Market Overview

The UAE BiPAP Machines market current size stands at around USD ~ million, reflecting sustained demand across clinical and homecare respiratory therapy pathways. Adoption is anchored in non-invasive ventilation needs within acute care, sleep therapy, and chronic respiratory management. Device penetration is supported by structured referral pathways, insurance-linked coverage for eligible indications, and a growing preference for domiciliary care models. Distribution relies on regulated medical device channels, trained respiratory therapists, and after-sales service networks.

Demand concentration is highest in Abu Dhabi and Dubai due to tertiary hospital density, specialized respiratory centers, and established homecare ecosystems. Northern emirates show expanding uptake as diagnostic access improves and referral pathways mature. Infrastructure investments in sleep laboratories, intensive care capacity, and community respiratory programs reinforce ecosystem maturity. Policy emphasis on regulated device registration, patient safety, and continuity of care strengthens channel reliability and post-installation support, shaping procurement and utilization patterns.

Market Segmentation

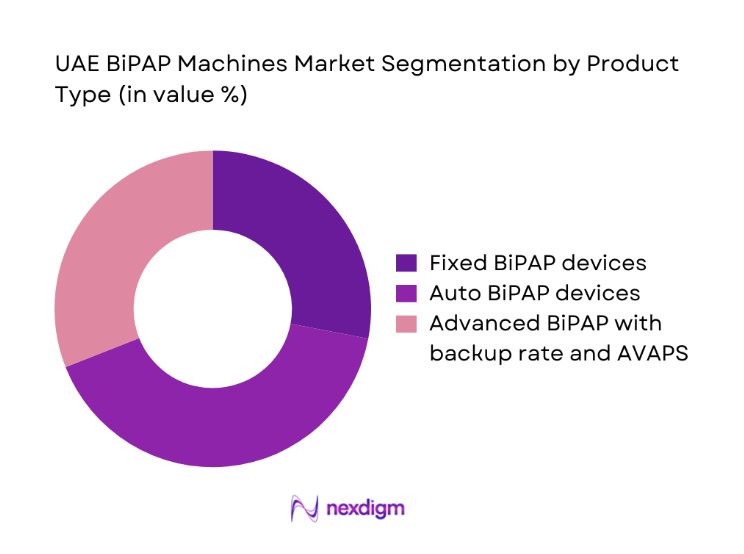

By Product Type

Demand is dominated by auto-titrating and advanced pressure-support variants due to clinical flexibility across sleep-disordered breathing and chronic respiratory insufficiency. Providers favor devices with integrated compliance monitoring, quiet operation, and adaptable algorithms to reduce titration burden across care settings. Fixed devices retain relevance in stable cases where protocols are standardized and follow-up capacity is limited. The shift toward connected devices aligns with care continuity requirements in home settings, enabling therapy adherence tracking and clinician oversight. Procurement decisions emphasize device reliability, mask compatibility, service availability, and lifecycle support. Advanced variants are increasingly specified in tertiary centers managing complex respiratory cases, reinforcing premium feature adoption across urban care networks.

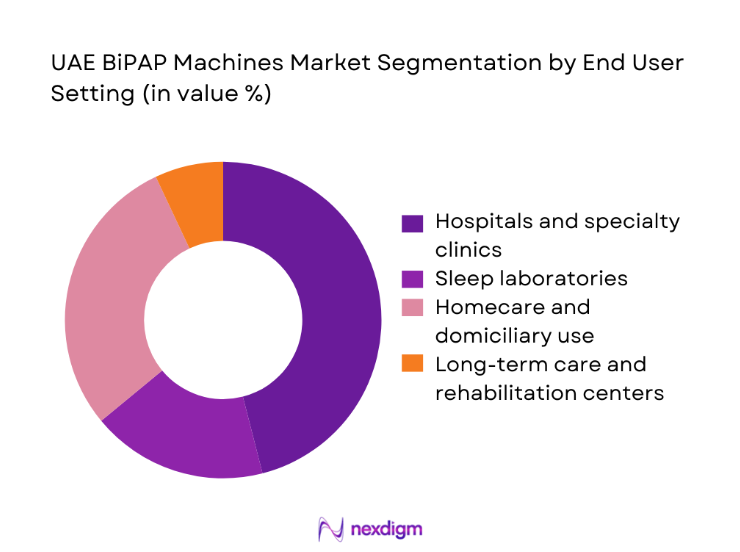

By End User Setting

Hospitals and specialty clinics anchor demand through acute admissions, post-acute transitions, and sleep clinic pathways. Homecare has expanded as payers encourage early discharge with monitored respiratory support, supported by trained provider networks and consumables logistics. Sleep laboratories influence device selection through titration protocols and therapy initiation, while long-term care and rehabilitation centers contribute steady replacement demand for chronic users. Procurement preferences vary by setting, with hospitals prioritizing service-level agreements and device interoperability, while homecare emphasizes portability, noise reduction, and patient usability. Channel partnerships and service reach shape access in secondary cities, supporting broader penetration beyond major urban hubs.

Competitive Landscape

The competitive environment reflects regulated device registration, channel partnerships with distributors and homecare providers, and service-led differentiation. Positioning is shaped by portfolio depth, connectivity features, service readiness, and channel strength across emirates.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ResMed | 1989 | San Diego, United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips Respironics | 1914 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Fisher & Paykel Healthcare | 1934 | Auckland, New Zealand | ~ | ~ | ~ | ~ | ~ | ~ |

| Drive DeVilbiss Healthcare | 2000 | Port Washington, United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Löwenstein Medical | 1988 | Hamburg, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

UAE BiPAP Machines Market Analysis

Growth Drivers

Rising prevalence and diagnosis of sleep apnea and COPD in UAE

Clinical detection has expanded through increased polysomnography capacity and respiratory clinics across tertiary hospitals. In 2023, the number of accredited sleep laboratories reached 34 nationwide, with 9 new facilities approved in 2024. Public hospitals reported 186000 respiratory outpatient visits in 2023, while emergency departments recorded 41200 acute exacerbation encounters in 2024. Primary care referral protocols standardized in 2022 reduced diagnostic delays by 21 days on average. National clinical pathways expanded coverage for non-invasive ventilation across step-down units in 2024. Training programs certified 128 respiratory therapists between 2023 and 2024, strengthening therapy initiation and follow-up continuity nationwide.

Expansion of homecare respiratory therapy services

Home-based respiratory programs expanded through licensing reforms and hospital-at-home pathways. In 2023, 62 licensed homecare providers operated across emirates, increasing to 71 in 2024. Hospital discharge protocols enabled 18400 patients to transition to domiciliary respiratory support in 2024, compared with 12100 in 2023. Remote follow-up clinics recorded 54000 virtual respiratory consultations in 2024, supported by interoperable device connectivity standards adopted in 2022. Workforce capacity grew with 214 new homecare nurses certified in respiratory therapy during 2023–2024. Logistics hubs expanded to 12 regional depots in 2024, improving consumables replenishment and maintenance turnaround times.

Challenges

High device acquisition cost and reimbursement variability

Procurement committees face constrained capital budgets despite rising respiratory caseloads. In 2023, public facilities processed 146 procurement tenders for respiratory equipment, with 38 deferred due to budget ceilings. Reimbursement frameworks varied across insurers, with 27 formularies updated in 2024, creating coverage uncertainty at discharge planning. Administrative approval cycles averaged 41 days in 2023, delaying therapy initiation in post-acute pathways. Import documentation requirements expanded to 14 compliance checkpoints in 2024, extending lead times for replacements. Service contracts required annual audits across 19 facilities, increasing operational burden. These frictions collectively slow deployment velocity and continuity of care in transitional settings.

Low patient adherence and therapy compliance challenges

Adherence remains constrained by mask discomfort, noise sensitivity, and limited follow-up capacity. In 2023, sleep clinics recorded 9600 first-time therapy initiations, while follow-up visits within 60 days occurred for only 6100 patients. Remote compliance monitoring enrollments increased to 7800 in 2024, yet 2300 users discontinued within 90 days. Education sessions reached 12400 patients in 2024, up from 8600 in 2023, indicating improved outreach but persistent drop-off. Care coordinators across 22 facilities reported 3180 missed follow-up appointments in 2024. Standardized adherence protocols introduced in 2022 require reinforcement to sustain long-term utilization.

Opportunities

Growth in remote monitoring and connected BiPAP devices

Digital health frameworks enable scalable monitoring across dispersed homecare populations. In 2024, national interoperability standards supported integration across 5 public health information exchanges, up from 3 in 2022. Telehealth respiratory check-ins increased from 21400 sessions in 2023 to 40200 in 2024, expanding clinician oversight without facility visits. Device connectivity pilots covered 36 clinics in 2024, enabling automated alerts for 9800 patients. Data governance guidelines issued in 2023 standardized consent workflows across 14 provider groups. Workforce training certified 92 clinicians in digital respiratory monitoring during 2024, creating capacity to expand connected therapy programs sustainably.

Expansion of home respiratory care under hospital-at-home models

Care redesign favors early discharge with structured respiratory support at home. In 2023, 11 tertiary hospitals launched hospital-at-home pathways; this expanded to 19 in 2024. Average length of stay for respiratory admissions decreased by 1.6 days between 2022 and 2024, supported by coordinated home follow-up. Multidisciplinary teams conducted 26800 post-discharge visits in 2024, compared with 15700 in 2023. Protocol harmonization across 7 care networks standardized escalation criteria and referral triggers in 2024. These shifts create sustained demand for domiciliary respiratory support, training services, and maintenance networks aligned to continuity-of-care objectives.

Future Outlook

The outlook through 2030 reflects sustained integration of home-based respiratory care with digital monitoring, deeper coordination between acute and community pathways, and continued expansion of sleep diagnostics. Policy emphasis on continuity of care and regulated device pathways will support steady adoption. Provider capacity and patient adherence initiatives are expected to shape utilization patterns across emirates.

Major Players

- ResMed

- Philips Respironics

- Fisher & Paykel Healthcare

- BMC Medical

- Drive DeVilbiss Healthcare

- Löwenstein Medical

- Curative Medical

- 3B Medical

- Apex Medical

- Vyaire Medical

- Intersurgical

- Medtronic

- Weinmann Emergency

- Transcend by Somnetics

- BreathCare

Key Target Audience

- Public hospital procurement departments

- Private hospital networks and specialty clinics

- Licensed homecare service providers

- Health insurance providers and third-party administrators

- Ministry of Health and Prevention

- Dubai Health Authority

- Department of Health Abu Dhabi

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Clinical use cases, care pathways, device categories, regulatory workflows, and service models were mapped across acute and homecare settings. Utilization touchpoints and procurement drivers were identified to frame demand logic. Channel structures and service readiness variables were defined to guide primary engagement.

Step 2: Market Analysis and Construction

Supply chains, distribution coverage, and service networks were assessed across emirates. Utilization flows from diagnosis to long-term therapy were constructed using institutional indicators. Segmentation logic was aligned to product types and end-user settings relevant to respiratory care delivery.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on adoption drivers, adherence constraints, and digital enablement were validated through clinician, procurement, and care coordinator inputs. Regulatory workflows and care redesign initiatives were cross-checked with institutional frameworks to ensure policy alignment and operational feasibility.

Step 4: Research Synthesis and Final Output

Findings were synthesized into market logic, segmentation, and analysis themes aligned to care pathways. Insights were structured for decision relevance across procurement, service design, and digital integration priorities. Outputs emphasize actionable levers for access, adherence, and continuity of care.

- Executive Summary

- Research Methodology (Market Definitions and clinical use cases, Primary interviews with sleep specialists and pulmonologists in UAE, Hospital and homecare procurement tender analysis, Distributor and importer shipment tracking in UAE, Device registration and MoHAP regulatory mapping, Installed base assessment across public and private facilities)

- Definition and Scope

- Market evolution

- Usage and care pathways in sleep and respiratory therapy

- Ecosystem structure across manufacturers, distributors, providers

- Supply chain and channel structure in UAE

- Regulatory environment and device registration requirements

- Growth Drivers

Rising prevalence and diagnosis of sleep apnea and COPD in UAE

Expansion of homecare respiratory therapy services

Increasing coverage for sleep studies and respiratory devices by insurers

Growing awareness among clinicians of non-invasive ventilation benefits

Government investment in tertiary care and respiratory centers of excellence - Challenges

High device acquisition cost and reimbursement variability

Low patient adherence and therapy compliance challenges

Dependence on imported devices and distributor margins

Limited sleep lab capacity outside major emirates

Fragmented homecare service quality and follow-up - Opportunities

Growth in remote monitoring and connected BiPAP devices

Expansion of home respiratory care under hospital-at-home models

Untapped demand in secondary cities and emirates

Partnerships with insurers for bundled therapy programs

Localization of service, maintenance, and training capabilities - Trends

Shift toward auto-titrating and volume-assured pressure support devices

Integration of telemonitoring and cloud-based compliance tracking

Preference for quieter, portable, and patient-friendly device designs

Rising use of BiPAP in post-acute and step-down care

Bundled device, mask, and consumables service contracts - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Fixed BiPAP devices

Auto BiPAP devices

Advanced BiPAP with backup rate and AVAPS - By End User Setting (in Value %)

Hospitals and specialty clinics

Sleep laboratories

Homecare and domiciliary use

Long-term care and rehabilitation centers - By Indication (in Value %)

Obstructive sleep apnea

Chronic obstructive pulmonary disease

Obesity hypoventilation syndrome

Neuromuscular and restrictive disorders - By Distribution Channel (in Value %)

Direct hospital sales

Medical equipment distributors

Homecare service providers

E-commerce and pharmacy-linked channels

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (product portfolio depth, clinical performance and algorithms, local distributor coverage, service and maintenance capability, regulatory approvals in UAE, pricing tiers and discounting, availability of consumables and masks, digital connectivity and data platforms)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

ResMed

Philips Respironics

Fisher & Paykel Healthcare

BMC Medical

Drive DeVilbiss Healthcare

Löwenstein Medical

Curative Medical

3B Medical

Apex Medical

BreathCare

Transcend by Somnetics

Vyaire Medical

Intersurgical

Medtronic

Weinmann Emergency

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030