Market Overview

The UAE Automated Data Analysis Solutions market is valued at USD ~ million, rising from USD ~ million based on a historical baseline that captures expanding enterprise analytics workloads and the rapid shift toward cloud-native data platforms and AI-assisted insight generation. Growth is being driven by (i) modernization of data estates (lakehouse, data mesh, governed self-serve BI), (ii) automation layers such as AutoML, augmented analytics, and data observability, and (iii) higher operational dependence on real-time decisioning across BFSI, government, logistics, and retail.

Dubai and Abu Dhabi dominate demand concentration because they host the UAE’s highest density of regional headquarters, government digital platforms, regulated financial institutions, and hyperscaler/telecom delivery ecosystems—creating faster procurement cycles and larger multi-year transformation programs. On the supply side, the most influential solution “countries of origin” remain the United States (hyperscalers and enterprise analytics suites), Western Europe (ERP-led analytics and governance-heavy stacks), and India (large-scale system integration and managed analytics delivery), as these ecosystems control core cloud/analytics IP, reference architectures, and scaled implementation talent that UAE buyers typically require for automation-at-scale.

Market Segmentation

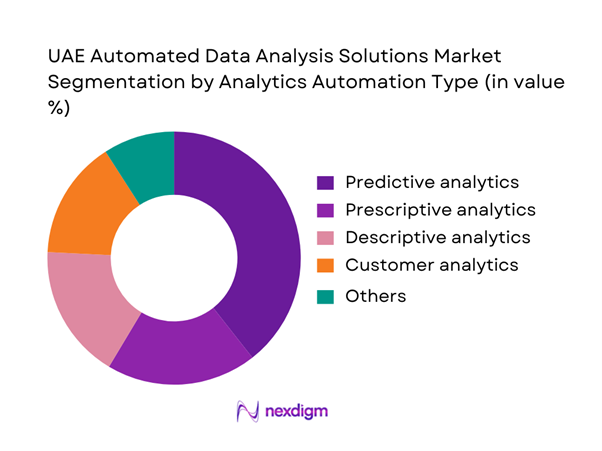

By Analytics Automation Type

The UAE Automated Data Analysis Solutions market is segmented by analytics automation type into predictive analytics, prescriptive analytics, descriptive analytics, customer analytics, and others. Recently, predictive analytics holds the dominant market share under this segmentation because UAE buyers prioritize automation that improves operational outcomes with measurable KPIs—such as demand forecasting, churn propensity, fraud signals, risk scoring, workforce planning, and asset-performance prediction—before moving into more advanced prescriptive decision automation. Predictive deployments also align better with enterprise governance, as they can be validated through back-testing and model monitoring while remaining interpretable for audit and compliance teams. In addition, predictive workflows are the most “productized” across hyperscalers, BI platforms, and lakehouse vendors, enabling faster proofs-of-value and easier scaling across business units.

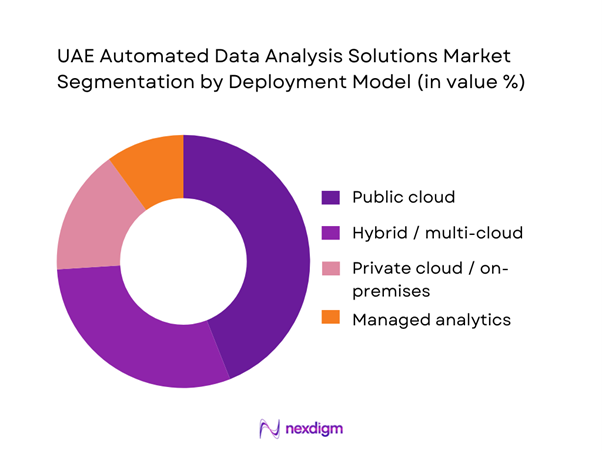

By Deployment Model

The UAE Automated Data Analysis Solutions market is segmented by deployment model into public cloud, hybrid/multi-cloud, private cloud/on-premises, and managed analytics (provider-run). Public cloud leads because automation-heavy analytics requires elastic compute for model training, fast experimentation, and scalable ingestion of multi-source data streams—capabilities that cloud environments provide with strong integration into AI services, governance tooling, and data platform primitives. UAE enterprises also benefit from cloud marketplaces and bundled commercial constructs that reduce time-to-procure for automation accelerators (AutoML, copilots, observability, semantic layers). While regulated workloads still sustain hybrid and private stacks, many organizations standardize on cloud-first reference architectures and keep only the most sensitive domains on controlled environments, allowing the automation layer to scale rapidly across the broader enterprise estate.

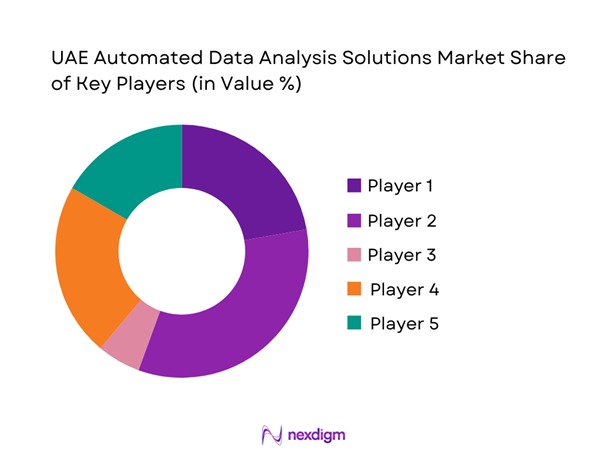

Competitive Landscape

The UAE Automated Data Analysis Solutions market is led by a concentrated set of global platform vendors and hyperscalers, supported by UAE-based AI/analytics champions and telecom-led enterprise integrators. This structure reflects how buyers typically procure automated analytics: core cloud + data platform primitives from hyperscalers, analytics/BI and automation layers from enterprise software leaders, and implementation/managed operations from local delivery ecosystems that can meet residency, security, and regulated-sector requirements.

| Company | Established | Headquarters | Primary UAE proposition | Key solution focus | UAE-region cloud readiness | Governance & compliance posture | Arabic/bilingual insight support | Partner ecosystem strength | Typical buyer segments |

| Microsoft (Fabric/Power BI/Azure AI) | 1975 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| AWS (Analytics + AI Services) | 2006 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Google Cloud | 2008 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Oracle (OCI + Analytics) | 1977 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Presight AI (G42) | 2018 | UAE | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Automated Data Analysis Solutions Market Analysis

Growth Drivers

Cloud Region Expansion and Enterprise Migration

UAE enterprise analytics automation is accelerating because hyperscaler infrastructure is now physically anchored in-country, letting CIOs move data gravity (storage + compute) closer to regulated workloads and latency-sensitive decisioning. AWS opened its Middle East (UAE) Region (me-central-1) and stated it launched with ~ Availability Zones, enabling HA architectures for automated pipelines and model serving. Microsoft confirms its UAE datacenter regions are located in Dubai and Abu Dhabi, supporting residency-aligned analytics stacks for banking, government, and critical infrastructure. This migration tailwind is reinforced by macro capacity: the UAE’s economy is large enough to fund multi-year platform programs, with GDP at USD ~ billion and GDP per capita USD ~. On the demand side, telecom authorities report ~ mobile subscribers and ~ mobile broadband subscribers, giving enterprises a high-usage digital base that generates data at scale—fuel for automated analysis, anomaly detection, and forecasting.

Smart Government Platform Adoption

Automated data analysis demand rises when government platforms shift citizens and businesses to digital-by-default service rails—because every transaction becomes a structured event stream that can be analyzed, predicted, and operationalized. Dubai government has reported that ~ out of every ~ government transactions are digital, indicating an execution environment where analytics automation (service SLA monitoring, fraud detection, channel optimization, proactive outreach) is not optional. Large utilities and mobility agencies also publish scale signals that translate directly into analytics automation workloads: DEWA recorded ~ digital transactions versus ~ previously, creating continuous demand for automated root-cause analysis, demand forecasting, and customer-journey optimization across billing, outages, and service requests. In transport, Dubai RTA reported ~ digital-channel transactions and AED ~ billion in digital revenues, which elevates the value of automated decisioning in pricing, routing, congestion, and customer experience. At the macro layer, GDP of USD ~ billion supports sustained digitization budgets and platform procurement across federal and emirate entities.

Challenges

Data Residency and Cross-Border Constraints

Automated data analysis programs are constrained when data can’t move freely across borders or between entities, because automation depends on unified datasets, shared feature stores, and centralized governance. The UAE’s federal personal data protection regime is anchored in Federal Decree-Law No. ~ and came into force on ~, shaping how organizations host, process, and transfer personal data used in automated analytics and AI workflows. In practice, residency requirements increase architecture complexity: organizations often implement UAE-hosted data lakes plus local model serving, while restricting external transfer for certain domains—slowing time-to-deploy for cross-border analytics centers of excellence. Macro scale raises the governance burden: with GDP at USD ~ billion and GDP per capita USD ~, the UAE hosts large multi-entity groups whose cross-border operating models must be re-engineered for compliant automation. This pushes demand toward in-country cloud regions and local MSPs, but also increases integration and control-plane overhead for automated pipelines and monitoring.

Legacy Core Systems and Data Silos

Even with cloud regions available, many UAE enterprises still run core banking, ERP, HCM, and sector platforms that were designed for batch reporting—not automated insights—creating fragmentation across customer, finance, risk, and operations data. The scale of regulated financial activity amplifies this issue: the banking sector reports assets of AED ~ trillion, which typically sit across multiple cores, channels, and reporting stacks, increasing reconciliation work and slowing automation of risk models, fraud detection, and customer analytics. Public-sector scale adds similar complexity: DEWA recorded ~ digital transactions, but the value of automation depends on linking these service events to asset data, GIS, outage logs, and workforce systems—often stored in separate domains. Macro modernization pressure is strong (GDP USD ~ billion), but transformation is slowed by integration debt, duplicated master data, and inconsistent KPI definitions that undermine “single version of truth” automation. As a result, many projects start with data prep automation and governance tooling before higher-order GenAI and prescriptive decisioning can be scaled safely.

Opportunities

Sector-Specific Analytics Accelerators

UAE buyers increasingly want “ready-to-deploy” accelerators—pre-built KPI models, dashboards, automated anomaly detection, and governed ML templates—because they shorten proof-of-value cycles and reduce reliance on scarce data engineering talent. Sector scale supports this packaging shift: the banking sector reports assets of AED ~ trillion, creating repeatable demand for accelerators in credit risk, AML monitoring, liquidity analytics, and regulatory reporting automation. Government and mobility platforms offer similar accelerator economics: Dubai RTA reported ~ digital transactions and AED ~ billion in digital revenues, making accelerators for service reliability analytics, network planning, and fraud controls commercially and operationally attractive. Utility digitization provides another repeatable blueprint: DEWA’s ~ digital transactions strengthen demand for accelerators around outage prediction, demand forecasting, and customer self-service optimization. With GDP at USD ~ billion, large anchor clients can fund reference architectures that integrators productize into reusable accelerators—expanding the market through faster deployments without relying on future-looking statistics.

Arabic-First Analytics Automation

Arabic-first automation is a structural growth opportunity because enterprise insight consumption in the UAE often spans bilingual executive layers, frontline operations, and citizen-facing services—where language coverage determines adoption depth. UAE Pass provides a measurable platform signal: users rose from ~ million to ~ million, and it is positioned as a national digital identity used across public and private services—expanding the audience that can consume automated insights and AI-assisted guidance securely in Arabic and English contexts. Government digitization intensity reinforces bilingual needs: Dubai government’s ~ out of ~ digital transaction rate increases the volume of service interactions where Arabic-first conversational analytics, automated triage, and narrative summaries can improve resolution speed and satisfaction. Connectivity scale supports mobile-first Arabic analytics experiences: telecom authorities report ~ mobile subscribers and ~ mobile broadband subscribers, which expands the footprint for app-based insights, field-ops analytics, and customer communications. With a high-income macro base (GDP per capita USD ~), enterprises can justify investing in Arabic NLP/NLG layers, domain lexicons, and governance guardrails—turning bilingual automation into a differentiating capability without depending on forward projections.

Future Outlook

Over the next five years, the UAE Automated Data Analysis Solutions market is expected to accelerate as enterprises move from dashboard-driven analytics to automation-first decisioning—where insight generation, anomaly detection, forecasting, and even recommended actions are embedded directly into workflows. This shift will be supported by continued cloud modernization, lakehouse consolidation, and governance hardening for regulated domains. Generative AI copilots will further expand adoption by lowering the barrier to insight discovery, while observability and lineage will become mandatory to scale automation safely.

Major Players

- Microsoft

- Amazon Web Services

- Google Cloud

- Oracle

- SAP

- IBM

- SAS

- Snowflake

- Databricks

- Salesforce

- Qlik

- Alteryx

- Dataiku

- Presight AI

Key Target Audience

- Chief Data Officers / Heads of Data & Analytics

- CIOs / Heads of IT Transformation

- Heads of Digital Government & Smart City Programs

- Heads of Risk, Compliance & Financial Crime Analytics

- Heads of FP&A / Enterprise Performance Management

- Heads of Customer Experience & Growth Analytics

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

We construct a UAE ecosystem map covering hyperscalers, enterprise analytics vendors, UAE-based AI firms, telecom integrators, and regulated-sector buyers. Desk research is used to define solution boundaries (AutoML, augmented analytics, automated BI, data prep automation, observability-driven automation). We finalize the key adoption and spend variables that shape demand.

Step 2: Market Analysis and Construction

We compile historical revenue baselines and map demand by sector (government, BFSI, telco, logistics, retail, energy) and by solution layers (platform, automation, services). We assess deployment preferences (public cloud vs hybrid vs private) and translate this into market structure. This phase also includes validation of typical contract constructs and consumption patterns.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions via structured expert interviews with vendor teams, cloud partners, integrators, and enterprise data leaders. Inputs focus on pipeline density, deal cycle realities, dominant use cases, and barriers (governance, integration debt, residency constraints). Findings are reconciled against published benchmarks to ensure consistency.

Step 4: Research Synthesis and Final Output

We synthesize results using triangulation across secondary sources, vendor signals, and buyer feedback to finalize segmentation logic, competitive positioning, and growth outlook. The output is quality-checked for internal consistency (market sizing math, segment totals, and narrative alignment). Final insights are packaged for decision-makers with clear adoption implications.

- Executive Summary

- Research Methodology (Market Definitions and Scope Boundaries, Solution Taxonomy for Automated Data Analysis, Assumptions and Exclusions, Abbreviations, UAE-Specific Demand Modeling Logic, Bottom-Up Sizing via Vendor and Partner Revenues, Top-Down Sizing via UAE ICT Cloud and Analytics Spend Proxies, Primary Research Framework, Expert Interview Plan, Data Triangulation and Validation, Bias Controls, Limitations and Confidence Grading)

- Definition and Scope

- Market Genesis and Evolution

- UAE Digital-First Operating Context

- Business Cycle and Buying Motions

- Ecosystem and Value Chain

- Stakeholder Map

- Growth Drivers

Cloud Region Expansion and Enterprise Migration

Smart Government Platform Adoption

Regulated Sector Governance Requirements

GenAI-Enabled Insight Generation

Real-Time Decisioning Demand - Challenges

Data Residency and Cross-Border Constraints

Legacy Core Systems and Data Silos

Model Governance and Accountability

Talent and Operating Model Constraints

Vendor Lock-In Risks - Opportunities

Sector-Specific Analytics Accelerators

Arabic-First Analytics Automation

Managed Analytics and Analytics-as-a-Service

ESG and Climate Data Automation - Trends

Lakehouse Consolidation and Unified Governance

Data Observability for Automation

Semantic Layers and Metrics Stores

Retrieval-Augmented Analytics Assistants - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Deployments / Active Tenants, 2019–2024

- By Consumption Metric, 2019–2024

- By Average Contract Band, 2019–2024

- By Fleet Type (in Value %)

AutoML and Model Automation Platforms

Augmented Analytics and Narrative Insights

Automated Data Preparation and ETL or ELT Automation

Self-Service BI with Automated Insight Layers

Data Quality and Observability for Automated Decisioning - By Application (in Value %)

Public Cloud

Private Cloud or On-Premise

Hybrid and Multi-Cloud

Managed Analytics - By Technology Architecture (in Value %)

Federal and Large Government Entities

Large Enterprises

Mid-Market Enterprises

Digital-Native and Scaleups - By Connectivity Type (in Value %)

BFSI

Government and Smart City Platforms

Healthcare Providers and Payers

Energy Utilities and Water

Retail and E-Commerce

Logistics Ports and Aviation - By End-Use Industry (in Value %)

Automated Reporting and Executive Dashboards

Fraud Risk and Compliance Analytics

Customer Intelligence and Personalization

Operations and Workforce Analytics

Finance and FP&A Automation

Supply Chain and Inventory Optimization

- Competitive Landscape Structure

- Market Share Assessment Framework

- Cross Comparison Parameters (UAE cloud-region availability, data residency controls, bilingual analytics capability, free-zone and DIFC compliance readiness, government platform integration capability, BFSI-grade governance maturity, observability and lineage depth, GenAI guardrails and approval workflows)

- Competitive Positioning Matrix

- Partnership Ecosystem Mapping

- M&A and Innovation Signals

- SWOT of Major Players

- Key Players

Microsoft

Amazon Web Services

Google Cloud

Oracle

SAP

IBM

SAS

Snowflake

Databricks

Salesforce

Qlik

Alteryx

Dataiku

G42 and Presight AI

e& enterprise

- Demand and Workload Mapping

- Budget Ownership and Spend Pattern

- Procurement and Vendor Selection Process

- Pain Points and Jobs-to-be-Done

- Decision-Making Unit (DMU) and Influence Map

- Success Metrics Used by UAE Buyers

- By Value, 2025–2030

- By Deployments / Active Tenants, 2025–2030

- By Consumption Metric, 2025–2030

- By Average Contract Band, 2025–2030