Market Overview

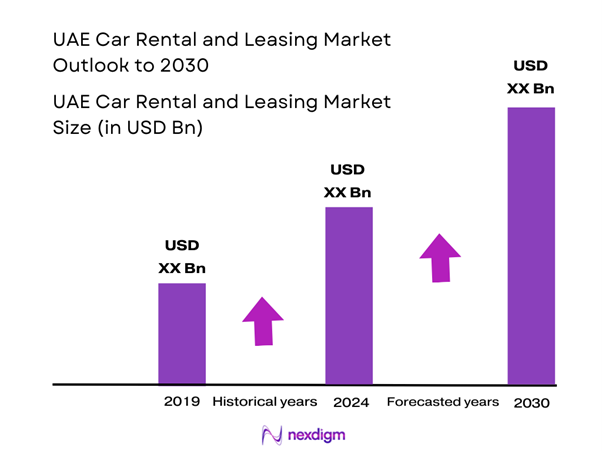

The UAE Car Rental and Leasing Market is valued at USD 2,456.0 million in 2024 with an approximated compound annual growth rate (CAGR) of 13.1% from 2024-2030, driven by factors such as the growing tourism sector and increased urbanization demanding efficient transportation solutions. The market has surged due to the rising number of expatriates and tourists, with UAE airports witnessing a considerable influx of visitors. Additionally, the introduction of digital platforms has simplified the booking process, increasing customer convenience and thereby fueling market growth.

The major cities dominating the UAE Car Rental and Leasing Market include Dubai and Abu Dhabi. Dubai remains a hub for tourism and business, with a diverse population that seeks convenient mobility options. Furthermore, Abu Dhabi, as the capital, houses numerous corporate clients and governmental agencies. These cities benefit from advanced infrastructure and a growing demand for car rental services, solidifying their dominance in the market landscape.

The expansion of e-commerce in the UAE has been profound, with online retail sales reaching approximately USD 8.3 billion in 2022, up from USD 3.9 billion in 2021. This significant rise, as reported by the UAE Ministry of Economy, is positioning the UAE as a leading market for online shopping in the region. The growth of e-commerce directly influences the car rental sector, as online consumer behavior often includes the need for flexible and immediate transportation solutions.

Market Segmentation

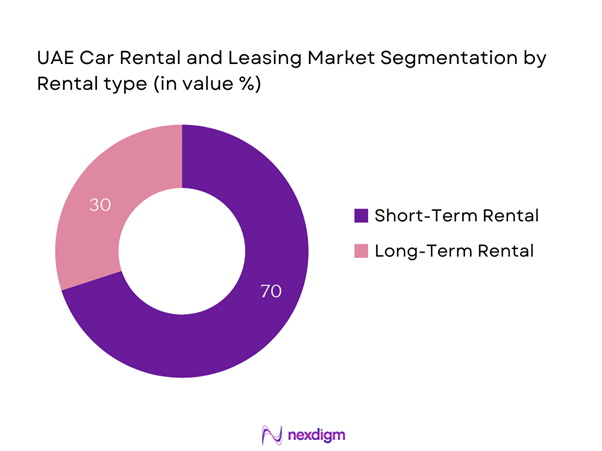

By Rental Type

The UAE Car Rental and Leasing Market is segmented by rental type into short-term rental and long-term leasing. The short-term rental segment dominates the market due to its flexibility and convenience in catering to the needs of tourists and business travelers who require temporary transportation solutions. The demand for short-term rentals has significantly increased, driven by the thriving tourism industry, where visitors prefer easily accessible and cost-effective options for mobility. Moreover, with a plethora of online platforms facilitating easy bookings, this segment attracts a wide array of consumers seeking convenience during their stay in the UAE.

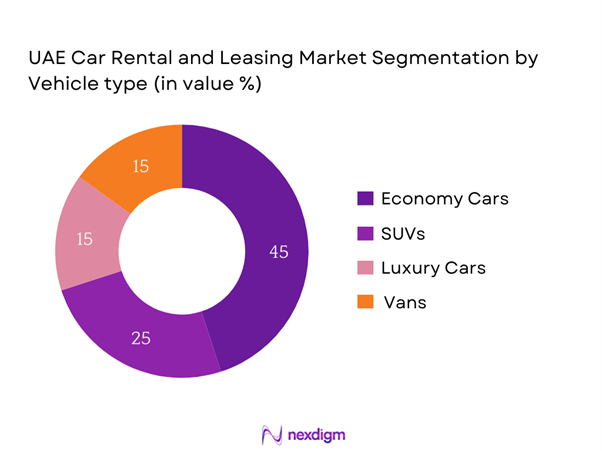

By Vehicle Type

The market is also segmented by vehicle type into economy cars, SUVs, luxury cars, and vans. The economy cars segment holds a dominant market share as these vehicles are preferred by both individuals and businesses looking for cost-effective transportation solutions. The high demand for fuel-efficient and affordable vehicles has driven this segment’s growth. Additionally, with a significant percentage of tourists seeking budget-friendly options, economy cars continue to see strong performance in rental models, making them a staple choice among rental companies.

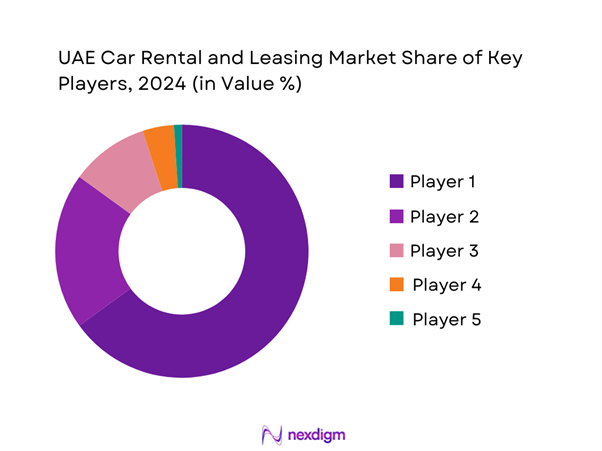

Competitive Landscape

The UAE Car Rental and Leasing Market is characterized by a competitive landscape comprising both international and local players. The market is dominated by major companies such as Emirates Car Rental, Hertz UAE, and Budget Rent A Car. These companies leverage strong brands, extensive networks, and diverse vehicle offerings to capture market share.

| Company | Establishment Year | Headquarters | Total Fleet Size | Rental Types Offered | Customer Segments | Annual Revenue (USD) |

| Emirates Car Rental | 2000 | Dubai | – | – | – | – |

| Hertz UAE | 1981 | Dubai | – | – | – | – |

| Budget Rent A Car | 1958 | Dubai | – | – | – | – |

| Sixt Rent a Car | 1912 | Dubai | – | – | – | – |

| Europcar UAE | 1949 | Abu Dhabi | – | – | – | – |

UAE Car Rental and Leasing Market Analysis

Growth Drivers

Rising Tourism Industry

The UAE’s tourism sector is thriving, with approximately 25 million international visitors expected in 2024, bolstered by major events like Expo 2020, which was held in 2021 but continued to contribute to tourism growth. The World Bank reported that tourism contributed 11.4% of GDP in 2022, showcasing its pivotal role in the economy. The influx of visitors generates significant demand for car rental services, as travelers seek convenient transportation to explore the vast attractions across the Emirates. This growth trend is expected to rise as global travel restrictions ease, maintaining a steady upward trajectory for the sector.

Increasing Urbanization

Urbanization in the UAE is accelerating, with the urban population projected to reach 90% by end of 2025 according to World Bank estimates. This rapid urban growth brings forth new traffic patterns, increased vehicle ownership, and a subsequent rise in car rental needs. Cities such as Dubai and Abu Dhabi are expanding their infrastructure, including transportation networks, which in turn fosters a heightened demand for rental vehicles among both residents and visitors. As more people reside in urban areas, the convenience of rental services will continue to become a preferred mode of transportation.

Market Challenges

Intense Competition

The UAE Car Rental and Leasing Market is highly competitive, with numerous established and new players vying for market share. As of 2023, the number of car rental companies operating in the UAE exceeds 400, resulting in a saturated market that pressures companies to differentiate their services. According to the UAE Federal Competitiveness and Statistics Authority, businesses are forced to continually innovate in service offerings and customer experience to remain competitive. This competitive landscape not only intensifies pricing pressures but also compels companies to invest more in marketing and technological enhancements to attract and retain customers.

Regulatory Compliance

Operating a car rental business in the UAE involves navigating a complex regulatory framework. The UAE government’s regulations require car rental companies to secure specific licenses, comply with safety standards, and adhere to insurance mandates for all rented vehicles. According to the UAE Road and Transport Authority, compliance requirements can be extensive and costly, impacting profitability for businesses, especially smaller operators. As new regulations are introduced or existing ones are updated, companies must stay informed and adapt to avoid penalties, further highlighting the challenges posed by regulatory compliance in the market.

Opportunities

Technological Advancements

The car rental sector in the UAE is increasingly leveraging technological advancements to enhance service efficiency and customer experience. Currently, around 70% of car rental transactions are completed via online platforms, reflecting a significant digital transformation within the industry. The integration of mobile apps and web portals facilitates real-time booking and vehicle tracking, aligning with customer expectations for instant service. As technology continues to evolve, car rental companies can capitalize on these advancements to attract tech-savvy consumers, streamline operations, and improve fleet management, thereby driving growth in the market.

Increasing Demand for Eco-friendly Vehicles

The global shift towards sustainability is evident in the UAE, where the demand for eco-friendly vehicles, including hybrids and electric cars, is on the rise. In 2023, reports indicated that electric vehicle (EV) registrations in the UAE reached around 23,000, up from approximately 15,000 in 2021, as consumers increasingly prioritize environmental concerns.

Future Outlook

Over the next few years, the UAE Car Rental and Leasing Market is expected to undergo significant growth, spurred by advancements in technology, increasing demand for flexible transportation solutions, and the rise of the gig economy. The expansion of the tourism sector post-pandemic, along with government initiatives to improve infrastructure, will further stimulate market dynamics. Additionally, the integration of digital platforms for seamless booking experiences will likely enhance customer engagement and retention, marking a promising future for the industry.

Major Players

- Emirates Car Rental

- Hertz UAE

- Budget Rent A Car

- Sixt Rent a Car

- Europcar UAE

- Fast Rent A Car

- Dollar Rent A Car

- Al-Futtaim Auto & Machinery Co.

- Click and Drive Car Rental

- Alamo Rent A Car

- National Car Rental

- Swaidan Trading Co.

- Carlease

- Al-Khaleej Cars

- Thrifty Car Rental

Key Target Audience

- Government and Regulatory Bodies (Dubai Roads and Transport Authority, Abu Dhabi Department of Transport)

- Corporate clients and organizations

- Tourism and hospitality industries

- Automotive manufacturers and suppliers

- Investments and venture capitalist firms

- Insurance companies

- Fleet management companies

- Logistics and transportation service providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key stakeholders within the UAE Car Rental and Leasing Market. This step includes extensive desk research combined with secondary and proprietary databases to gather comprehensive industry-level information. The objective is to identify and define critical variables influencing market dynamics, such as consumer behavior, regulatory factors, and competitive benchmarks.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data relevant to the UAE Car Rental and Leasing Market. The analysis focuses on market penetration, demand patterns, and service diversification. Further evaluation of historical revenue performance helps ensure that the insights derived reflect the market’s actual landscape and inform strategic decisions accurately.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses that emerge from preliminary research will be validated through in-depth telephone interviews and surveys with industry experts. These experts come from a range of companies, providing practical insights on operational aspects, trends, and financial indicators within the car rental industry. Such firsthand accounts are crucial for refining market data and contextualizing findings.

Step 4: Research Synthesis and Final Output

The final phase entails engaging with various car rental companies to acquire detailed insights into service offerings, sales performance, and consumer preferences. This interaction complements the quantitative data, allowing for a more nuanced analysis of market dynamics and consumer trends. The synthesis of qualitative and quantitative data leads to a comprehensive and validated analysis of the UAE Car Rental and Leasing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Landscape

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain Analysis

- Value Chain Analysis

- Growth Drivers

Rising Tourism Industry

Increasing Urbanization

Growth of E-commerce - Market Challenges

Intense Competition

Regulatory Compliance - Opportunities

Technological Advancements

Increasing Demand for Eco-friendly Vehicles - Trends

Adoption of Digitization

Innovative Customer Experience - Government Regulation

Licensing and Permits

Safety Standards and Guidelines - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Daily Rate, 2019-2024

- By Rental Type (In Value %)

Short-term Rental

– Daily Rentals

– Weekly Rentals

– Weekend Rentals

Long-term Leasing

– 6-Month Lease

– 12-Month Lease

– Lease-to-Own Programs - By Vehicle Type (In Value %)

Economy Cars

– Hatchbacks

– Compact Sedans

SUVs

– Compact SUVs

– Full-size SUVs

Luxury Cars

– Executive Sedans

– Sports Cars

Vans

– Passenger Vans

– Cargo Vans

Buses

– Mini Buses

– Full-size Buses - By Region (In Value %)

Dubai

Abu Dhabi

Sharjah

Ras Al Khaimah

Fujairah

Ajman - By Customer Type (In Value %)

Corporate Clients

– Long-term Fleet Contracts

– Chauffeured Executive Rentals

Individual Consumers

– Self-drive Personal Rentals

– Monthly Lease Packages

Tourists

– Airport Pick-up Services

– Hotel Partner Packages - By Distribution Channel (In Value %)

Online Platforms

– Aggregator Websites

– Direct Brand Websites

– Mobile Apps

Traditional Rental Offices

– Airport Counters

– City Branches

– Hotel Desks

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenue by Service Type, Fleet Size and Composition, Vehicle Utilization Rate, Customer Segmentation, Distribution Channels, Number of Rental Locations, Pricing and Promotional Strategies, Technology Adoption, Geographic Reach, Customer Satisfaction Metrics, Unique Value Offering)

- SWOT Analysis of Major Competitors

- Pricing Analysis by Vehicle Type for Major Players

- Detailed Profiles of Major Companies

Emirates Car Rental

Hertz UAE

Budget Rent A Car

Sixt Rent a Car

Europcar UAE

Thrifty Car Rental

Al-Futtaim Auto & Machinery Co.

Fast Rent A Car

Dollar Rent A Car

Avis Rent A Car

National Car Rental

Alamo Rent A Car

Swaidan Trading Co.

Click and Drive Car Rental

Carlease

- Market Demand and Service Utilization

- Budget Allocations by Customer Segment

- Regulatory Considerations

- Consumer Needs and Pain Points

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Daily Rate, 2025-2030