Market Overview

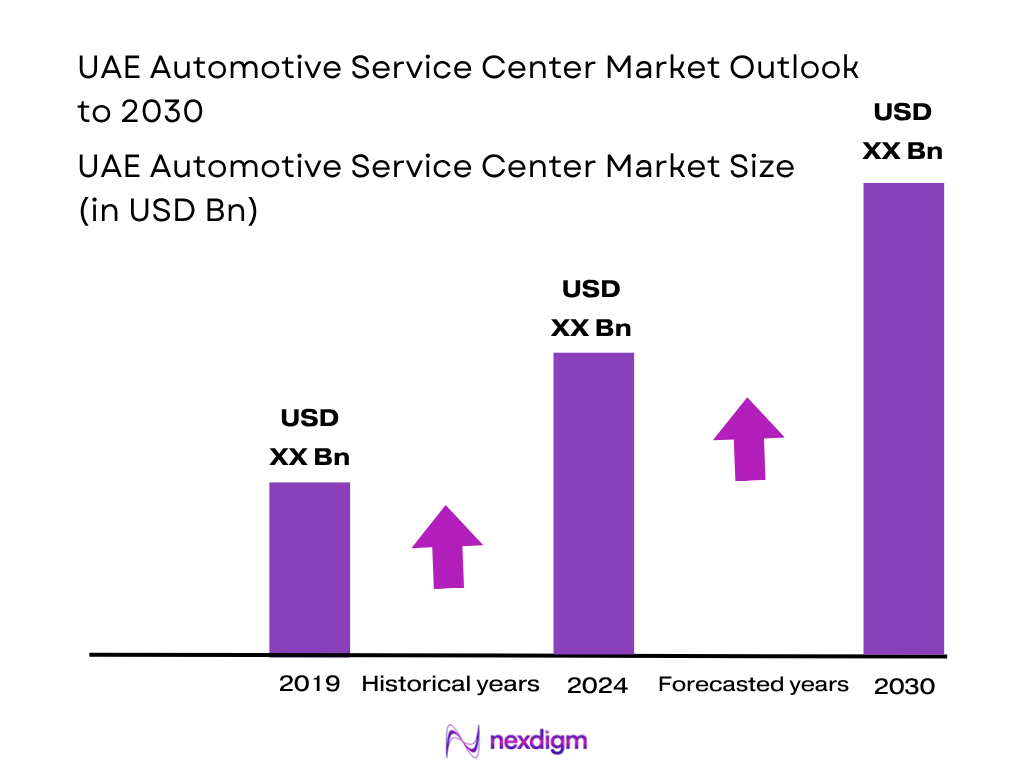

The UAE automotive service center market was valued at USD 7 billion in 2024, up from approximately USD 6.8 billion in 2023. This growth is driven by a rising vehicle parc—including new and used cars—exposure to extreme temperatures (exceeding 45 °C) and frequent dust storms, which collectively accelerate wear and tear. High-income consumers continue to demand frequent servicing, diagnostics, and customization, thereby boosting service revenues.

Service center activity is primarily concentrated in Dubai, Abu Dhabi, and Sharjah. Dubai dominates due to its urban density, tourism-driven fleet services, and advanced aftermarket infrastructure. Abu Dhabi benefits from government fleet programs and widespread dealership networks. Sharjah’s rapid industrialization—coupled with commercial vehicle servicing—makes it a key market. Together, these metro areas attract the majority of investment in service workshop expansion and digital platform penetration.

Market Segmentation

By Service Type

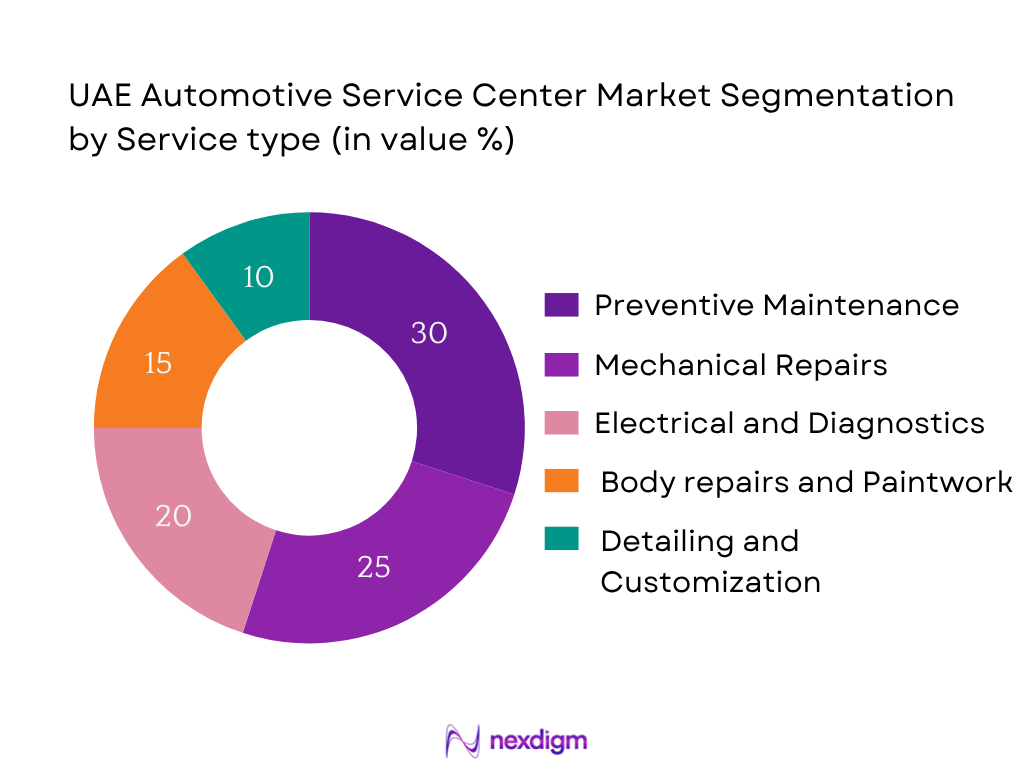

Preventive maintenance currently leads the segment, capturing around 30% of service revenues. This is fueled by strong demand for routine services such as oil changes and tire rotations—essential in the UAE’s severe climate. Dealerships and quick-lube centers have capitalized on this trend through subscription maintenance packages. High vehicle mileage and stringent inspection cycles also reinforce repeat service visits.

By Vehicle Type

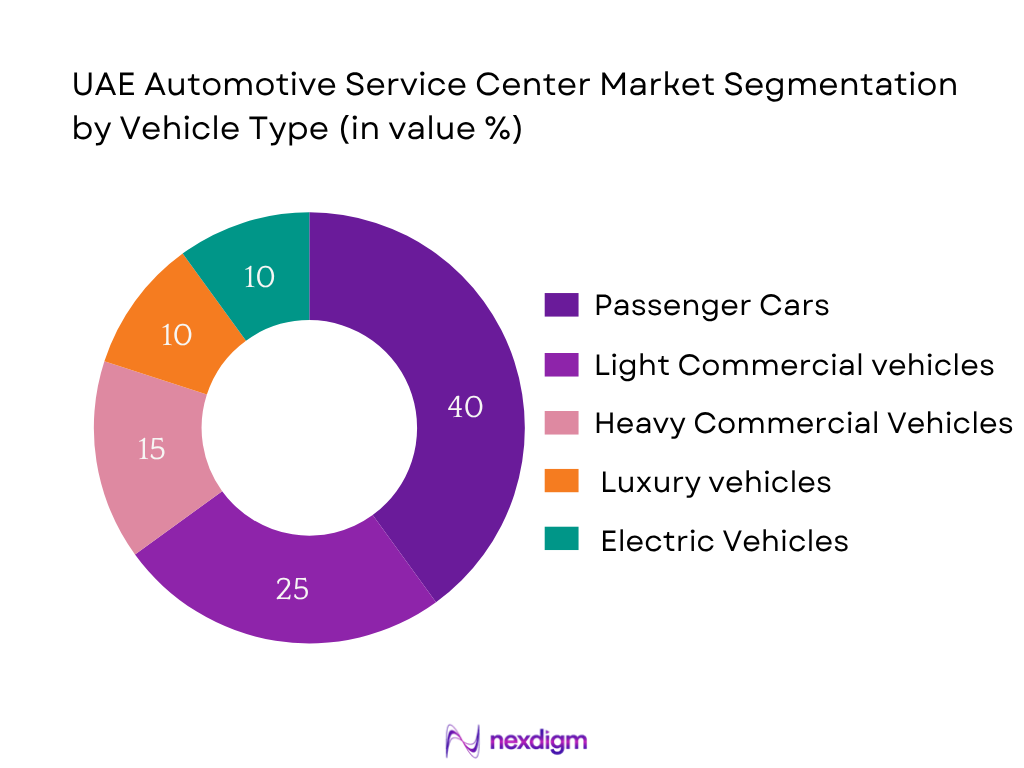

Passenger cars dominate with roughly 40% share, owing to strong private vehicle ownership (over 540 cars per 1,000 residents). Independent garages and dealerships drive this segment. Light commercial vehicles follow, driven by Dubai-Abu Dhabi logistics and delivery operations. Growing EV and luxury vehicle fleets—supported by premium service packages—are breaking into the market, though still emerging.

Competitive Landscape

The UAE automotive service center market is concentrated among key players with strong regional reach. The UAE service center landscape is governed by a core group of providers operating nationwide workshop networks and digital service offerings. Dealership chains, auto-aggregators, and government-affiliated outlets dominate. Smaller workshops contribute significantly but face challenges in scale and technology adoption.

| Company | Established | HQ | Service Bays | Certified Technicians | EV Capability | Digital Booking |

| Al‑Futtaim Auto Centers | 2003 | Dubai | – | – | – | – |

| Dynatrade Auto Service | 1989 | Sharjah | – | – | – | – |

| AutoPro (ENOC) | 1999 | Abu Dhabi | – | – | – | – |

| ServiceMyCar.ae | 2019 | Dubai | – | – | – | – |

| Fasttrack Emarat | 1998 | Abu Dhabi | – | – | – | – |

UAE Automotive Service Center Market Analysis

Growth Drivers

Surge in Vehicle Parc (No. of registered vehicles in UAE)

At the end of 2024, UAE registered 316,000 new vehicles, following a 15.7% increase from 2023’s ~274,000 registrations. Additionally, rental fleets expanded to 71,040 vehicles, up from 49,725 in 2023. With over 3.2 million registered vehicles on national roads, per Civil Defence open data, this expanding parc significantly boosts demand for regular servicing and maintenance across every category—private, rental, logistics—fueling sustained workshop throughput.

Rise in Used Car Sales

The UAE’s used-car market reached USD 18.40 billion in 2024, marking a rapid rise from previous years. This reflects consumers’ preference for pre-owned mobility options, aided by certified used-car programs and online marketplaces. Registrations for used vehicles surged simultaneously with new vehicle growth, indicating a growing overall vehicle volume requiring aftermarket servicing—mechanical checks, inspections, warranty work—often routed through service centers or aggregated platforms.

Market Challenges

High Dependence on Skilled Labour

The UAE employs thousands of specialized auto technicians—Vehicle Maintenance Supervisors, Automotive Air Conditioning Mechanics, Auto Body Repairers, and Tyre Repairers. As Emiratisation quotas require that private firms with more than 50 skilled employees hire 2% Emirati nationals annually, reaching 10% by 2026, service centers face pressure to refine hiring practices. The limited skilled national workforce and dependence on expatriates can constrain capacity, especially when scaling EV and ADAS-related services. This labor challenge complicates sustainable service delivery.

Price Sensitivity in Independent Segment

Growth of low-cost alternatives—independent garages and quick-lube centers—has surged amid inflation and economic uncertainty. In 2024, average maintenance parts costs rose 7% (grease, refrigerant, diagnostic services), pushing budget-conscious consumers to seek cheaper service options. These independents often use commoditized parts and lower-cost labor, undercutting dealership pricing. While volume remains strong, achieving quality consistency and profitability is difficult, especially as consumers equip newer vehicles with ADAS and require certified technicians.

Opportunities

Electric Vehicle Service Specialization

The UAE’s Electric Vehicle revenues hit USD 2.22 billion in 2024, with 147,000 EVs on roads as of 2023 . Although EV-specific aftermarket remains nascent, it grew to USD 2.38 billion in 2023 . This reveals a growing need for EV specialization: battery diagnostics, high-voltage system repairs, software calibration. Workshops that proactively invest in EV equipment and technician training can establish themselves as leaders in this fast-growing niche, positioning ahead of standard gasoline-focused competitors.

AI and Predictive Maintenance Integration

Global automotive data monetization reached USD 7.8 billion in 2024. Adoption of UBI and telematics-based monitoring in UAE fleets is rising, with usage-based insurance (UBI) and connected-car data enabling workload forecasting. Integrating AI-driven predictive maintenance could allow service centers to anticipate part failures, optimize inventory, and schedule service visits proactively—enhancing customer satisfaction and operational efficiency while unlocking new revenue streams via value-added analytics.

Future Outlook

Over the next six years, the UAE automotive service center market is expected to continue steady growth at 3.5–3.8% CAGR. Key drivers include increasing EV adoption, fleet and logistics expansion, and demand for advanced services like ADAS calibration. Service providers will need to invest in technician training, EV tools, and IoT-based diagnostics. Digital booking, subscription maintenance models, and EV-specialist centers tailored for luxury fleets will evolve as core strategic initiatives.

Major Players

- Al‑Futtaim Auto Centers

- Fasttrack Emarat

- Dynatrade Auto Service

- AutoPro (ENOC)

- AAA UAE

- Max Garage

- MySyara

- ServiceMyCar.ae

- ZDegree

- Orange Auto

- PitStopArabia

- QuikFix Auto Services

- Radiant Auto Repair

- Carcility

- Rapid Auto Services

Key Target Audience

- Fleet operators (logistics, ride-hailing, rental companies)

- EV charging infrastructure investors

- Luxury vehicle fleet managers

- National Transport Authority (NTA) and RTA

- Ministry of Energy & Infrastructure

- Investment and venture capital firms

- Auto component and diagnostic tool suppliers

- Large dealership groups (e.g., Al Tayer, Al Habtoor)

Research Methodology

Step 1: Identification of Key Variables

We first mapped stakeholders—dealerships, independent garages, digital platforms. Using secondary sources and proprietary databases, we defined critical variables: number of registered vehicles, service outlets, technician counts, digital platform penetration, and service ticket values.

Step 2: Market Analysis and Construction

We compiled historical data (2019–2023) on service revenues and visit frequency from OEMs, RTA, and private registries. We adjusted for inflation and service price changes. Service quality indicators and average service times were analyzed to validate revenue models.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on service mix, EV readiness, and subscription acceptance were validated through CATI interviews with service center managers, dealership service directors, and fleet operations from major logistics and rental firms.

Step 4: Research Synthesis and Final Output

We engaged with national dealership groups and aggregators to verify data and gather insights on future initiatives—especially EV/ADAS tools, digital services, and platform integration. This bottom-up verification solidifies the final report, ensuring accuracy and relevance.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research, Limitations and Conclusion)

- Definition and Scope

- Industry Genesis

- Timeline of Major Service Milestones

- Industry Lifecycle Mapping

- Supply Chain and Value Chain Analysis

- Growth Drivers

Surge in Vehicle Registration

Rise in Used Car Sales

Technological Integration (ADAS, telematics-based diagnostics)

Shift to Subscription-Based Maintenance Packages - Market Challenges

High Dependence on Skilled Labour

Price Sensitivity in Independent Segment

Low Aftermarket Readiness for EVs - Opportunities

Electric Vehicle Service Specialization

AI and Predictive Maintenance Integration

Rise of Service Aggregation Platforms - Trends

Rise of Fleet Servicing Contracts

Expansion of Mobile Service Vans

Increasing Digitization - Government Regulations

Workshop Licensing by RTA

EV Servicing Protocols

Sustainable Waste Disposal Norms - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value (2019-2024)

- By Volume (2019-2024)

- By Average Ticket Size (2019-2024)

- By Number of Service Visits (2019-2024)

- By Service Type (In Value %)

Preventive Maintenance

– Oil Change and Filter Replacement

– Brake Inspection and Service

– Tire Rotation and Balancing

– Battery Check and Replacement

– Fluid Top-Ups and Flushes

Mechanical Repairs

– Engine Overhaul and Repairs

– Transmission Repairs

– Suspension and Steering Repairs

– Exhaust and Emissions Repairs

Electrical and Diagnostics

– ECU Diagnostics

– Battery and Alternator Services

– Lighting and Wiring Repairs

– Sensor and Control Module Diagnostics

Body Repairs and Paintwork

– Dent and Scratch Removal

– Full Body Painting

– Collision Repairs

– Windshield and Glass Replacement

Detailing and Customization

– Exterior Polishing and Waxing

– Interior Deep Cleaning

– Upholstery and Dashboard Restoration

– Paint Protection Film (PPF) and Ceramic Coating

– Performance Modifications and Aesthetic Custom Kits - By Vehicle Type (In Value %)

Passenger Cars

– Sedans

– Hatchbacks

– Compact SUVs

Light Commercial Vehicles

– Vans

– Pickup Trucks

– Fleet Delivery Vehicles

Heavy Commercial Vehicles

– Trucks

– Buses

– Construction Vehicles

Luxury Vehicles

– High-End European Brands

– Supercars

– Custom Exotic Cars

Electric Vehicles

– Battery Diagnostics and Servicing

– EV Motor and Controller Servicing

– Charging Port Repairs

– Software Updates and Calibration - By Service Provider Type (In Value %)

Authorized Dealership Workshops

– OEM-Specific Services

– Under Warranty Repairs

Certified Technicians

Independent Garages

– Multi-Brand Repair Services

– Cost-Effective Maintenance Packages

– Used Parts and Rebuilt Components

Mobile Mechanics

– Doorstep Vehicle Servicing

– Emergency Repairs

– Subscription-Based Maintenance

Quick Lube Centers

– Express Oil Changes

– Minor Fluid Services

– Rapid Inspection Services

Aggregator Platforms

– App-Based Booking and Scheduling

– Comparative Pricing and Reviews

– Doorstep Pickup and Delivery Options - By Region (In Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

Western Region - By Booking Channel (In Value %)

Walk-in/Offline

Website

Mobile Application

Aggregator App

Phone Booking

- Market Share of Major Players (By No. of Garages, Service Revenue, Digital Footprint)

- Cross Comparison Parameters (Company Overview, Pricing Model, Service Offerings, Average Ticket Size, No. of Service Bays, Vehicle Segment Focus, Service Aggregator Partnership, Technician Certification Levels)

- SWOT Analysis of Major Players

- Price Mapping (For Popular Services: Oil Change, AC Service, Brake Pads)

- Detailed Profiles of Major Players

Al-Futtaim Auto Centers

Fasttrack Emarat

Dynatrade Auto Service

AutoPro (ENOC)

AAA UAE

Max Garage

MySyara

ServiceMyCar.ae

ZDegree

Orange Auto

PitStopArabia

QuikFix Auto Services

Radiant Auto Repair

Carcility

Rapid Auto Services

- Customer Preferences and Loyalty Drivers

- Price Band and Willingness to Pay

- Pain Points in Existing Service Structures

- Expectations from Digital Service Channels

- Institutional vs. Retail Customer Behavior

- By Value (2025-2030)

- By Volume (2025-2030)

- By Average Ticket Size (2025-2030)

- By Number of EVs in Workshop Pipeline (2025-2030)