Market Overview

The UAE biosensors market is valued at USD ~ million, based on detailed industry report data, reflecting the aggregated revenue generated from sales of biosensing devices across healthcare, diagnostics, and monitoring segments. This valuation is supported by a structured market study that incorporates historical revenue, key technology segments such as electrochemical, optical, and piezoelectric biosensors, and validated industry benchmarks. The market’s revenue base is driven by sustained demand for point-of-care diagnostics and remote patient monitoring solutions, where technologies such as electrochemical biosensors dominate due to their widespread application in chronic disease management and clinical diagnostics.

Across the Middle East region, the UAE, Saudi Arabia, and Israel are seen as primary adopters of biosensor technologies. The UAE’s dominance stems from its advanced healthcare infrastructure, substantial digital health investments, and strong inclination toward adopting wearable and remote monitoring solutions. Additionally, government initiatives to integrate IoT and smart health technologies into hospital systems have strengthened biosensor uptake. Saudi Arabia remains significant due to its large population and healthcare transformation programs, while Israel’s strong medtech innovation ecosystem provides complementary growth momentum in the regional biosensors market.

Market Segmentation

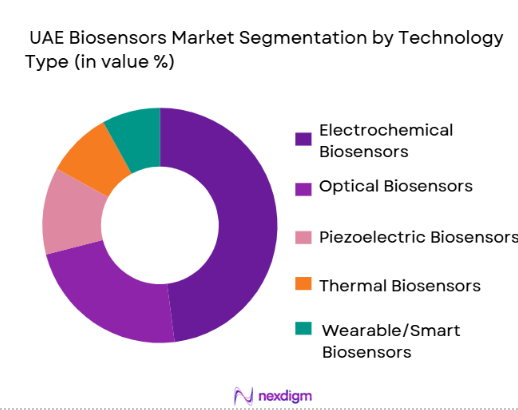

By Technology Type

Electrochemical biosensors hold the largest share under this segment, driven by their extensive use in glucose monitoring and chronic disease management. Electrochemical biosensors are preferred due to their sensitivity, cost efficiency, and integration into portable diagnostics devices, particularly in diabetes care, which remains a high-priority health concern in the UAE. Their widespread adoption in both clinical and home settings sustains their leadership. Optical and piezoelectric technologies are growing due to increased demand for high-accuracy, real-time analysis in oncology diagnostics, infectious disease testing, and advanced biometric sensing applications. Together, these technologies enable healthcare providers to offer rapid diagnostics, significantly reducing turnaround times in critical care settings, enhancing patient monitoring, and supporting telehealth implementations. Optical biosensors in particular are gaining traction due to their non-invasive nature and versatility across diagnostic scenarios.

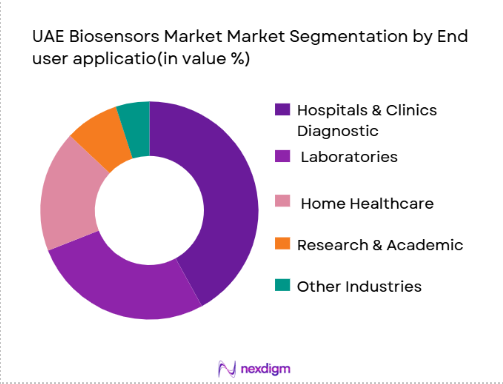

By End-User Application

Under end-user application, hospitals and clinics dominate, owing to the UAE’s expanding healthcare infrastructure, high investments in digital health technologies, and growing preference for integrated biosensing solutions in diagnostic workflows. Hospitals deploy biosensors extensively for point-of-care testing, ICU monitoring, and chronic disease management, where rapid, reliable biosensor output is critical. Diagnostic laboratories follow, driven by demand for accurate, automated workflows capable of handling high testing volumes. Emerging segments such as home healthcare and wearable biosensing are also gaining traction due to increased acceptance of self-monitoring technologies among patients with chronic conditions and remote monitoring applications, facilitated by the UAE’s smart health initiatives.

Competitive Landscape

The UAE biosensors ecosystem features major international manufacturers that have established distribution channels, regulatory compliance expertise, and broad product portfolios spanning clinical diagnostics, wearable devices, and advanced sensing platforms. This competitive landscape underscores the significant influence of global brands while providing opportunities for localized product adaptations and new entrants specializing in IoT-enabled biosensing technologies.

| Company | Year Established | Headquarters | Core Biosensor Focus | UAE Presence | R&D Intensity | Distribution Reach | Regulatory Approvals |

| Abbott Laboratories | 1888 | USA | ~ | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ |

~ |

| Siemens Healthineers | 2015 | Germany | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Ireland | ~ | ~ | ~ | ~ | ~ |

| Bio-Rad Laboratories | 1952 | USA | ~ | ~ | ~ | ~ | ~ |

UAE Biosensors Market Analysis

Growth Drivers

Digital Healthcare Infrastructure Expansion

The UAE’s investment in digital health platforms, including biosensor‑linked remote monitoring systems, is underpinned by macro‐level healthcare spending dynamic. The UAE allocates around ~ of GDP to healthcare, with planned moderated increases through healthcare digitization initiatives as part of national strategic planning. As of the most recent data, healthcare constitutes a significant share of government services, reflecting prioritization of health technology integration, which supports adoption of biosensor technologies in clinical and community care settings. This health expenditure commitment underpins demand for advanced diagnostic and real‑time monitoring devices.

Rising Chronic Disease Burden and Diagnostic Demand

The UAE faces a documented increase in chronic conditions that directly fuel biosensor utilization. National health assessments report that nearly one in five adults is diabetic, while ~ of adults are overweight and ~obese—conditions where continuous monitoring solutions such as glucose monitoring biosensors are intensively applied in clinical and home settings. These chronic disease statistics drive demand for biosensor devices for routine checks, remote monitoring, and integration into telehealth services across hospitals and primary care hubs.

Restraints

Skilled Workforce Gaps in High‑Tech Medical Deployment

The deployment of advanced biosensor systems, particularly those requiring integration with cloud and AI analytics, is constrained by the UAE’s medical technology workforce structure. While expatriates account for about ~ of the UAE workforce, specific high‑tech healthcare specialist density remains limited, slowing adoption of biosensor systems in some regional hospitals and diagnostic centers. The healthcare–technology skill gap is especially evident in sophisticated device calibration, telemedicine integration, and IoT data management roles critical for biosensor implementation pipelines.

Regulatory Compliance Complexity and Timeframes

Advanced biosensing devices classified as medical devices are subject to federal and emirate‑level regulatory review processes in the UAE. Regulatory authorities such as the

Ministry of Health and Prevention (MOHAP), Dubai Health Authority (DHA), and Department of Health – Abu Dhabi (DoH) require comprehensive conformity assessments for clinical biosensors. While no central repository quantifies regulatory delays, the multiple review pathways across federal and regional agencies, alongside technical compliance documentation requirements, extend time‑to‑market for new biosensor products, reflecting a systemic bottleneck for manufacturers.

Opportunities

IoT and Smart Health Integration

The UAE is a regional leader in IoT adoption, particularly in healthcare. While specific biosensor data integration figures are limited, broader IoT in healthcare projections underline rapid uptake: healthcare IoT systems are accelerating remote monitoring and patient data collection. The push for integrating biosensor outputs with telehealth and digital hospital workflows creates opportunities for vendors capable of delivering interoperable devices compatible with national digital health systems. This positions biosensor suppliers to support acute care, chronic disease management, and personalized health programs.

Population Growth and Aging Demographics

The UAE’s mid‑year population was estimated at over ~ million residents, underpinning sustained healthcare demand. As the population grows and ages, the prevalence of chronic conditions requiring monitoring—such as cardiovascular disease and diabetes—will maintain upward pressure on demand for biosensing technologies in both clinical and home monitoring settings. The size of the population pool increases the potential user base for biosensor applications including wearable devices and point‑of‑care tools.

Future Outlook

Over the forecast period, the UAE biosensors market is expected to expand significantly, supported by favorable government initiatives promoting digital health infrastructure and strategies to enhance chronic disease management through advanced diagnostics. Investments in smart hospital frameworks and telehealth platforms will accelerate the integration of biosensors into clinical workflows and personal health monitoring solutions. The rise of AI-enabled biosensing and real-time data analytics is also anticipated to elevate market growth, enabling predictive diagnostics, remote patient management, and personalized healthcare pathways. The increasing prevalence of lifestyle and age-related diseases, expanding healthcare services, and a technology-savvy population further bolster prospects for sustained demand, particularly in point-of-care and wearable categories.

Major Players

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Medtronic

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Nova Biomedical

- Dexcom

- LifeScan

- ARKRAY

- Senseonics

- Ascensia Diabetes Care

- Philips Healthcare

- QIAGEN

- GE HealthCare Technologies

Key Target Audience

- Healthcare Device Manufacturers

- Investments and Venture Capitalist Firms

- Hospital and Diagnostic Network Operators

- Government and Regulatory Bodies

- Medical Device Distributors and Supply Chain Stakeholders

- Telemedicine and Digital Health Platform Providers

- Healthcare IT and Integration Partners

- Medical Device Import and Compliance Specialists

Research Methodology

Step 1: Market Scoping & Variable Identification

This stage involved mapping the UAE biosensors ecosystem through structured desk research using secondary data sources such as industry surveys, Grand View Research market data, regulatory filings, and industry whitepapers. Critical variables such as technology type, end-user adoption, pricing dynamics, and supply chain structures were defined.

Step 2: Data Triangulation & Historical Analysis

Historical revenue data from 2018 to 2024 was compiled and validated through triangulation of vendor revenues, hospital procurement reports, and import/export activity. This established baseline figures and ensured consistency with reported market sizing.

Step 3: Expert Interviews & Hypothesis Validation

Hypotheses developed around technology adoption, regulatory impacts, and segment growth trends were validated via interviews with healthcare technology managers, in-clinic users, and biosensor OEM representatives, refining insights into competitive dynamics.

Step 4: Forecast Modeling & Reporting

Comprehensive bottom-up and top-down forecast models were constructed incorporating macroeconomic indicators, healthcare expenditure growth, and technology adoption curves. This ensured an accurate, validated projection of the biosensors market from 2024 to 2030.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, UAE-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across Hospitals–Labs–OEMs–Distributors, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution Pathway

- UAE Biosensors Industry Timeline

- Biosensors Industry Business Cycle

- Biosensors Supply Chain & Value Chain Analysis

- Key Growth Drivers

Regulatory Approval Timelines

Cost of Miniaturization

Calibration Complexity - Market Opportunities

Local Manufacturing Incentives

Remote Patient Monitoring

Precision Medicine Demand - Key Trends

Wearable Adoption

Continuous Monitoring Shift

AI-Driven Diagnostics - Regulatory & Policy Landscape

MOHAP Approvals

UAE Medical Device Regulations

Import Compliance

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Selling Price, 2019-2025

- By Biosensor Type (In value %)

Electrochemical Biosensors

Optical Biosensors

Piezoelectric Biosensors

Thermal Biosensors

Wearable & Implantable Biosensors - By Product Configuration (In Value %)

Disposable Biosensors

Reusable Biosensors

Patch-Based Sensors

Lab-on-Chip Devices

Continuous Monitoring Devices - By Application Area (In Value %)

Glucose Monitoring

Cardiac Biomarker Detection

Infectious Disease Diagnostics

Oncology Diagnostics

Environmental & Food Safety Testing - By End User (In Value %)

Hospitals & Clinics

Diagnostic Laboratories

Home Healthcare Users

Research Institutes & Universities

Food & Environmental Testing Agencies - By Technology Platform (In Value %)

Enzymatic Biosensors

Immunosensors

DNA/RNA Biosensors

Nanomaterial-Based Biosensors

AI-Enabled Smart Biosensors

- Market Share Analysis (Value & Volume Contribution)

- Cross Comparison Parameters (Product Portfolio Breadth, Sensor Accuracy & Sensitivity, Regulatory Approvals in UAE, Pricing & Reimbursement Alignment, Local Distribution Footprint, Manufacturing & Localization Capability, R&D Investment Intensity

Strategic Partnerships & Alliances) - SWOT Analysis of Key Players

- Pricing Analysis

- Detailed Company Profiles

Abbott Laboratories

Roche Diagnostics

Siemens Healthineers

Medtronic

Johnson & Johnson

Bio-Rad Laboratories

Nova Biomedical

Dexcom

LifeScan

ARKRAY

Senseonics

Ascensia Diabetes Care

Thermo Fisher Scientific

Sysmex

EKF Diagnostics

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles

- Compliance & Certification Expectations

- Needs, Desires & Pain-Point Mapping

- Clinical & Non-Clinical Decision-Making Framework

- By Value, (2026-30)

- By Volume (2026-30)

- By Average Selling Price (2026-30