Market Overview

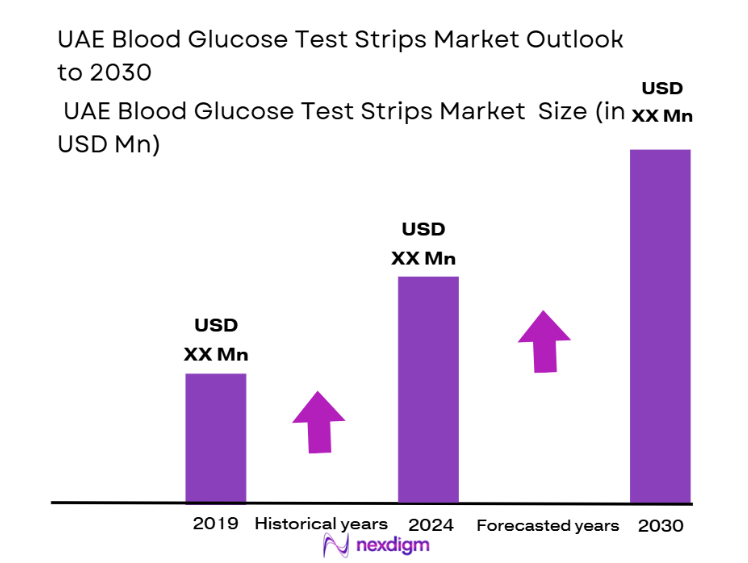

The UAE Blood Glucose Test Strips Market is valued at approximately USD ~ million in 2025, showing consistent growth driven by the expanding diabetic population, increased awareness about diabetes management, and the rise of home diagnostics. The growth of healthcare infrastructure and the rising adoption of self-monitoring devices among diabetic patients are key factors in driving this market. The market has witnessed a surge in consumer demand for affordable and easy-to-use glucose monitoring solutions, propelled by innovations in test strip technology. As diabetes prevalence continues to rise in the region, the market size is expected to expand at a steady pace, supported by governmental initiatives for better healthcare access.

The UAE market is dominated by cities like Dubai, Abu Dhabi, and Sharjah. These cities exhibit the highest market concentration due to the advanced healthcare infrastructure and high urbanization levels. Dubai and Abu Dhabi have the largest healthcare spending per capita in the region, which drives the demand for medical devices such as blood glucose test strips. The extensive availability of healthcare services, pharmacies, and e-commerce platforms in these cities further accelerates the market’s growth. Additionally, these cities attract a large expatriate population, particularly from diabetes-prone regions like South Asia, increasing the demand for personal health monitoring solutions.

Market Segmentation

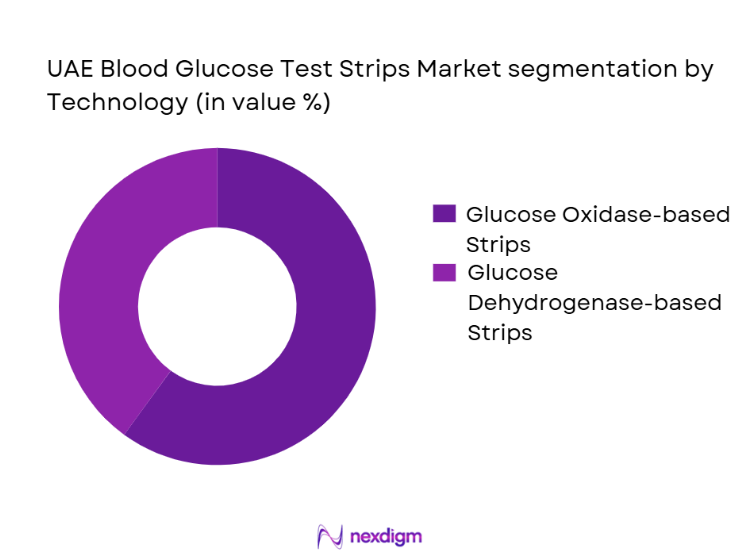

By Technology

The market for blood glucose test strips is segmented by technology into glucose oxidase-based test strips and glucose dehydrogenase-based test strips. Currently, the glucose oxidase-based test strips segment dominates the market. This dominance can be attributed to the long-standing adoption of glucose oxidase in blood glucose testing due to its high accuracy and reliability. The technology is widely recognized and trusted by both healthcare professionals and consumers, which ensures its continued market leadership. Furthermore, the existing partnerships between major test strip manufacturers like Abbott and Roche with healthcare providers, coupled with the consistent product innovation in this category, cement its position in the UAE market.

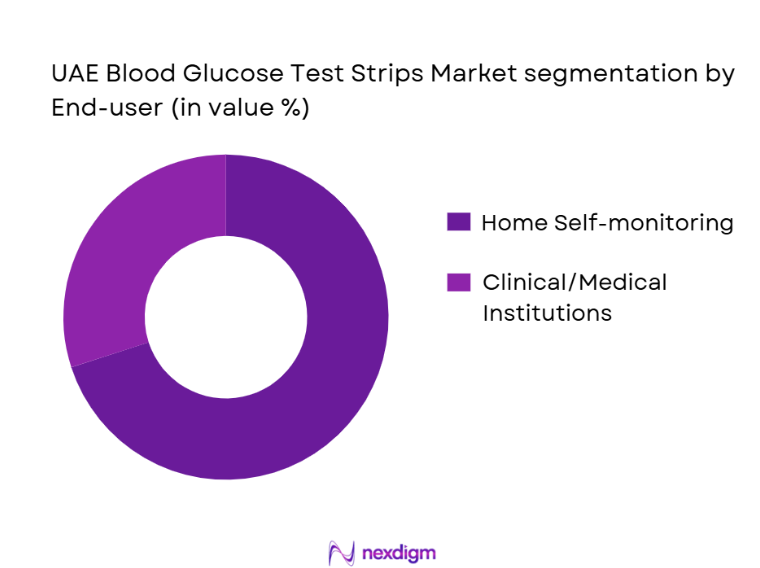

By End User

The blood glucose test strips market is segmented into home self-monitoring and clinical/medical institutions. The home self-monitoring segment currently holds the dominant market share. This trend is driven by the growing preference for self-testing devices among diabetic patients due to their convenience and ease of use. With the rise in home-based healthcare services and increased consumer awareness about diabetes management, home self-monitoring has gained substantial traction in the UAE. The increasing number of diabetic patients opting for home diagnostic solutions further bolsters this segment’s dominance, as it offers more frequent testing, improved disease management, and reduced hospital visits.

Competitive Landscape

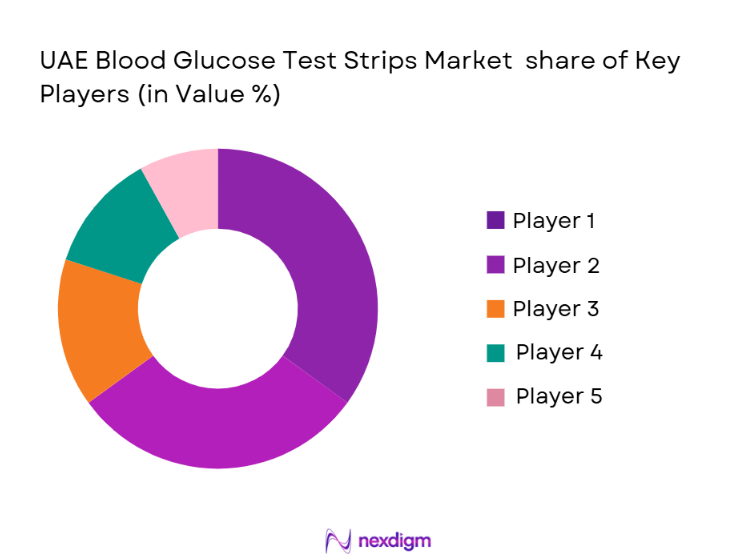

The UAE Blood Glucose Test Strips market is competitive, with several key players contributing to its growth. Major companies in this space include Abbott, Roche Diagnostics, LifeScan, Ascensia Diabetes Care, and Nipro, among others. These companies have established strong brand recognition and widespread distribution channels in the region. The presence of both global and regional brands in the market fosters innovation and drives competitive pricing. Additionally, partnerships with healthcare providers and digital integration of glucose meters further enhance their market standing. These players dominate by offering reliable, accurate, and affordable glucose testing solutions that meet the needs of both healthcare professionals and consumers.

| Company | Establishment Year | Headquarters | Technological Advancements | Pricing Strategy | Distribution Network | Product Innovation |

| Abbott | 1888 | Chicago, USA | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Basel, Switzerland | ~ | ~ | ~ | ~ |

| LifeScan | 1981 | Wayne, USA | ~ | ~ | ~ | ~ |

| Ascensia Diabetes Care | 2016 | Basel, Switzerland | ~ | ~ | ~ | ~ |

| Nipro | 1954 | Osaka, Japan | ~ | ~ | ~ | ~ |

UAE Blood Glucose Test Strips Market Analysis

Growth Drivers

Rising Prevalence of Diabetes

The increasing number of diabetic patients in the UAE, especially Type 2 diabetes, is a major growth driver for the blood glucose test strips market. This is primarily due to lifestyle changes, high rates of obesity, and aging populations. As more people are diagnosed with diabetes, the demand for home self-monitoring solutions, including blood glucose test strips, continues to rise.

Government Initiatives for Healthcare Improvement

The UAE government’s focus on improving healthcare services and infrastructure plays a pivotal role in driving the market. Initiatives aimed at providing better access to diabetes care, including the subsidization of medical devices and promotion of preventive health measures, contribute to increasing demand for glucose monitoring devices and strips.

Market Challenges

High Cost of Test Strips

While demand for blood glucose test strips is rising, the high cost of these products can be a significant barrier for many patients, especially in a region with a mix of high and low-income demographics. Without sufficient subsidies or insurance coverage, affordability remains a major challenge for the broader population.

Supply Chain and Regulatory Barriers

The blood glucose test strips market in the UAE faces challenges related to import tariffs, regulatory hurdles, and delays in product approvals. Stricter regulatory requirements and logistical bottlenecks can create barriers to consistent supply, leading to occasional shortages or price fluctuations.

Opportunities

Technological Advancements in Test Strips

The development of advanced, more accurate, and user-friendly glucose test strips presents a major opportunity. Innovations like multi-analyte strips, strips with higher accuracy, and those integrated with smartphone apps or digital platforms offer significant potential for growth in the market.

Growth of E-commerce and Home Healthcare

The increasing preference for home healthcare solutions and the rise of e-commerce platforms in the UAE present a key opportunity for the blood glucose test strips market. With more patients opting for convenience and direct-to-consumer models, online platforms provide easy access to glucose monitoring products, broadening market reach and accessibility.

Future Outlook

The UAE Blood Glucose Test Strips Market is set to experience sustained growth over the next several years, with increasing demand driven by the rising diabetic population and growing adoption of home self-monitoring. The integration of digital technologies with glucose meters and the rise of mobile health applications will further boost market expansion. Additionally, governmental efforts to improve healthcare accessibility and the shift towards preventive healthcare are expected to create significant growth opportunities. The ongoing developments in test strip technology, such as multi-analyte capabilities and integration with AI for personalized healthcare, will define the future trajectory of the market.

Major Players

- Abbott

- Roche Diagnostics

- LifeScan

- Ascensia Diabetes Care

- Nipro

- Medtronic

- Dexcom

- AgaMatrix

- B. Braun

- Arkray

- Omron

- HMD (Humetrix)

- TaiDoc

- Betachek

- Universal Biosensors

Key Target Audience

- Investments and Venture Capitalist Firms

- Healthcare Providers and Hospitals

- Diabetes Treatment Centers

- Pharmaceutical Companies

- Medical Device Manufacturers

- Retail Pharmacies

- Government and Regulatory Bodies (UAE Ministry of Health and Prevention)

- Insurance Companies (providing diabetes-related policies)

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we construct an ecosystem map of the UAE Blood Glucose Test Strips Market. This involves gathering comprehensive data from secondary sources, including government reports, medical journals, and credible market research databases. The primary goal is to identify key variables like diabetes prevalence, healthcare spending, technological advancements in glucose testing, and distribution networks.

Step 2: Market Analysis and Construction

Historical data and market trends are compiled and analyzed to assess the market penetration of different test strip technologies. This phase also includes a study of consumer behavior, adoption rates, and the impact of self-monitoring devices. Sales figures and market forecasts are built using advanced analytical models to ensure accurate and validated estimates.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through telephone interviews (CATIs) with key industry players, including manufacturers, distributors, and healthcare providers. Insights gathered during this phase help refine our analysis, adding a layer of operational and financial precision to the market insights.

Step 4: Research Synthesis and Final Output

In the final phase, we compile data gathered from multiple sources and cross-check it through industry consultations. The market data is then refined to provide a comprehensive, detailed, and accurate report on the UAE Blood Glucose Test Strips Market. These findings are synthesized to ensure strategic relevance for decision-makers.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Data Collection Framework, Market Sizing & Forecasting Approach, Data Normalization & Validation, Limitations and Future Outlook)

- Market Definition & Scope

- Industry Genesis & Evolution

- Diagnostic Value Chain

- Supply Chain Mapping

- Market Access & Reimbursement Landscape

- Growth Drivers

Rising Diabetic Population & SelfMonitoring Adoption

Increasing Awareness & Preventive Healthcare

Expansion of Retail & Online Pharma Channels - Market Challenges

Price Sensitivity & Test Strip Affordability

Supply Chain & Import Constraints

Reimbursement & Policy Gaps - Market Opportunities

Digital Integration: Mobile Data Analytics & Telehealth Connectivity

Partnerships with Meter OEMs for CoBranded Strips

EcoFriendly & Sustainable Packaging Trends - Demand & Usage Trends

Shift to atHome Monitoring

Increased Chronic Disease Screening

Adoption of MultiParameter MeterStrip Platforms - Regulatory & Compliance Framework

UAE & MOH Clinical Testing Standards

Import & Quality Certification Requirements

Tariff & Duty Structures Affecting Pricing

- By Market Value 2019-2025

- By Shipment Volume 2019-2025

- Average Selling Price Analysis 2019-2025

- Price Sensitivity & Elasticity 2019-2025

- Segment Shares 2019-2025

- By Strip Technology (In Value%)

Glucose Oxidase Based

Glucose Dehydrogenase Based

MultiAnalyte Strips - By Meter Compatibility (In Value%)

Abbott Compatible

Roche Compatible

Other OEM Compatible - By Distribution Channel (In Value%)

Hospital & Clinic Pharmacies

Retail Pharmacies

ECommerce & D2C

Medical Device Wholesalers - By End User (In Value%)

Home SelfMonitoring

Hospital/Inpatient Use

Diagnostic Labs - By Patient Type (In Value%)

Type 2 Diabetes

Type 1 Diabetes

Gestational Diabetes

- Market Share Analysis

- CrossComparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength & Weakness, Revenue & Revenue by Strip Type, Distribution Reach, Pricing Strategy & Price Bands, Meter Compatibility Footprint, AfterSales Support & Data Platforms)

- Player SWOT Overview

- Pricing Benchmarking Across SKU Portfolios

- Major Players:

Abbott (FreeStyle Test Strips)

Roche Diagnostics (AccuChek Strips)

LifeScan (OneTouch Strips)

Ascensia Diabetes Care

iSENS (CareSens Strips)

Nipro

B. Braun / Omnitest

ARKRAY (Glucocard Strips)

AgaMatrix

Universal Biosensors

TaiDoc Technology

APEX Biotechnology

HMD (Humetrix)

Betachek

Yuwell (Jiangsu Yuwell)

- Adoption Patterns

- Purchasing Decision Drivers

- Patient PainPoints

- Budget Allocation & Reimbursement Behavior

- Healthcare Provider Preferences & Protocols

- Market Size Projection 2026-2030

- ASP Trend Forecast 2026-2030

- Technology & MultiParameter Innovation Adoption 2026-2030

- Future Regulatory & Reimbursement Impact Scenarios 2026-2030