnostic pathway across both public and private healthcare settings.

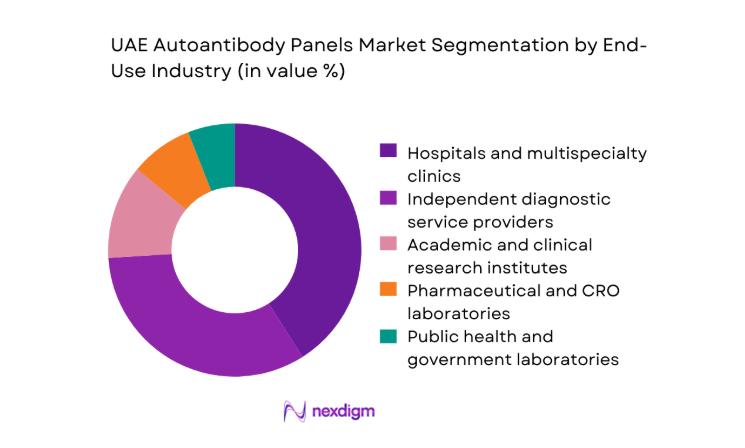

By End-Use Industry

Hospitals and multispecialty clinics represent the largest end-use segment as they manage the majority of autoimmune diagnostic workflows, from initial screening to long-term disease monitoring. These facilities increasingly invest in automated immunoassay platforms to support high patient inflow and faster turnaround requirements. Independent diagnostic service providers follow closely, leveraging extensive collection networks and home sample services to expand testing reach. Research institutes and pharmaceutical laboratories contribute a smaller but strategically important share, driven by clinical trials and biomarker validation programs. Public health laboratories remain focused on population-level screening initiatives and standardized testing protocols.

Competitive Landscape

The UAE Autoantibody Panels market exhibits a moderately concentrated structure, with a limited number of multinational diagnostics providers dominating high-throughput and automated testing segments. These players benefit from strong regulatory preparedness, established distributor networks, and deep clinical relationships with major hospital groups. Smaller regional suppliers and niche immunology specialists operate mainly in manual and semi-automated segments, competing on flexibility and localized service support.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott Diagnostics | 1888 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Bio-Rad Laboratories | 1952 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Autoantibody Panels Market Analysis

Growth Drivers

Rising prevalence of autoimmune and inflammatory disorders

Clinical caseloads related to autoimmune conditions now exceed ~ diagnosed patients annually across major care centers, driving sustained demand for comprehensive antibody profiling. Hospital laboratories process more than ~ autoimmune-related tests each month, reflecting a sharp increase in screening referrals from rheumatology and endocrinology departments. The growing number of chronic disease management programs has led to repeat testing cycles averaging ~ tests per patient annually. This expanding diagnostic intensity has elevated the importance of multi-marker panels that reduce repeat visits and improve clinical decision timelines. As patient pathways become more protocol-driven, laboratories continue to scale automated testing capacity to manage growing volumes.

Expansion of specialized immunology and rheumatology services

The number of specialty immunology and rheumatology clinics has crossed ~ facilities nationwide, significantly expanding access to advanced autoimmune diagnostics. These centers collectively handle over ~ patient consultations annually, creating consistent downstream demand for antibody panel testing. Dedicated clinics typically order ~ distinct autoimmune panels per week per physician, reflecting higher diagnostic intensity than general practice settings. Investment in sub-specialty services has also increased the installed base of automated immunoassay systems to more than ~ platforms, strengthening the testing ecosystem. This clinical specialization trend continues to reinforce structured diagnostic pathways that rely heavily on standardized autoantibody profiling.

Challenges

High cost of advanced immunoassay platforms and reagents

Laboratories face substantial financial barriers as a single fully automated immunoassay system requires capital deployment exceeding USD ~ million, limiting adoption among mid-sized facilities. Annual reagent procurement for comprehensive autoimmune panels often surpasses USD ~ million for high-volume laboratories, placing pressure on operating budgets. Smaller diagnostic centers typically restrict test menus to ~ core assays, reducing access to advanced profiling. This cost sensitivity slows market penetration of newer multiplex technologies and constrains geographic expansion beyond major urban hubs. As a result, advanced autoantibody testing remains concentrated in well-funded hospital networks and premium private laboratories.

Limited availability of trained immunodiagnostics specialists

The UAE currently supports fewer than ~ certified immunology laboratory specialists across public and private healthcare systems, creating capacity constraints in complex test interpretation. Each specialist oversees an average workload of ~ tests per week, increasing turnaround times during peak referral periods. Training pipelines remain limited, with only ~ structured professional development programs focused on advanced autoimmune diagnostics. This talent gap restricts the scalability of sophisticated testing platforms and drives dependence on automated interpretation tools. Until workforce depth improves, laboratories will continue to face operational bottlenecks in expanding specialized autoantibody services.

Opportunities

Expansion of private diagnostic chains across the UAE

Private diagnostic networks now operate more than ~ collection centers nationwide, offering a scalable platform for expanding autoimmune testing access. These chains collectively process over ~ diagnostic tests annually, with autoimmune panels representing a fast-growing category. Strategic expansion into secondary cities has added ~ new outlets in recent years, enabling broader patient reach beyond major metropolitan hubs. Centralized laboratory models allow these operators to run high-throughput immunoassay systems capable of handling ~ tests per day. This structural growth positions private chains as key drivers of market volume expansion and service standardization.

Integration of multiplex testing to improve clinical efficiency

Multiplex immunoassay platforms now enable simultaneous detection of ~ autoantibodies in a single run, significantly improving laboratory efficiency. Facilities adopting these systems report reductions of ~ manual processing steps per test cycle, freeing technical staff for higher-value activities. Average turnaround times for comprehensive autoimmune profiles have dropped to under ~ hours in high-throughput settings. This efficiency gain supports higher daily test capacities exceeding ~ panels per system, making multiplex solutions increasingly attractive for large hospital networks. As clinical protocols favor faster and more comprehensive diagnostics, multiplex integration represents a major growth lever.

Future Outlook

The UAE Autoantibody Panels market is expected to sustain steady growth through 2030 as healthcare providers increasingly prioritize early diagnosis and long-term management of autoimmune diseases. Continued expansion of private diagnostic chains, rising medical tourism, and deeper integration of laboratory automation will strengthen demand for comprehensive testing solutions. Regulatory alignment with international standards and ongoing investments in digital health infrastructure are set to further enhance service quality and market accessibility across the country.

Major Players

- Roche Diagnostics

- Abbott Diagnostics

- Siemens Healthineers

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- EUROIMMUN

- Inova Diagnostics

- Werfen

- DiaSorin

- Orgentec Diagnostika

- Trinity Biotech

- QuidelOrtho

- ZEUS Scientific

- Grifols

- Sysmex

Key Target Audience

- Hospital groups and multispecialty clinic networks

- Independent diagnostic laboratory chains

- Specialty immunology and rheumatology clinics

- Pharmaceutical and clinical research organizations

- Health insurance providers and payers

- Investments and venture capital firms

- Ministry of Health and Prevention

- Dubai Health Authority

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through mapping of diagnostic workflows, testing volumes, and platform adoption across major healthcare facilities. Key demand drivers, supply-side constraints, and regulatory touchpoints were identified. Variables included test utilization rates, automation penetration, and service delivery models.

Step 2: Market Analysis and Construction

A structured framework was built using historical diagnostic activity, laboratory capacity benchmarks, and healthcare infrastructure indicators. Segmentation models were developed across application areas and end-use industries. Market sizing logic was validated through cross-checks with operational data patterns.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were refined through structured discussions with laboratory managers, clinicians, and procurement teams. Assumptions on growth pathways and adoption barriers were stress-tested. Insights were consolidated to ensure alignment with on-ground realities.

Step 4: Research Synthesis and Final Output

All qualitative and quantitative inputs were integrated into a unified analytical narrative. Data consistency checks and logical validations were applied across sections. Final outputs were structured to support strategic decision-making and long-term market planning.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, autoantibody panel taxonomy and test menu mapping, market sizing logic by panel utilization and test volume, revenue attribution across assays reagents and analyzers, primary interview program with immunology labs hospitals and distributors, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Clinical care and diagnostic usage pathways

- Ecosystem structure

- Supply chain and distribution channels

- Regulatory environment

- Growth Drivers

Rising prevalence of autoimmune and inflammatory disorders

Expansion of specialized immunology and rheumatology services

Increasing adoption of early and preventive diagnostic screening

Growing investment in advanced laboratory automation

Medical tourism growth and demand for high-quality diagnostics

Government focus on strengthening diagnostic infrastructure - Challenges

High cost of advanced immunoassay platforms and reagents

Limited availability of trained immunodiagnostics specialists

Reimbursement constraints for specialized autoimmune testing

Complex regulatory and product registration processes

Variability in test standardization and result interpretation

Dependence on imported diagnostic consumables - Opportunities

Expansion of private diagnostic chains across the UAE

Integration of multiplex testing to improve clinical efficiency

Growth in personalized medicine and targeted therapies

Rising demand for point-of-care autoimmune screening solutions

Public-private partnerships in laboratory services

Digital pathology and AI-supported result interpretation - Trends

Shift from single-analyte to comprehensive panel testing

Growing preference for fully automated high-throughput platforms

Increasing use of reflex testing algorithms in immunology

Adoption of standardized international testing protocols

Expansion of home sample collection services

Rising focus on quality assurance and external proficiency testing - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Installed Base, 2019–2024

- By Revenue per Test, 2019–2024

- By Fleet Type (in Value %)

Hospital-based diagnostic laboratories

Independent reference laboratories

Specialty immunology clinics

Academic and research laboratories

Government and public health laboratories - By Application (in Value %)

Antinuclear antibody (ANA) testing

Extractable nuclear antigen (ENA) profiling

Anti-neutrophil cytoplasmic antibody (ANCA) testing

Anti-dsDNA and anti-histone panels

Thyroid autoantibody testing

Celiac disease autoantibody testing - By Technology Architecture (in Value %)

ELISA-based panels

Chemiluminescent immunoassays (CLIA)

Indirect immunofluorescence assays (IFA)

Line immunoassays and blot-based panels

Multiplex bead-based immunoassays - By End-Use Industry (in Value %)

Hospitals and multispecialty clinics

Independent diagnostic service providers

Academic and clinical research institutes

Pharmaceutical and CRO laboratories

Public health and government laboratories - By Connectivity Type (in Value %)

Manual and semi-automated testing workflows

Fully automated immunoassay platforms

Laboratory information system integrated solutions

Cloud-enabled data management platforms

Remote quality control and proficiency testing systems - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (panel breadth, automation compatibility, turnaround time, clinical sensitivity, regulatory approvals, local service support, pricing model, reagent supply reliability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Roche Diagnostics

Abbott Diagnostics

Siemens Healthineers

Thermo Fisher Scientific

Bio-Rad Laboratories

EUROIMMUN

Inova Diagnostics

Werfen

DiaSorin

Orgentec Diagnostika

Trinity Biotech

QuidelOrtho

ZEUS Scientific

Grifols

Sysmex

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Installed Base, 2025–2030

- By Revenue per Test, 2025–2030