Market Overview

The UAE Autoimmune Marker Testing market current size stands at around USD ~ million, reflecting steady expansion driven by rising diagnostic demand and expanding specialty care infrastructure. In the most recent assessment periods, the market recorded values of USD ~ million followed by USD ~ million, supported by higher testing volumes in tertiary hospitals and independent diagnostic laboratories. Growth momentum is reinforced by increased physician-led screening protocols, broader availability of automated immunoassay systems, and higher patient throughput across urban healthcare clusters.

Market activity is highly concentrated in Dubai and Abu Dhabi, where advanced hospital networks, well-established diagnostic service providers, and strong insurance penetration drive sustained testing demand. These cities benefit from mature laboratory ecosystems, higher density of immunology specialists, and faster adoption of automated platforms. Supportive health policies, accreditation frameworks, and strong private sector participation further strengthen their dominance, while Sharjah and the Northern Emirates continue to expand gradually through public healthcare investments.

Market Segmentation

By Application

Systemic autoimmune disease diagnostics dominates this segmentation lens due to consistent demand from rheumatology, nephrology, and endocrinology practices. High clinical reliance on antinuclear antibodies, extractable nuclear antigen panels, and disease-specific markers positions this segment as the backbone of routine autoimmune screening. Hospitals and reference laboratories prioritize these tests for early detection and therapy monitoring, reinforcing volume stability. Organ-specific autoimmune testing is gaining traction, supported by improved clinician awareness and structured referral pathways. Together, these applications benefit from expanding specialty clinics, rising chronic disease prevalence, and growing integration of automated platforms that enable faster turnaround times and standardized reporting across the diagnostic ecosystem.

By Technology Architecture

ELISA-based immunoassays continue to hold a strong position due to cost efficiency, broad test menu availability, and familiarity among laboratory technicians. However, chemiluminescence immunoassays and multiplex platforms are steadily expanding their footprint, driven by demand for higher throughput, automation, and reduced hands-on time. Large hospital laboratories increasingly favor integrated systems that combine speed with analytical consistency, while reference laboratories invest in multiplex technologies to handle complex testing profiles efficiently. The gradual shift toward automated and connected diagnostic platforms reflects the market’s focus on scalability, quality assurance, and alignment with international laboratory standards.

Competitive Landscape

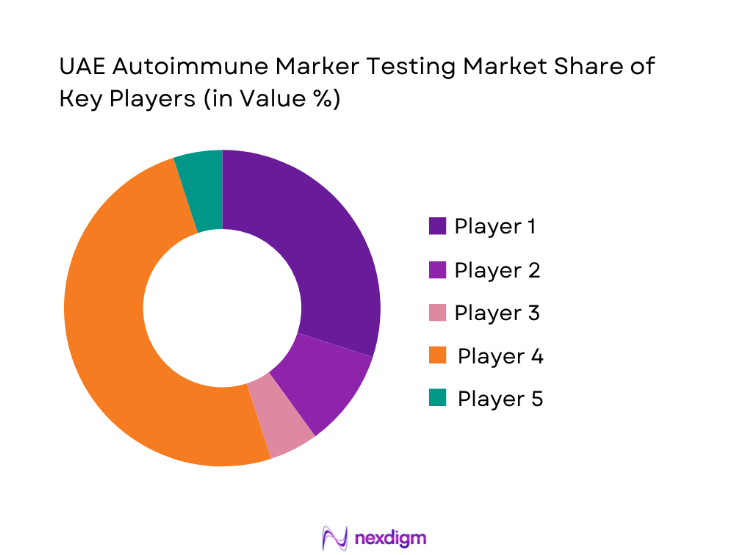

The UAE Autoimmune Marker Testing market is moderately concentrated, characterized by the presence of multinational diagnostics manufacturers alongside strong regional distributors and service partners. Competition centers on technology depth, assay portfolio breadth, regulatory alignment, and post-installation support capabilities. Market leadership is shaped less by pricing and more by platform reliability, service responsiveness, and the ability to integrate with laboratory information systems across large healthcare networks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott Diagnostics | 1888 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Bio-Rad Laboratories | 1952 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Autoimmune Marker Testing Market Analysis

Growth Drivers

Rising prevalence of autoimmune disorders and chronic inflammatory diseases

Healthcare systems across the UAE have reported sustained growth in autoimmune-related outpatient visits, with diagnostic centers processing ~ tests annually in recent assessment cycles. Specialist clinics in rheumatology and endocrinology now manage ~ patient consultations per year linked to immune-mediated conditions, driving consistent demand for marker testing. Public hospitals alone have expanded autoimmune diagnostic capacity by ~ systems between recent operating periods, enabling higher throughput. The cumulative effect is a steady rise in baseline testing volumes, reinforcing the central role of autoimmune markers in routine diagnostic pathways.

Expansion of specialty clinics in rheumatology and immunology

The number of dedicated specialty clinics focusing on immune-mediated disorders has increased by ~ facilities over the latest development phase, particularly in Dubai and Abu Dhabi. These centers collectively conduct ~ diagnostic procedures annually, with autoimmune panels forming a core service line. Investments in advanced laboratory infrastructure have led to the installation of ~ automated immunoassay systems across major hospital networks, improving turnaround times and clinical confidence. This structural expansion directly supports higher testing frequency and deeper market penetration across both public and private healthcare segments.

Challenges

High cost of advanced autoimmune diagnostic panels

Advanced autoimmune panels deployed in tertiary hospitals typically require investment levels of USD ~ million for full-scale implementation, including analyzers, reagents, and quality assurance protocols. Smaller laboratories often operate with budgets limited to USD ~ million annually for specialty diagnostics, constraining their ability to adopt newer multiplex technologies. As a result, testing volumes in secondary care settings remain at ~ procedures per year, well below potential demand. This cost barrier slows uniform technology diffusion and maintains disparities in diagnostic access across different healthcare tiers.

Limited availability of trained immunology laboratory specialists

The UAE healthcare system currently operates with an estimated workforce of ~ trained immunology technologists, spread unevenly across major cities. Large hospital laboratories handle ~ tests per specialist annually, creating operational strain during peak diagnostic cycles. Training programs add only ~ new specialists each year, which is insufficient to match expanding laboratory capacity. This skills gap impacts turnaround times, increases dependency on automated systems, and constrains the pace at which advanced autoimmune testing protocols can be standardized nationwide.

Opportunities

Expansion of preventive health screening programs

National and emirate-level health initiatives are gradually integrating autoimmune marker testing into preventive screening frameworks, particularly for high-risk population groups. Public healthcare providers now conduct ~ preventive diagnostic panels annually that include immune-related markers, compared to ~ panels in earlier cycles. This expansion opens pathways for broader test utilization beyond symptomatic cases. As screening volumes grow, laboratories can achieve better reagent utilization efficiency and justify investments of USD ~ million in scalable platforms designed for high-throughput preventive diagnostics.

Localization of reagent manufacturing and kit assembly

Efforts to strengthen domestic medical supply chains have encouraged regional assembly of diagnostic reagents, with ~ production lines now under development in local free zones. These facilities are expected to support ~ test kits annually once fully operational, reducing reliance on imports and improving supply stability. Localized manufacturing also enables faster regulatory alignment and customization for regional clinical needs. Over time, this initiative could lower operational costs for laboratories by USD ~ million across the value chain, improving overall market accessibility.

Future Outlook

The UAE Autoimmune Marker Testing market is set to advance steadily toward 2030, supported by continued healthcare infrastructure development and deeper integration of specialty diagnostics into routine care pathways. Expansion of automated laboratories, policy focus on early disease detection, and the gradual maturation of local supply chains will reinforce long-term sustainability. As digital health platforms evolve, data-driven diagnostics and integrated laboratory networks are expected to redefine efficiency and clinical impact across the autoimmune testing landscape.

Major Players

- Roche Diagnostics

- Abbott Diagnostics

- Siemens Healthineers

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- EUROIMMUN

- DiaSorin

- Beckman Coulter

- Ortho Clinical Diagnostics

- INOVA Diagnostics

- Grifols Diagnostic Solutions

- Werfen

- bioMérieux

- Randox Laboratories

- Omega Diagnostics

Key Target Audience

Public hospital networks and government healthcare providers

Private hospital groups and specialty clinics

Independent diagnostic laboratories and reference centers

Health insurance providers and managed care organizations

Ministry of Health and Prevention UAE

Dubai Health Authority and Abu Dhabi Department of Health

Investments and venture capital firms focused on healthcare innovation

Medical device distributors and laboratory service partners

Research Methodology

Step 1: Identification of Key Variables

Core demand indicators, technology adoption patterns, and healthcare infrastructure parameters were mapped to establish the analytical foundation. Regulatory frameworks and accreditation standards were reviewed to align market scope. Stakeholder roles across laboratories, hospitals, and distributors were defined to structure ecosystem understanding.

Step 2: Market Analysis and Construction

Segment-level dynamics were developed by evaluating application trends, technology architecture shifts, and end-user demand patterns. Supply chain structures and service models were assessed to capture operational realities. This phase translated qualitative insights into structured market narratives.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through structured consultations with laboratory managers, clinical specialists, and healthcare administrators. Feedback loops refined assumptions related to demand drivers, operational constraints, and adoption barriers. Consensus-building ensured alignment with on-ground market conditions.

Step 4: Research Synthesis and Final Output

Validated insights were consolidated into a coherent analytical framework. Cross-section linkages were established between market drivers, challenges, and opportunities. The final output was curated to deliver strategic clarity and actionable intelligence for decision-makers.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, autoimmune marker testing taxonomy across ANA ENA and disease specific panels, market sizing logic by test volume and panel utilization, revenue attribution across assays analyzers reagents and controls, primary interview program with immunology labs hospitals and distributors, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Clinical diagnostic pathways and care delivery models

- Ecosystem structure across laboratories, hospitals, and reference centers

- Supply chain and distribution channel structure

- Regulatory environment and accreditation standards

- Growth Drivers

Rising prevalence of autoimmune disorders and chronic inflammatory diseases

Expansion of specialty clinics in rheumatology and immunology

Increasing physician awareness and early diagnostic protocols

Government investment in advanced laboratory infrastructure

Growing medical tourism and demand for specialized diagnostics

Adoption of automated and high-throughput immunoassay systems - Challenges

High cost of advanced autoimmune diagnostic panels

Limited availability of trained immunology laboratory specialists

Reimbursement variability across public and private payers

Complexity in test interpretation and result standardization

Supply chain dependency on imported diagnostic kits

Data integration challenges across fragmented healthcare systems - Opportunities

Expansion of preventive health screening programs

Localization of reagent manufacturing and kit assembly

Growth in companion diagnostics for targeted therapies

Adoption of AI-enabled pattern recognition in immunofluorescence

Partnerships with international reference laboratories

Rising demand for multiplex and syndromic testing solutions - Trends

Shift toward automation and random-access analyzers

Increasing use of multiplex immunoassays for efficiency

Integration of diagnostic platforms with hospital information systems

Growing preference for standardized testing protocols

Expansion of specialty diagnostic hubs in free zones

Rising demand for rapid turnaround time solutions - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Installed Base of Diagnostic Platforms, 2019–2024

- By Revenue per Test and Unit Economics, 2019–2024

- By Fleet Type (in Value %)

Hospital-based diagnostic laboratories

Independent reference laboratories

Physician office laboratories

Government and public health laboratories - By Application (in Value %)

Systemic autoimmune disease diagnostics

Organ-specific autoimmune disease diagnostics

Inflammatory bowel disease testing

Rheumatology and immunology screening panels

Transplant and immunological monitoring - By Technology Architecture (in Value %)

ELISA-based immunoassays

Indirect immunofluorescence assays

Chemiluminescence immunoassays

Multiplex immunoassay platforms

Point-of-care autoimmune testing solutions - By End-Use Industry (in Value %)

Hospitals and tertiary care centers

Diagnostic service providers

Academic and research institutes

Contract research organizations

Public healthcare laboratories - By Connectivity Type (in Value %)

Standalone diagnostic systems

LIS-integrated laboratory analyzers

Cloud-connected diagnostic platforms

Remote data access and telepathology-enabled systems - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (test menu breadth, assay sensitivity and specificity, automation level, throughput capacity, regulatory approvals, pricing strategy, service network coverage, digital integration capability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Roche Diagnostics

Abbott Diagnostics

Siemens Healthineers

Thermo Fisher Scientific

Bio-Rad Laboratories

EUROIMMUN

Ortho Clinical Diagnostics

DiaSorin

Beckman Coulter

INOVA Diagnostics

Grifols Diagnostic Solutions

Werfen

bioMérieux

Randox Laboratories

Omega Diagnostics

- Demand and utilization drivers across public and private healthcare

- Procurement and tender dynamics in government hospitals

- Buying criteria and vendor selection parameters

- Budget allocation and financing preferences of diagnostic centers

- Implementation barriers and operational risk factors

- Post-purchase service, training, and technical support expectations

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Installed Base of Diagnostic Platforms, 2025–2030

- By Revenue per Test and Unit Economics, 2025–2030