Market Overview

As of 2024, the UAE automotive manufacturing market is valued at USD 848.7 million, with a growing CAGR of 3.4% from 2024 to 2030, driven primarily by substantial investments in technology and infrastructure. The country’s strategic location, serving as a gateway between Europe and Asia, facilitates the flow of automotive parts and finished vehicles. Coupled with the government’s Vision 2021, which emphasizes sustaining economic growth through diversification, the automotive industry is seeing significant advancements.

Dubai and Abu Dhabi dominate the UAE automotive manufacturing scene due to robust infrastructure and high consumer demand. Dubai’s position as a global trade center enables efficient distribution channels and logistics, bolstered by its rich automotive culture. Abu Dhabi, with its abundant financial resources and government backing, supports extensive manufacturing projects, contributing to its dominant market presence.

Market Segmentation

By Vehicle Type

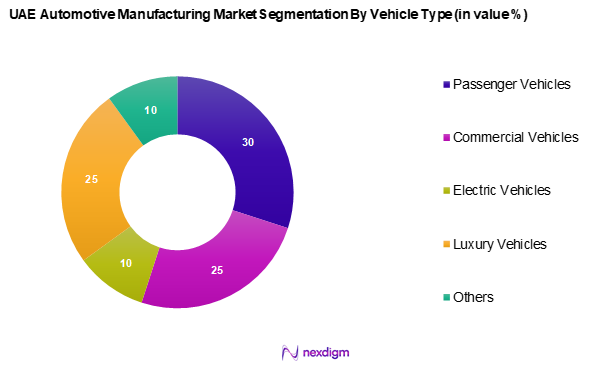

The UAE automotive manufacturing market is segmented into passenger vehicles, commercial vehicles, electric vehicles, luxury vehicles, others. Luxury vehicles dominate the market, capitalizing on the UAE’s tax-free status and affluent population. The demand for luxury cars is driven by a combination of high disposable income and consumer preference for premium brands. Manufacturers like Mercedes-Benz and BMW capitalize on this by offering models tailored to local tastes, further strengthening this segment’s market grip.

By Manufacturing Component

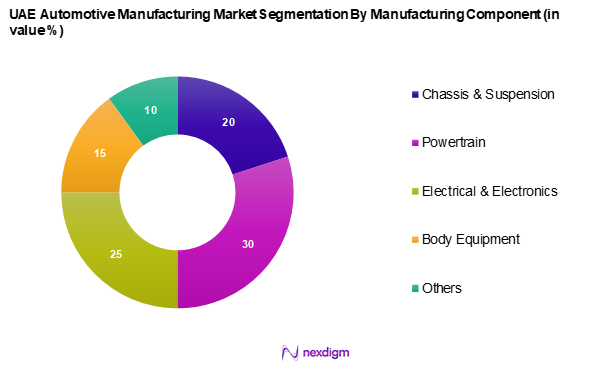

The UAE automotive manufacturing market is segmented into chassis & suspension, powertrain, electrical & electronics, body equipment, and others. The powertrain segment holds significant market dominance due to continual advancements in combustion efficiency and hybrid technologies. Companies focus on innovating fuel-efficient engines and integrating soft hybrid systems. This trend aligns with global shifts towards emission reduction, and several manufacturers are investing in R&D to enhance powertrain capabilities, thereby driving its market leadership.

Competitive Landscape

The UAE automotive market features a competitive landscape where a handful of major players exert significant influence. Companies like Al Ghandi Auto and Al-Futtaim Group have a strong foothold owing to extensive dealership networks and exclusive partnerships with global brands.

| Company Name | Establishment Year | Headquarters | Market Share | Revenue (USD bn) | Product Lines | Innovation Score |

| Al-Futtaim Group | 1930 | Dubai | – | – | – | – |

| Emirates Transport | 1981 | Abu Dhabi | – | – | – | – |

| Al Naboodah Group | 1958 | Dubai | – | – | – | – |

| Liberty Automobiles | 1975 | Dubai | – | – | – | – |

| Al Ghandi Auto | 1961 | Dubai | – | – | – | – |

UAE Automotive Manufacturing Market Analysis

Growth Drivers

Rising Urbanization and Population Expansion

Urbanization and population expansion are among the key factors propelling the growth of the UAE automotive manufacturing market. With major cities like Dubai and Abu Dhabi continuing to attract a growing number of residents, the demand for personal and public transport vehicles has risen notably. The growing concentration of people in urban areas is also driving investments in transportation infrastructure, further stimulating vehicle demand. This trend indicates a long-term requirement for both private and mass mobility solutions, creating favorable conditions for local automotive production.

Strategic Government Support for Local Manufacturing

The UAE government has been actively fostering domestic manufacturing capabilities as part of its broader economic diversification strategy. Initiatives aimed at strengthening industrial capacity, including dedicated programs to develop the local manufacturing ecosystem, have created a conducive environment for automotive production. Strategic partnerships with international vehicle manufacturers and increased government backing for industrial innovation are laying the groundwork for a more resilient and self-reliant automotive sector. These policy-driven efforts are expected to enhance local production capabilities and generate new employment opportunities.

Market Challenges

High Capital Requirements for Market Entry

One of the primary challenges faced by new entrants in the UAE automotive manufacturing market is the substantial capital investment needed to establish production facilities. The cost of setting up advanced manufacturing plants, acquiring cutting-edge equipment, and maintaining compliance with regulatory standards can be a significant burden, particularly for smaller players. Limited access to cost-effective financing options and fluctuating economic conditions further compound the difficulty of launching operations, often resulting in a market dominated by a few established players.

Volatility in Input Costs

Unpredictable fluctuations in the cost of essential raw materials pose a persistent challenge to automotive manufacturers in the UAE. Materials such as steel and aluminum, which are fundamental to vehicle production, are subject to global supply chain disruptions and pricing volatility. This unpredictability impacts production budgets and narrows profit margins, making it difficult for manufacturers to maintain stable pricing.

Opportunities

Advancements in Manufacturing Technologies

Technological progress presents a transformative opportunity for automotive manufacturing in the UAE. The adoption of automation, artificial intelligence, and smart factory technologies is reshaping the production landscape by improving operational efficiency and reducing reliance on manual labor. These advancements enable higher precision and productivity while minimizing downtime and errors. Additionally, the increasing focus on electric vehicles and sustainable mobility solutions aligns well with global trends, positioning UAE-based manufacturers to capitalize on emerging automotive innovations.

Market Expansion Beyond National Borders

The UAE’s strategic geographic position offers local manufacturers the advantage of tapping into neighbouring emerging markets. As demand for vehicles grows in developing economies across the Middle East, Africa, and parts of Asia, UAE manufacturers are well-positioned to supply these markets efficiently. Leveraging regional trade networks and export-friendly policies, automotive firms can broaden their reach and establish a strong regional footprint. This outward expansion not only drives growth but also enhances the UAE’s status as a key hub for automotive manufacturing in the wider region.

Future Outlook

Over the next five years, the UAE automotive manufacturing market is poised for robust growth catalyzed by advancements in autonomous vehicle technologies, the rising popularity of electric vehicles, and intensified government initiatives towards sustainability and innovation in manufacturing processes. Strategic agreements with international leaders and increased digitalization in production will further accelerate the market’s evolution.

Major Players

- Al-Futtaim Group

- Arabian Automobiles

- Al Naboodah Group

- Al Ghandi Auto

- Emirates Transport

- Gargash Enterprises

- Liberty Automobiles

- Juma Al Majid Group

- AW Rostamani Group

- Bin Hamoodah Automotive

- Majid Al Futtaim

- Al Habtoor Motors

- Swaidan Trading

- Union Motors

- Galadari Brothers

- Emirates Techno Casting FZE

- Ashok Leyland (UAE) LLC

Key Target Audience

- Automotive Manufacturers

- Investments and Venture Capitalist Firms

- Government Regulatory Bodies (e.g., Ministry of Economy, Emirates Authority for Standardization and Metrology)

- Automotive Parts Suppliers

- Distributors and Dealerships

- Fleet Management Companies

- Research and Development Institutions

- Automotive Aftermarket Retailers

- Logistics and Supply Chain Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE automotive manufacturing market. Extensive desk research is conducted using secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including consumer demands, production capabilities, and regulatory environments.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the UAE automotive manufacturing market. This encompasses assessing market penetration, key industry trends, and the dynamics between various market players. Additionally, a thorough evaluation of service quality statistics ensures the reliability and accuracy of the revenue estimates, accounting for fluctuations in consumer preferences and economic trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from practitioners, which are instrumental in refining and corroborating the dataset. This process also helps in identifying emerging trends and potential market shifts.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple automotive manufacturers to obtain detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the UAE automotive manufacturing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Urbanization and Population Growth

Government Initiatives towards Manufacturing - Market Challenges

High Initial Investment Costs

Fluctuating Raw Material Prices - Opportunities

Technological Innovations

Expansion in Emerging Markets - Trends

Integration of Advanced Driver Assistance Systems (ADAS)

Digital Transformation in Vehicle Purchases - Government Regulations

Safety and Emission Standards

Incentives for Green Manufacturing - SWOT Analysis

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Passenger Vehicles

– Sedans

– Hatchbacks

– SUVs

– Crossovers

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Heavy Commercial Vehicles (HCVs)

– Buses & Vans

Electric Vehicles

– Battery Electric Vehicles (BEVs)

– Plug-in Hybrid Electric Vehicles (PHEVs)

– Hybrid Electric Vehicles (HEVs)

Luxury Vehicles

– High-End Sedans

– Luxury SUVs

– Sports Cars

Others

– Off-Road Vehicles

– Special-Purpose Vehicles - By Manufacturing Component (In Value %)

Chassis & Suspension

– Frames

– Axles

– Shock Absorbers

Powertrain

– Engines

– Transmissions

– Drivetrain Systems

Electrical & Electronics

– Wiring Harnesses

– Battery Packs & Management Systems

– Infotainment & Telematics

– ADAS Modules

Body Equipment

– Panels

– Bumpers

– Lighting Systems

Others

– Interior Trim

– Tires & Wheels

– HVAC Systems - By Production Technology (In Value %)

Conventional Manufacturing

– Manual Assembly Lines

– Standard Tooling and Fabrication

Advanced Manufacturing Techniques

– Robotics & Automation

– 3D Printing & Additive Manufacturing

– Smart Factories / Industry 4.0

– AI & IoT Integration - By End-User (In Value %)

OEMs (Original Equipment Manufacturers)

– Domestic Assemblers

– International Joint Ventures

Aftermarket

– Spare Parts Manufacturers

– Customization & Tuning Companies

– Refurbishing Units - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Ajman

Ras Al Khaimah

Umm Al Quwain

Fujairah

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Component Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Component, Production Plant Capacity, Unique Value Offering, and others)

- Competitive Matrix

- Pricing Analysis

- Detailed Profiles of Major Companies

Al-Futtaim Group

Arabian Automobiles

Al Naboodah Group

Al Ghandi Auto

Emirates Transport

Gargash Enterprises

Liberty Automobiles

Juma Al Majid Group

AW Rostamani Group

Bin Hamoodah Automotive

Majid Al Futtaim

Al Habtoor Motors

Swaidan Trading

Union Motors

Galadari Brothers

Emirates Techno Casting FZE

Ashok Leyland (UAE) LLC

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030