Market Overview

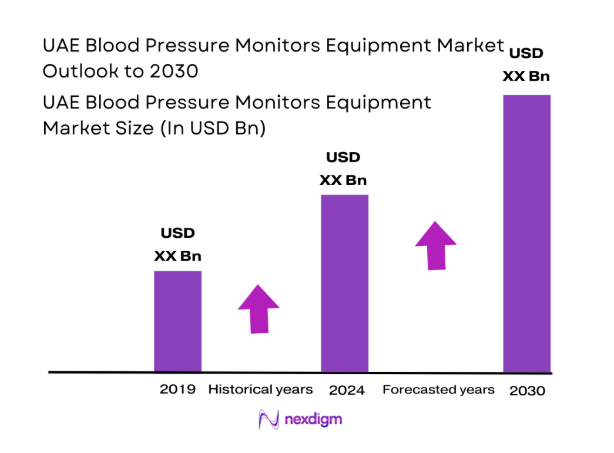

The UAE Blood Pressure Monitors Equipment market current size stands at around USD ~ million, reflecting a well-established ecosystem of clinical-grade and home-use monitoring devices supported by strong distributor networks and a mature retail pharmacy footprint. Demand is shaped by routine hypertension screening across care settings, preventive health programs, and integration into chronic disease management pathways. The market structure emphasizes device reliability, regulatory conformity, and service coverage, with procurement influenced by institutional purchasing cycles and standardized clinical protocols across public and private providers.

Demand concentration is highest across Abu Dhabi, Dubai, and Sharjah due to dense hospital networks, specialized cardiac centers, and higher outpatient throughput. These cities benefit from advanced logistics, strong distributor presence, and established calibration and service infrastructure. Primary care clinics and homecare providers anchor community-level adoption, while digital health ecosystems enable device integration into remote monitoring pathways. Regulatory maturity and streamlined registration processes support faster device onboarding, reinforcing ecosystem depth and channel efficiency across metropolitan clusters.

Market Segmentation

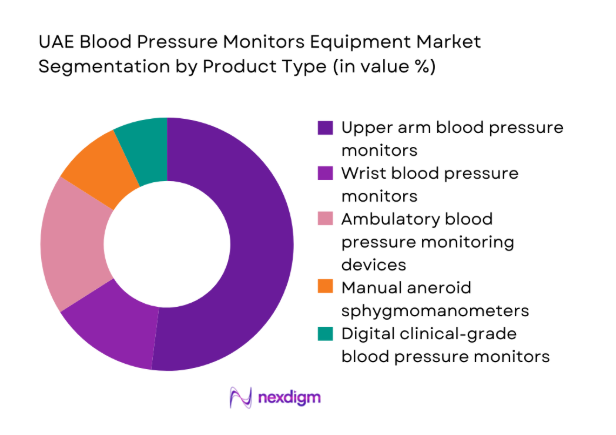

By Product Type

Upper arm digital monitors dominate clinical and homecare usage due to superior accuracy, clinician acceptance, and ease of integration into routine screening workflows. Ambulatory monitoring devices see higher adoption in cardiology practices for diagnostic confirmation, while manual devices persist in selected clinical settings for training and backup use. Wrist monitors remain niche, driven by portability preferences among mobile users, but face accuracy perception barriers. Product mix is shaped by clinical validation requirements, procurement standards, and patient adherence considerations, reinforcing demand for upper arm devices with digital memory and connectivity features in high-throughput care environments.

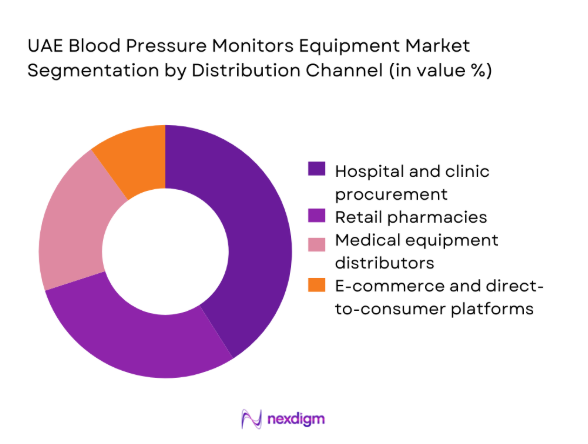

By Distribution Channel

Hospital and clinic procurement leads due to centralized purchasing, standardized device protocols, and recurring replacement cycles. Retail pharmacies capture steady demand from chronic patients seeking validated home monitoring tools, supported by pharmacist-led recommendations. Medical equipment distributors play a pivotal role in institutional coverage, service contracts, and calibration logistics. E-commerce and direct-to-consumer channels are expanding, driven by convenience and growing digital adoption, though constrained by regulatory checks and after-sales service expectations. Channel performance is shaped by procurement governance, service responsiveness, and omnichannel availability across urban catchments.

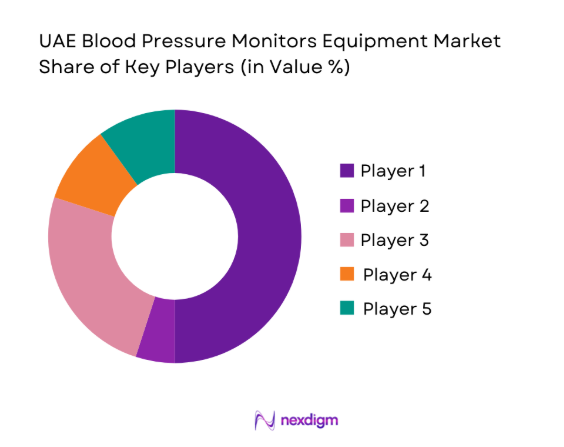

Competitive Landscape

The competitive environment reflects a mix of multinational device manufacturers and regionally entrenched distributors, differentiated by clinical validation depth, regulatory readiness, and service networks. Channel strength and after-sales capability remain decisive for institutional adoption, while product portfolio breadth and connectivity features influence retail.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Omron Healthcare | 1933 | Kyoto, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994 | Chicago, United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Microlife Corporation | 1981 | Widnau, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Beurer GmbH | 1919 | Ulm, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Blood Pressure Monitors Equipment Market Analysis

Growth Drivers

Rising prevalence of hypertension and cardiovascular disease

Hypertension screening volumes expanded across public and private facilities as outpatient cardiology visits increased in 2023 and 2024, supported by national noncommunicable disease programs. Primary care consultations exceeded 1200000 annually across major emirates, with protocolized blood pressure measurement embedded in triage. Emergency department presentations linked to cardiovascular risk factors surpassed 180000 cases in 2024. The expansion of family medicine clinics added 240 new screening points between 2022 and 2024. Workforce growth included 1900 additional nurses trained in vital sign protocols. Digital health records integration covered 48 hospital networks, increasing routine measurement frequency. These indicators sustain device utilization intensity across care pathways nationally.

Expansion of home healthcare and self-monitoring adoption

Homecare provider licensing increased by 26 entities during 2023 and 2024, expanding chronic patient monitoring capacity across emirates. Remote care visits exceeded 900000 interactions in 2024, embedding routine blood pressure capture within teleconsultation workflows. National digital health initiatives connected 37 integrated care platforms to primary care networks, enabling data exchange. Chronic disease registries enrolled over 410000 patients across hypertension and diabetes programs by 2024. Home nursing workforce expanded by 1600 practitioners since 2022, reinforcing in-home measurement frequency. Pharmacy-led patient education programs conducted 22000 device onboarding sessions in 2024, supporting sustained self-monitoring adherence across urban catchments.

Challenges

Price sensitivity in retail and tender-driven hospital procurement

Centralized procurement frameworks across public providers capped unit specifications within tender thresholds reviewed annually in 2023 and 2024, constraining premium device uptake. Hospital tender cycles averaged 18 months, delaying technology refresh across 42 large facilities. Retail pharmacies reported 64000 instances of purchase deferral linked to out-of-pocket constraints in 2024. Household health expenditure controls intensified through insurance formularies limiting device reimbursement coverage. Distributor margin compression followed 27 tender renegotiations across emirates during 2023. Public procurement audit requirements expanded documentation across 14 regulatory checkpoints, increasing administrative burden and elongating sales cycles for advanced monitoring platforms within institutional channels nationwide.

Accuracy concerns and calibration requirements for low-cost devices

Clinical audits in 2023 and 2024 identified 3100 noncompliant devices failing calibration thresholds during hospital equipment checks. Biomedical engineering teams increased calibration cycles to 2 per year across 68 hospital groups, raising operational workload. Primary care clinics recorded 14000 remeasurements annually due to device variance, affecting workflow efficiency. Regulatory inspections flagged 220 retail SKUs requiring revalidation against international accuracy protocols. Training programs enrolled 900 technicians to standardize cuff sizing and measurement technique. These factors elevate compliance burdens and constrain adoption of low-cost devices, reinforcing preference for validated equipment within regulated care environments nationally.

Opportunities

Integration with remote patient monitoring programs

National telehealth utilization surpassed ~ interactions in 2024, creating structured pathways for integrating blood pressure data into care plans. Public digital health platforms onboarded 23 remote monitoring pilots across primary care networks between 2023 and 2024. Chronic disease programs tracked 180000 hypertension patients through connected care workflows, enabling clinician review intervals every 30 days. Homecare agencies deployed 420 mobile teams equipped for in-home monitoring integration. Health information exchange connectivity expanded to 41 facilities, supporting interoperable data flows. These institutional indicators underpin scalable integration of monitoring devices into remote care pathways, enhancing longitudinal management and adherence across distributed patient cohorts nationally.

Partnerships with telehealth and chronic disease management platforms

Platform consolidation increased, with 12 national telehealth operators integrating chronic disease modules by 2024. Clinical guideline digitization standardized hypertension pathways across 29 provider networks, enabling device data ingestion into care dashboards. Public health campaigns registered 76000 new chronic patients into digital follow-up programs in 2023 and 2024. Provider contracts expanded to 18 integrated care networks, creating standardized device onboarding requirements. Interoperability frameworks covered 34 electronic record systems by 2024, easing device data integration. These developments create partnership opportunities aligned to structured care pathways, supporting scale deployment of validated monitoring devices within coordinated disease management ecosystems.

Future Outlook

The market outlook remains anchored in preventive care expansion, digital health integration, and sustained institutional procurement cycles. Adoption will continue to concentrate in metropolitan care networks, while home monitoring pathways deepen through telehealth integration. Regulatory alignment and service infrastructure expansion will shape vendor participation through 2030.

Major Players

- Omron Healthcare

- Philips Healthcare

- GE HealthCare

- Microlife Corporation

- Beurer GmbH

- A&D Medical

- Withings

- Rossmax International

- Welch Allyn

- SunTech Medical

- Yuwell Medical

- Contec Medical Systems

- Citizen Systems

- ForaCare

- Braun Healthcare

Key Target Audience

- Public and private hospitals and integrated health systems

- Primary care clinics and diagnostic centers

- Home healthcare providers and nursing agencies

- Retail pharmacy chains and medical device retailers

- Telehealth and remote care platform operators

- Health insurance providers and payer networks

- Investments and venture capital firms

- Government and regulatory bodies with agency names including Ministry of Health and Prevention and Department of Health Abu Dhabi

Research Methodology

Step 1: Identification of Key Variables

Clinical workflows, procurement governance, regulatory compliance criteria, service infrastructure readiness, and digital integration requirements were mapped across institutional and homecare settings. Device validation standards and care pathway touchpoints were defined to anchor analytical variables within UAE healthcare delivery structures.

Step 2: Market Analysis and Construction

Supply chain structures, distributor coverage, channel performance, and adoption environments were analyzed across metropolitan clusters. Utilization intensity across care settings and service network density informed scenario construction and segmentation logic.

Step 3: Hypothesis Validation and Expert Consultation

Clinical operations leaders, biomedical engineers, and care pathway coordinators were engaged to validate workflow assumptions and calibration practices. Regulatory process interpretation and service expectations were reviewed with institutional stakeholders.

Step 4: Research Synthesis and Final Output

Insights were synthesized into a cohesive framework aligning ecosystem structure, regulatory context, and channel dynamics. Outputs were structured to support strategic planning, partnership assessment, and go-to-market design.

- Executive Summary

- Research Methodology (Market Definitions and device classification scope, Distributor and importer sales channel mapping in UAE, Hospital procurement tender data analysis, Retail pharmacy and e-commerce sales tracking, KOL interviews with cardiologists and biomedical engineers, Regulatory approvals and standards review with MOHAP)

- Definition and Scope

- Market evolution

- Usage and care pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising prevalence of hypertension and cardiovascular disease

Growing geriatric population and chronic disease burden

Expansion of home healthcare and self-monitoring adoption

Government focus on preventive care and digital health

Increasing penetration of connected and smart monitoring devices

Growth of private healthcare facilities and outpatient care - Challenges

Price sensitivity in retail and tender-driven hospital procurement

Limited reimbursement for home monitoring devices

Accuracy concerns and calibration requirements for low-cost devices

Fragmented distributor network and parallel imports

Regulatory compliance costs and product registration timelines

User adherence and improper measurement practices - Opportunities

Integration with remote patient monitoring programs

Partnerships with telehealth and chronic disease management platforms

Premiumization through clinically validated connected devices

Expansion in corporate wellness and employer health programs

Localization of after-sales service and calibration networks

Private label opportunities for pharmacy chains - Trends

Shift from manual to automatic digital monitors

Growing demand for Bluetooth and app-enabled devices

Rising adoption of ambulatory blood pressure monitoring

Increased focus on clinical validation and accuracy standards

Bundling devices with digital health subscriptions

Growth of omnichannel distribution strategies - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Upper arm blood pressure monitors

Wrist blood pressure monitors

Ambulatory blood pressure monitoring devices

Manual aneroid sphygmomanometers

Digital clinical-grade blood pressure monitors - By Technology (in Value %)

Automatic digital monitors

Semi-automatic digital monitors

Manual devices - By Connectivity (in Value %)

Non-connected devices

Bluetooth-enabled devices

Wi-Fi enabled devices

Integrated telehealth platform devices - By Measurement Modality (in Value %)

Oscillometric devices

Auscultatory devices - By Distribution Channel (in Value %)

Hospital and clinic procurement

Retail pharmacies

Medical equipment distributors

E-commerce and direct-to-consumer platforms - By End Use Setting (in Value %)

Hospitals

Clinics and diagnostic centers

Homecare settings

Ambulatory care centers

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (Product portfolio breadth, Clinical validation and certifications, Connectivity and software ecosystem, Distribution network strength in UAE, Pricing and discounting flexibility, After-sales service and calibration support, Brand recognition among clinicians, Partnerships with hospitals and pharmacies) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Omron Healthcare

Philips Healthcare

GE HealthCare

A&D Medical

Microlife Corporation

Withings

Rossmax International

Beurer GmbH

Welch Allyn

SunTech Medical

Contec Medical Systems

Yuwell Medical

Citizen Systems

ForaCare

Braun Healthcare

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030