Market Overview

The UAE Biomarkers Market is valued at USD ~ billion, driven by rapid advancements in medical diagnostics and personalized medicine. The demand for biomarkers, used in diagnostic, prognostic, and therapeutic applications, has grown significantly over the past few years due to rising healthcare investments and the increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions. Moreover, the integration of biomarkers in drug development and clinical trials has also contributed to the growing market, positioning the UAE as a leading hub in the Middle East for the biomarker industry.

Dubai and Abu Dhabi dominate the UAE Biomarkers Market due to their robust healthcare infrastructure, world-class medical facilities, and significant government support for healthcare innovation. These cities also serve as key centers for medical research and diagnostics, attracting global players in the biomarker industry. Additionally, the UAE’s strategic geographic location, coupled with government initiatives aimed at enhancing healthcare accessibility and quality, strengthens the UAE’s position as a critical player in the global biomarker market.

Market Segmentation

By Product Type

Diagnostic biomarkers dominate the UAE Biomarkers Market due to their essential role in early detection and accurate diagnosis of diseases, particularly in oncology and cardiovascular diseases. As personalized medicine gains traction in the UAE, diagnostic biomarkers have become a cornerstone in clinical practice for providing targeted therapies and improving patient outcomes. The growing demand for precision medicine and early diagnosis supports the continued dominance of this sub-segment in the market.

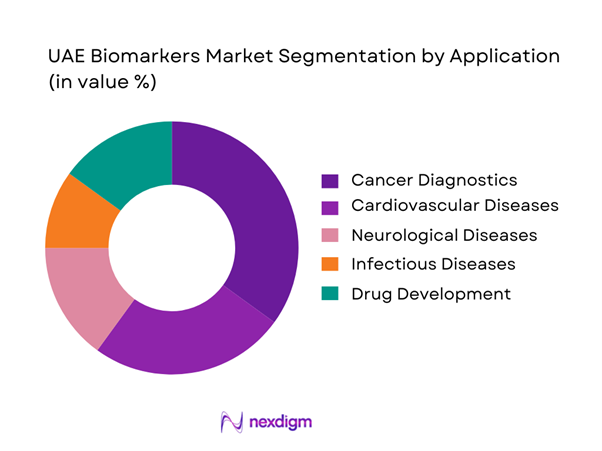

By Application

Cancer diagnostics lead the application segment in the UAE Biomarkers Market. The rising prevalence of cancer and the increasing emphasis on early detection and personalized treatment are key drivers of growth in this sub-segment. Cancer biomarkers enable more effective treatment planning by identifying specific molecular markers linked to cancer, enhancing the precision of therapeutic approaches. The significant investment in cancer research and healthcare infrastructure in the UAE further solidifies the dominance of this sub-segment.

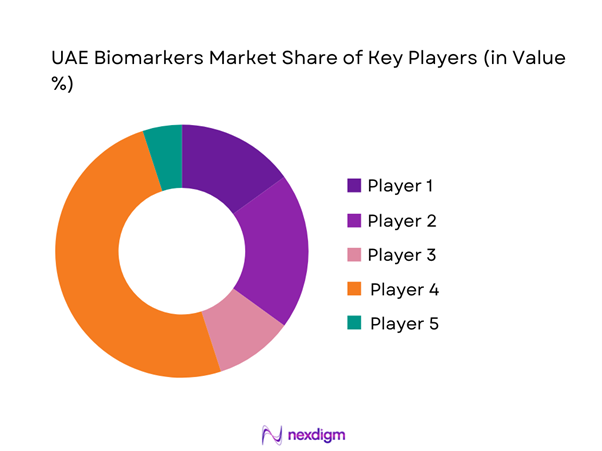

Competitive Landscape

The UAE Biomarkers Market is dominated by a few major players, including Bio-Rad Laboratories and global brands like Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, and PerkinElmer. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Research Collaborations | Market Share | Patents Filed | R&D Investment | Product Offering | Global Reach |

| Bio-Rad Laboratories | 1952 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott Laboratories | 1888 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | USA | ~ | ~% | ~ | ~ | ~ | ~ |

| PerkinElmer | 1937 | USA | ~ | ~% | ~ | ~ | ~ | ~ |

UAE Biomarkers Market Analysis

Growth Drivers

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases, such as cancer, cardiovascular disorders, diabetes, and neurological conditions, is significantly driving the demand for biomarkers. Chronic diseases are becoming more prevalent due to changing lifestyles, aging populations, and environmental factors, placing a growing burden on healthcare systems. Biomarkers play a critical role in the early detection, diagnosis, and monitoring of these diseases, leading to better patient outcomes. As healthcare professionals increasingly rely on biomarkers for more accurate and timely diagnoses, the demand for advanced diagnostic tools and biomarker testing continues to rise, contributing to market growth.

Advancements in Personalized Medicine

Personalized medicine, which tailors medical treatment to individual characteristics such as genetics, lifestyle, and environment, is a key factor driving the growth of the biomarkers market. Advancements in genomics, molecular biology, and biotechnologies have enabled the identification of specific biomarkers that help in predicting individual responses to treatments. This shift toward precision healthcare is revolutionizing treatment plans, making therapies more effective and reducing side effects. As the demand for personalized care increases, biomarkers are becoming indispensable tools in designing tailored therapies, propelling market growth and fostering the development of more targeted and efficient medical treatments.

Market Challenges

High Cost of Biomarker Discovery

The high costs associated with biomarker discovery and development pose significant challenges to the growth of the biomarkers market. Research and development of novel biomarkers require substantial financial investments in advanced technologies, laboratories, and skilled professionals. Additionally, the time-consuming nature of identifying reliable and effective biomarkers further increases the overall costs. These financial barriers can limit the number of research projects, particularly for smaller companies and startups. Despite these challenges, investments in biomarker research are vital to improving diagnostics and treatment outcomes, and overcoming these costs is a key focus for stakeholders in the industry.

Regulatory and Compliance Challenges

Regulatory hurdles and compliance requirements represent significant challenges in the biomarker market. Different regions have their own regulatory frameworks for biomarker validation and commercialization, which can be complex and time-consuming to navigate. The lack of standardized guidelines for biomarker testing and the approval process for biomarker-based diagnostics adds another layer of complexity. As a result, biomarker developers must invest considerable time and resources to ensure compliance with regulatory bodies, such as the FDA or EMA, which can delay product launches and increase operational costs. Overcoming these regulatory barriers is critical for accelerating innovation and market adoption.

Opportunities

Growing Demand for Point-of-Care Testing

Point-of-care (POC) testing is emerging as a key opportunity in the biomarker market. With increasing consumer demand for rapid, accessible, and cost-effective diagnostic solutions, POC testing is transforming healthcare delivery. Biomarkers are playing a pivotal role in these tests, enabling the detection of diseases in a non-invasive, timely manner. These tests are particularly valuable in settings such as rural areas, emergency rooms, and at-home diagnostics, where access to traditional lab testing may be limited. The adoption of POC testing is expected to expand, creating significant opportunities for biomarker-based solutions that can provide instant, accurate results at the point of care.

Emerging Use of AI and Machine Learning in Biomarker Discovery

Artificial intelligence (AI) and machine learning (ML) are transforming the field of biomarker discovery by enabling faster, more accurate identification of biomarkers. AI and ML algorithms can analyze vast amounts of data from clinical studies, genomic research, and medical records to detect patterns and predict disease biomarkers that may otherwise be overlooked. This technological advancement enhances the precision of biomarker development, speeds up the research process, and reduces costs. The integration of AI and ML in biomarker discovery is paving the way for new diagnostic methods and personalized treatment strategies, creating significant growth opportunities in the biomarkers market.

Future Outlook

The UAE Biomarkers Market is expected to continue expanding in the coming years, driven by advancements in diagnostic technologies, growing healthcare infrastructure, and increasing demand for personalized medicine. The market will benefit from ongoing government support and investment in healthcare innovation. With a focus on non-invasive testing, digital health, and AI integration, the market is poised for further growth, presenting new opportunities for both local and global players.

Major Players

- Bio-Rad Laboratories

- Roche Diagnostics

- Abbott Laboratories

- Thermo Fisher Scientific

- PerkinElmer

- Agilent Technologies

- QIAGEN

- Merck Group

- LabCorp

- Genomic Health

- Beckman Coulter

- Illumina

- BioMérieux

- Medtronic

- Siemens Healthineers

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (UAE Ministry of Health and Prevention)

- Healthcare providers (Hospitals, Clinics)

- Diagnostic laboratories

- Pharmaceutical companies

- Biotechnology companies

- Research institutions

- Private healthcare sector stakeholders

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the critical market variables influencing the UAE Biomarkers Market, including healthcare infrastructure, regulatory landscape, and key industry players. This is achieved through secondary data analysis and industry reports.

Step 2: Market Analysis and Construction

We analyze historical data and market trends to develop accurate market models and forecasts. This includes examining the current state of biomarker applications and identifying growth opportunities within various segments.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses are validated through interviews with key industry experts, including healthcare professionals and executives from leading companies. Their insights help refine our understanding of the market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data, validating findings, and presenting them in a comprehensive report that provides an in-depth analysis of the UAE Biomarkers Market.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Biomarker Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- UAE Industry / Service / Delivery Architecture

- Growth Drivers

Increasing Prevalence of Chronic Diseases

Advancements in Personalized Medicine

Government Support and Healthcare Investment

Expansion of Healthcare Infrastructure

Rising Adoption of Precision Medicine - Market Challenges

High Cost of Biomarker Discovery

Regulatory and Compliance Challenges

Limited Access to Advanced Diagnostic Technologies

Shortage of Skilled Professionals in Biomarker Research - Opportunities

Growing Demand for Point-of-Care Testing

Emerging Use of AI and Machine Learning in Biomarker Discovery

Rise in Public and Private Investments for Biomarker Research

Increasing Demand for Early Disease Detection Solutions - Trends

Shift Toward Non-Invasive Biomarker Tests

Integration of Digital Health Tools in Biomarker Detection

Growing Interest in Liquid Biopsy Technologies

Personalized Healthcare Becoming More Mainstream - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Price, 2019–2024

- By Product Type, (In Value %)

Diagnostic Biomarkers

Prognostic Biomarkers

Predictive Biomarkers

Pharmacodynamic Biomarkers

Risk Assessment Biomarkers - By Application, (In Value %)

Cancer Diagnostics

Cardiovascular Diseases

Neurological Diseases

Infectious Diseases

Drug Development - By End User, (In Value %)

Hospitals and Clinics

Research Institutes

Diagnostic Laboratories

Pharmaceutical Companies - By Region, (In Value %)

Dubai

Abu Dhabi

Sharjah

Other Emirates

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share by Biomarker Type - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Biomarker Type, Number of Research Collaborations, Number of Patents Filed, Production Capacity, R&D Investment, Unique Value Offering)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Bio-Rad Laboratories

Roche Diagnostics

Abbott Laboratories

Siemens Healthineers

Thermo Fisher Scientific

PerkinElmer

Agilent Technologies

QIAGEN

Merck Group

LabCorp

Genomic Health

Beckman Coulter

Illumina

BioMérieux

Medtronic

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025-2030

- By Average Price, 2025-2030