Market Overview

The UAE automotive dealership market is valued at USD ~ billion as of 2024, up from around USD ~ billion in 2023, driven by rising disposable incomes, strong expatriate population turnover and improved financing penetration.

Key cities dominating the market include Dubai and Abu Dhabi: Dubai leads because of its regional trade hub status, major tourist import/export vehicle flows and dense dealer clusters, while Abu Dhabi’s strong economic base and institutional fleet demand underpin its dominance.

Market Segmentation

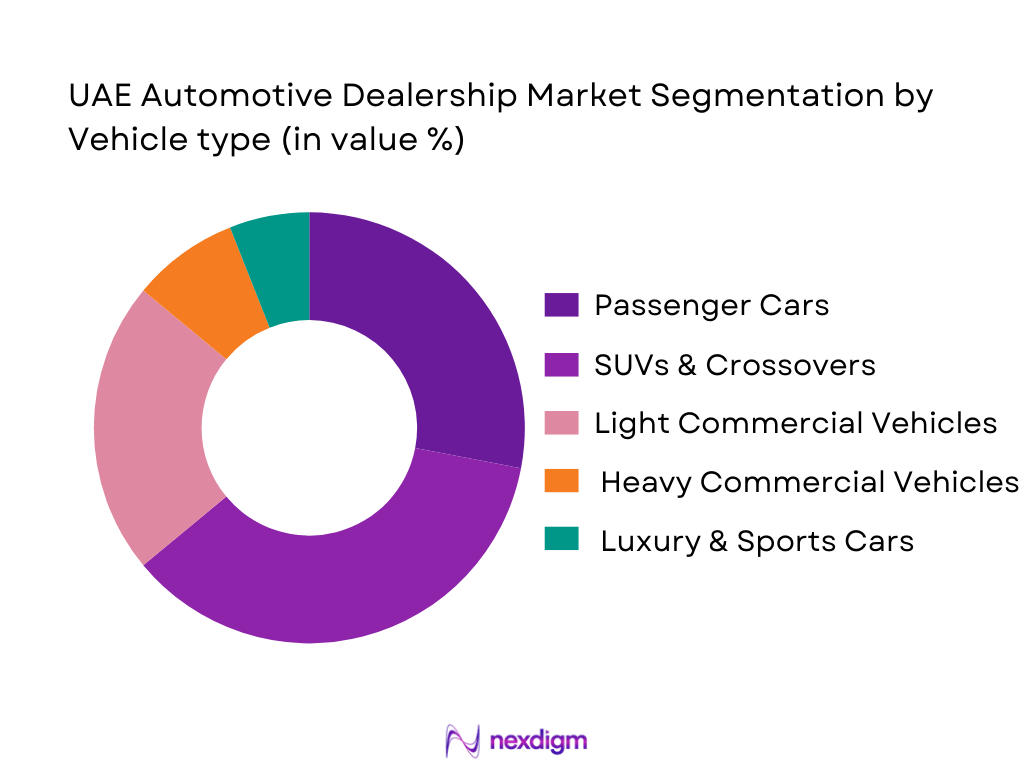

By Vehicle Type

The UAE automotive dealership market is segmented into passenger cars, SUVs & crossovers, light commercial vehicles & pick‑ups, heavy commercial vehicles & buses, and luxury & sports cars. In 2024, SUVs & crossovers hold the dominant share (36 %) given their appeal to families, high clearance suitability for regional conditions, and strong resale value. Dealers prioritise SUV brand line‑ups and stock volumes to capitalise on both retail and fleet demand.

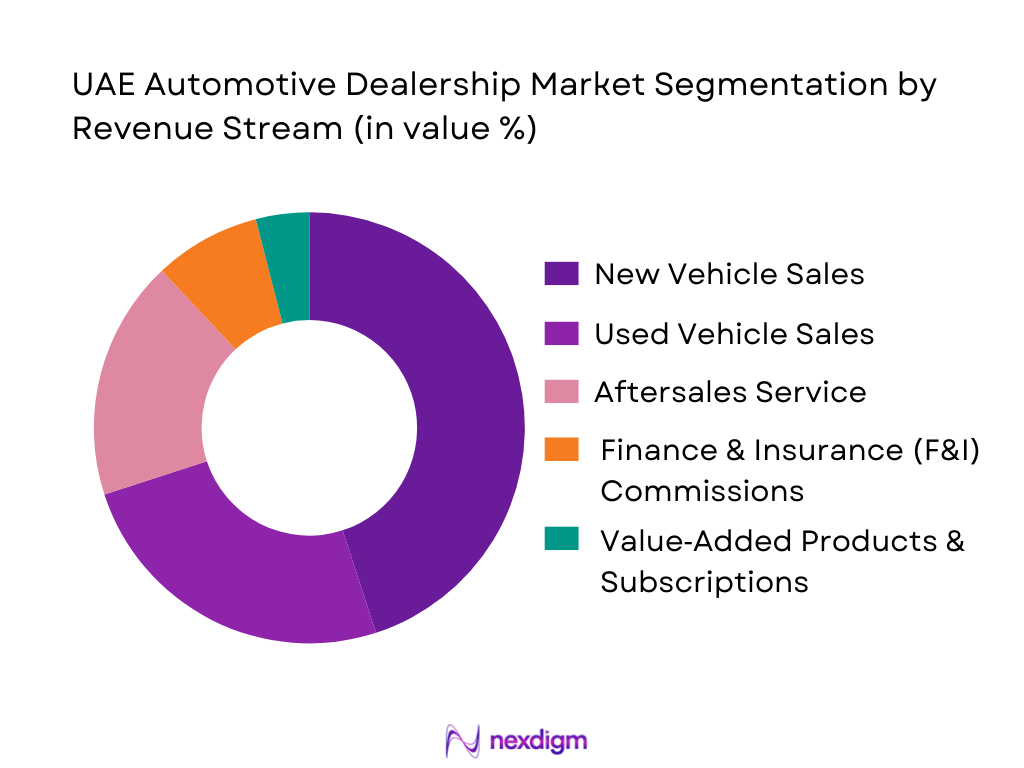

By Revenue Stream

The UAE automotive dealership market is segmented by new vehicle sales, used/CPO sales, aftersales service & spare parts, F&I commissions, and value‑added products & subscriptions. In 2024, new vehicle sales dominate with 45 % of revenue given the high import volumes and strong consumer turnover. However, used/CPO (25 %) and aftersales streams are increasingly important for margin stability and business diversification.

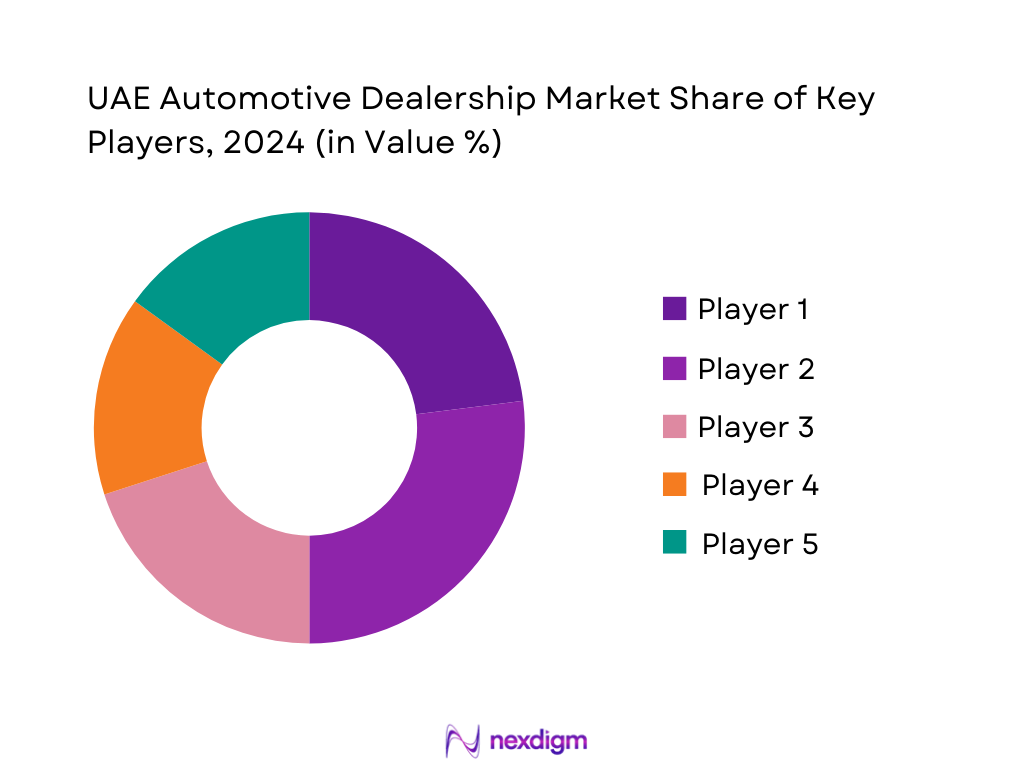

Competitive Landscape

The UAE automotive dealership market is characterised by a small set of well‑established dealer groups with strong brand portfolios and regional footprints. Pressure on margins, rising digital retailing and used‑vehicle competition are pushing consolidation and capability shifts.

| Company | Establishment Year | Headquarters | Brands Represented | Outlet Count | Used‑Vehicle / CPO Program | Digital Retail Presence | Aftersales Service Bays |

| Al‑Futtaim Automotive | 1930 | Dubai, UAE | Multi‑brand (Toyota, Lexus, Honda, etc) | 180+ | Yes | Advanced | 350+ |

| Al Tayer Motors | 1982 | Dubai, UAE | Jaguar, Land Rover, Ferrari, Ford | 120+ | Yes | Strong | 300+ |

| Arabian Automobiles Co. (AW Rostamani) | 1968 | Dubai, UAE | Nissan, Infiniti, Renault | 140+ | Yes | Growing | 250+ |

| Al Nabooda Automobiles LLC | 1970 | Dubai, UAE | Porsche, Audi, Volkswagen | 90+ | Yes | Established | 200+ |

| Al Ghandi Auto Group | 1954 | Dubai, UAE | Kia, Renault, Alpine | 85+ | Yes | Moderate | 150+ |

UAE Automotive Dealership Market Analysis

Growth Drivers

Expansion of vehicle registration base

The UAE’s new passenger car sales surged to 268,876 units in the year, up from 225,386 units in the previous period, showcasing expanding demand for retail vehicles which underpin dealership activity. Concurrently, vehicle registration statistics highlight that 801,857 vehicles were registered nationwide across all categories in the last recorded period, with Dubai alone contributing 484,223 registrations. This increasing vehicle fleet expansion drives dealerships’ new‑car sales, trade‑in volumes, and parts/service business, thereby supporting growth in the automotive dealership market.

Robust macro‑economic base and high per‑capita income

The economy of the UAE posted a nominal GDP of USD 537.08 billion in the recent year, according to official World Bank data. At the same time, GDP per capita reached USD 49,377.60, signaling strong consumer purchasing power. The combination of high income levels and a large expatriate population that frequently rotates and upgrades vehicles supports sustained demand at dealerships for new and premium vehicles, thereby fueling the broader dealership ecosystem including sales, financing and aftermarket services.

Market Challenges

Inventory and residual value risk amid accelerating vehicle parc

While the vehicle base expands, with over 3.5 million vehicles on Dubai’s roads during daytime hours and an approximate 10 % increase in registered vehicles over two years in that emirate alone, dealerships face amplified inventory risk and residual value uncertainty — especially in segments such as electric vehicles, where resale patterns are not yet mature. The large fleet growth places pressure on used‑car channels and trade‑in programs, increasing the risk for dealers in managing ageing stock and sales turnaround.

Competitive dynamics and digital disruption

The UAE market registered growth in rental company vehicles: by end of the latest period the rental fleet count rose to 71,040 vehicles, up from 49,725 previously, reflecting a 43 % increase in one year. Such rapid expansion of fleet‑based vehicle flows creates alternate channels for vehicle movement and intensifies used‑car supply, thereby pressuring dealer margins. Simultaneously, the average consumer is demanding seamless digital retail experiences — evidenced by the 4.427 billion AED digital revenues reported by one regulatory agency in 2024. Dealers that cannot adapt risk margin erosion and competitiveness.

Opportunities

Growth of the certified pre‑owned (CPO) and used‑vehicle channels

The used vehicle market in the UAE has shown notable activity: for instance 318,981 used vehicle registrations were recorded in the latest annual review, up from prior years. This dynamic presents a significant opportunity for dealership groups to build or expand certified pre‑owned programmes, enhance margin‑rich used‑vehicle sales, and develop trade‑in ecosystems. With new car markets maturing, dealerships can capture volume and revenue growth by developing strong used‑car retail and remarketing capabilities.

Servicing and aftersales growth driven by increasing parc size

Given the increasing number of vehicles on UAE roads and registrations across new and used vehicles, the servicing base is expanding. For example, the vehicle fleet growth in Dubai (3.5 million during peak hours) indicates more vehicles requiring maintenance, parts replacement and accessory upgrades. For dealership groups this translates into steady recurring revenue through aftersales, parts, accessories and service contract sales — making the service and spare‑parts stream a growth driver beyond new‑car retail, enabling diversification of income sources.

Future Outlook

Over the next six years the UAE automotive dealership market is expected to sustain strong growth driven by fleet renewal cycles, growing used‑/CPO channel maturity, rising EV penetration and digital retail adoption. Dealerships will increasingly shift to integrated retail‑service models and must scale used‑vehicle, subscription and after‑sales revenue streams to maintain margins. Geographic diversification into Northern Emirates and export hubs will surface as strategic priorities.

Major Players

- Al‑Futtaim Automotive

- Al Tayer Motors

- Arabian Automobiles Company (AW Rostamani)

- Al Nabooda Automobiles LLC

- Al Ghandi Auto Group

- AGMC (BMW, MINI)

- Al Habtoor Motors

- Juma Al Majid Automotive

- Gargash Enterprises LLC

- Galadari Automobiles

- Al Masaood Automobiles

- Trading Enterprises (part of Al‑Futtaim)

- VIP Motors

- Elite Motors

- Al‑Futtaim Automall (Pre‑Owned Vehicles Division)

Key Target Audience

- Automotive OEMs and regional distributors

- Leading dealer groups and independent dealerships

- Auto finance and leasing companies

- Investments and venture capital firms (focused on mobility/retail)

- Government and regulatory bodies (e.g., Dubai RTA, Abu Dhabi Department of Municipalities & Transport)

- Fleet & rental companies

- Aftermarket parts & service providers

- Online automotive marketplaces and digital retail platforms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the dealership ecosystem in UAE covering franchised, independent, used‑/CPO, online‑dealer, after‐sales services. This is built via desk research using registrations, RTA data, OEM annual reports and regional market studies to define the core variables.

Step 2: Market Analysis and Construction

In this phase we aggregated historical dealership revenues, vehicle registrations, outlet counts, used versus new ratios, and average transaction values. We also reviewed service bay throughput and finance product penetration to build bottom‑up revenue models.

Step 3: Hypothesis Validation and Expert Consultation

We developed hypotheses on growth drivers (fleet renewal, used‑car stock flow, digital retail uptake) and validated them via expert interviews with dealer principals, OEM network heads, banking finance executives, and digital marketplace founders.

Step 4: Research Synthesis and Final Output

The final phase integrated primary inputs, secondary data and market reviews. We reconciled forecasts via scenario modelling and triangulated the findings to produce an accurate dealer‑market sizing and outlook.

- Executive Summary

- Research Methodology (Market Definitions and Taxonomy, Scope and Assumptions, Data Triangulation, Market Sizing Approach, Primary and Secondary Research, Dealer Surveys and Interviews, Limitations and Future Assumptions)

- Definition and Scope

- Evolution of Dealership Models (Franchise, Independent, Agency Model)

- Historical Landscape and Business Cycle

- Vehicle Parc Overview and Replacement Cycle

- Dealer Supply Chain and Value Chain

- Licensing and Regulatory Framework (ESMA, RTA, Ministry of Economy)

- Growth Drivers

- Market Challenges

- Market Opportunities

- Key Trends and Technology Adoption

- Regulatory Environment

- SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Dealer Profitability Benchmarks

- By Value, 2019-2024

- By Volume, 2019-2024

- By Number of Dealerships, 2019-2024

- By Average Transaction Value, 2019-2024

- By Average Dealer Throughput, 2019-2024

- By Vehicle Type (In Value %)

Passenger Cars

Sports Utility Vehicles (SUVs)

Pick-up Trucks

Commercial Vehicles

Luxury & Sports Cars - By Dealership Type (In Value %)

OEM-Franchised Dealers

Independent Multi-brand Dealers

Pre-Owned Certified Dealers

Digital/Online-First Dealerships

Grey Import Dealers - By Sales Channel (In Value %)

Walk-in Retail Sales

Digital / Online Platforms

Corporate & Fleet Sales

Rental & Leasing Alliances

Export & Re-Export Sales - By Customer Type (In Value %)

- Individual Buyers

SMEs & Corporates

Government Entities

Leasing & Rental Firms

Ride-Hailing Operators - By Region (In Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

Free Zones

- Market Share Analysis (By Volume/Value, New vs Used)

- Cross Comparison Parameters (Dealer Footprint, Digital Retail Capability, Number of Brands Represented, New-to-Used Vehicle Ratio, F&I Revenue Share, Average Throughput per Dealer, EV Sales Share, Parts & Aftersales Penetration)

- Pricing Strategy and Incentive Benchmarking

- Service and Aftermarket Comparison

- Dealer Network Expansion Plans

- Detailed Profiles of Major Dealer Groups

Al-Futtaim Motors

Al Tayer Motors

Arabian Automobiles Company (AW Rostamani)

Al Nabooda Automobiles

Al Ghandi Auto

AGMC (BMW)

Al Habtoor Motors

Juma Al Majid Group

Gargash Enterprises

Galadari Automobiles

Al Masaood Automobiles

Trading Enterprises

VIP Motors

Elite Motors

Al-Futtaim Automall (Used Cars Division)

- End-User Purchase Behavior

- Key Buyer Archetypes (Value Seekers, Brand Loyalists, EV Early Adopters, Fleet Operators)

- Financing Preferences & Ownership Models

- Digital vs Physical Retail Experience

- Vehicle Lifecycle and Trade-in Trends

- By Value, 2025-2030

- By Volume, 2025-2030

- By Number of Dealerships, 2025-2030

- By Average Transaction Value, 2025-2030

- By Average Dealer Throughput, 2025-2030